OSE Derivatives

The Outlook for Platinum Automotive Demand

Summary

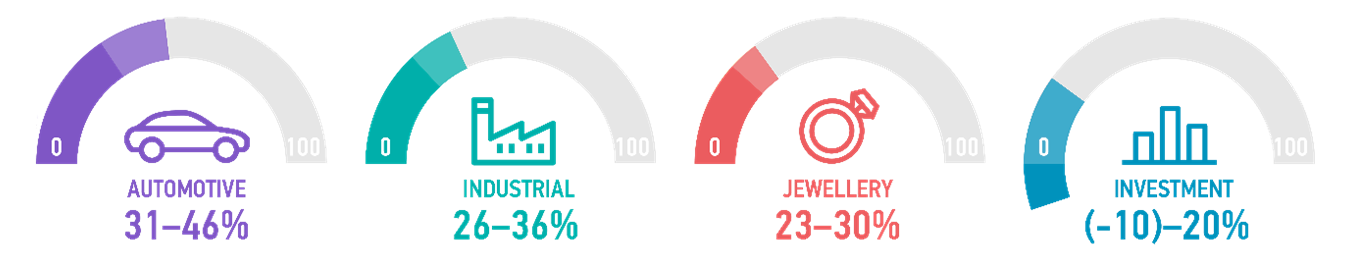

Platinum has been used in autocatalysts in internal combustion engine (ICE) vehicles for almost fifty years, and automotive demand is the single largest demand segment for platinum, accounting for around 40 per cent of annual platinum demand. As a result, automotive demand is key to platinum’s supply-demand fundamentals and the size of this demand segment results in developments here having a significant impact on investor sentiment towards platinum.

This year, automotive demand for platinum is forecast to grow by 12 per cent to 3,255 koz (+357 koz year-on-year). This growth is predicated on two major trends – higher platinum loadings per vehicle due to tighter emissions regulations and increasing platinum-for-palladium substitution in gasoline autocatalysts. This substitution could see platinum displace as much as 615 koz of what could have otherwise been palladium demand in 2023.

While the electrification of the global fleet is essential to meet global emissions reductions targets, not all vehicle applications or geographies are compatible with electrification using current battery technologies. Consequently, ICE vehicles will remain a material part of the drivetrain mix for the foreseeable future, albeit a gradually declining one with increasing mild hybridisation.

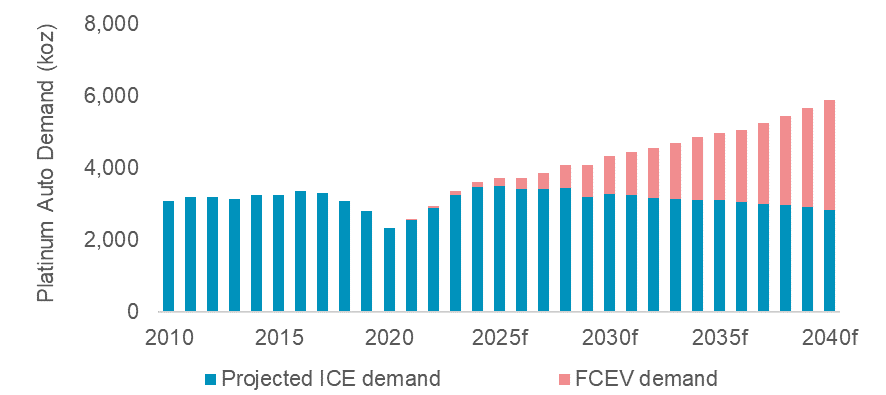

ICE automotive demand is expected to peak in 2025 at 3,496 koz, before slowly declining thereafter. Decline in platinum demand from ICE will be offset by growing fuel cell electric vehicle (FCEV) demand which will, ultimately, lead to total automotive platinum demand exceeding current levels.

Introduction

Platinum has diverse demand drivers, spanning automotive, industrial, jewellery and investment sectors. Automotive is the largest use sector at around 40 per cent of total annual platinum demand, split between three main applications: autocatalysts; sensors; and spark plugs. Of these, platinum’s use in autocatalysts is by far the most prevalent.

Figure 1: Platinum demand split by end use sectors

Global vehicle production remains below pre-pandemic levels, yet platinum automotive demand is growing. In 2022, platinum automotive demand rose 13 per cent to 2,897 koz, and this year’s forecast anticipates growth of 12 per cent, taking it to 3,255 koz, 16 per cent higher than automotive demand for platinum in 2019. In contrast, global vehicle production reached 82 million units in 2022, some 8 per cent below the 89 million units manufactured in 2019. This year, global vehicle production is also expected to remain below 2019 levels, reaching 86 million units.

What is an autocatalyst?

An autocatalyst is a device that reduces harmful emissions from internal combustion engine (ICE) vehicles by converting exhaust pollutants, including: carbon monoxide (CO); oxides of nitrogen (NOx); hydrocarbons (HC); and particulates into ‘atmospheric’ products, mainly CO2, nitrogen and water.

The platinum group metals (PGMs) used in autocatalysis are platinum, palladium, and rhodium. Autocatalysts are made using a metal or ceramic substrate that is coated with a layer of PGM-containing material, or washcoat, and canned in a metal housing. The placement of the autocatalyst (there can be more than one unit per vehicle) within a vehicle varies depending on the design of the vehicle and the vehicle’s powertrain (whether it is a diesel or gasoline powered vehicle, or a hybrid of either).

Both heavy duty vehicles, for example trucks and buses, and light duty vehicles (passenger cars and vans), are fitted with autocatalysts; almost all ICE vehicles sold worldwide each year have these devices. Patterns of use between platinum, palladium, and rhodium in autocatalysts have varied over time. Usage is determined by multiple factors including the effectiveness, availability, and price of each metal.

The catalytic efficiency of each metal is influenced by engine temperature, fuel type, fuel quality and the durability of the autocatalyst washcoat. Today, platinum is predominantly used in autocatalysts in diesel vehicles, with palladium principally used in gasoline vehicles. However, this usage is shifting, with increasing substitution of palladium-for-platinum occurring in gasoline vehicles.

Automotive demand trends

Emissions standards

The dominant driver of platinum automotive demand is to meet tightening emissions legislation. Countries and regions have applied progressively more stringent emission limits on HC, CO, CO2, NOx, NH3 and particulates emitted from vehicles. Regulation is typically most strict in developed countries, with developing countries following a similar trend. All major automotive markets have introduced tighter vehicle emissions limits over time and significantly tighter light duty vehicle emissions legislation in recent years. The introduction that has had the biggest impact on PGM use is the China 6 standards which started being implemented in major cities in China from mid-2019.

All else being equal, to achieve lower emissions from a vehicle, a higher volume of PGM content is needed. Technological improvements can go some way to offset this; autocatalyst manufacturers have significantly improved the efficiency of catalysts in meeting emissions regulations and this has allowed them to ‘thrift’ PGM usage per catalyst.

Underpinning the 2023 forecast for automotive platinum demand is the introduction of China’s VIb emissions regulations, applicable to all powertrain types from July 2023, requiring all heavy-duty vehicles to be fitted with a compliant aftertreatment system. In the Rest of the World, growth in vehicle production together with tighter legislation in countries such as India, Brazil and Mexico is growing automotive demand for platinum.

Loadings

The term ‘loadings’ refers to the quantity of metal used in an emissions control system. As systems have become increasingly sophisticated in response to more stringent emissions limits and the advent of on-road, rather than in-laboratory, testing, metal loadings have increased. For example, in Europe, following the 2015 ‘Dieselgate’ scandal, the increased focus on reducing oxides of nitrogen (NOx) from diesel vehicles resulted in higher urea dosing rates and more platinum per catalytic converter to convert nitrogen oxide to nitrogen dioxide, optimising the removal of NOx.

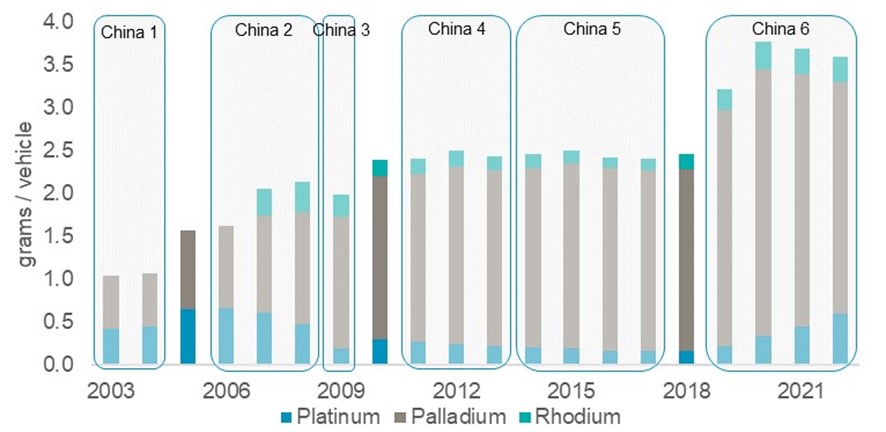

While European legislation has generally driven material increases in platinum demand via loadings in diesel vehicles, Chinese PGM loadings have increased approximately 40 per cent since the implementation of China VI. Typically, these additions are largely driven by palladium in gasoline engines, however, an increasing proportion of platinum is now being substituted into these high PGM-containing vehicles (Figure 2), a trend that may be followed in the rest of the world as countries catch up to those with mature emissions legislation.

Figure 2: Tightening emissions in China have given rise to increased total PGM loadings per vehicle. Platinum content is also rising in new vehicle models as platinum for palladium substitution occurs.

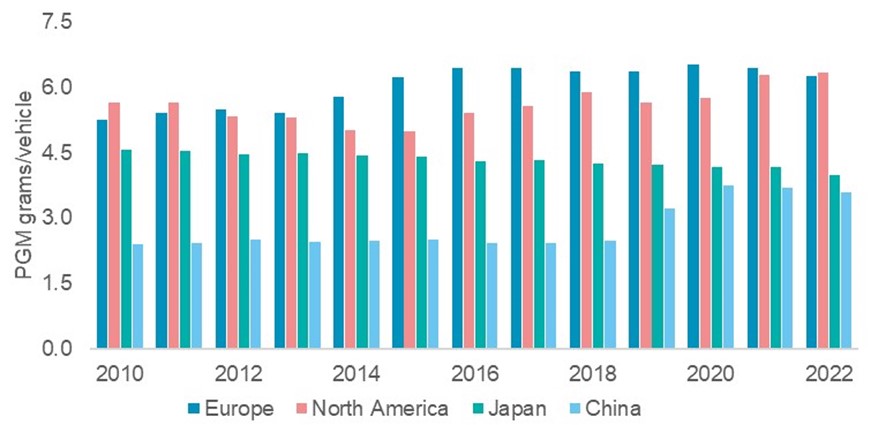

Figure 3: China’s loadings continue to approach those of more developed regions. If this trend continues for the rest of the world there should be a positive impact for platinum content.

Substitution

In turn, tightening emissions standards are a driver behind the growth in substitution, leading to higher loadings of platinum per vehicle.

Platinum and palladium both have the necessary physical and chemical properties that make them well suited to autocatalysis. Since platinum was used in the first autocatalysts in the 1970s, changes in emissions standards, technological innovations, and market price differentials have resulted in variations in the mix of platinum group metals (PGMs) that have been used in catalytic converters, with periods when platinum has been substituted for palladium and vice versa.

During the 2000s, the sulphur content of fuel fell significantly, which enabled the ‘substitution ratio’ between the two metals to move from 2:1 palladium:platinum to 1:1 in autocatalysts. As a result, palladium-for-platinum substitution became a feature of the gasoline autocatalyst market until it became the established PGM catalyst in gasoline vehicles, while platinum remained the predominant catalyst in diesel vehicles.

However, this is changing as demand, supply, and the associated cost of purchasing these respective platinum group metals has impacted usage. In recent years, platinum-for-palladium substitution has gained traction due to a market – and consequently price – imbalance between platinum and palladium, incentivising automakers to switch to the equally-effective, yet less expensive, platinum.

Once platinum-for-palladium substitution in a vehicle model’s autocatalyst has occurred, the associated annual demand remains in place each year for the life of that vehicle platform, which is typically seven years. So, even under a scenario in which platinum and palladium prices moved to parity (reflecting their 1:1 substitution ratio) and thereby removing the financial incentive to replace palladium, the additional platinum demand generated as a result of substitution to date would be sustained over the life of all existing vehicle platforms using platinum.

Drivetrain trends

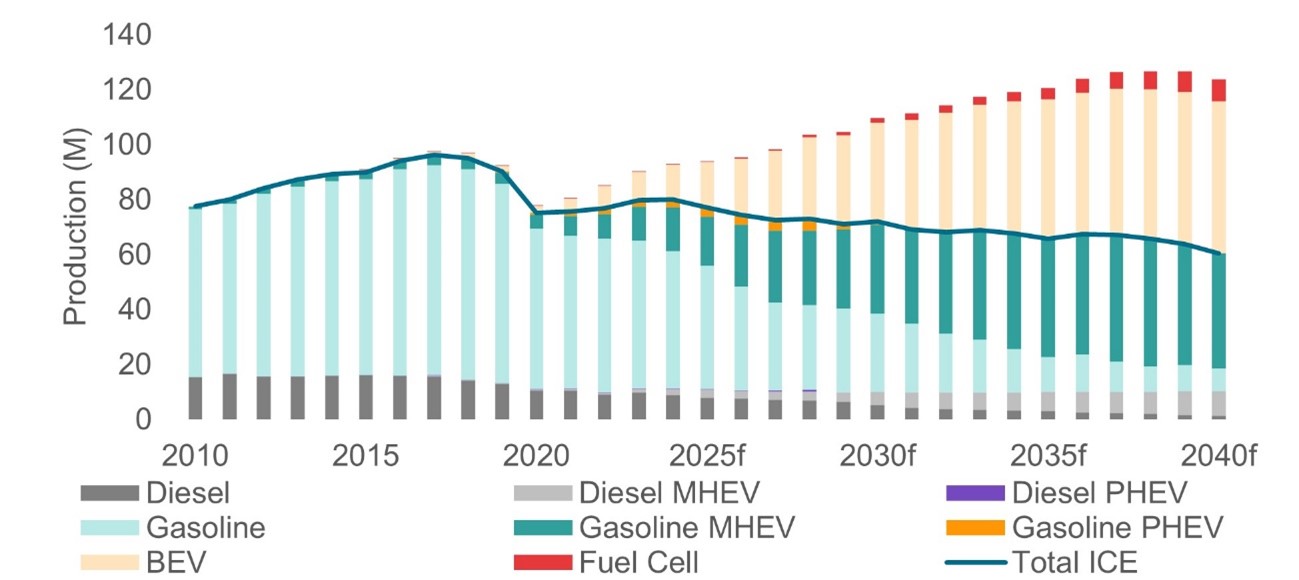

On a combined basis, any future growth in total global vehicle production will be due to growth in electric vehicles (both battery electric and FCEV); it is not expected that total ICE production numbers will ever return to pre-COVID levels. However, ICEs are expected to continue to be a major, albeit slowly declining, part of the drivetrain mix, with almost all ICE production transitioning to mild hybrid electric vehicle. Due to their greater temperature variability, hybrid vehicles require higher loadings per vehicle to ensure effective emissions control.

Demand for platinum in hydrogen fuel cells used in FCEVs will offset the eventual long-term decline in automotive demand for platinum from autocatalysts. Supportive hydrogen policies could result in FCEV demand for platinum equalling current automotive demand by 2039, with broad-based commercial adoption of FCEVs bringing this forward to 2033, adding over three million ounces to annual automotive platinum demand in eleven years.

Figure 4: As BEV & FCEV gain market penetration, ICE production will undertake a long-term decline. ICE vehicles will transition to mild hybrids which contain higher loadings, combined with FCEV growth this will offset any decline in automotive demand for platinum.

Outlook for platinum automotive demand

While the electrification of the transport industry is undeniably essential to meet global emissions targets to minimise global temperature rise, not all vehicle roles or geographies are suitable for electrification with current technologies. Consequently, ICE vehicles will remain a material part of the drivetrain mix for the foreseeable future, albeit a gradually declining one and with increasing mild hybridisation.

In combination with the latest emission standards which raise loadings, and, in particular, increased platinum-for-palladium substitution in gasoline vehicles, this results in ICE-related automotive demand for platinum peaking in 2025 at 3,496 koz with further platinum demand growth thereafter due to FCEVs. When adding the platinum demand from slowly growing FCEV volumes, automotive demand for platinum is expected to exceed 4,350 koz in 2030, 30 per cent higher than forecast automotive platinum demand in 2023.

Figure 5: Under government policy and incentive program driven forecast scenario’s FCEV demand could boost platinum automotive demand to over 6,000 koz by 2035.

This publication is general and solely for educational purposes. The publisher, The World Platinum Investment Council, has been formed by the world’s leading platinum producers to develop the market for platinum investment demand. Its mission is to stimulate investor demand for physical platinum through both actionable insights and targeted development, providing investors with the information to support informed decisions regarding platinum and working with financial institutions and market participants to develop products and channels that investors need.

The research for the period since 2019 attributed to Metals Focus in the publication is © Metals Focus Copyright reserved. All copyright and other intellectual property rights in the data and commentary contained in this report and attributed to Metals Focus, remain the property of Metals Focus, one of our third-party content providers, and no person other than Metals Focus shall be entitled to register any intellectual property rights in that information, or data herein. The analysis, data and other information attributed to Metals Focus reflect Metals Focus’ judgment as of the date of the document and are subject to change without notice. No part of the Metals Focus data or commentary shall be used for the specific purpose of accessing capital markets (fundraising) without the written permission of Metals Focus.

The research for the period prior to 2019 attributed to SFA in the publication is © SFA Copyright reserved.

This publication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. With this publication, neither the publisher nor its content providers intend to transmit any order for, arrange for, advise on, act as agent in relation to, or otherwise facilitate any transaction involving securities or commodities regardless of whether such are otherwise referenced in it. This publication is not intended to provide tax, legal, or investment advice and nothing in it should be construed as a recommendation to buy, sell, or hold any investment or security or to engage in any investment strategy or transaction. Neither the publisher nor its content providers are, or purports to be, a broker-dealer, a registered investment advisor, or otherwise registered under the laws of the United States or the United Kingdom, including under the Financial Services and Markets Act 2000 or Senior Managers and Certifications Regime or by the Financial Conduct Authority.

This publication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor. You are solely responsible for determining whether any investment, investment strategy, security or related transaction is appropriate for you based on your investment objectives, financial circumstances, and risk tolerance. You should consult your business, legal, tax or accounting advisors regarding your specific business, legal or tax situation or circumstances.

The information on which this publication is based is believed to be reliable. Nevertheless, neither the publisher nor its content providers can guarantee the accuracy or completeness of the information. This publication contains forward-looking statements, including statements regarding expected continual growth of the industry. The publisher and Metals Focus note that statements contained in the publication that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect actual results and neither the publisher nor its content providers accept any liability whatsoever for any loss or damage suffered by any person in reliance on the information in the publication.

The logos, services marks and trademarks of the World Platinum Investment Council are owned exclusively by it. All other trademarks used in this publication are the property of their respective trademark holders. The publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the publisher to any rights in any third-party trademarks.

© 2022 World Platinum Investment Council Limited. All rights reserved. The World Platinum Investment Council name and logo and WPIC are registered trademarks of World Platinum Investment Council Limited. No part of this report may be reproduced or distributed in any manner without attribution to the publisher, The World Platinum Investment Council, and the authors.

Related links

World Platinum Investment Council - WPIC®

World Platinum Investment Council - WPIC®