OSE Derivatives

OSE 3-Month TONA Futures: Evaluating the New Dish on the Japanese Product Menu

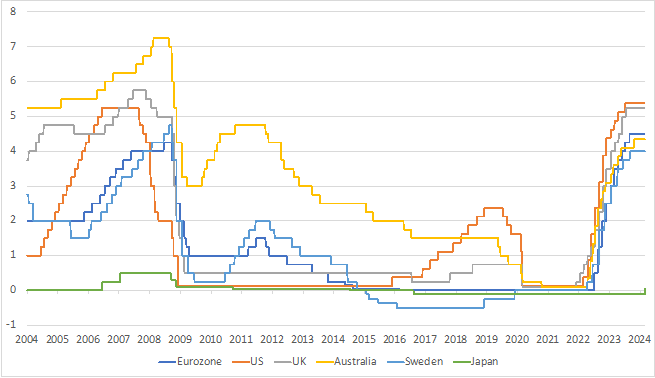

Since late 2021, a number of countries have raised interest rates to combat inflationary pressures.

Japan, however, remained the exception for a long time.

However, on 19 March 2024, the Bank of Japan finally abandoned its policy framework of yield curve control and negative interest rates.

Suddenly, economists, traders, investors, central bankers, and other observers are paying extra attention to the short end of the Japanese yield curve. What story does it tell about the probability, timing, and magnitude of the next move? What does it mean, in practical terms, for market participants wanting to hedge against, or speculate on a change in the BOJ monetary policy?

It was 17 years ago when the BOJ last raised interest rates. Since then, international financial markets have changed dramatically.

For example, the London Interbank Offered Rate (LIBOR), by far the most widely used benchmark in the money market and sometimes dubbed “the world’s most important number,” no longer exists. Euroyen TIBOR, the short-term interest rate benchmark underpinning the historical 3-month Euroyen futures contract, is scheduled to disappear by the end of 2024.

Since the aftermath of the LIBOR manipulation scandal, countries have adopted alternative risk-free rates (RFRs) to represent the short end of the yield curve. The Tokyo Over-Night Average (TONA) has been selected as the floating rate for JPY-denominated interest rate derivatives. As a result, TONA overnight index swaps (OISs) are now dominating the over-the-counter (OTC) swap market.

In essence, the Japanese “product menu” now looks entirely different compared to the early 2000s.

In May 2023, Osaka Exchange (OSE), part of the Japan Exchange Group (JPX), launched the 3-month TONA futures contract to fill the gap in the exchange-traded derivatives market. A new dish was introduced to the menu.

It is widely known that robust and reliable benchmarks for short-term interest rates (and derivatives based on them) are crucial for central banks because they provide the first indication of whether monetary policy is effective or not. But the shift from LIBOR and TIBOR to TONA also has major implications for hedgers and speculators closely watching the BOJ.

In this respect, the OSE 3-Month TONA futures market offers 4 benefits that were not available 17 years ago.

Benefit 1

First, the underlying reference rate (TONA) is based upon actual transactions in the uncollateralized overnight call market rather than non-binding or indicative quotes and estimates. This makes the benchmark underpinning the OSE 3-month TONA futures market much less susceptible to manipulative or collusive attempts compared to LIBOR or TIBOR.

Benefit 2

Second, since 3-month LIBOR and TIBOR are fixed and known at the start of the contract period, they are “forward-looking” term rates. However, the underlying benchmark for the OSE 3-month TONA futures contract is “backward-looking” because it requires the actual overnight rates to be compounded in arrears after the 3 months have passed. As the calendar of BOJ monetary policy meetings is announced far in advance, more mathematically precise and granulated trading and hedging strategies can be crafted ahead of monetary policy announcements. There are also similarities between the OSE 3-month TONA future and the classic 30-day Federal Funds future traded on CME in that both can be used to derive the future path of central bank policy rates as expected by market participants.

For instance, suppose it is late October 2023. A pension fund faces a funding gap for the next seven weeks and wants to hedge against a potential BOJ rate hike following their meeting on October 30-31. The consensus view among economists and market participants is that the central bank will leave the short-term interest rate unchanged. But the pension fund wants to play it safe. In this case, the OSE 3-month TONA future serves a similar role as the 3-month Euroyen TIBOR future in being the go-to exchange-traded instrument to hedge against or speculate on a change in short-term interest rates. However, because the OSE 3-month TONA future uses compounded overnight rates in arrears as the underlying, rather than the forward-looking TIBOR, the risk-reward assessment can be made with greater precision. In late October 2023, the Sept-2023 Euroyen TIBOR future would already have settled. In fact, no TIBOR-based futures contract could have captured the exact period between the BOJ meetings in October and December. Selling the Dec-2023 Euroyen TIBOR future could, possibly, have been an alternative, but it would have involved a maturity mismatch and a greater cost given that the yield curve, at the time, was positive.

Benefit 3

Third, the OSE 3-month TONA future is exchange-traded and, therefore, has the same general benefits of “standardisation” as the 3-month Euroyen TIBOR future. Also, OSE 3-month TONA futures can be used to construct yield curve steepeners and flatteners ahead of hawkish or dovish central bank statements. In addition, strategies may include combinations with TONA OISs traded in the OTC market, precisely echoing the connectedness between the exchange-traded and OTC-traded LIBOR and TIBOR interest rate markets back in the “old days”. Two important changes are notable, though. First, the reset (or fixing) risk has decreased dramatically because of the adoption of overnight rather than 3-month underlying maturities. Second, with cross-margining between OTC IRS cleared at Japan Securities Clearing Corporation (JSCC) and OSE 3-month TONA futures having been launched on 4 March 2024, cross-product trading, risk management, and monitoring have been facilitated, and the collateral burden has been reduced.

Benefit 4

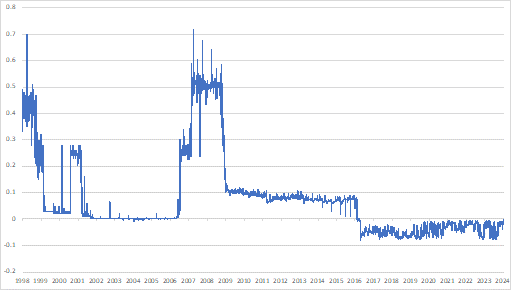

Fourth, OSE 3-month TONA futures can be used to construct so-called “butterfly spreads” and other yield curve strategies that take a view on the relative magnitude, likelihood, and timing of future interest rate changes. However, compared to 3-month Euroyen TIBOR futures, OSE 3-month TONA futures are virtually immune to money market risk premia in the underlying, which may have a significant impact on the curve structure.

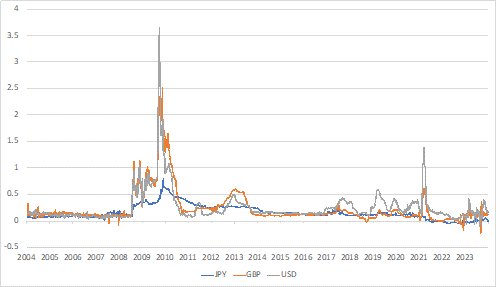

This is because LIBOR was not only determined by the current and expected future central bank interest rate. It was also influenced by the perceived credit risk among the counterparties and the cost of accessing liquidity over a 3-month horizon. The credit and liquidity risk premia could be significant, especially during periods of stress, uncertainty, and crises in the banking and financial systems.

If, when, and by how much the Bank of Japan will change interest rates again soon remains to be seen. Regardless, however, the OSE 3-month TONA futures market is probably going to play a central role for central bankers, market participants, and analysts going forward.