OSE Derivatives

Overview of Japanese and Chinese Equity Index Futures Markets

On September 7, 2022, Japan Exchange Group (JPX) and China Financial Futures Exchange (CFFEX) signed an MOU to enhance their cooperation on the development of both derivatives markets.

This article will take the opportunity to introduce a brief market overview of the equity index futures listed at Osaka Exchange (OSE) under JPX and CFFEX.

Market Overview of Equity Index Futures in Japan and China

China and Japan have the second and third largest economies in the world in terms of GDP, so their sizable equities markets also have a significant presence. The market capitalization of the Chinese and Japanese equities markets at the end of 2021 was RMB 91 trillion (equivalent to around USD 14.4 trillion) and JPY 753 trillion (equivalent to around USD 6.5 trillion), respectively.

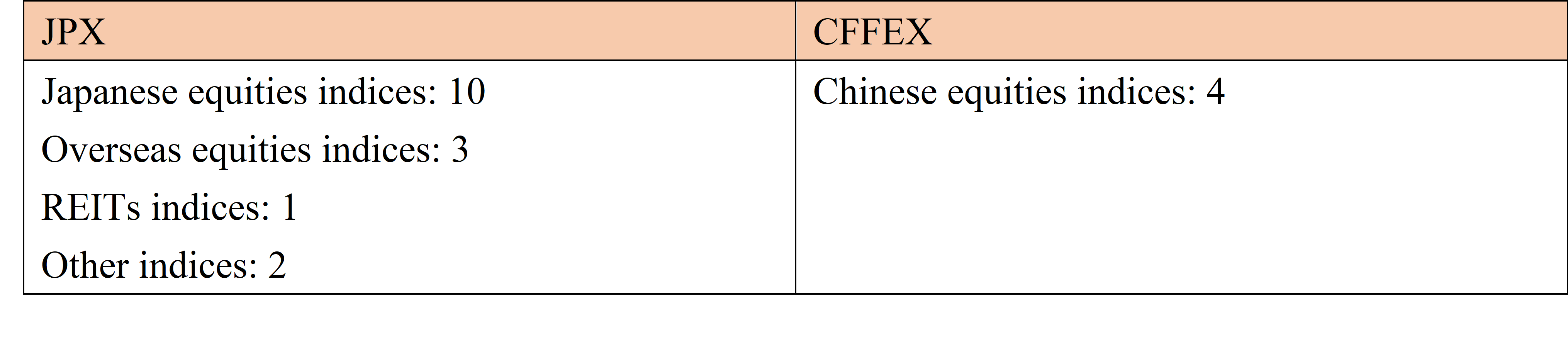

In addition to these cash-equities markets, both countries have active listed equities derivatives markets. The table below shows the types of the equity index futures listed at JPX and CFFEX.

As of December 2022, JPX has 16 listed equity index futures, underlying Japanese, overseas, REITs, and other indices, while CFFEX has 4 Chinese equity index futures.

Types and the Number of Listed Equity Index Futures

Source: JPX,CFFEX

Source: JPX,CFFEXIn Japan, trading of Nikkei 225 Futures, the most popular listed equity index futures, and TOPIX Futures, a wide used product among institutional investors for hedging purposes, began in 1988.

Since then, JPX has expanded its product lineup and improved its trading rules and sophisticated trading systems to meet the demands of various players, including retail and domestic and overseas investors. JPX’s initiatives that have had a particularly significant impact on market expansion include:

- Mini-sized contract futures, Nikkei 225 mini, were launched in 2006. Many Japanese retail investors rushed to equities and derivatives markets in the early 2000s, and the mini-sized products captured their trading demands.

- A new derivatives trading system, J-GATE, was introduced in 2011 and upgraded in 2016 and 2021. This state-of-the-art trading system was developed by NASDAQ, providing market services at an international standard level for various investors, including HFTs.

- The night trading session was introduced in 2007, and trading hours were extended until 8.00 pm in 2008, 11.30 pm in 2010, 3.00 am in 2011, 5.30 am in 2016, and 6 am in 2021. These changes provided further trading opportunities with overseas investors. In addition, JPX introduced holiday trading for derivatives markets in September 2022.

In China, the first equity index futures, CSI 300 Index Futures, were launched in April 2010, followed by SSE 50 Index Futures and CSI 500 Index Futures in April 2015, and CSI 1000 Index Futures in July 2022.

Upholding high standards with a focus on market stability, CFFEX strives to expand its financial derivatives product lineup to meet market participants’ diversified risk management demands. CFFEX’s chief efforts for market development are:

- CFFEX has expanded market access for various types of investors. Over the years, CFFEX has witnessed a steady growth in institutional participation by catering to institutional investors’ hedging and investment needs.

- CFFEX endeavors to steadily advance market opening-up, including catering to QFIIs/RQFIIs’ increasing needs to trade equity index futures for risk management purposes.

- In consideration of global best practices and domestic market dynamics, CFFEX continues to improve its access channels, trading mechanisms, and risk control measures to ensure orderly market operations and safeguard transparency, fairness, and impartiality.

- CFFEX has improved its IT infrastructure and data services. For example, CFFEX has secured three data centers to ensure continuous business operations: a primary data center, a same-city disaster recovery center and a remote disaster recovery center.

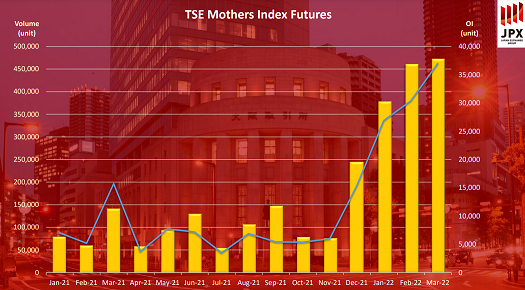

Trends in Trading Volume and Open Interests

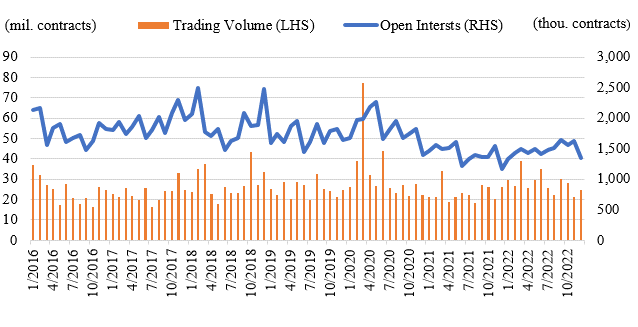

JPX’s annual trading volume of equity index futures expanded to 338 million contracts in 2022, compared to just 13 million in 2000. Though the monthly trading volume fluctuated between 10 million and 20 million contracts, trading volume was recorded at its highest level in several decades in March 2020 due to market turbulence caused by the COVID-19 pandemic. In contrast, the open interest showed no remarkable trends, moving between a range of 1.5 million and 2.5 million contracts.

Monthly Trading Volume and Open Interest of JPX’s Equity Index Futures

As for the investor base, in the case of Nikkei 225 Futures in 2022, around 74% of the trading volume was dominated by overseas investors, followed by brokers’ proprietary trading and retail investors. This significant presence of overseas investors represents why the derivatives trading share of JPX’s night session reaches almost 40%.

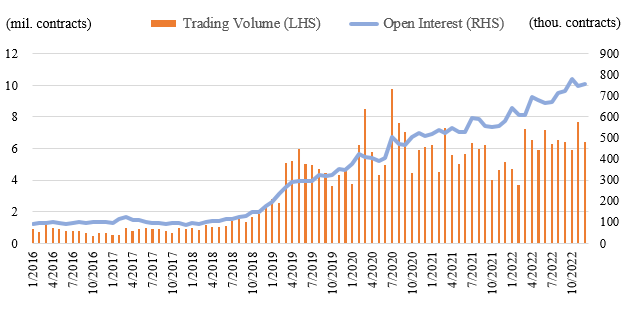

CFFEX’s annual trading volume of equity index futures recorded 74.5 million contracts in 2022, a steady increase from 9.4 million contracts in 2016.

The open interest balance reached 755,960 contracts at the end of 2022, which is about 7.5 times higher than in 2016 and 175,861 contracts higher than the previous year. In recent years, CFFEX’s equity index futures market welcomed greater participation by a more diverse array of institutional investors.

Monthly Trading Volume and Open Interest of CFFEX’s Equity Index Futures

On July 22, 2022, CFFEX launched CSI 1000 Index futures, which registered stable and moderate trading activities with the open interest steadily building up. As of December 2022, its average daily trading volume stood at approx. 55,595 contracts and average daily open interest was approx. 96,194 contracts. The price of the front month contract closely mirrored that of the underlying index, with a correlation coefficient of 99.5%.

Major Equity Index Futures in Japan and China

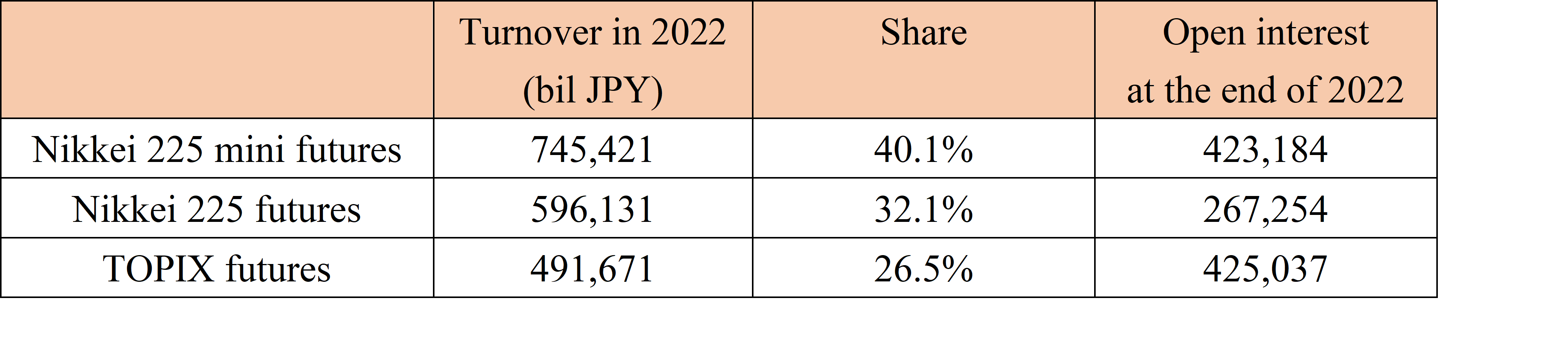

In Japan, three major futures contracts, Nikkei 225 mini, Nikkei 225 Futures, and TOPIX Futures, dominated 98% of the trading turnover among all equity index futures in 2021. According to the World Federation of Exchanges, JPX’s most liquid product, Nikkei 225 mini, ranked the third biggest equity index futures in the world in 2021.

In addition to the current Nikkei 225 index futures series, JPX is preparing to launch a new smaller contract-sized futures product, Nikkei 225 micro Futures, on May 29, 2023.

TOP-3 Turnover of JPX’s Equity Index Futures in 2022

In addition to the three futures above, JPX has different types of futures underlying equities indices such as JPX-Nikkei Index 400, TSE Mothers Index, TSE REIT Index, and Dow Jones Industrial Average (DJIA).

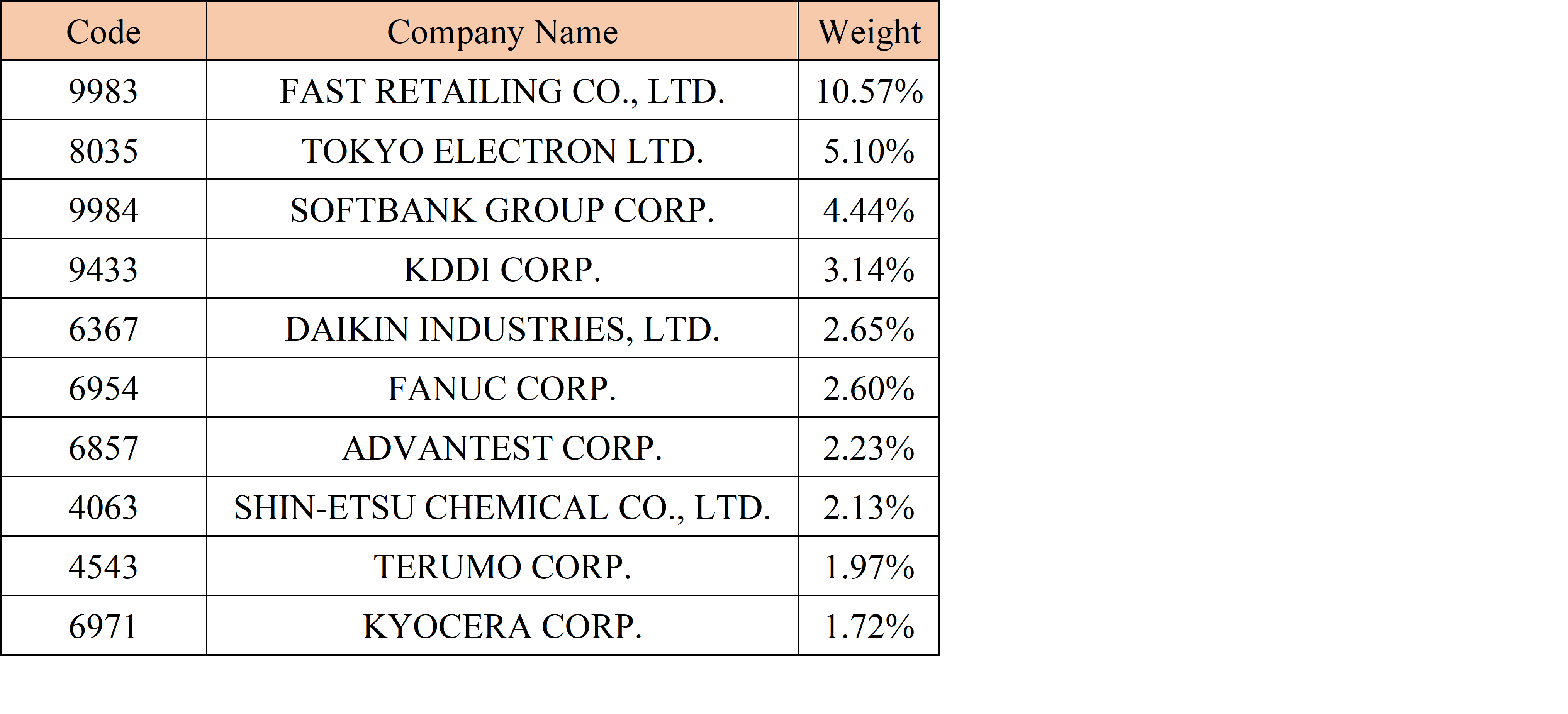

Nikkei 225 Futures and Nikkei 225 mini are underliers of the most popular Japanese stock index, the Nikkei 225 index. The Nikkei 225 index is calculated by a simple average of 225 Japanese listed companies and has been widely used as the indicator of Japanese equities markets for more than 70 years. Major constituents of the index are as below:

Top 10 Constituents of the Nikkei 225 Index (December 30, 2022)

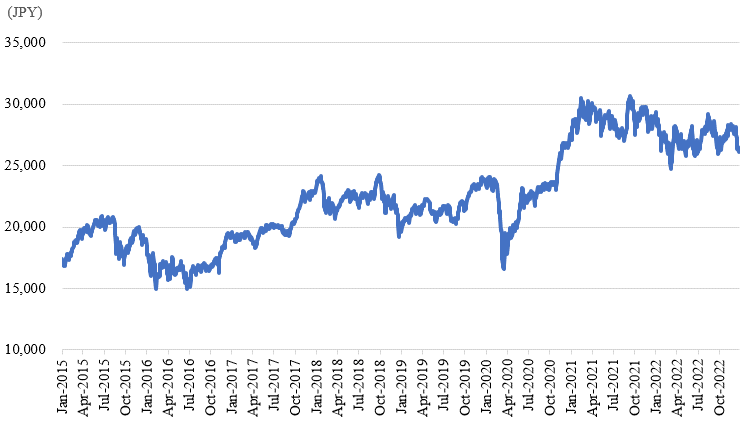

The Nikkei 225 index recorded its highest value in 1989, but had then been in a slump for nearly 20 years due to the sluggish Japanese economy impacted by the burst of the bubble economy in the 1990s, the crush of the IT bubble in the early 2000s, and the global financial crisis in 2008. The index started to recover in 2013 in line with an aggressive economic policy called Abenomics and touched the 30,000 level at the end of 2020.

Performance of the Nikkei 225 Index

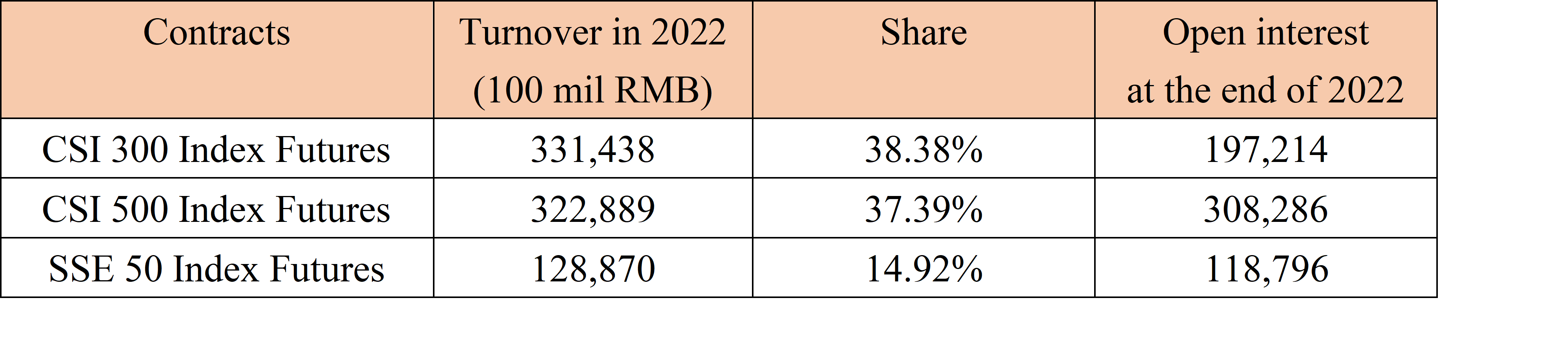

In 2022, the four equity index futures listed at CFFEX registered a total turnover of 86.4 trillion RMB. The most liquid equity index futures were CSI 300 Index futures, which accounted for 38.4% of the total turnover of equity index futures.

TOP-3 Turnover of CFFEX’s Equity Index Futures in 2022

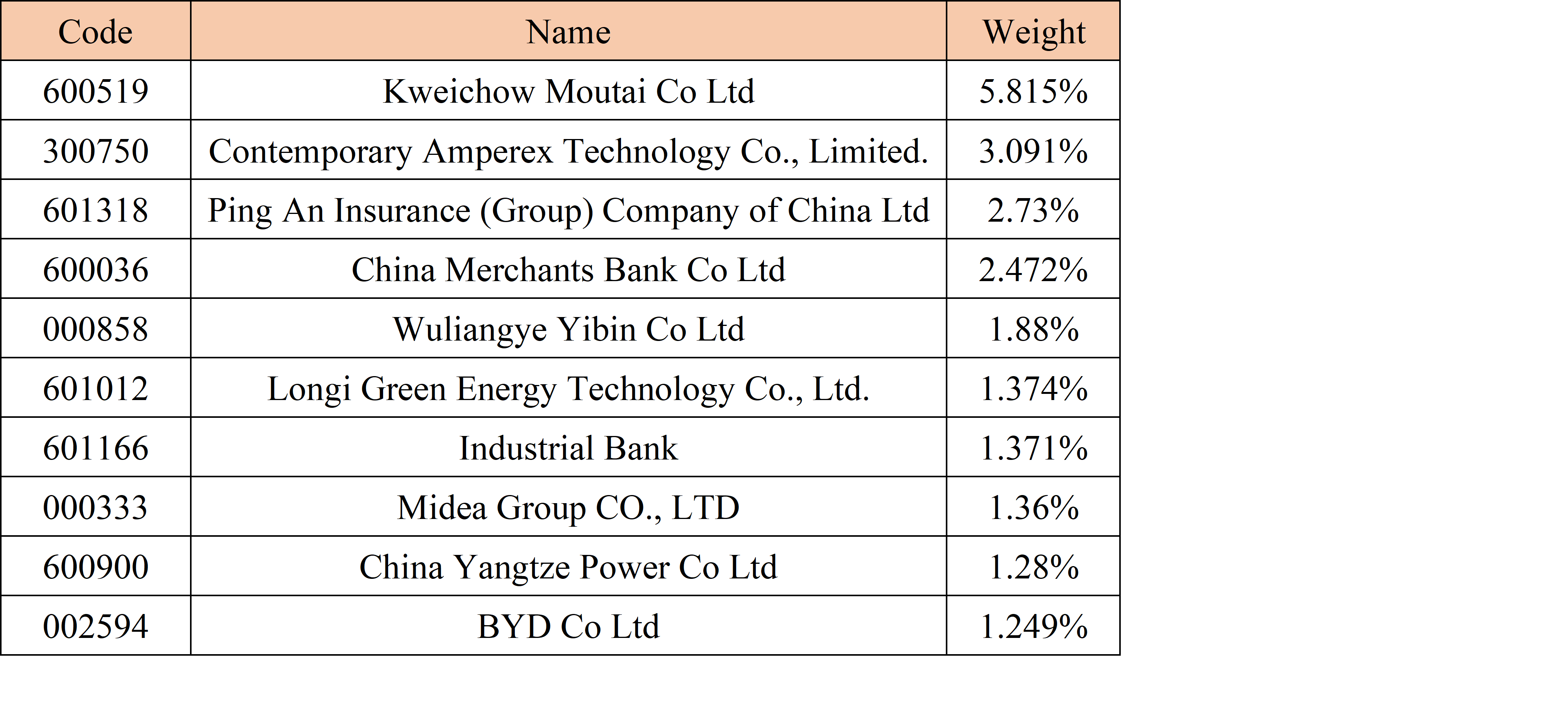

As for CSI 300 Index futures, the underlying CSI 300 Index consists of the 300 largest and most liquid stocks listed on Shanghai Stock Exchange and Shenzhen Stock Exchange. Major constituents of the index are as below:

Top 10 Constituents of the CSI 300 Index (December 30, 2022)

The CSI 300 index gradually recovered post 2015 market fluctuations, but tilted downward in 2018. Between 2019 and 2020, the index showed strong momentum but experienced a bumpy decrease since February 2021. As of December 2022, the index maintained a level of approx. 3,900 points.

Performance of the CSI 300 Index

The underlying indices of other CFFEX listed equity index futures include the CSI 500 index, CSI 1000 index and SSE 50 index. The CSI 500 index constituents are selected from A-shares excluding the CSI 300 index constituents and the top 300 stocks ranked by average daily market value, and consists of the rest 500 stocks with the largest market value. The CSI 1000 index consists of 1000 small and liquid stocks after excluding the constituents of the CSI 800 index, thus complementing the coverage of the CSI 300 and CSI 500 indices. The SSE 50 index consists of the 50 largest and most liquid stocks listed on Shanghai Stock Exchange.

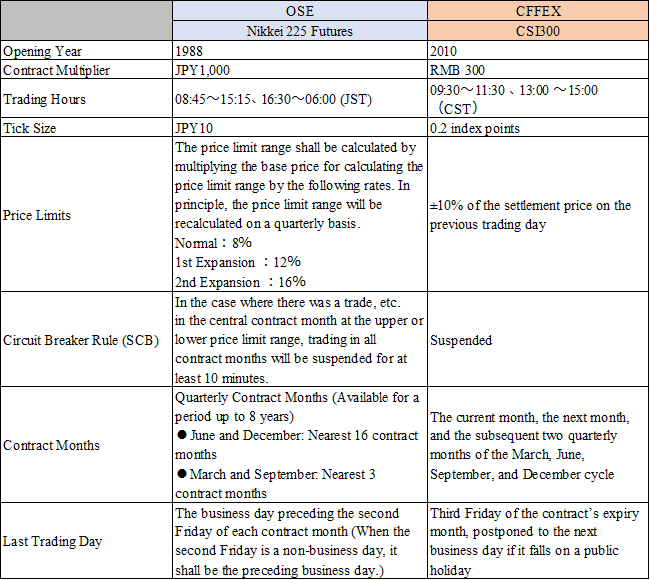

Comparison of Product Specifications and Trading Rules of Equity Index Futures

Comparing product specifications between JPX’s Nikkei 225 Futures and CFFEX’s CSI 300 Index futures, it’s worth noting that their contract sizes are almost at the same level. Although the multiplier of CSI 300 Index futures is around six times bigger than that of Nikkei 225 Futures, because of the differences in index values, both contract sizes are equivalent to approximately USD 200,000.

For other specifications, CFFEX has daily price limit ranges but currently has suspended its circuit breaker mechanism, while JPX has both mechanisms.

For more details about the differences in product specifications and trading rules, please see the table below.

Japan and China have extremely large cash-equities markets, and the derivatives markets in both countries are expanding their presence within the global market. Under the MOU signed in September 2022, JPX and CFFEX will accelerate further cooperation toward developing both derivatives markets.

Related links