Data

Alternative Data on OSE

Increased Demand for Financial Industry Alternative Data

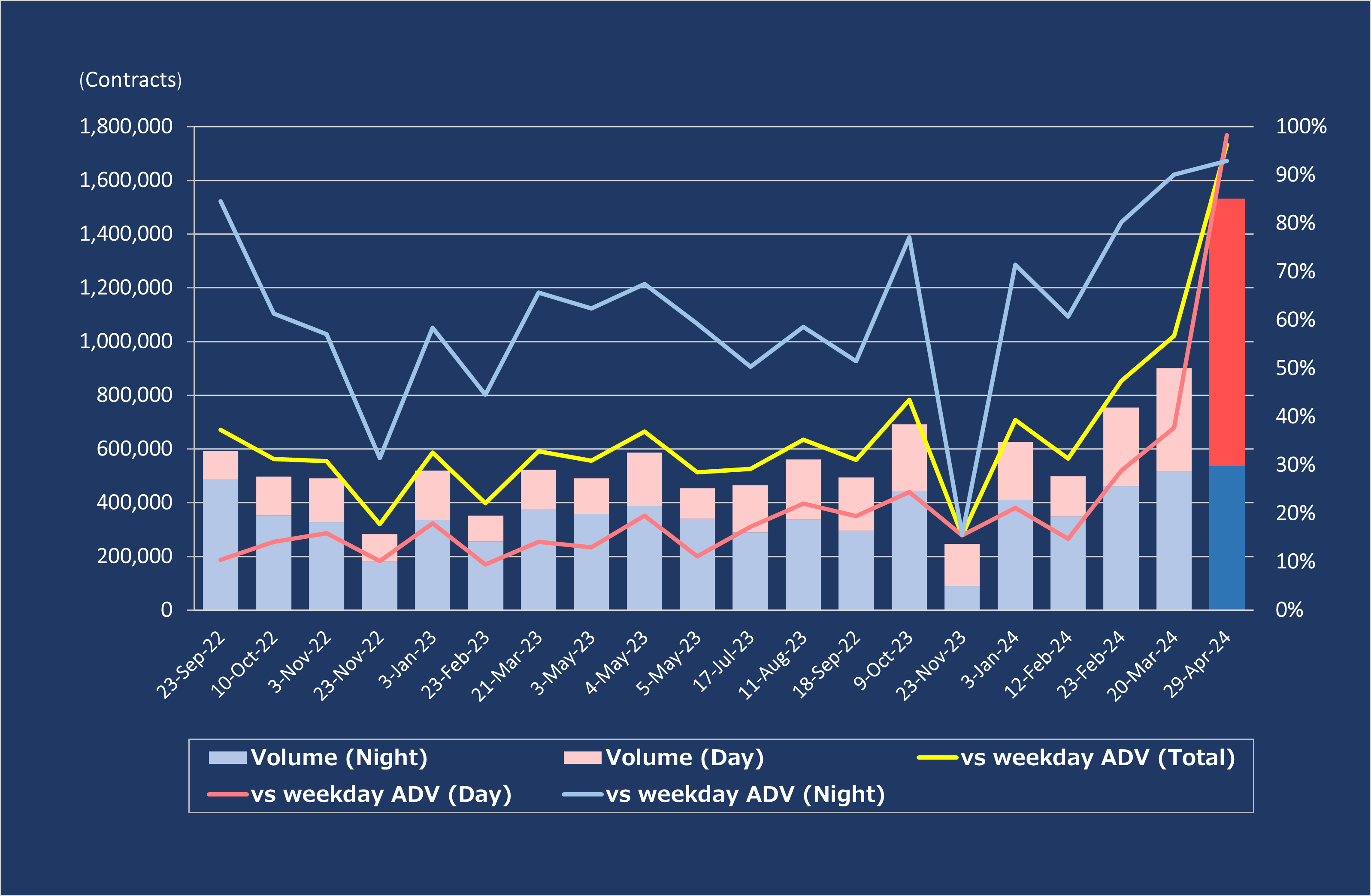

As applications for artificial intelligence and machine learning continue to multiply, interest in alternative data has risen, including in the financial industry. Alternative data or “non-conventional data” is information derived from Internet of Things (IoT) devices, satellite images, social network services (SNS), etc.

In the financial sector, alternative data can be used to inform and formulate investment decisions. Unlike traditional data, which consists primarily of corporate financial disclosures and government publications, alternative data can be gleaned on the internet from a variety of sources. Examples include sentiment information from Twitter and Facebook, trend information from internet search engines like Google, the number of smartphone app downloads, an analysis of remaining oil tank volume using satellite images, and credit card usage information. Alternative data is being used not only by quantitative funds but also by a wide range of asset management companies that are strengthening their systems for advanced data analysis (machine learning, natural language processing, etc.).

According to Coalition Greenwich, 44% of institutional asset managers and hedge funds use alternative data as part of their portfolio construction and trading process, and 73% of those say their use of alternative data has increased over the past two years (March 2023).

Alternative data is likely to continue to draw attention, as Precedence Research, a Canadian research organization, predicts the market size of alternative data will reach approximately USD 150 billion by 2030.

![[Source]Precedence Research](https://market-news-insights-jpx.com/wordpress/wp-content/uploads/2023/08/29d3bc99193cb0b837fb8cc53f050ae5-1.png)

Alternative Data and Japanese Derivative Markets

Since June 2019, the Osaka Exchange (OSE), which operates the derivatives market, has responded to increased demand for alternative data by providing latency-sensitive investors with data from its J-GATE derivatives trading system.

Some of this data is uploaded to buckets in the public cloud environment (AWS) provided by Amazon Web Service and can be accessed via the internet rather than being transferred by email or other means. Investors have expressed high demand for the following alternative data from J-GATE:

Order/Trade Data

・ J-GATE Information (Order/Trade Data)

J-GATE orders and trades event by event. The data includes “Immediate or Cancel” orders (e.g. FOK, FAK, etc.) which are unavailable on API or ITCH. Information that can identify the trader (e.g. participant code, user IDs) is not included.

System Status Data

・J-GATE Information (System Stats Data)

Data related to running status of Matching Engine, ITCH and OUCH servers of J-GATE (e.g. CPU usage, Memory usage, NIC usage, PTP time synchronization offset value, transaction volume per GW/TAP, etc.).

Timestamp Data

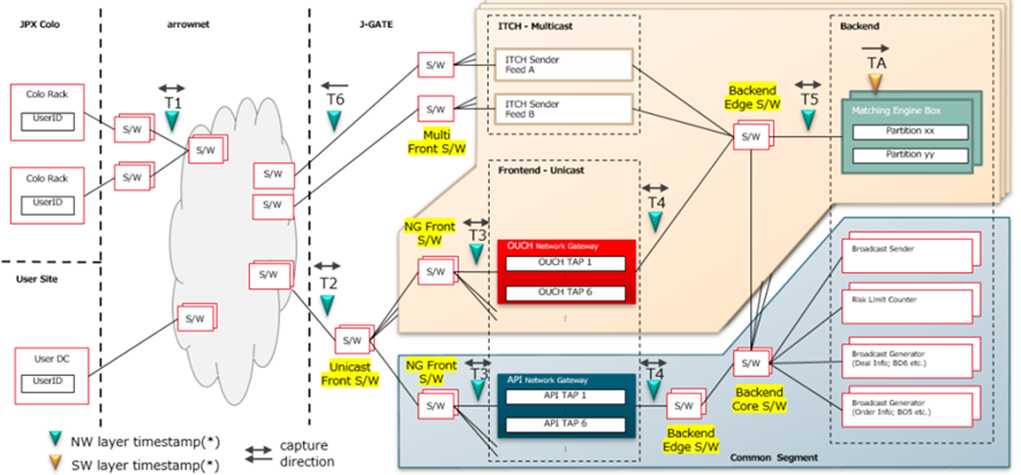

・J-GATE Information (Timestamp Data)

J-GATE timestamp records the time at which each order and execution message sent by OUCH and OMNetAPI passes each point on the NW pathway comprising “arrownet” and J-GATE, and the time each is processed by the matching engine application. Latency-sensitive investors welcome the timestamp data and use it to analyze investment strategies.

The data shows in nanoseconds the time when an individual order message passes each timestamping point. Information that can identify the trader (e.g. participant code, user IDs) is not included. Order data may be incomplete when the number of orders rapidly increases in a day or some malformed packets in the traffic cause unexpected issues in a relevant system.

Other alternative data provided by OSE are:

ITCH Binary Data

・J-GATE Information (ITCH Binary Data)

Data recorded in binary format in Full Order Information (ITCH data) telegrams delivered (from 9-21-2021), 2021) by J-GATE 3 via the ITCH protocol. The data needs to be decoded according to a designated binary format before being used.

ITCH Historical CSV Data

・J-GATE Information (ITCH Historical CSV Data)

Data recorded in CSV format in Full Order Information (ITCH data) telegrams that J-GATE 2.0 distributed (from 7-19-2017) via the ITCH protocol. It is available only through the Spot Data Service.

Drop Copy Data

・J-GATE Information (Drop Copy Data)

Data recording broadcast information related to orders and executions by individual companies, delivered via J-GATE’s OMNetAPI.

Further details can be found on: https://www.jpx.co.jp/english/markets/paid-info-derivatives/alternative/index.html

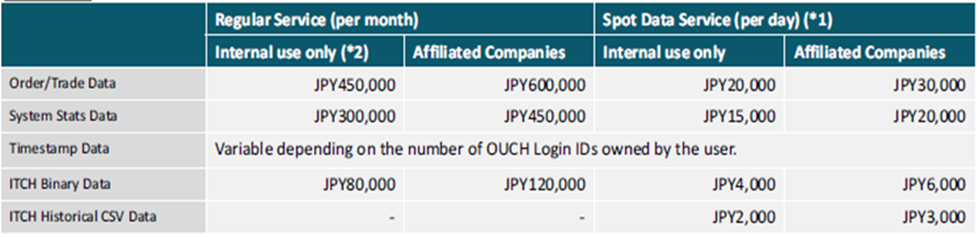

Fees for J-GATE data depend on the type of use, such as internal use or use by affiliates. For more information, please send an e-mail to deri-w1@jpx.co.jp

The OSE provides alternative data in the derivatives market to meet the need for more detailed data analysis used in investment decisions. Additional data releases will be considered based on investor feedback.

The TSE equity market also provides flag information on margin trading and short selling, including “trading breakdown data” that can be used for more detailed forecasts of future supply and demand, etc. For details, please refer to https://market-news-insights-jpx.com/tse/article003264/ and https://market-news-insights-jpx.com/tse/article003272/

Related links