OSE Derivatives

Industrial Demand for Platinum

Executive summary

Platinum has a unique combination of physical and chemical properties resulting in its extensive use in industry and manufacturing, where its high melting point, density, ultra-stability, extreme non-corrosiveness and catalytic effects are highly valued.

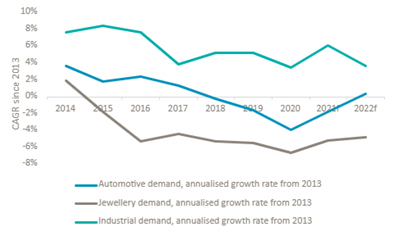

Industrial demand for platinum has grown at twice the pace of global GDP since 2013 and is the second largest demand segment for platinum after automotive demand.

Figure 1: Platinum demand drivers

Despite its importance, industrial demand is often overlooked due to fragmented end-uses and high variability of demand over the short term. Industrial demand is typically estimated net of closed loop, or ‘internal’ recycling.

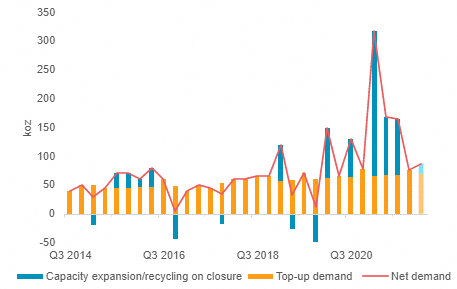

Industrial processes that use platinum typically require significant up-front loadings when a plant is built or expanded, after which only small top-ups are needed to make up for depletion or ‘wear’ that arises during ongoing plant operation. Consequently, most industrial demand comprises steady ongoing top-up demand, punctuated by periods of higher, one-off demand due to capacity expansions.

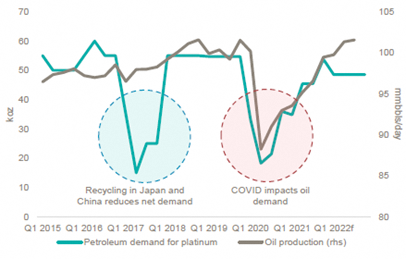

Occasionally, platinum re-enters the supply chain as recycled supply when industrial plants are permanently closed. These effects are clearly illustrated by glass demand, while platinum demand from other industrial sub-sectors can be more volume led, petroleum providing a good recent example.

Figure 2: WPIC illustration of how platinum glass demand has recently been led by capacity additions and closures

Figure 3: Platinum petroleum demand has been far more volume led in recent years

What is industrial demand?

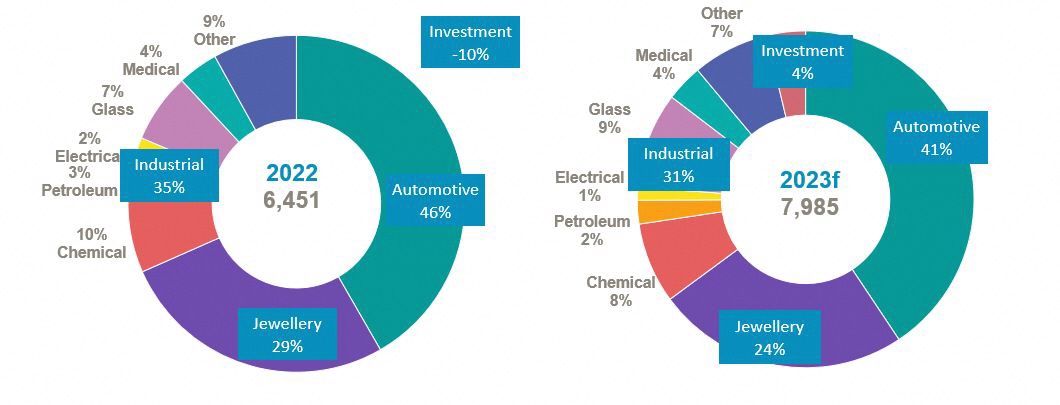

Industrial use of platinum is diverse in terms of both end-uses and geography, coming from six main sectors, as figure 4 demonstrates.

Figure 4: Sources of platinum demand 2022 versus 2023 (forecast koz)

Industrial demand has been the most consistent platinum demand segment, averaging 6 per cent growth per annum between 2013 and 2021, in contrast to a broadly flat automotive demand growth profile and a contraction of 6 per cent for jewellery. Industrial demand was also the segment that was least impacted by the challenges and disruptions of COVID in 2020 and 2021.

Figure 5: Although variable on a year-to-year basis, industrial demand for platinum has maintained annual growth since 2013

Industrial demand in 2022 declined by 11 per cent year-on-year (-288 koz) due to fewer glass and chemical plant capacity expansions and lower demand for consumer electronics which offset growth in other areas. It is worth noting that 2021 was a record year for industrial demand, and 2022 is still the second strongest year for industrial demand on record.

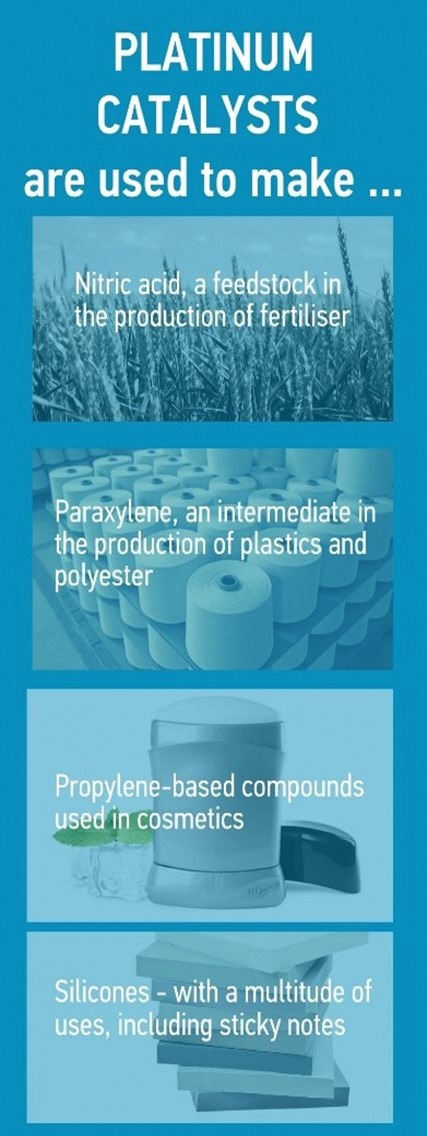

One of platinum’s most important uses in industrial applications is as a catalyst – the presence of even a small molecule can speed up chemical reactions, reducing process energy needs and improving yields.

Figure 6: Platinum catalysts

Source: WPIC

Platinum catalytic demand comes from both the relatively small volumes attributable to the ongoing ‘wear’ of platinum catalysts already in service and, of more significance, the deployment of entirely new catalysts as new plant capacity is constructed.

Further, platinum from industrial catalysts that have been subject to ‘wear’ is typically recycled and used to produce entirely new catalysts. This process is known as closed-loop recycling and usually the industrial user owns or leases the metal necessary while the old catalyst, plus the ‘top-up’ metal to account for wear, is used to produce a replacement catalyst.

Unlike other sources of demand, consumption of platinum in industrial applications is usually expressed on a net basis, that is the gross demand less the supply of closed-loop recycled metal. This net industrial demand is in contrast to automotive demand, for example, which is gross demand with metal recycled from used catalysts treated as recycled supply from open loop recycling.

Industrial demand sub-sectors and end-uses

Chemical: Platinum catalysts allow for higher yields and reduced energy requirements as processes typically can be conducted at lower temperatures and pressures than when catalysts are not used. Examples of platinum’s use in the chemicals industry include the production of nitric acid for fertiliser manufacturing, making high-quality silicone rubbers, and hydrogen generation from steam methane reformation.

Petroleum: The petroleum industry employs platinum’s catalytic abilities in reforming low octane petroleum naphtha into high quality products, as well as in the gas to liquids industry and the manufacturing of biofuels.

Electrical: Platinum is used in the recording substrates of hard discs for data recording, particularly in cloud-based servers, as well as for coating electrodes to protect against corrosion.

Glass: Glass demand for platinum is primarily for the bushings used in the manufacturing of glass fibre, and the casting surfaces for the manufacturing of LCD screens as, unlike base metals, platinum and platinum-rhodium alloys are unreactive and do not oxidise or scale at the high temperatures required.

Medical: Medical uses of platinum include pacemakers, implants and surgical equipment visible under x-ray due to platinum’s radiopacity. It is its important application in platinum-based antineoplastic anti-cancer drugs.

Other: Other industrial uses for platinum include sensors, such as those used in engine management systems and on spark plug electrodes, to reduce spark erosion and prolong operating life. Hydrogen-related applications – proton exchange membrane electrolysers and stationary fuel cells – are also included in this segment (excluding fuel cell electric vehicles FCEVs). While hydrogen-related demand for platinum is currently relatively small, it is expected to grow strongly, equating to a third of all annual demand for platinum by the latter half of the 2030s (when FCEV platinum demand is also included).

Outlook for platinum industrial demand

Industrial demand in 2023 is forecast to grow by 12 per cent year-on-year to 2,505 koz, driven by considerable glass capacity expansions in China which will offset declines forecast in the chemical, petroleum and electronics sectors.

Petroleum demand is forecast to decline 4 per cent to 180 koz. This is mostly due to significant, cyclical gas-to-liquid plant changeouts which benefited platinum offtake volumes in 2022 and will not be repeated in 2023. Partially offsetting this, reforming and isomerisation capacity is expected to rise, led by growth in the Middle East and China.

Chemical demand is forecast to contract by 2 per cent year-on-year to 619 koz, driven by weaker paraxylene offtake, as capacity expansions continue to slow, following several years of significant expansion in China. Nitric acid offtake is expected to remain largely flat year-on-year. Silicone demand will rise modestly reflecting slower global growth.

Glass demand is expected to rise significantly this year, the majority coming from the anticipated growth in capacity expansions/investments in China. Installations in LCD tanks will drive this growth, resulting in platinum LCD demand more than doubling this year. This is broadly in line with past industry growth cycles where capacity expansions/investments are concentrated to take advantage of economies of scale. Meanwhile, the construction of new fiberglass plants from China’s project pipeline will continue as the country’s COVID-19 restrictions ease. Platinum demand from the glass industry will increase by 55 per cent to 737 koz, resulting in 2023 superseding 2022 as the second strongest year on record for glass demand for platinum after 2021.

Medical demand is expected to grow 3 per cent year-on-year to 283 koz, its first year surpassing pre-pandemic levels. While there will still be a hangover effect from COVID, the industry will return to its pre-pandemic natural growth path, led by population growth, an ageing population, and better access to healthcare.

Electrical demand is expected to fall by around 6 per cent this year.

Other demand is forecast to grow by 3 per cent year-on-year in 2023, with diverging trends in the underlying categories. Despite the automotive aftermarket continuing to recover, the popularity of electric vehicles and downsized engines is likely to constrain metal usage in sensors and spark plugs. The fall in demand from other areas will offset significant growth in electrolyser and stationary fuel cell demand, which is estimated to increase threefold compared to 2022.

This publication is general and solely for educational purposes. The publisher, The World Platinum Investment Council, has been formed by the world’s leading platinum producers to develop the market for platinum investment demand. Its mission is to stimulate investor demand for physical platinum through both actionable insights and targeted development, providing investors with the information to support informed decisions regarding platinum and working with financial institutions and market participants to develop products and channels that investors need.

The research for the period since 2019 attributed to Metals Focus in the publication is © Metals Focus Copyright reserved. All copyright and other intellectual property rights in the data and commentary contained in this report and attributed to Metals Focus, remain the property of Metals Focus, one of our third-party content providers, and no person other than Metals Focus shall be entitled to register any intellectual property rights in that information, or data herein. The analysis, data and other information attributed to Metals Focus reflect Metals Focus’ judgment as of the date of the document and are subject to change without notice. No part of the Metals Focus data or commentary shall be used for the specific purpose of accessing capital markets (fundraising) without the written permission of Metals Focus.

The research for the period prior to 2019 attributed to SFA in the publication is © SFA Copyright reserved.

This publication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. With this publication, neither the publisher nor its content providers intend to transmit any order for, arrange for, advise on, act as agent in relation to, or otherwise facilitate any transaction involving securities or commodities regardless of whether such are otherwise referenced in it. This publication is not intended to provide tax, legal, or investment advice and nothing in it should be construed as a recommendation to buy, sell, or hold any investment or security or to engage in any investment strategy or transaction. Neither the publisher nor its content providers are, or purports to be, a broker-dealer, a registered investment advisor, or otherwise registered under the laws of the United States or the United Kingdom, including under the Financial Services and Markets Act 2000 or Senior Managers and Certifications Regime or by the Financial Conduct Authority.

This publication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor. You are solely responsible for determining whether any investment, investment strategy, security or related transaction is appropriate for you based on your investment objectives, financial circumstances, and risk tolerance. You should consult your business, legal, tax or accounting advisors regarding your specific business, legal or tax situation or circumstances.

The information on which this publication is based is believed to be reliable. Nevertheless, neither the publisher nor its content providers can guarantee the accuracy or completeness of the information. This publication contains forward-looking statements, including statements regarding expected continual growth of the industry. The publisher and Metals Focus note that statements contained in the publication that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect actual results and neither the publisher nor its content providers accept any liability whatsoever for any loss or damage suffered by any person in reliance on the information in the publication.

The logos, services marks and trademarks of the World Platinum Investment Council are owned exclusively by it. All other trademarks used in this publication are the property of their respective trademark holders. The publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the publisher to any rights in any third-party trademarks.

© 2022 World Platinum Investment Council Limited. All rights reserved. The World Platinum Investment Council name and logo and WPIC are registered trademarks of World Platinum Investment Council Limited. No part of this report may be reproduced or distributed in any manner without attribution to the publisher, The World Platinum Investment Council, and the authors.

Related links

World Platinum Investment Council - WPIC®

World Platinum Investment Council - WPIC®