OSE Derivatives

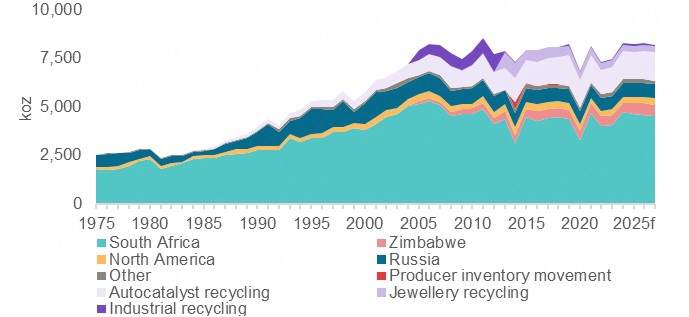

Platinum mined supply

Introduction

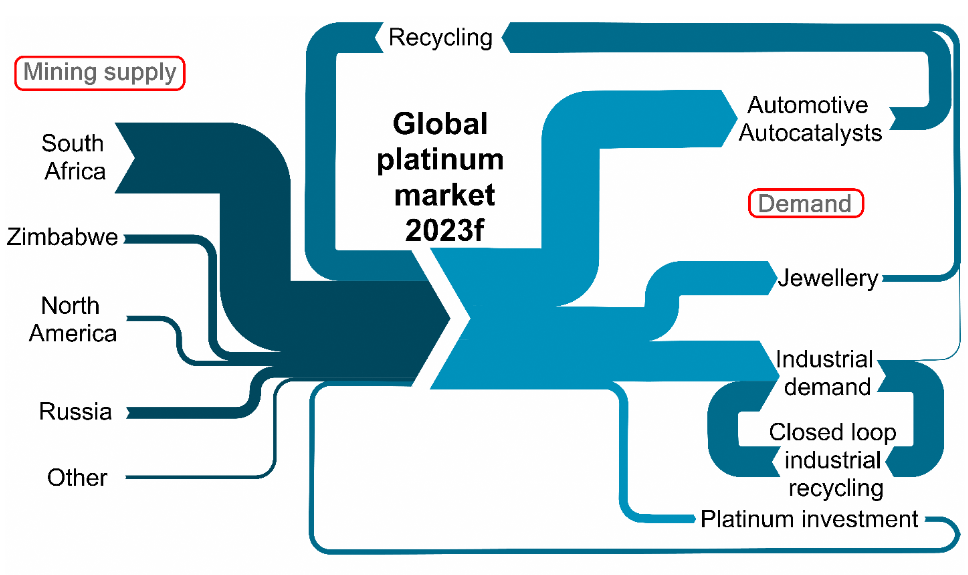

Platinum mine supply is unusually highly concentrated, with over 70 per cent of global mine supply coming from a relatively small geographic region in South Africa. Here platinum mine supply has declined from a peak of 5.3 moz in 2006 to an estimated 4.3 moz in 2022. Globally, refined platinum mine supply has declined from 6.8 moz in 2006 to an estimated 5.0 moz in 2022.

When compared to gold and silver mine supply, platinum supply reflects its scarcity as a resource. In 2021, the mined production of silver, gold and platinum was 823 moz, 115 moz and 6 moz, respectively. Each year, a further 2 moz or so of platinum comes from mainly autocatalyst and jewellery recycling. Here we consider the dynamics and drivers of mined platinum supply only.

Figure 1: Platinum mined supply versus platinum recycled supply

Figure 2: Total platinum supply

Where does platinum come from?

Thirty times rarer than gold, platinum occurs at very low concentrations in the Earth’s crust – it ranks as the 72nd most common out of 92 natural elements. There are only four regions in the world that have platinum mining operations of any significance and of these South Africa has the largest platinum resources, and output, by far, with 75 per cent of annual mined platinum supply coming from there. The balance comes from: Russia – 11 per cent; Zimbabwe – 8 per cent; and North America – 4 per cent. Other minor producers including China, Colombia and Finland produce the balance. Concentration of supply does bring some risks to mine supply should geopolitical or weather events, or regional operational challenges, act to impede the mining industry in specific geographies.

Figure 3: Global platinum market schematic

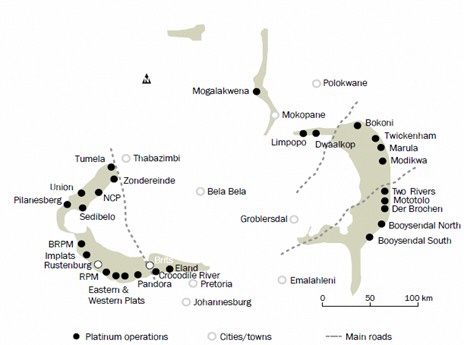

South Africa’s Bushveld Igneous Complex ore body dominates global platinum production. Here, over 80 per cent of the world’s economically viable platinum-bearing deposits (reserves) are located.

Figure 4: Bushveld PGM operations

In addition to its rarity, platinum is not easy to extract. While over 70 per cent of all mineral extraction globally arises from surface mining, in contrast, the geology and location of the world’s platinum reserves mean that platinum mining takes place principally underground. The main exception to this is the Mogalakwena mine in South Africa which is the largest open-pit platinum mine in the world, producing some eight per cent of annual platinum mine supply.

Platinum is very rarely found in isolation, it is more commonly found alongside other metals, including the other Platinum Group Metals (PGMs) – palladium, rhodium, ruthenium, iridium and osmium – and base metals like nickel and copper and chrome, as well as gold and silver.

This means that a platinum mine produces a mix of PGMs and other metals for each ounce of platinum mined, refined and sold, at ratios that vary from mine to mine. Each commodity is priced individually by the global markets, contributing to total sales revenue, which when divided by the number of ounces produced derives a mine level basket price. Depending on the composition of the ore that is extracted, platinum can be classed as either the primary product or a by-product metal. For example, in South Africa and Zimbabwe, platinum is mined as a primary metal, whereas in Russia platinum is produced predominantly as a by-product of nickel mining. In North America mined platinum is produced as a by-product of palladium and nickel mining. The various ratios of metals found within different ore types is known as the ‘prill split’.

Producers’ revenues are determined by both the volume of ore mined and the grade of the deposit; the higher the grade, the greater the metal content, with the prices of the commodities being mined – reflecting the composition of the ore body – also having a significant bearing. For PGM producers, platinum has historically made up ~ 60% of revenues, which has meant that the revenue leverage has typically been to the platinum price. Since 2018, price appreciation has resulted in that equation swinging in favour of a combination of palladium and rhodium, which currently account for ~70% of revenues.

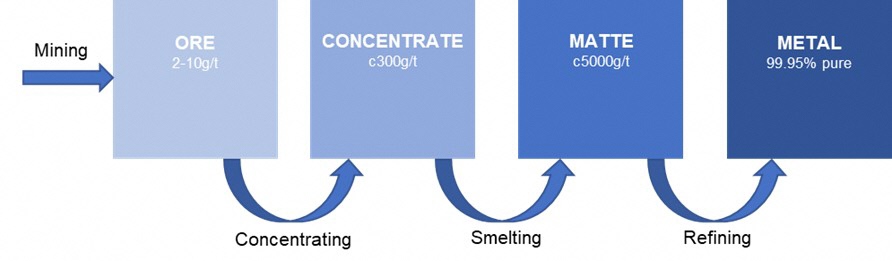

Platinum is extracted, processed and purified through a complex series of physical and chemical processes, namely mining, concentrating, smelting and refining.

Figure 5: Overview of PGM production

Platinum mine supply

Mining activity requires significant initial investment to discover and evaluate a deposit, develop a mine and produce refined metal. To make this an economically sensible decision, the revenue from the future sale of the metal minus the associated costs of running the mine (operating costs, capital expenditure, taxes, financing costs, etc.) should lead to a good return on the initial investment (many mining companies use a 15 per cent Internal Rate of Return as a benchmark). Often the time from discovery of PGMs in the ground to mine development and eventual production can take over a decade. Some of the factors that can impact mined platinum supply are detailed below:

- Reserve and resource limitations – how much metal remains in a deposit.

- Mineral economics – how much of that metal can be extracted at current commodity prices and production costs.

- Confident projections – Planning ten years ahead requires confidence in the future demand outlook and a stable regulatory and fiscal environment.

- Barriers to entry/exit – How easy is it to establish brand new operations or to shut-down or suspend existing operations.

- Licence to operate – This is a complex combination of social and environmental considerations.

Outlook for platinum mined supply

Mined platinum supply grew steadily up until 2005, since when it has broadly plateaued at almost 6 moz p.a. There are some prospects for future growth, but few projects of significance are being sanctioned, and most that are sanctioned are replacement production for reserve depletion elsewhere. This reflects an uncertain operating environment in South Africa, as well as investors in the platinum mining equities showing a preference for shareholder returns over production growth. Challenges facing South African mining companies include a worsening socio-economic climate leading to increased community unrest, as well as ongoing power shortages due to the problems being experienced by ESKOM, the state power utility.

This publication is general and solely for educational purposes. The publisher, The World Platinum Investment Council, has been formed by the world’s leading platinum producers to develop the market for platinum investment demand. Its mission is to stimulate investor demand for physical platinum through both actionable insights and targeted development, providing investors with the information to support informed decisions regarding platinum and working with financial institutions and market participants to develop products and channels that investors need.

The research for the period since 2019 attributed to Metals Focus in the publication is © Metals Focus Copyright reserved. All copyright and other intellectual property rights in the data and commentary contained in this report and attributed to Metals Focus, remain the property of Metals Focus, one of our third-party content providers, and no person other than Metals Focus shall be entitled to register any intellectual property rights in that information, or data herein. The analysis, data and other information attributed to Metals Focus reflect Metals Focus’ judgment as of the date of the document and are subject to change without notice. No part of the Metals Focus data or commentary shall be used for the specific purpose of accessing capital markets (fundraising) without the written permission of Metals Focus.

The research for the period prior to 2019 attributed to SFA in the publication is © SFA Copyright reserved.

This publication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. With this publication, neither the publisher nor its content providers intend to transmit any order for, arrange for, advise on, act as agent in relation to, or otherwise facilitate any transaction involving securities or commodities regardless of whether such are otherwise referenced in it. This publication is not intended to provide tax, legal, or investment advice and nothing in it should be construed as a recommendation to buy, sell, or hold any investment or security or to engage in any investment strategy or transaction. Neither the publisher nor its content providers are, or purports to be, a broker-dealer, a registered investment advisor, or otherwise registered under the laws of the United States or the United Kingdom, including under the Financial Services and Markets Act 2000 or Senior Managers and Certifications Regime or by the Financial Conduct Authority.

This publication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor. You are solely responsible for determining whether any investment, investment strategy, security or related transaction is appropriate for you based on your investment objectives, financial circumstances, and risk tolerance. You should consult your business, legal, tax or accounting advisors regarding your specific business, legal or tax situation or circumstances.

The information on which this publication is based is believed to be reliable. Nevertheless, neither the publisher nor its content providers can guarantee the accuracy or completeness of the information. This publication contains forward-looking statements, including statements regarding expected continual growth of the industry. The publisher and Metals Focus note that statements contained in the publication that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect actual results and neither the publisher nor its content providers accept any liability whatsoever for any loss or damage suffered by any person in reliance on the information in the publication.

The logos, services marks and trademarks of the World Platinum Investment Council are owned exclusively by it. All other trademarks used in this publication are the property of their respective trademark holders. The publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the publisher to any rights in any third-party trademarks.

© 2022 World Platinum Investment Council Limited. All rights reserved. The World Platinum Investment Council name and logo and WPIC are registered trademarks of World Platinum Investment Council Limited. No part of this report may be reproduced or distributed in any manner without attribution to the publisher, The World Platinum Investment Council, and the authors.

Related links

World Platinum Investment Council - WPIC®

World Platinum Investment Council - WPIC®