Insights

Growth in 2024 for JPX Prime 150 Index and Related Products

The Nikkei Stock Average’s astounding recent performance – new highs every day since the beginning of 2024 – has drawn increasing attention to the Japanese market at home and abroad. Interest in Japanese stocks rose following the request by Tokyo Stock Exchange (TSE) in March 2023 that all listed companies on the prime and standard markets take “Action to Implement Management That Is Conscious of Capital and Stock Price” (https://www.jpx.co.jp/english/news/1020/dreu250000004n19-att/dreu250000004n8s.pdf). In addition, the renewal and expansion of NISA, Japan’s tax-free investment plan, has sparked a flow of individual investors from savings to investments.

On July 3, 2023, JPX Market Innovation & Research, Inc. (JPXI) began calculating and promoting the JPX Prime 150 Index as a new index to highlight companies that create value. New products linked to the JPX Prime 150 Index will be introduced in early 2024. Beginning January 24, ‘iFreeETF JPX Prime 150’ will target retail and institutional investors both domestic and foreign (https://www.jpx.co.jp/english/news/1070/20231228-02.html). On March 18, Osaka Exchange (OSE, a JPX company) will launch ‘JPX Prime 150 Index Futures’ to facilitate asset management using the index (see “JPX Prime 150 Index Futures” below).

What is the JPX Prime 150 Index?

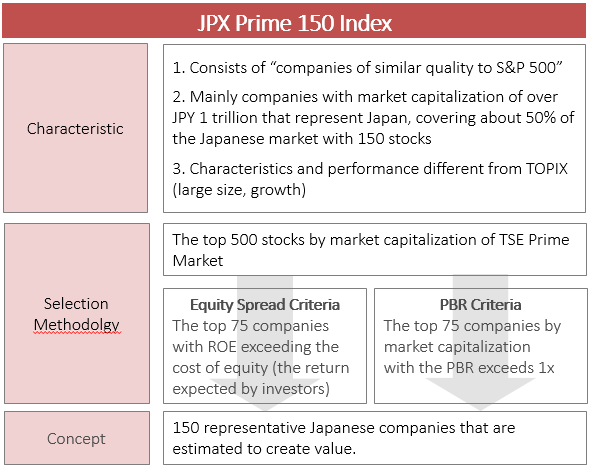

Prior to the JPX Prime 150 Index, only about half of listed companies in the TSE Prime Market had a PBR (price-to-book ratio) exceeding 1x, which represents the expectation of future value creation. The JPX Prime 150 Index was designed to draw attention to Japanese companies that are expected to create value. The new stock price index comprises 150 stocks selected to represent “Japanese companies that are estimated to create value” from among the top-ranked companies on the TSE Prime Market by market capitalization, as determined by two measures of value creation: “return on capital” based on financial results, and “market valuation” based on future information and non-financial information. The 150 companies cover approximately 50% of the Prime Market by market capitalization. By orienting the index and its constituent stocks toward medium- to long-term investment from institutional and individual investors in Japan and abroad, JPX aims to stimulate corporate management that creates value and enhance the appeal of the Japanese stock market.

PAST VALUES (PERFORMANCE)

Base date = August 29, 2013, Base point = 1,000

The “Past values of JPX Prime 150” is an estimation model based on the assumption that the initial selection was made in 2013 and the priority rule for stocks selected in the previous year was applied in the regular reconfiguration. It does not have continuity with the JPX Prime 150 Index, which will be initially selected with a base date of May 26, 2023, and will begin calculation on July 3, 2023.

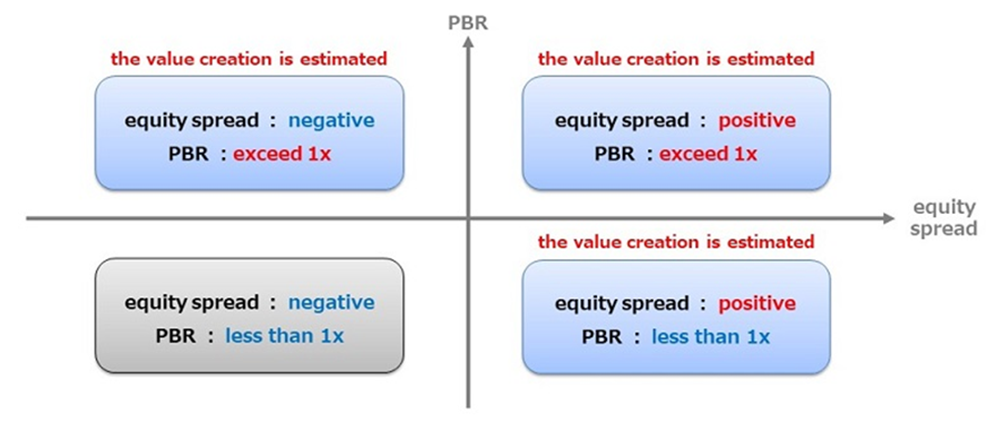

The JPX Prime 150 Index is an index of the top 500 stocks by market capitalization listed on TSE Prime Market, a market for companies that focuses on constructive dialogue with global investors, as “qualifying stocks”, from which 150 stocks are selected based on the following indicators to measure value creation.

– When ROE (return on equity) exceeds the cost of equity, which is the return expected by investors, the equity spread becomes positive and the value creation is estimated.

– When the stock price exceeds the BPS (Book Value per Share), the PBR exceeds 1x, and the value creation is estimated.

The stock selection method for the JPX Prime 150 Index is explained below:

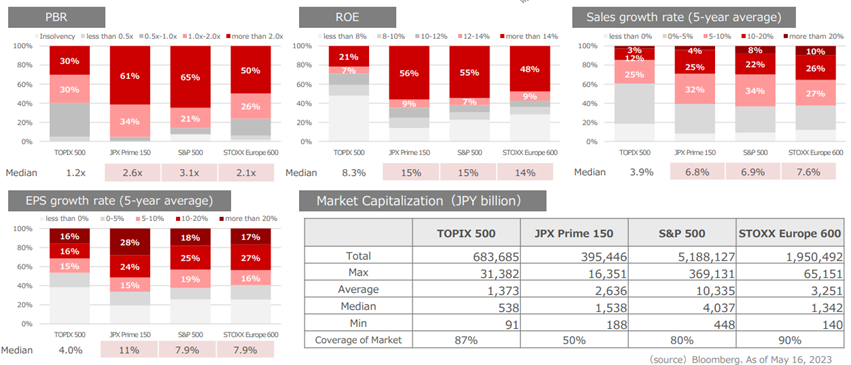

The distribution of PBR, ROE, growth potential, and market capitalization of the Index’s constituent stocks is comparable to that of S&P 500 and STOXX Europe 600.

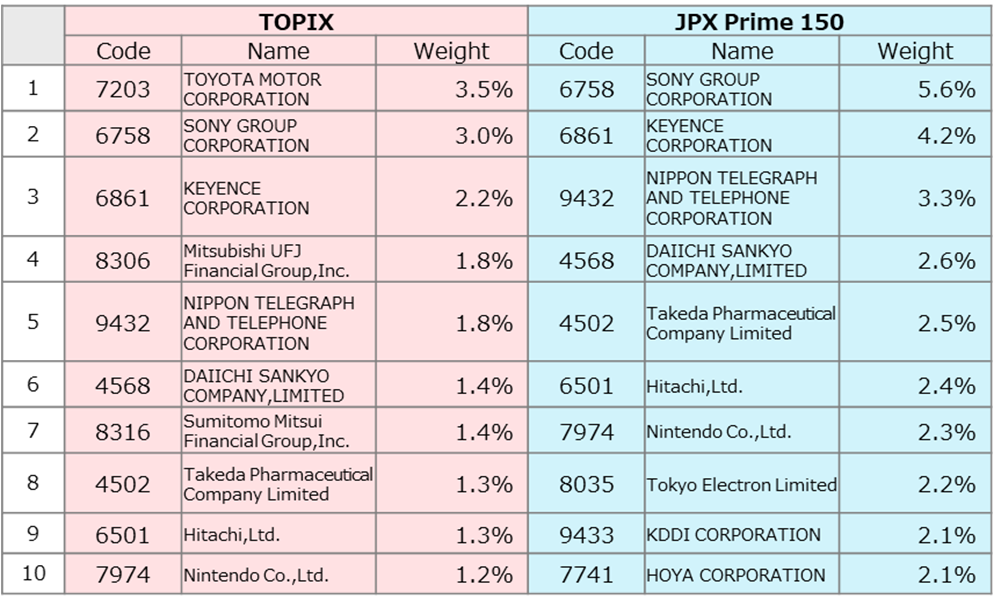

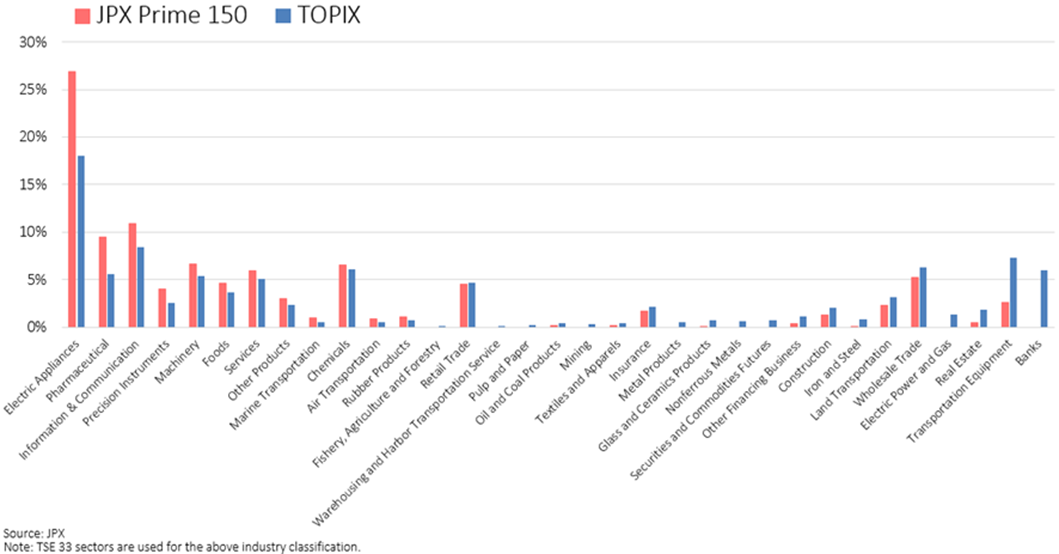

The top 10 weighted stocks in JPX Prime 150 Index are shown below. Compared to TOPIX, electric equipment, pharmaceuticals, and information and telecommunications are overweighted, while banks, transportation equipment, and real estate are underweighted.

SECTOR WEIGHT OF JPX PRIME 150 AND TOPIX

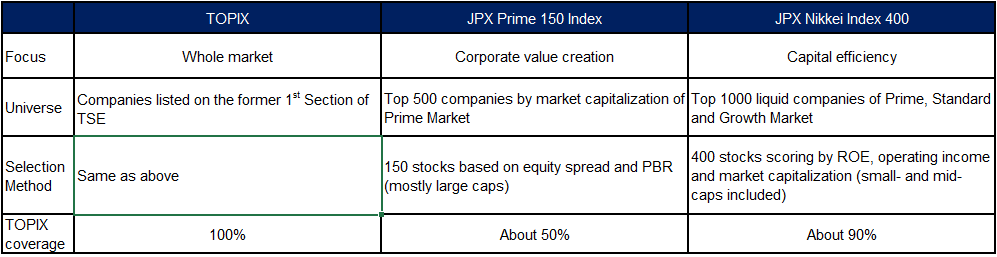

Comparison with other Japanese stock indexes

The table below compares TOPIX, JPX Nikkei Index 400, and the JPX Prime 150 Index, representative indexes calculated by JPXI.

TOPIX is a market benchmark covering a wide range of markets from large-cap to small-cap stocks, and is used by many passive managers such as pension funds and investment trusts. While the JPX Prime 150 Index focuses on corporate value creation, the JPX Nikkei Index 400 focuses on “capital efficiency” and selects 400 stocks (including small- and mid-cap stocks) from the top 1,000 liquid companies in Prime, Standard and Growth Markets of TSE, scoring them based on ROE, operating income and market capitalization.

The main users of the TOPIX and JPX Nikkei 400 Index are domestic institutional investors, whereas the JPX Prime 150 Index is intended for use by a wide range of investors, including overseas investors.

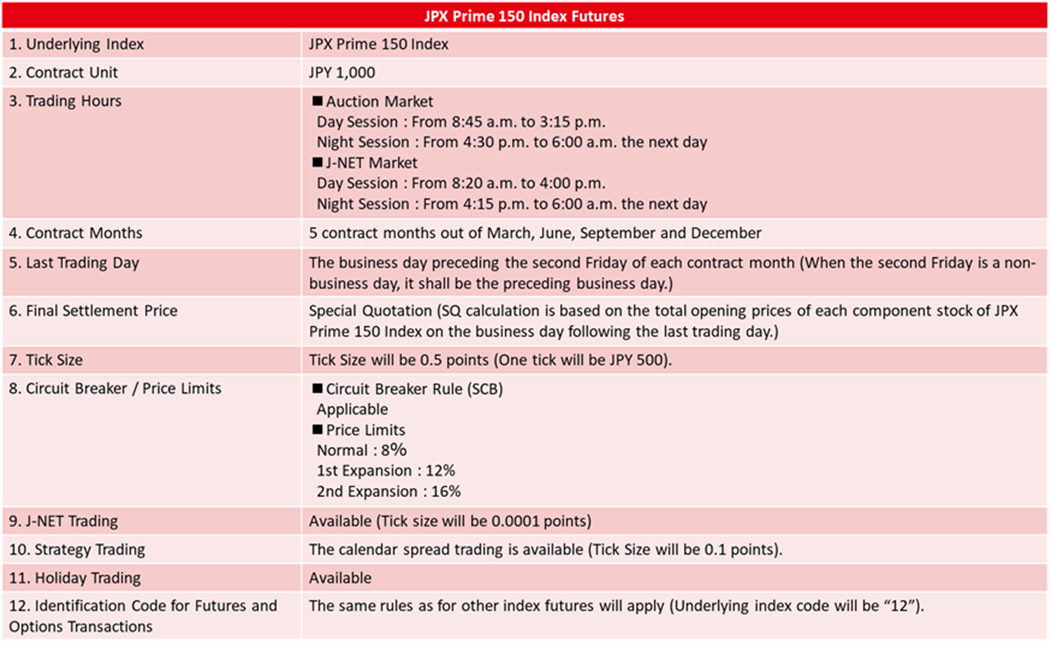

JPX Prime 150 Index Futures

OSE, which operates the JPX derivatives market, plans to list JPX Prime 150 Index Futures on March 18, 2024, to allow for smoother asset management that takes advantage of the JPX Prime 150 Index. Many overseas investors are expected to use the futures as a hedging tool for funds.

Through this ecosystem of listing the JPX Prime 150 Index and related ETFs and futures, we aim to contribute to the further penetration of value-creating management in Japanese markets and to enhance the attractiveness of the Japanese stock market in the future.