TOCOM Energy

A brief introduction to the physical and financial layers of Dubai crude oil market

The Dubai price is the primary physical pricing reference for crude oil loading from the Middle East Gulf, Far East Russia and other parts of the world to refiners and has been since spot markets first emerged in the 1980s. As many Japanese trading houses and Wall Street refiners started entering the market during the period of 1985-1987, Dubai crude oil market liquidity began to increase gradually. The major impetus came in 1988 when key OPEC countries abandoned the administered pricing system and started pricing their crude export to Asia on the basis of the Dubai crude. Now Dubai crude oil price responsible for the pricing of almost 30 million barrels per day of crude oil currently exported to Asia.

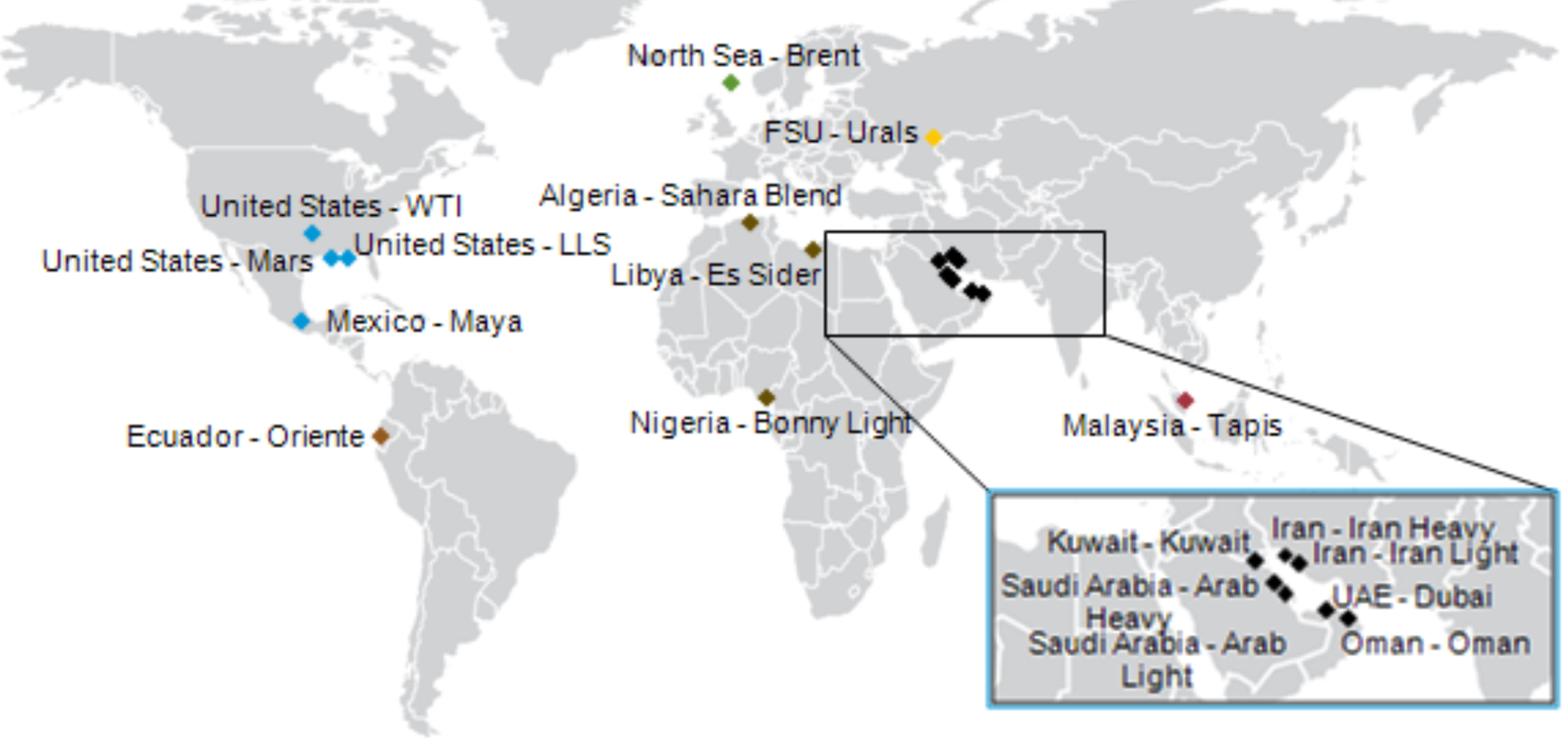

Figure 1: Location of Dubai crude stream

Source: EIA

To understand what the Dubai benchmark price actually is, it is worth briefly reviewing the various highly interconnected financial and physical layers relevant to the price formation process.

In the Dubai market, the spot price usually refers to the physical price of Dubai crude oil loading through the month of assessment by S&P Global.

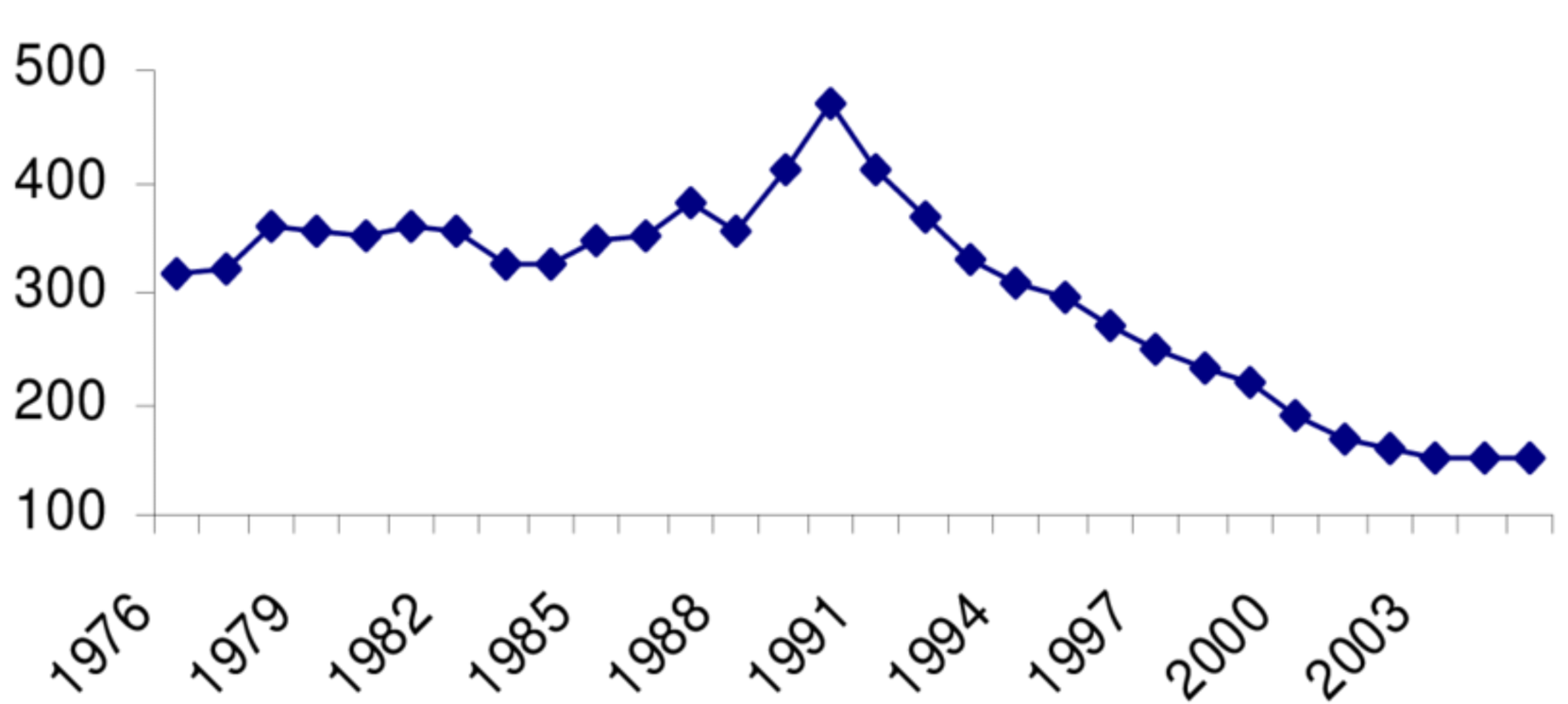

In the early stages of its development, the Dubai benchmark only included crude oil produced from Dubai’s fields. However, since its introduction, Dubai production has diminished substantially. Dubai does not release figures for its crude oil production, however, from the loading data and sales, it can be deduced that production has fallen below 70,000 b/d in 2019 from a peak of about 400,000 b/d in 1991.

Figure 2: Dubai Crude Oil Production

Source: ResearchGate

The falling production in Dubai’s oil output has pushed Platts to search for alternatives to maintain the viability of Dubai as a global benchmark.

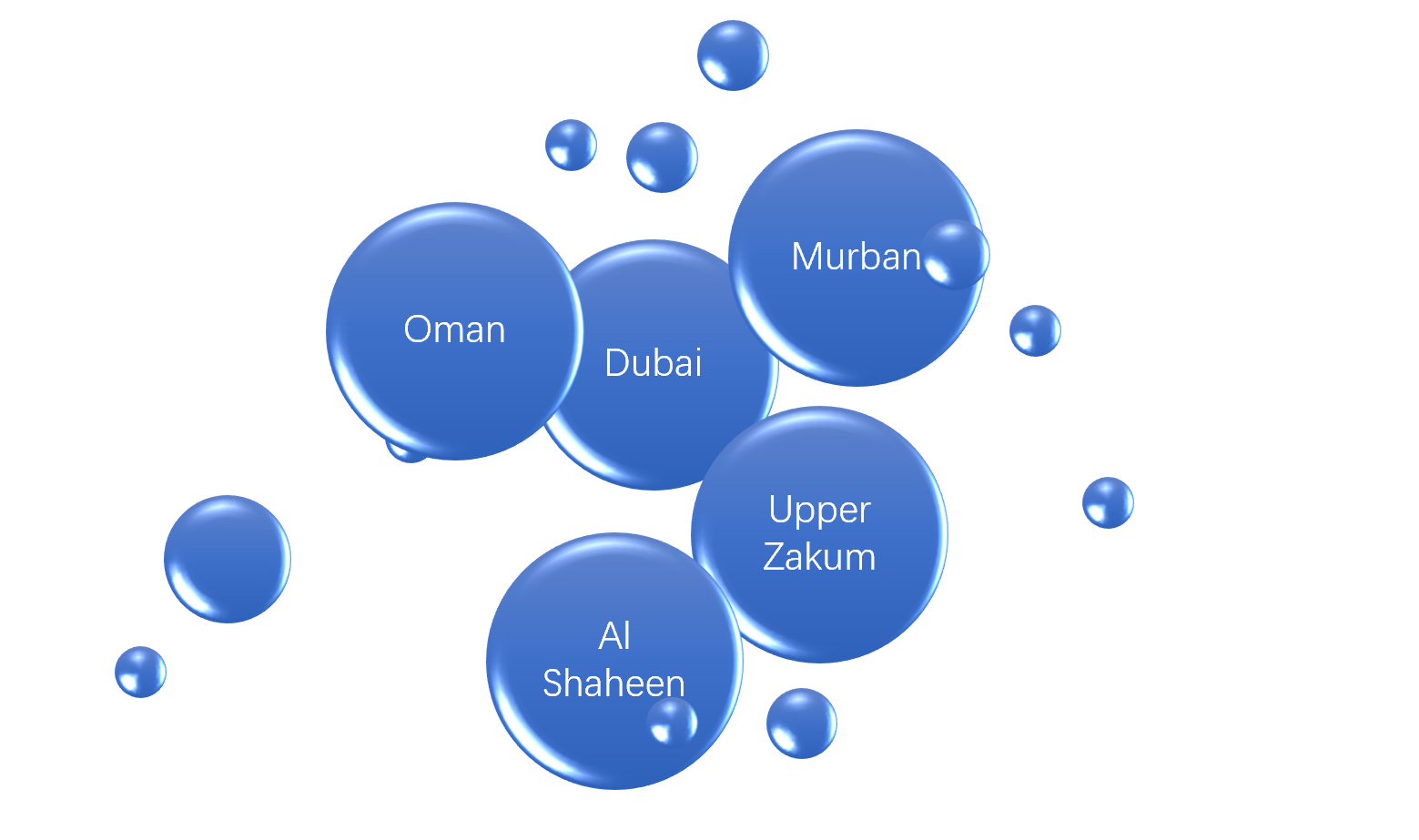

The first idea is to introduce other deliverable crude oil. In 2001, Platts allowed the delivery of Oman against Dubai. Over the years, three other crude grades were added to the Dubai basket namely known as Upper Zakum, Al Shaheen and Murban. Quality premiums or discounts is reported against the Dubai stream by price reporting agencies to compensate for the delivery of any of the Dubai basket that is not Dubai itself. Total production of these five fields is around 3.6 million b/d, and typically there will be almost 2.4 million b/d of Dubai, Oman, Upper Zakum, Al Shaheen and Murban available to be freely traded. This compares to around 1,000,000 b/d underpinning the North Sea Brent benchmark BFOET. In a sense, Dubai has turned into a brand or index that represents a basket of mid-sour grade.

Figure 3: The current Dubai crude oil basket

Source: Author

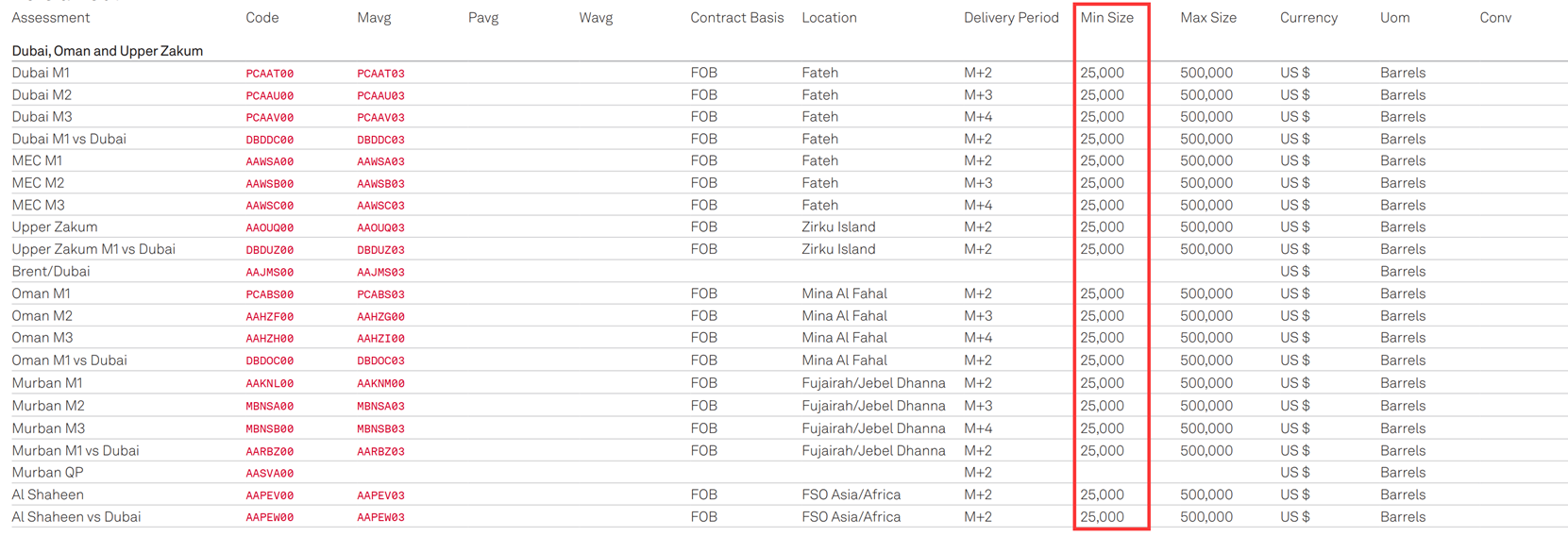

Secondly, in 2004, Platts introduced a mechanism known as the partials mechanism, which has the effect of slicing a Dubai or Oman cargo into small parcels. The smallest trading unit for the partial was set at 25000 barrels. Once a buyer acquires 20 partial cargoes of 25,000 barrels each of the same grade (Dubai, Oman, Upper Zakum, Al Shaheen or Murban) from a single seller within the calendar month, the partials converge into a physical full cargo of 500,000 barrels. Any traded amount less than that amount is not deliverable and should be cash settled. The shift to partials trading in 2004 produced encouraging results, increasing the volume of trading activity and hence improving the efficiency of price discovery.

Figure 4: The primary specifications for S&P Global Commodity Insights’ Platts crude oil assessments in the Middle East

Source: S&P Global Commodity Insights

Source: S&P Global Commodity Insights

Platts Dubai assessments reflect market activity in Dubai partials and full cargoes on the basis of concluded deals, or failing that, on bids and offers on the Platts Window. The Platts window can be thought of a structured system used for gathering information, on the basis of which Platts assess the daily price of key physical benchmarks. In this system, only deals transacted within this time window (for instance from 4:00 to 4:30 for European crudes) are used to assess the oil price for that day.

At the same time, a large derivatives market has grown around this brand name, feeding back into the price discovery of the benchmark itself.

On the OTC markets, the two most important layers surrounding the Dubai market are the Brent/Dubai Exchange of Futures for Swaps (EFS) and the Dubai inter-month swaps markets. The EFS is the premium of ICE Brent crude futures to Dubai crude swaps for the same contract month.

By trading EFS, traders can convert their Dubai Swap exposure into a Brent price exposure. The EFS is also a key indicator of the competitiveness of Brent linked Atlantic basin light sweet crude relative to Dubai linked sour Mideast Gulf grades.

As the vast majority of sour crude oil trading East of Suez is priced against the Dubai and typically on the monthly average, the Dubai swap contracts in turn settle against the monthly average of the Platts Dubai physical assessment.

Dubai inter-month swaps are also actively traded, by trading differentials, market participants limit their exposure to risks of time, these differentials are then used by oil reporting agencies to identify the price level of a physical Dubai benchmark.

Figure 5: Buying Brent futures and selling Dubai swaps can be done as one trade by buying the EFS

Source: Author

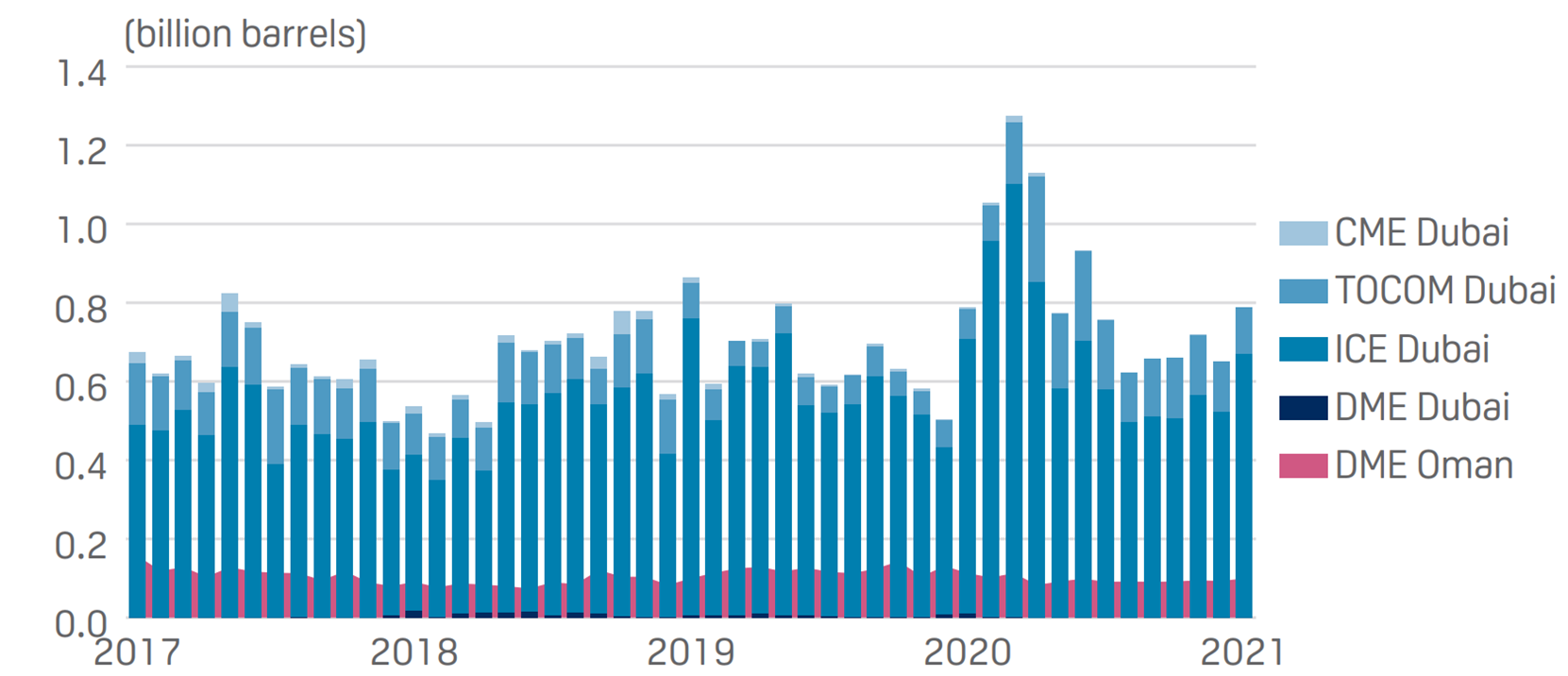

The valuation methodology of these price agencies is not sufficiently objective, because it is based on information about physical oil transactions and does not reflect the large number of futures transactions in the market. Over the years, some former OTC Dubai crude swaps markets are now traded as futures contract, an estimated 27.4 million barrels per day of Dubai oil futures are traded in 2020. There is also a greater concentration of activity levels onto a handful of exchanges while the JPX Dubai contract remains an important market.

Figure 6: Dubai futures liquidity

Source: S&P Global Commodity Insights

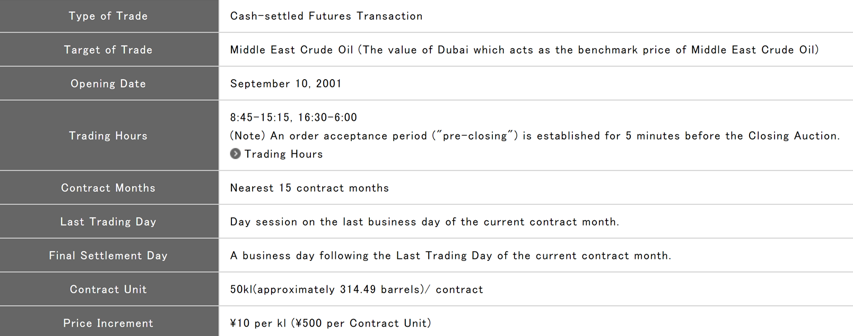

JPX’s crude oil contract differs from the other Middle East Asia crude oil derivatives primarily because of its units: the contract is denominated in kiloliters rather than barrels and yen rather than US dollars. JPX lists six forward months and the activity is weighted towards the later listed months.

Figure 7: JPX Dubai futures contract specification

Source: JPX

The futures market plays two important roles: price discovery and hedging/speculation or what is termed as risk management.

The Dubai crude futures contract traded on JPX provides a visible real-time reference price for the market. The price of Dubai is often derived using information from the futures market outside the Platts window when there’s low liquidity. The futures market has also provided an easy and a safe way for various participants, both institutional and retail investors, to gain exposure to commodities. Expectations of relative higher returns in investment in commodities due to perception of tightened market fundamentals have already motivated many investors to enter the crude oil market.