TOCOM Energy

Japan Electric Power Exchange (JEPX) Overview

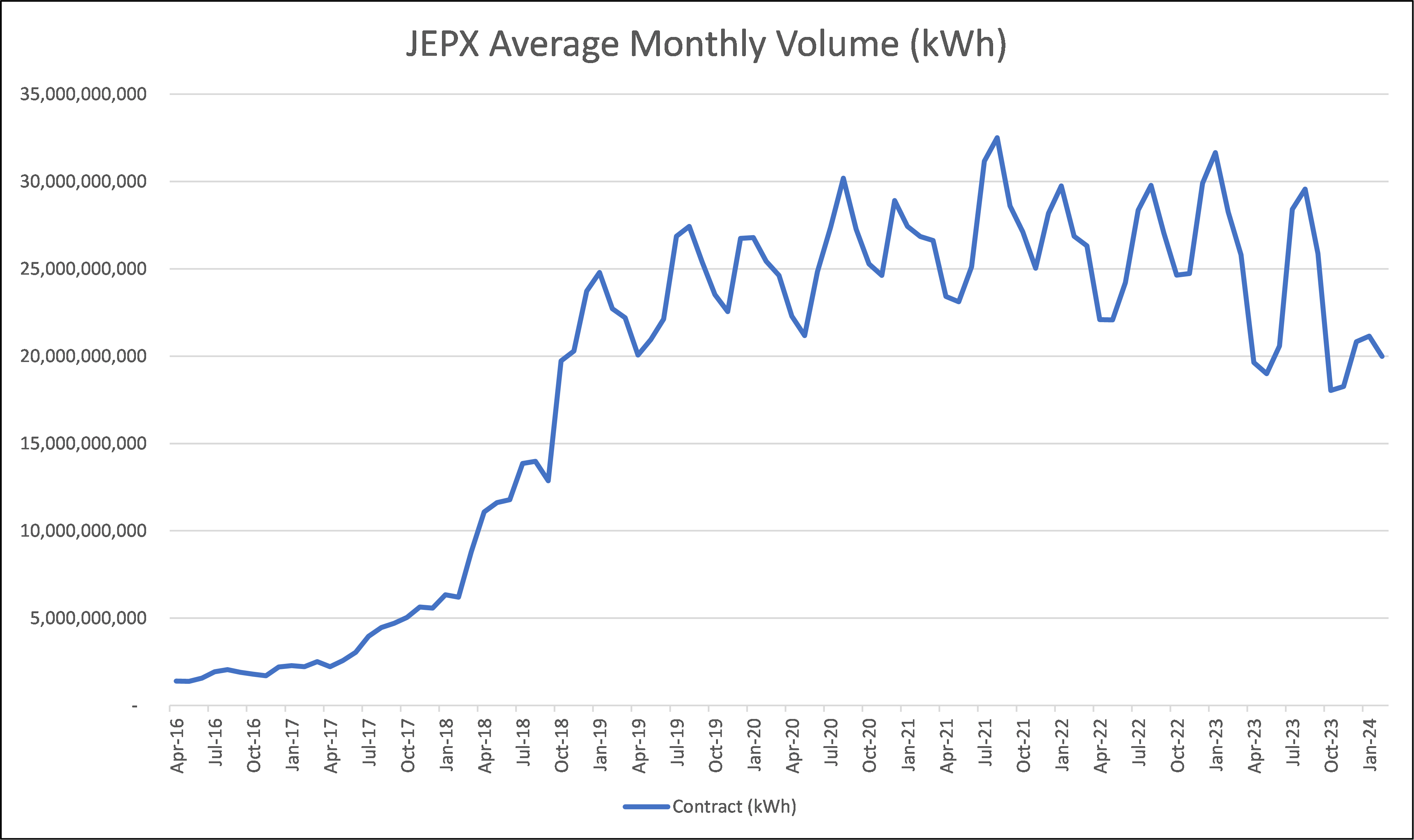

JEPX was founded in 2003 as Japan’s physical wholesale spot market for electricity. Trading volumes of electricity until 2016 were very small, representing approximately 2% of Japan’s generation supply. This changed dramatically starting in 2016.

In 2016, full liberalization of Japan’s electricity market commenced. Liberalization laws enabled all customers in Japan to select a supplier other than their host utility. This resulted in hundreds of new entrants coming into the electricity market as retail suppliers. These new entrants, known as PPSs (Power Producers and Suppliers), utilized JEPX to source supply. As a result, the demand side of JEPX spot market trading grew steadily.

To meet the growing demand, METI (Ministry of Economy, Trade, and Industry), the energy markets regulator, mandated that generators owned by utilities be required to submit supplies into the JEPX market. Since then, trading volume has grown steadily to its current level of approximately 40% of generation supply.

JEPX manages several electricity trading markets

Baseload Market – : Auctions for the whole following fiscal year (April-March). The auctions are held 4 times a year July, September, November, and January.

Spot (Day-Ahead, DA) – JEPX: 48 slots/day, single price auction per slot using demand/supply curves formed from bids/offers for each of the 9 utility regions.

Same Day (Intraday, ID) – JPEX: 48 slots/day, multiple prices with continuous trading during each ½ hour slot. A single market applies to all regions.

Indirect Transmission Rights (ITR) – JEPX: Auction for the right to receive the spot price difference between regions. The auctions cover 4 to 5 weeks of transmission rights and are held two months before the weeks being auctioned on the second weekday after the 20th of the month, or on the first weekday if the 20th is a holiday or weekend. The Exchange may change the ITR transaction implementation date when deemed necessary, notifying their members of the change in advance.

Non-Fossil Fuel Certificates (NFC) – JEPX auction for NFCs which are derived from renewable energy sources and electricity from other sources that do not emit carbon dioxide (CO2) including nuclear.

The spot market is traded either by each of the nine mainland utility territories or Japan East and Japan West, which is the same East and West as the futures market. Intraday is only traded as a single system price, not East, West, or a specific utility territory.

JEPX is a membership-style organization requiring an application and documentation showing a member has a METI PPS license or generation license, as well as an OCCTO membership (Organization for Cross-regional Coordination of Transmission Operators). OCCTO, among other functions, is the single entity for scheduling physical power across all of Japan. To become a JEPX member there is a one-time admission fee, an annual fee, a trust deposit, and trading fees of JPY .03 per kWh for spot trades and JPY .10 per kWh for intraday trades. Currently, there are no system usage fees. Bank deposit requirements for each member are calculated daily as 1.5X the sum of unsettled net JPY of payable, minus receivables from Spot and Intraday transactions, minus fees payable.

If a trading entity retains a long or short position at the end of the spot trading day, that position rolls into the Intraday market. If the trading company does not zero out the position in the Intraday market, JEPX automatically sends the details to OCCTO, and the trading company must schedule the power with JEPX or incur balancing penalties.

JEPX transactions are settled based on two business days after the transaction. JEPX is currently the settlement entity and automatically draws from each trading member’s bank account. JEPX and the Japan Exchange Group (JPX), owner of the TOCOM electricity futures market, signed a Memorandum of Understanding (MOU) on January 19, 2023, to strengthen the relationship between the two markets and promote their development and efficient operation.

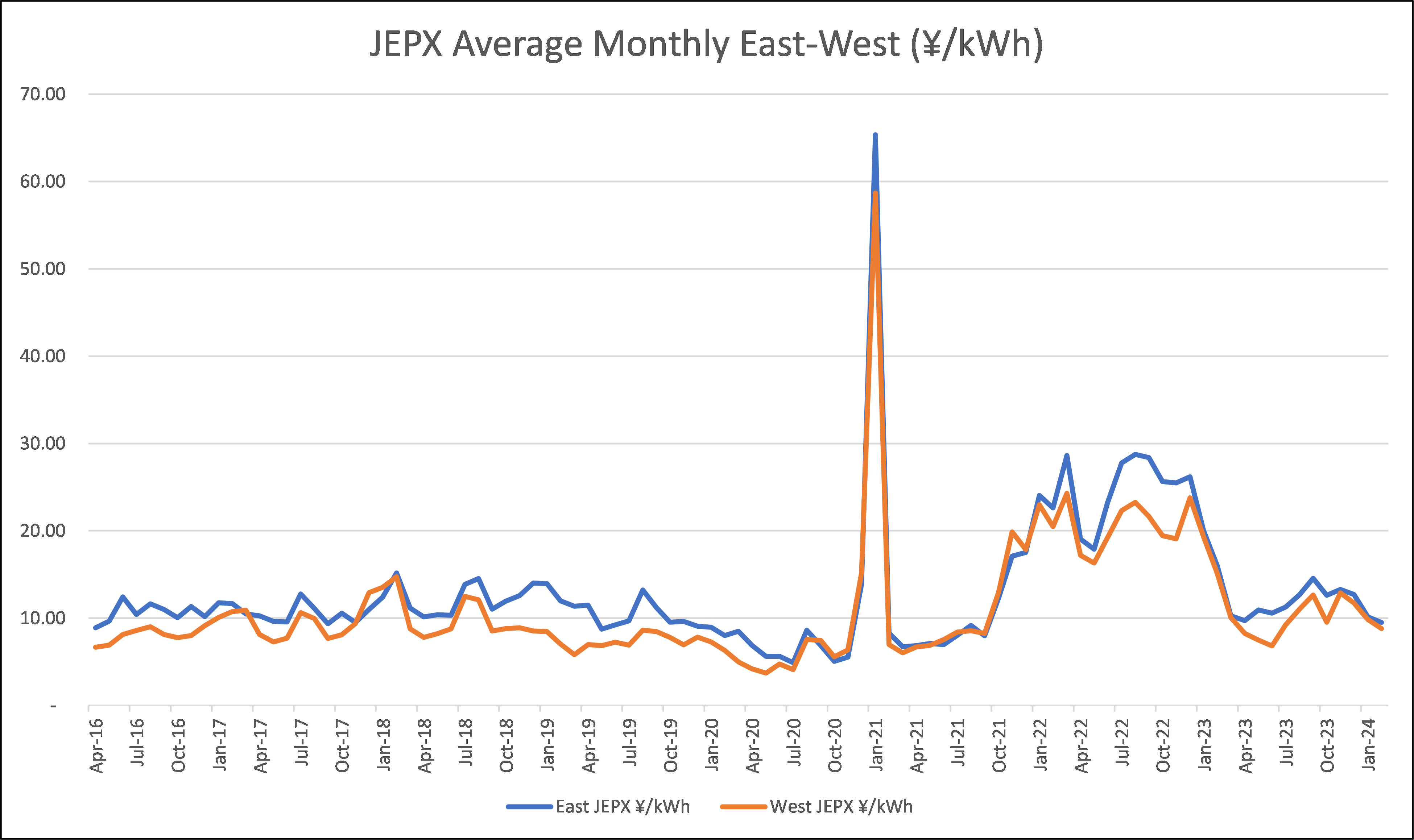

Volatility

Japan has both a summer and a winter peak demand, which is reflected in spot market pricing. A major driver of generation prices is LNG, which fluctuates with international supply and demand trends. Until 2021, spot prices in Japan were somewhat predictable based on seasonal peaks. In winter 2021/2022 lower than expected temperature with low national LNG inventory caused extreme volatility in the spot market for the first time since liberalization in 2016. Then, the Ukraine war caused global LNG prices to rise dramatically which brought ongoing volatility to Japanese power markets for the next year and a half. As global LNG and Coal prices came down during 2023, Japanese power spot prices followed through down to pre- year 2021 level.

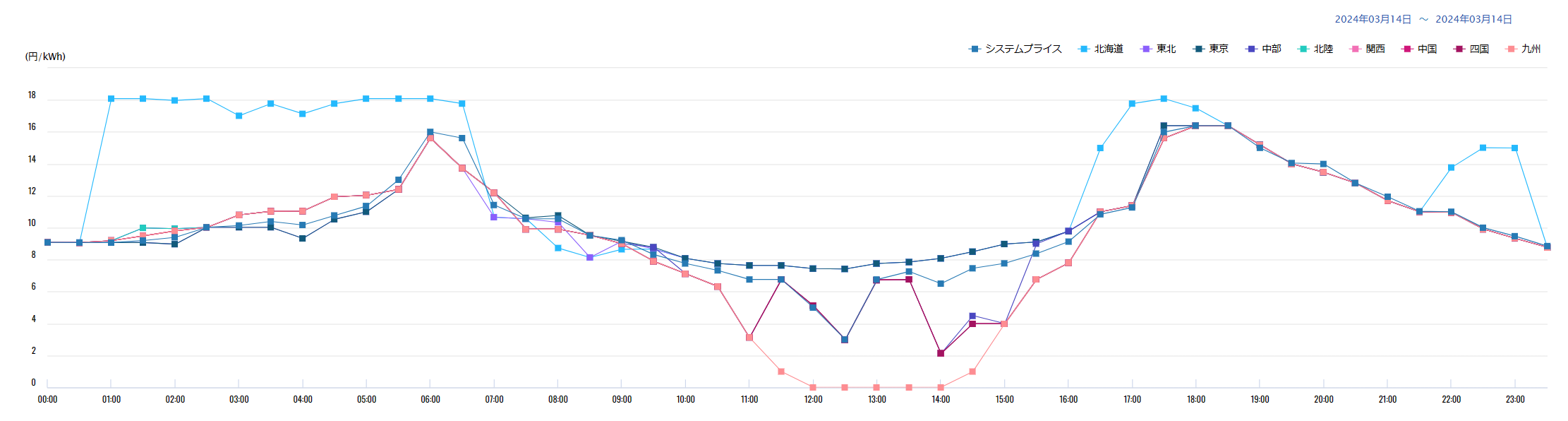

Additional spot and intra-day price movements are growing due to the “Duck Curve” phenomenon in which mid-day prices are much cheaper than early morning and evening prices. This price differential is due to excess solar generation during the day. The Duck curve started in the Kyushu utility area in the West-South part of Japan and has grown to most other utility markets as solar penetration continues to grow.

Duck Curve JEPX Spot Price Example (March 14, 2024) Source; JEPX

This volatility has resulted in several shifts in Japan’s electricity market.

- METI modified its policies and called for widespread adoption of risk management practices by energy companies.

- Futures market volumes were driven significantly higher as energy companies started using futures for hedging.

- Some 195 retail suppliers formed since liberalization in 2016 exited the electricity business. There are still more than 700 retailers remaining.

- Volatility has attracted a good number of international trading firms that have now entered the Japan spot and futures markets.

What’s Next

While global LNG prices have stabilized for now, other factors will alter the dynamics of the spot market.

- Per Government laws and METI mandates, the generation mix in Japan is undergoing a transition from fossil to renewable power as Japan pushes toward net zero by 2050.

- Post Fukushima, nuclear generation in Japan reached an all-time low in production. In the past few years about a third of the nuclear fleet is back online with more scheduled to return to active status.

- While traditional load growth is flat to slightly down, data centers and EV charging are driving load growth.

- Solar generation in some utility markets is driving early afternoon spot prices to near zero. This is attracting battery developers to enter the market to take advantage of the price spread opportunities.

By Peter Weigand, CEO, Skipping Stone