TOCOM Energy

Will Volatility Spur Growth in Japan’s Electricity Futures Market?

While demand for electricity is rising in the northern hemisphere ahead of winter, energy prices been rising globally since the European gas crisis of 2021. Several factors, including Russian aggression in Ukraine beginning in the spring of 2022, rising fuel prices, and rapid depreciation of the Japanese yen, have caused electricity prices in Japan to rise significantly and volatility to expand. Electric power companies and electricity consumers can hedge these risks in the electricity futures market.

The electricity futures market on the Tokyo Commodity Exchange (TOCOM) was launched three years ago, and participants and trading volume have been expanding since January 2021, when spot prices soared in response to tight supply and high demand for power. The TOCOM electricity futures market is positioned to provide an effective hedge against electricity price variations.

Electricity market in Japan

According to the International Energy Agency (IEA), Japan’s electricity consumption in 2020 was 987 tWh per year, ranking 4th in the world after China, the US, and India. Japan’s electricity market, considered the largest single liberalized electricity market in the world, was liberalized in 1995.

In April 2016, the electricity retail market was fully liberalized, resulting in a flood of new entrants. Further power system reform and separation of power transmission and distribution have followed.

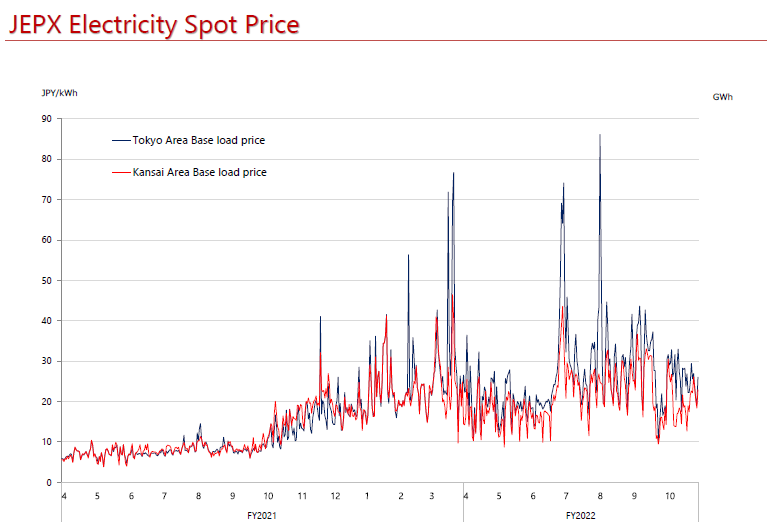

Trading volume on the Japan Electric Power Exchange (JEPX)¹, the wholesale electricity market, has grown to account for more than one-third of Japan’s electricity demand. While JEPX gains in importance as many new entrants rely on it for most of their power procurement, there is also growing awareness of the risks from fluctuations in electricity prices.

The winter of 2020-2021, marked by a combination of severe cold weather, troubles at domestic power plants, and problems with supply facilities in LNG-producing countries, caused a shortage of electricity sales bids in the electricity spot markets. Tight supply, high demand, and soaring electricity spot prices highlighted the need for power companies to hedge against risks; increasingly, companies have sought protection in the electricity futures market.

Japan’s Cabinet approved the Sixth Strategic Energy Plan² in December 2021. The plan sets basic policies for medium- and long-term energy supply, demand, and use, and promotes risk management by power companies by activating the electricity futures market, along with the use of forward and baseload markets.

¹ JEPX: http://www.jepx.org/english/index.html

² Sixth Strategic Energy Plan:

https://www.enecho.meti.go.jp/en/category/others/basic_plan/pdf/6th_outline.pdf

TOCOM electricity futures market

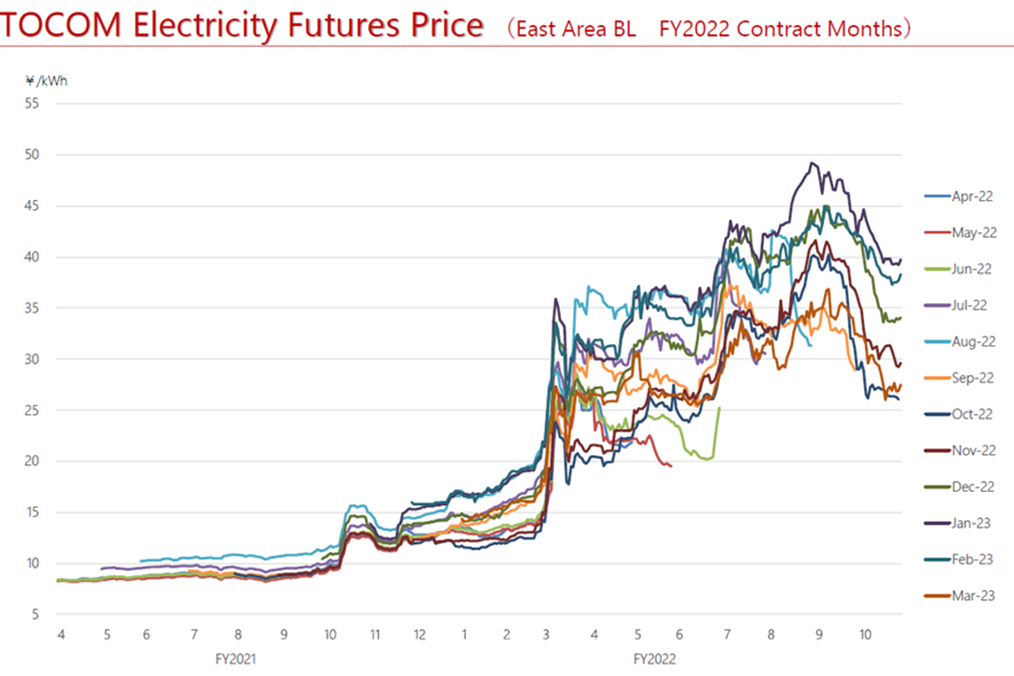

In September 2019, Tokyo Commodity Exchange, Inc. (TOCOM), a subsidiary of Japan Exchange Group (JPX), launched an electricity futures market to help insulate power companies against price volatility. The electricity futures market provides: 1) medium- to long-term price outlooks (forward curve), 2) a hedging function for spot price volatility risk, and 3) a hedging function against credit risk in bilateral transactions.

On April 4, 2022, TOCOM upgraded its electricity futures from trial listing to permanent listing. Marking the event, Takashi Ishizaki, TOCOM’s president, predicted further growth for Japan’s electricity futures market, and committed to a fivefold increase in trading volume over the next three years.

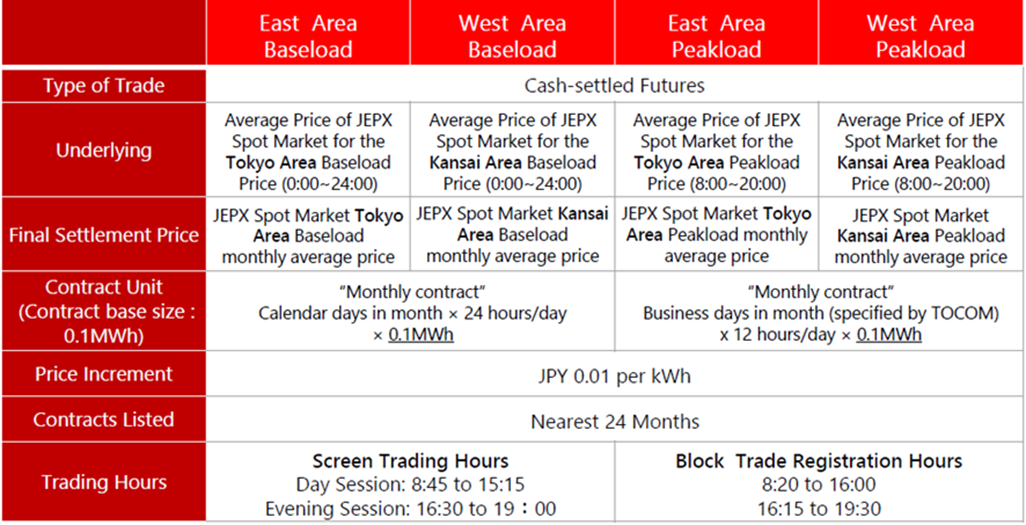

TOCOM lists four products: East Area Baseload, West Area Baseload, East Area Peakload, and West Area Peakload. As electricity futures do not require physical delivery and clearing is accomplished via cash settlement, the market is open to financial institutions and overseas energy companies as well as Japanese power companies.

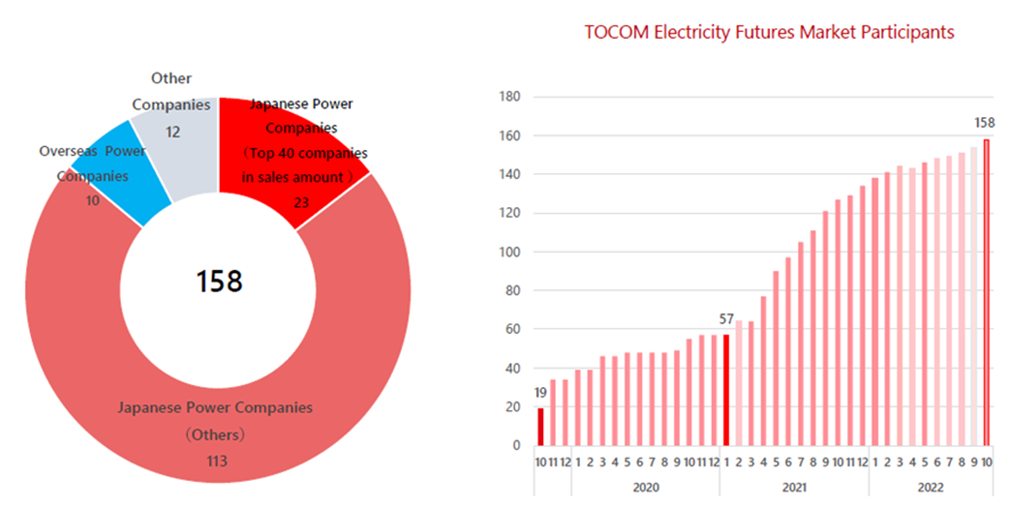

Participants

The JEPX price spike of January 2021 prompted many power companies to consider hedging opportunities in TOCOM’s electricity futures market. Currently, there are 158 trading participants (as of the end of October 2022), including domestic electric utilities, overseas power traders, and financial institutions. More domestic power companies have joined the market since last year.

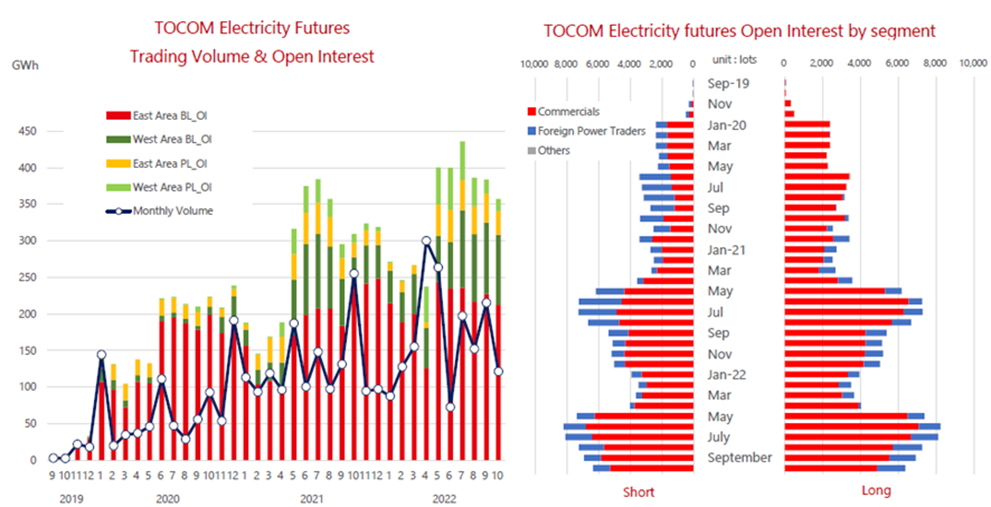

Transaction volume in FY2021 increased 1.7 times over the previous year. TOCOM recorded its highest monthly transaction volume in April 2022, and the highest ever volume of open interest contracts in July 2022.

Floor (auction) trading and off-floor (block) trading

TOCOM supports auction trading through trading screens provided by TOCOM, and off-floor trading (block trading) via external brokers. In the TOCOM electricity future market, floor trading tends to be used for small-lot transactions, while off-floor trading is used for large-lot trades.

Access to TOCOM energy markets

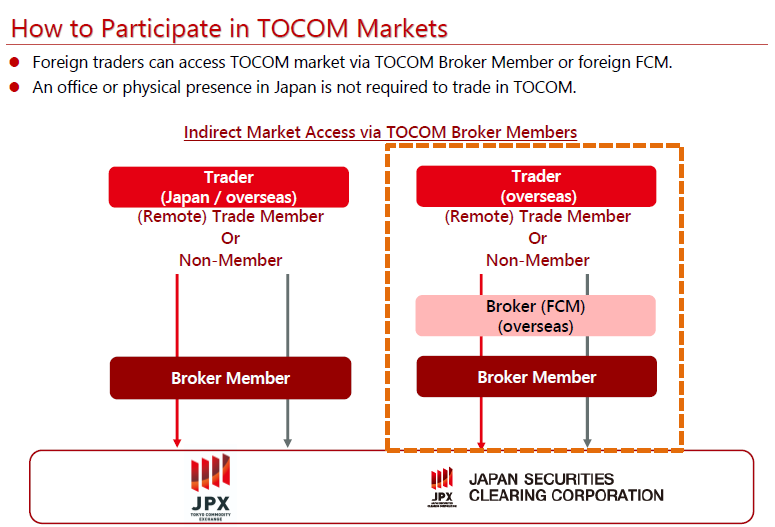

Traders may access the TOCOM market in two ways:

1) Direct access to TOCOM system (proprietary trading and clearing).

Obtain TOCOM and JSCC (Japan Securities Clearing Corporation) qualification to conduct trading and clearing on your own.

2) Open an account with a commodity futures broker for trading and clearing (brokerage trading).

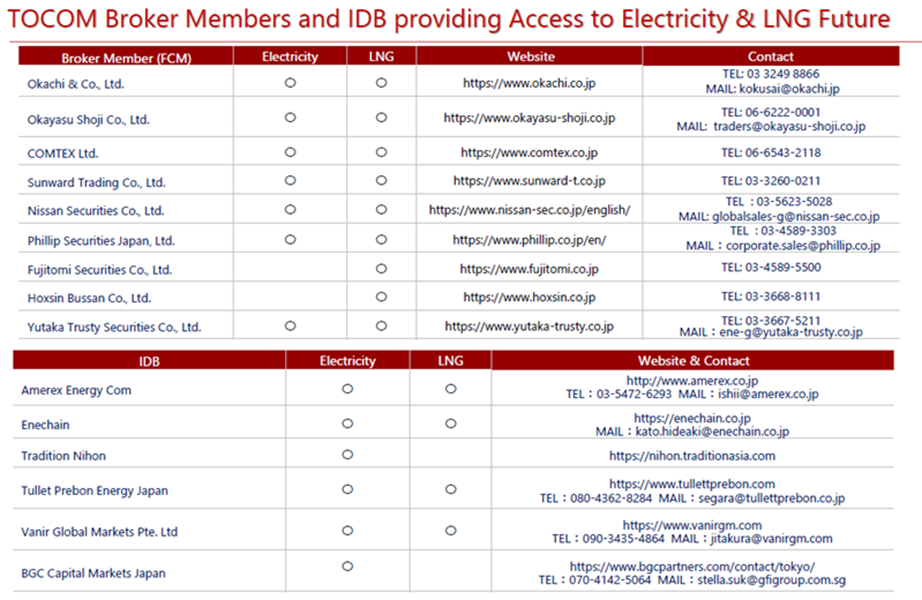

Broker members and interdealer brokers (IDBs) that handle TOCOM power futures are listed below. For more information on brokers and IDBs, please contact each company.

Related links