TOCOM Energy

Quick guide to TOCOM’s Electricity Futures market

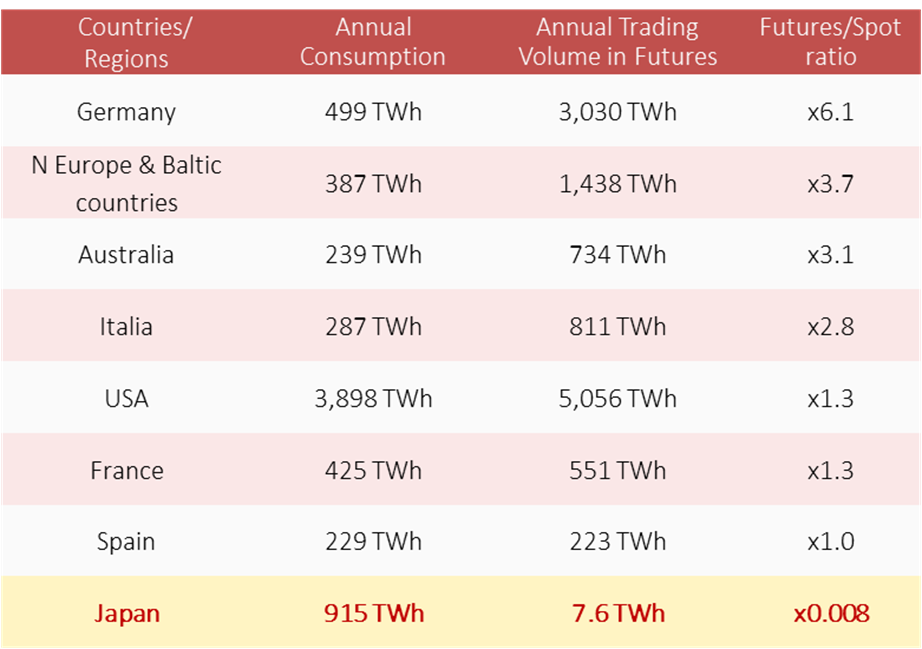

Japan’s electricity consumption is the fifth highest in the world (939TWh) as of 2022 [1], following China, the United States, India, and Russia, making it one of the largest electricity-consuming countries. When comparing trading volume of electricity global futures markets, Europe and the United States, trade about 1 to 6 times the countries consumption, whereas Japan (TOCOM) is much newer and trades less than 1% of consumption.

Based on the history of global electricity futures markets, the Japan trading volumes are expected to grow. This growth is being driven by both international traders entering the Japan market and domestic Japanese energy companies becoming more comfortable using futures for hedging.

Futures vs Spot Market Size by Country (2022)

Source: EIA

[1] https://yearbook.enerdata.jp/electricity/electricity-domestic-consumption-data.html

The electricity futures market at TOCOM achieved listing in September 2019. The purpose of TOCOM opening the electricity futures market is to provide (1) a hedging tool for price volatility risks in the electricity market, given its non-storability nature, (2) a hedge function for credit risks between trading counterparties in relative transactions, and (3) to serve as a future price discovery function by providing an electricity forward curve.

In the electricity futures market, physical delivery does not take place, and all transactions are settled in cash. This enables participation from electricity companies, end use customers, financial institutions and international energy companies.

Since the price surge and volatility starting in January 2021 at Japan Electric Power Exchange (JEPX, Japan’s physical spot market) driven by LNG disruption due to the war in Ukraine, there has been a growing interest among electricity players in using electricity futures trading for hedging price risk.

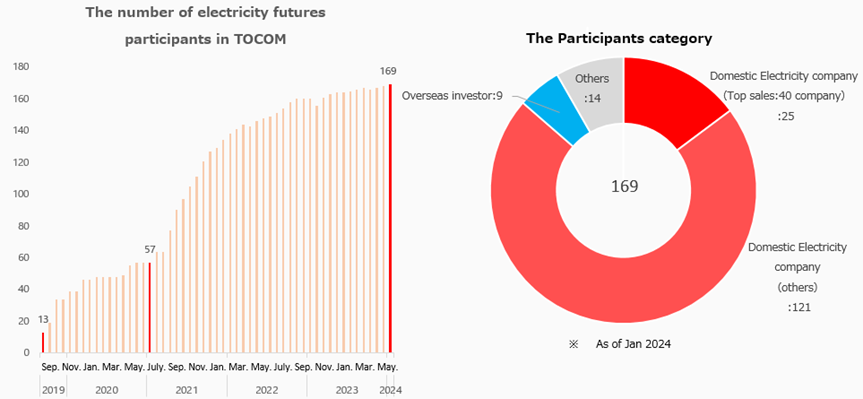

The volatility also attracted speculative and proprietary trading activity. As of the end of January 2024, there were 169 market participants in the TOCOM electricity market, including local electricity companies, large end use customers, international power traders, and financial institutions. TOCOM receives new membership inquiries daily, and the number market participants, both domestic and international, is increasing steadily.

Source: TOCOM

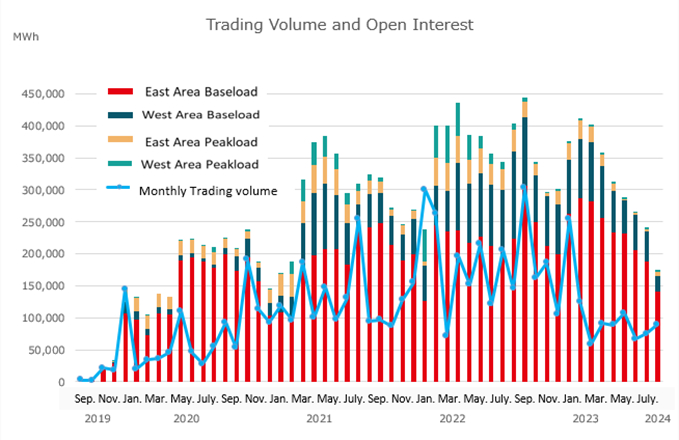

Based on the Japan’s power industry characteristics four types of contracts are currently traded at TOCOM: East Area Base Load, East Area Peak load, West Area Base Load, and West Area Peak load, which group together the Eastern and the Western Japan areas.

Since its listing in 2019, trading volume has expanded mainly in the East Area Baseload and has been steadily increasing due to increased awareness in the West Area and arbitrage trading between the East and West. After listing, there has been a significant increase in the fluctuation of wholesale energy commodity prices globally due to geopolitical risks combined with global supply and demand swings. Japan, as an importer of LNG and coal, are subject to these global commodity fluctuations. As a result, power companies and businesses are increasingly utilizing the functionality of futures contracts to hedge against price fluctuations.

Source: TOCOM

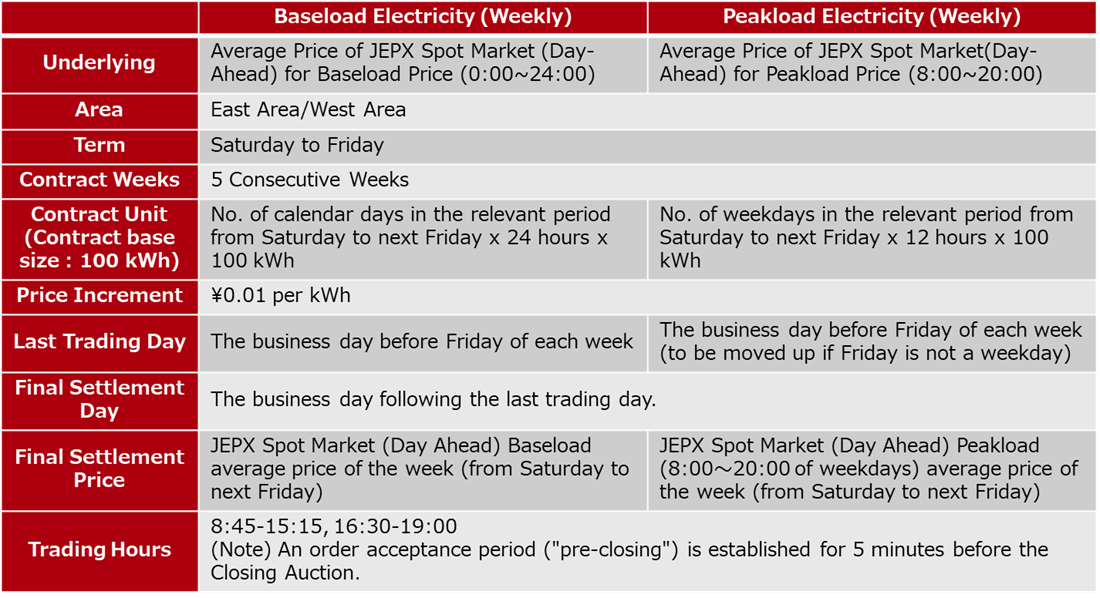

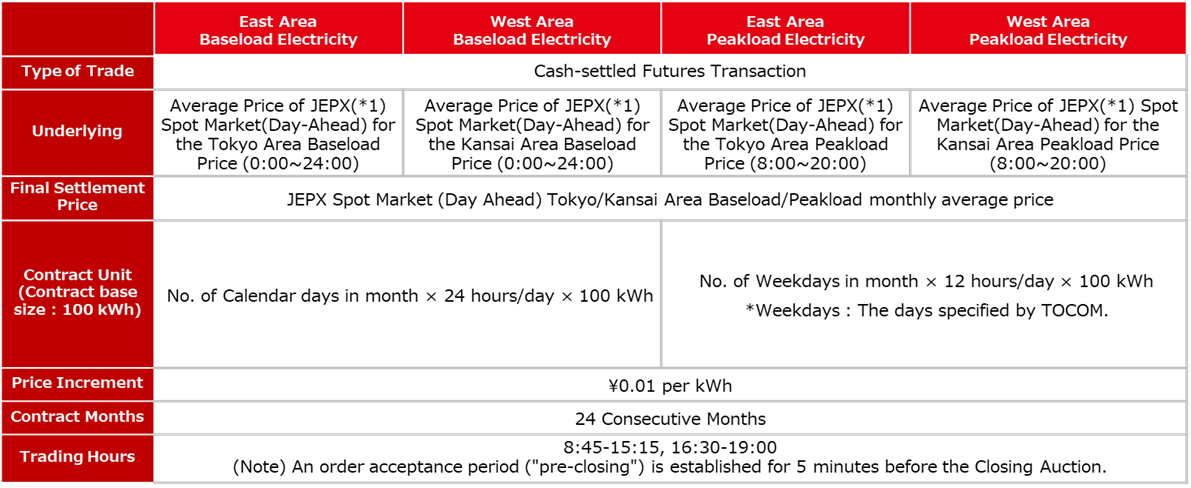

TOCOM Electricity Contract Specifications

- Weekly contracts for electricity futures

TOCOM plans to introduce weekly contracts for electricity futures, effective from March 18th, 2024. This initiative aims to cater to the demand for shorter-term hedging options for electricity price risk. The underlying of the contract is the weekly average of prices traded on the JEPX spot market for the Tokyo (East of Japan) and Kansai (West of Japan) areas.

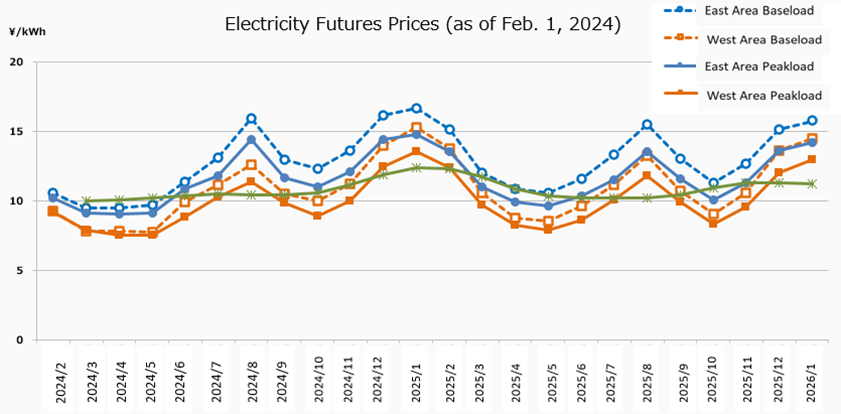

- The characteristics of Japan’s electricity forward curve

There is a significant seasonal pattern where prices are higher in summer and winter, and lower in spring and autumn. In general, the prices in East Japan are lower than those in West Japan when comparing different areas. In addition, prices for Peak Load are generally higher than Base Load prices.

It’s worth noting that the price relationship between East and West Japan can reverse depending on the supply-demand situation. Additionally, the price relationship between Base Load and Peak Load can also reverse depending on the area and season, influenced by factors such as the generation status. These diverse relationships are growing due renewable energy sources like solar power.

Source: TOCOM

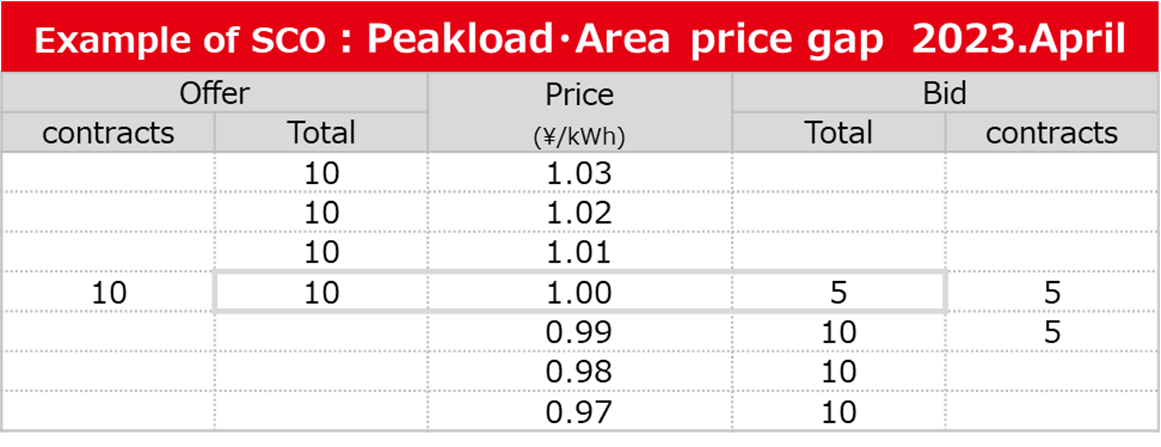

- Spread Trading in Electricity Futures (SCO Trading)

For TOCOM’s electricity futures, spread board (SCO order board) trading is available, which allows trading the price difference between the same product and delivery month in the East Area and West Area. The buy order for SCO trading represents “Buy East Area/Sell West Area,” while the sell order represents “Sell East Area/Buy West Area.” Buyers (sellers) of SCO orders make a profit (loss) when the price difference widens and incur a loss (profit) when the price difference narrows. Orders are placed on a dedicated SCO trading board. By using SCO trading to engage in East-West spread trading, it is possible to hedge against the risk of market fragmentation between the East and West areas and achieve similar economic effects as those seen in indirect transmission rights trading.

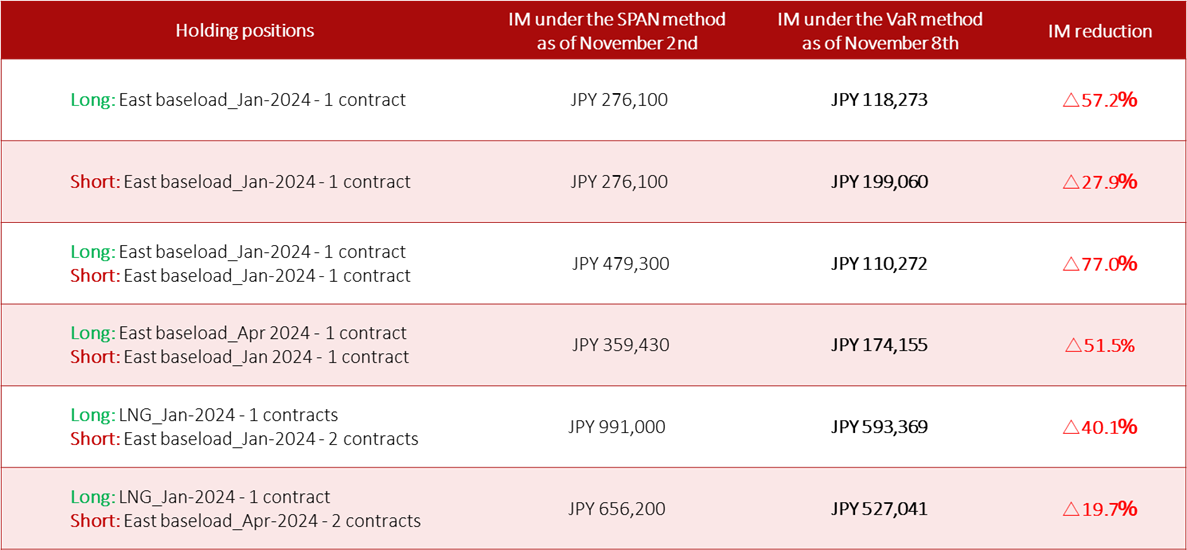

After introducing the VaR Method to the Initial Margin (IM) calculation at Japan Securities Clearing Corporation (JSCC) on November 6th, 2023, IM on Electricity Futures outright or the combination between different contract months or LNG futures contracts showed a margin-efficient tendency.

- Building synergies with Spot markets

On January 19, 2023, the Japan Exchange Group (JPX) and the JEPX, which operates the physical spot market for electricity, signed a Memorandum of Understanding (MOU) to strengthen the relationship between the two markets and promote their development and efficient operation. Leveraging the expertise in exchange operations within the JPX Group, the goal is to improve the overall convenience and functionality of the electricity markets for all participants.