OSE Derivatives

The Osaka Exchange (OSE) offers a wide range of investment opportunities across multiple types of futures and options underlying equity indices, fixed income or commodities. One of the prosperous derivatives products in JPX is Nikkei 225 mini Futures, the third-largest trading volume of equity index futures contracts in the world in 2020. Please refer to the OSE Tips for our market regarding regulations, etc.

-

Gold Market Commentary: Jumbo cut drives gold rally

World Gold Council

10月 21, 2024 4 min read

-

Are Japanese bond investors re-engaging foreign bonds?

Harry Ishihara, Macro Strategist

9月 15, 2024 4 min read

-

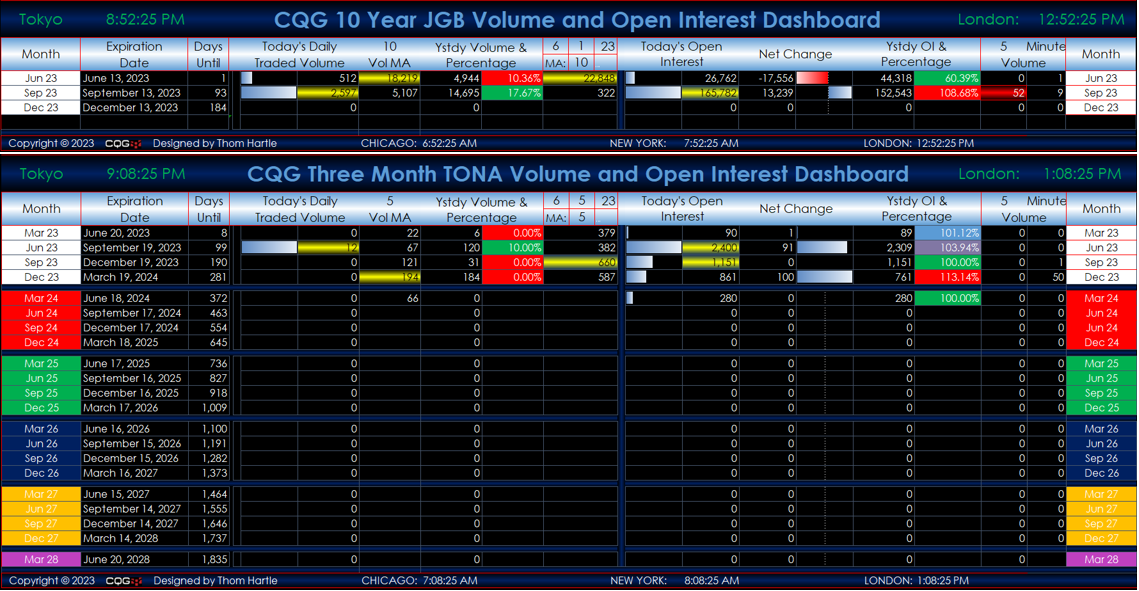

CQG Offers Roll Dashboard of JPX 3-Month TONA Futures and 10-year JGB Futures

CQG

9月 9, 2024 3 min read

-

How to invest in platinum

World Platinum Investment Council - WPIC®

9月 3, 2024 5 min read

-

Gold ETF Flows: July 2024

World Gold Council

8月 30, 2024 4 min read

-

A GUIDE TO TSE’S BANKS INDEX, ETFS, AND FUTURES

OSE

8月 16, 2024 6 min read

-

Japanese retail’s yen carry trade

Harry Ishihara, Macro Strategist

8月 16, 2024 4 min read

-

Japan’s Inflation Revolution – an update

Harry Ishihara, Macro Strategist

7月 31, 2024 4 min read

-

Second quarter gold demand hits record highs, supporting rising prices

World Gold Council

7月 31, 2024 4 min read

-

You asked, we answered: What’s behind gold’s March rally?

World Gold Council

7月 24, 2024 4 min read

-

Central bank gold buying picks up in April

World Gold Council

7月 24, 2024 3 min read

-

Is the yen’s weakness more structural now?

Harry Ishihara, Macro Strategist

6月 19, 2024 5 min read