TOPIX Updates; Performance and Revision

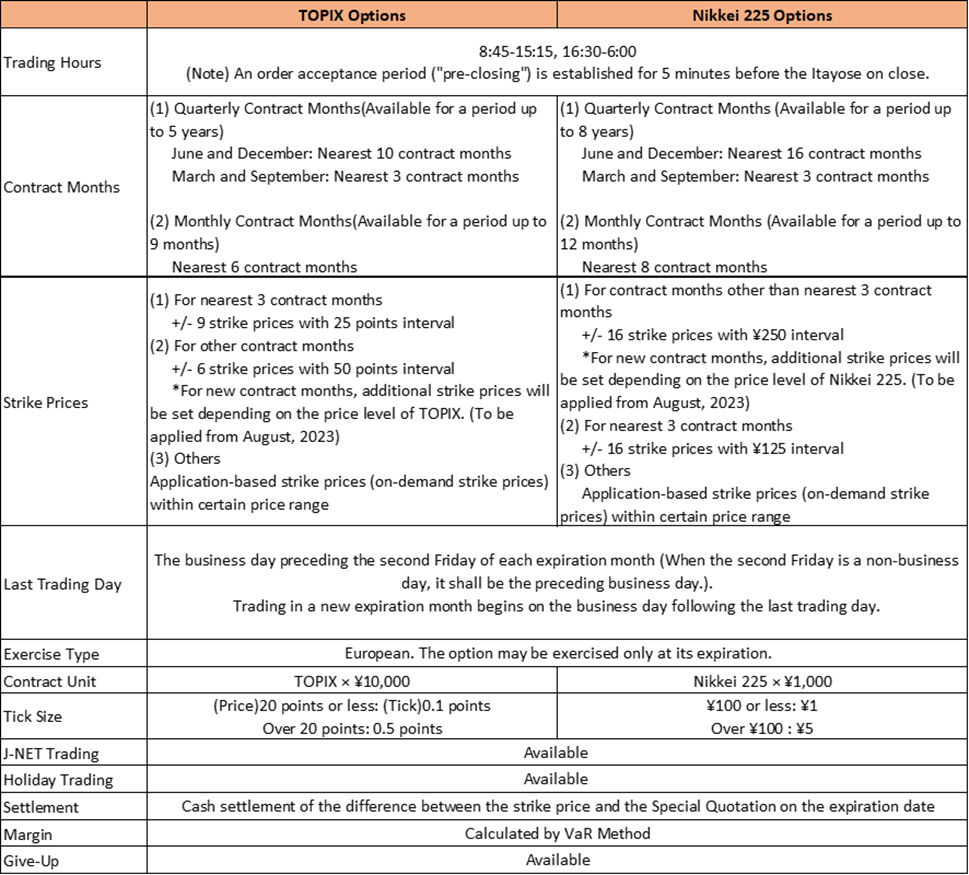

The Tokyo Stock Price Index (TOPIX) is gradually transitioning to a new standard scheduled to go into effect in 2025. Meanwhile, the recent trend toward passive management has pushed TOPIX-linked ETFs and pension funds to more than JPY 80 trillion in value. The index also supports TOPIX futures and options, which are traded on the Osaka Exchange (OSE) and the Chicago Mercantile Exchange (CME).

Performance of TOPIX

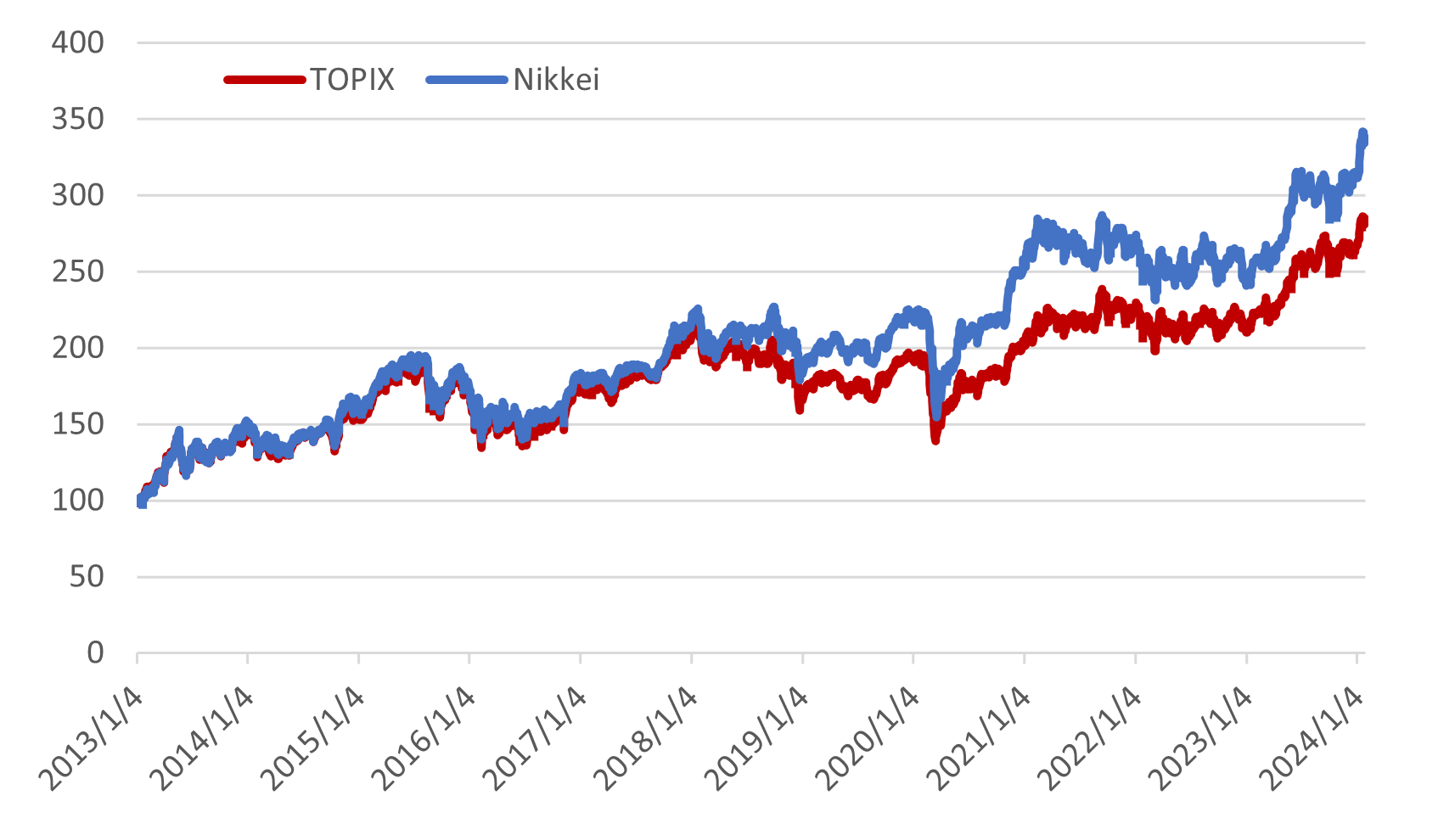

Between January 2013 and 2014, two important factors helped drive growth on the TOPIX by 51%. The Bank of Japan’s (BOJ) extraordinary monetary easing caused the yen to drop precipitously against the dollar from 86 at the end of 2012 to 105 at the end of 2013. Shinzo Abe’s “Abenomics” policy fueled increased buying in anticipation of improved performance by Japanese companies. In 2018, however, the TOPIX fell as US-China trade friction and confusion over Brexit injected uncertainty about the global economic outlook into the market. TOPIX recovered, and in 2023 enjoyed its best performance since 2013 with an annual increase of 25%, when aggressive monetary and fiscal easing policies raised expectations for an economic turnaround.

Index Performance: TOPIX vs Nikkei 225 (January 4, 2013 = 100)

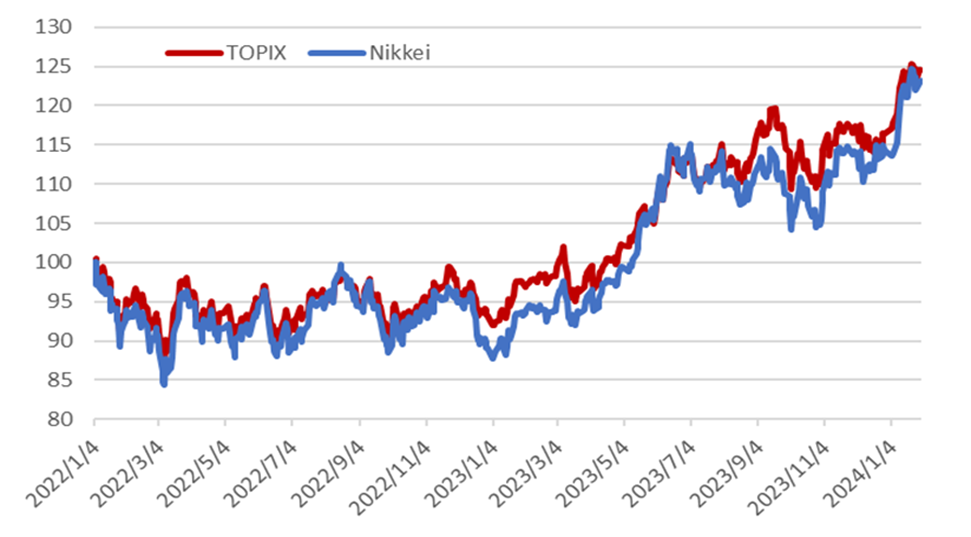

Between January 2022 and January 2024, TOPIX slightly outperformed the Nikkei Stock Average.

Index Performance: TOPIX vs Nikkei 225 (January 4, 2022 = 100)

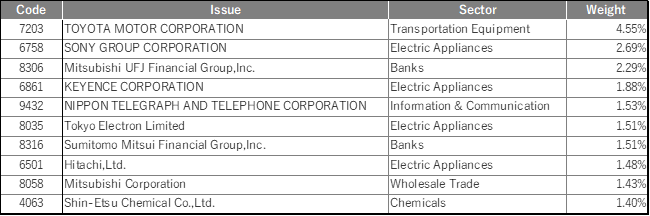

Components of TOPIX

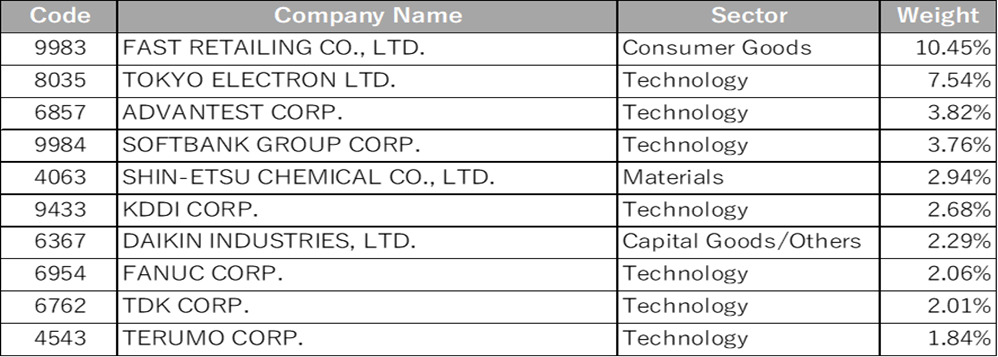

Compared to the Nikkei Stock Average, TOPIX component stocks and top 10 companies differ as shown in the table below. To encourage investment across the Tokyo Stock Exchange (TSE), weighting between stocks is still limited to 1.9% as of November 2023.

Top 10 TOPIX Component Issues (as of Nov. 2023)

Top 10 Nikkei 225 Component Issues (as of Nov. 2023)

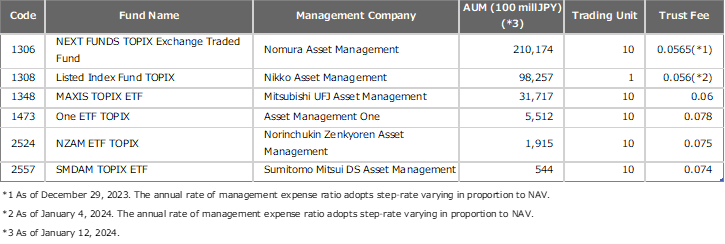

TOPIX ETFs

Assets under management in ETFs linked to TOPIX combined with pension funds and others that invest in TOPIX exceed JPY 70 trillion. As of January 2024, 6 TOPIX-linked ETFs are listed on TSE, excluding dividend types, etc. (see https://www.jpx.co.jp/english/equities/products/etfs/issues/01-01.html).

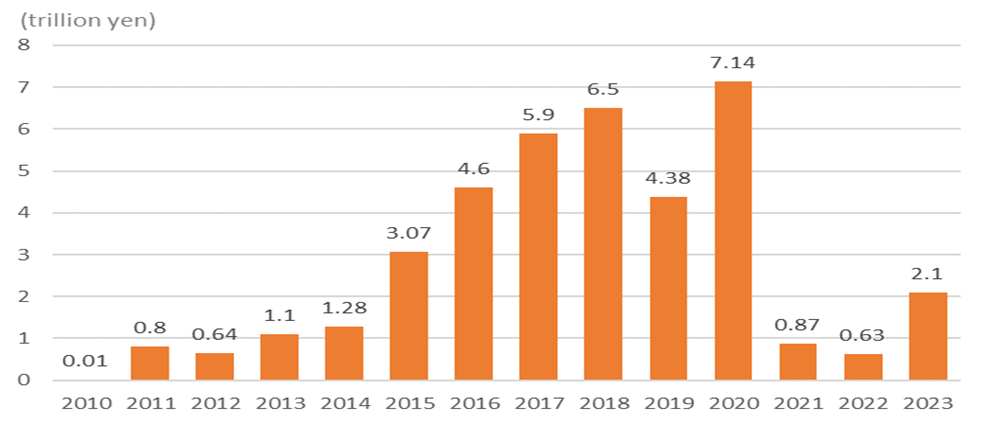

The BOJ has purchased TOPIX-linked ETFs since 2013. Beginning in May 2020, the Bank increased its weighting of TOPIX-linked ETFs covering the entire market to moderate the influence of specific issues on stock market pricing. From April 2021, BOJ investment targets (excluding ETFs for human resources and equipment investment with an annual purchase limit of JPY 300 billion) are TOPIX ETFs only, with an annual purchase limit of JPY 12 trillion.

BOJ’S ETF Purchases (including ETFs linked to non-TOPIX indexes)

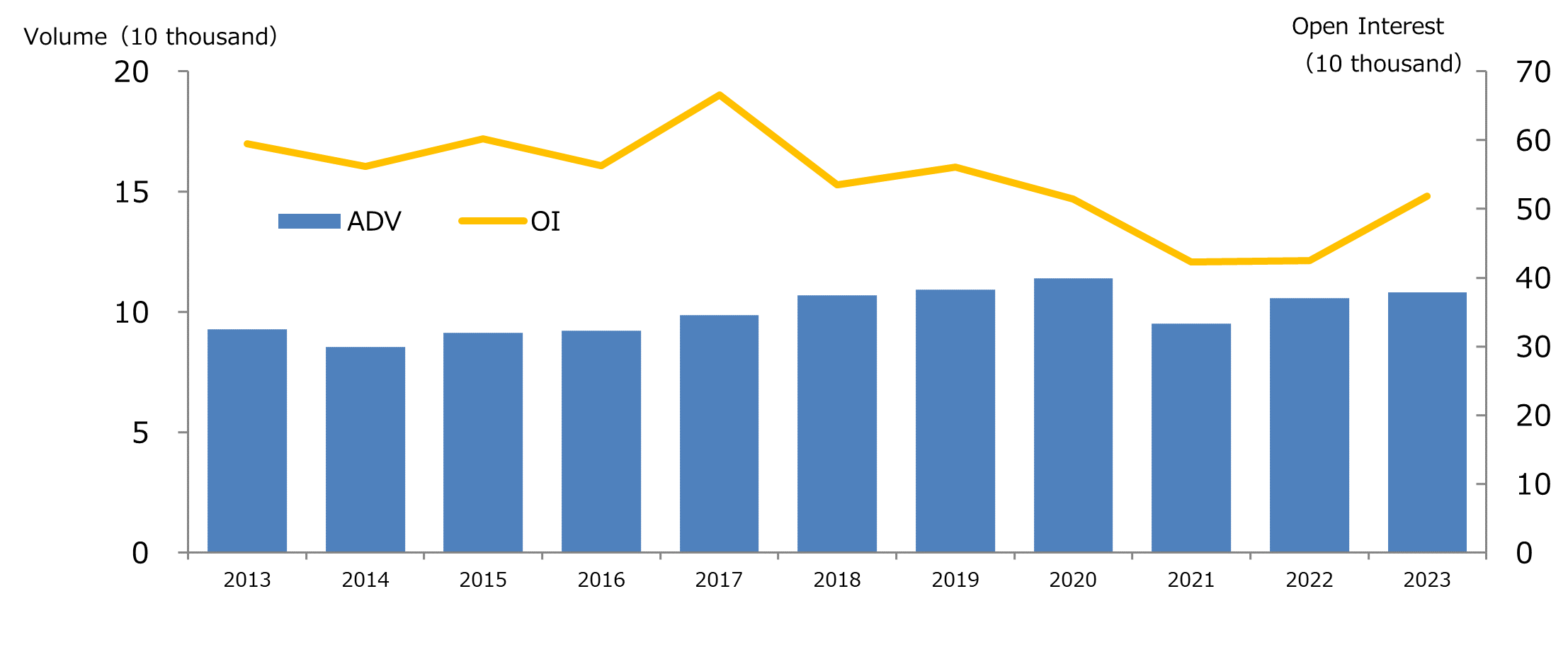

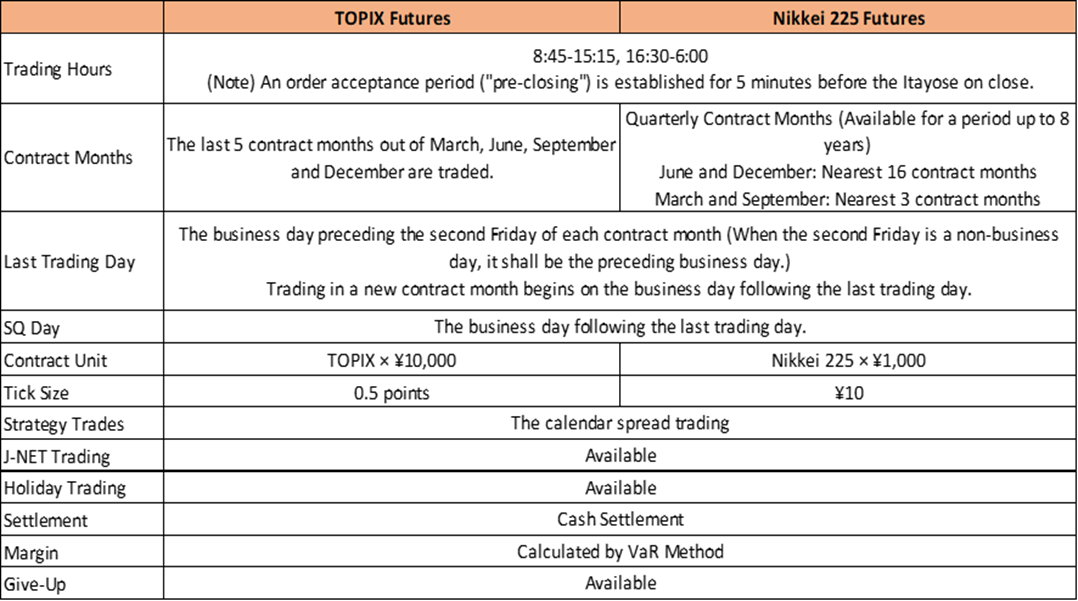

TOPIX Futures

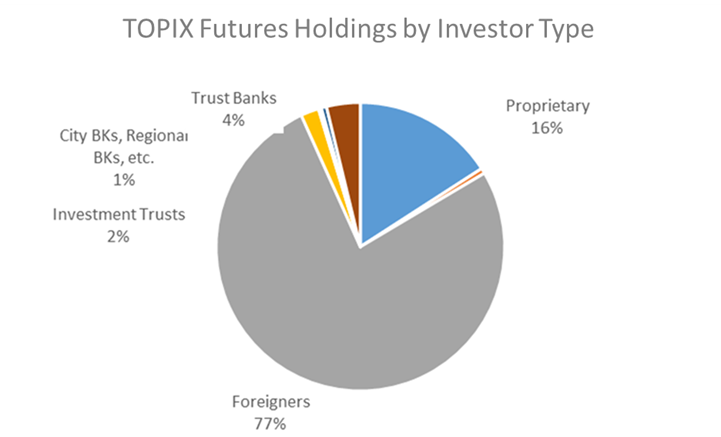

TOPIX futures are listed on OSE and CME. Foreign investors account for a large share of trading on OSE at 77% (2023). TOPIX futures trading volume reached 26,627,140 contracts, the second highest on record in 2023, due to expectations for PBR (price-to-book ratio) improvements at TSE and a trend toward buying value stocks with a higher TOPIX component, which were more advantageous than previous trading in Nikkei 225 futures.

TOPIX Futures Trading Volume & Open Interest

TOPIX Options

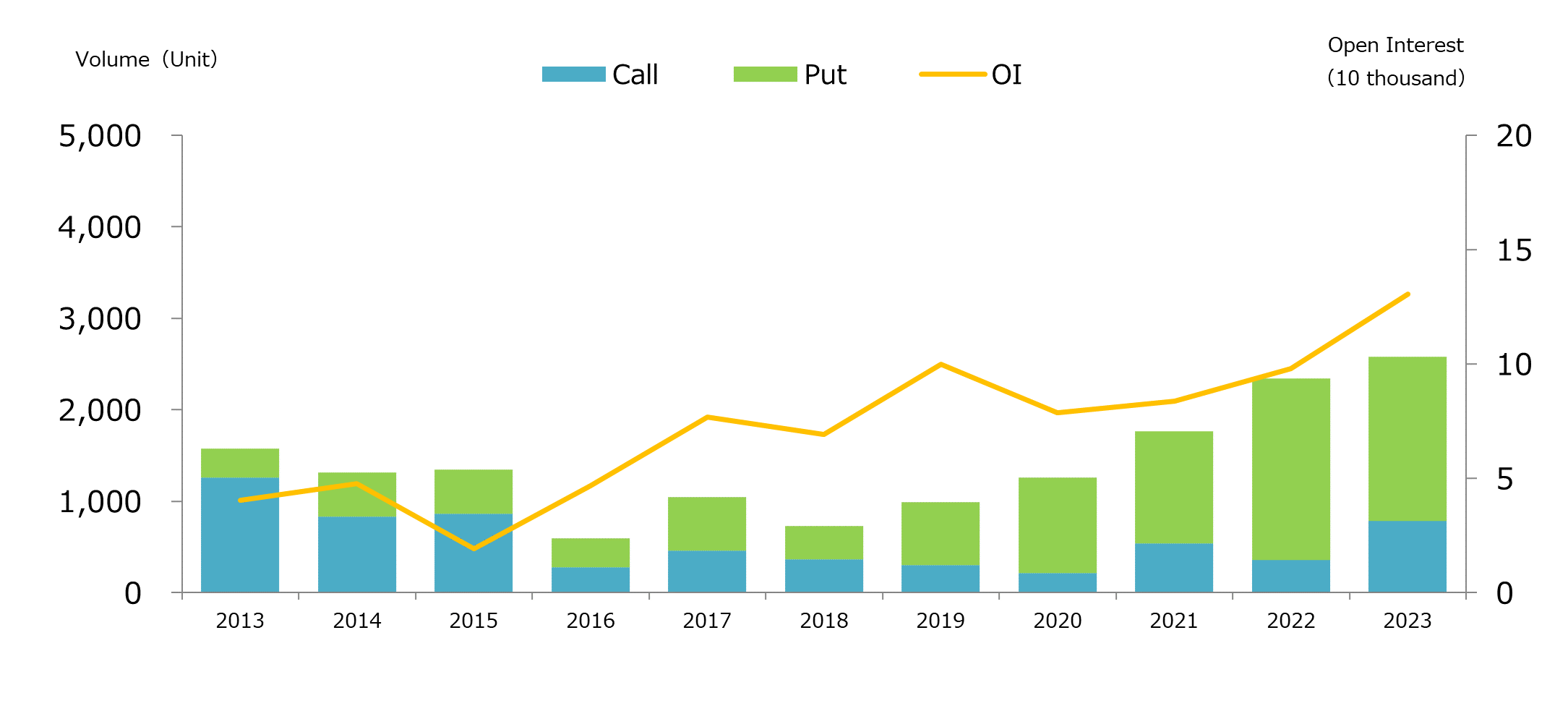

TOPIX options are also listed on OSE in addition to futures, and in 2023 two new market makers began quote quotations. At the end of 2023, 130,646 open interest contracts were recorded, a significant increase from the end of 2022 (98,128 contracts) and a record high for year-end value. Many market participants commented, “Until now, TOPIX options were mainly traded off-auction (J-NET trading), with almost no trading on the board (in-auction), but market makers’ quotes have gradually allowed trading in-auction.” With reference to off-auction prices made easier and liquidity increased, market participants anticipate using TOPIX options for in-auction trading which has been substituted by Nikkei 225 options.

TOPIX Option Trading Volume & Open Interest

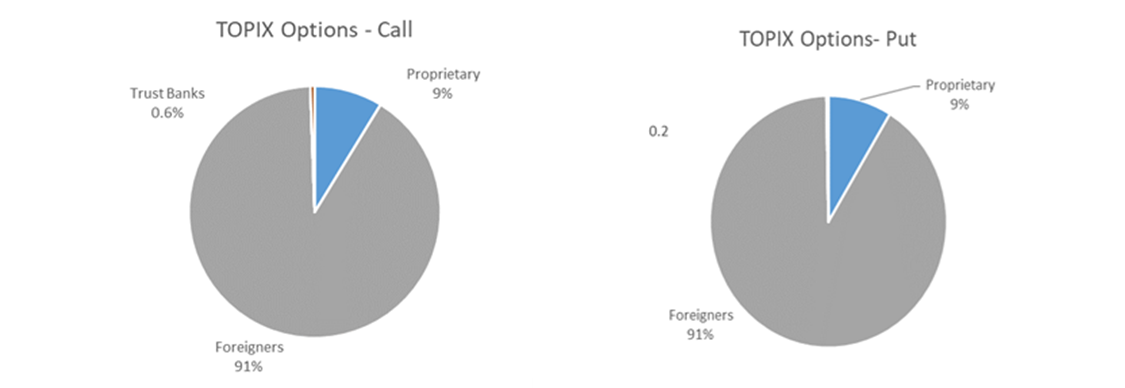

TOPIX Option Holdings by Investor Type (2023)

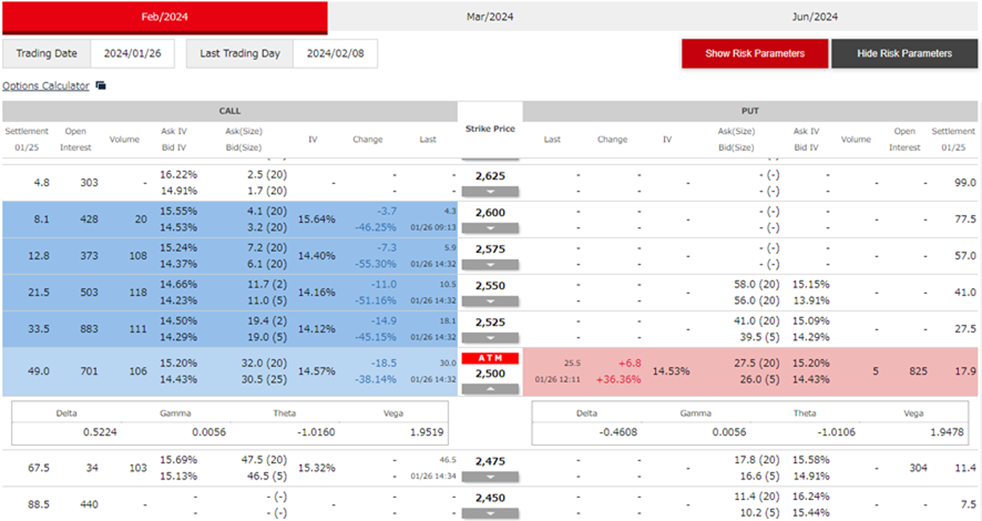

Example of TOPIX Options Board (in-auction) Trading (Jan. 26, 2024)

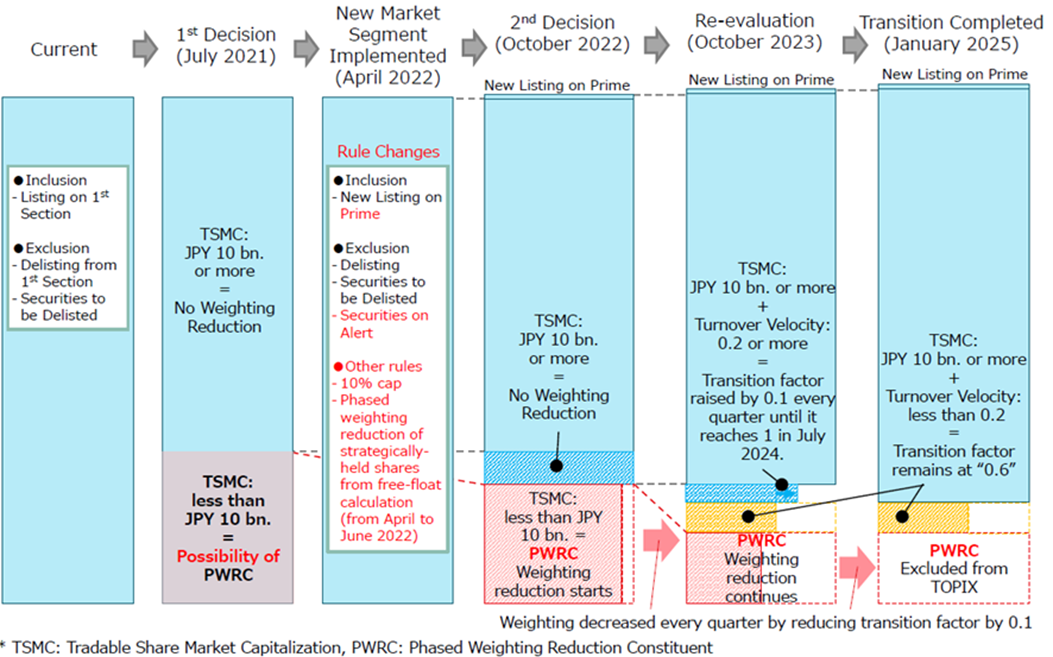

Revision of TOPIX

The TOPIX was originally calculated using a market capitalization-weighted index of all companies listed on the former First Section of TSE. Following the TSE’s 2022 market reclassification (Prime, Growth, and Standard), however, stock weighting is gradually being adjusted according to new criteria, such as market capitalization of JPY 10 billion or more. The transition is expected to conclude by January 2025. The revision is intended to make TOPIX more useful as an investment target and more representative of the market by separating it from market segmentation.

Once the revision is complete, the method for selecting constituent stocks of TOPIX will be determined in the future after soliciting opinions from market participants.

TOPIX Revision Timeline