Detail Breakdown Trading Data

Detail Breakdown Trading Data

Key Points

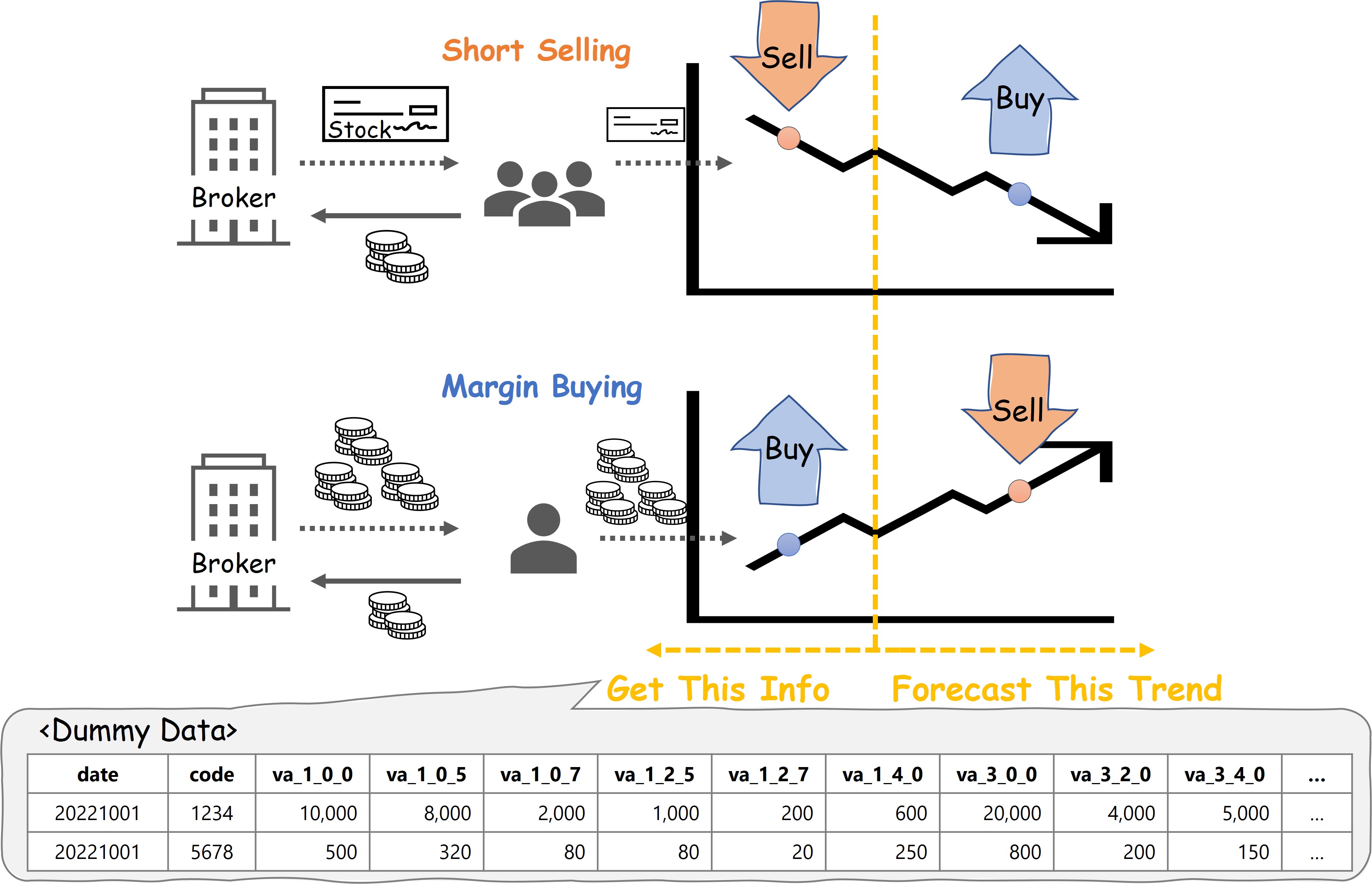

Daily trade value/volume for all stocks that have been sold short/traded on margin Daily trade value/volume for all stocks that have been sold short/traded on margin |

Helps you to track investors’ trading activity & forecast future buying/selling trends Helps you to track investors’ trading activity & forecast future buying/selling trends |

Sample data & FREE trial available Sample data & FREE trial available |

Tips

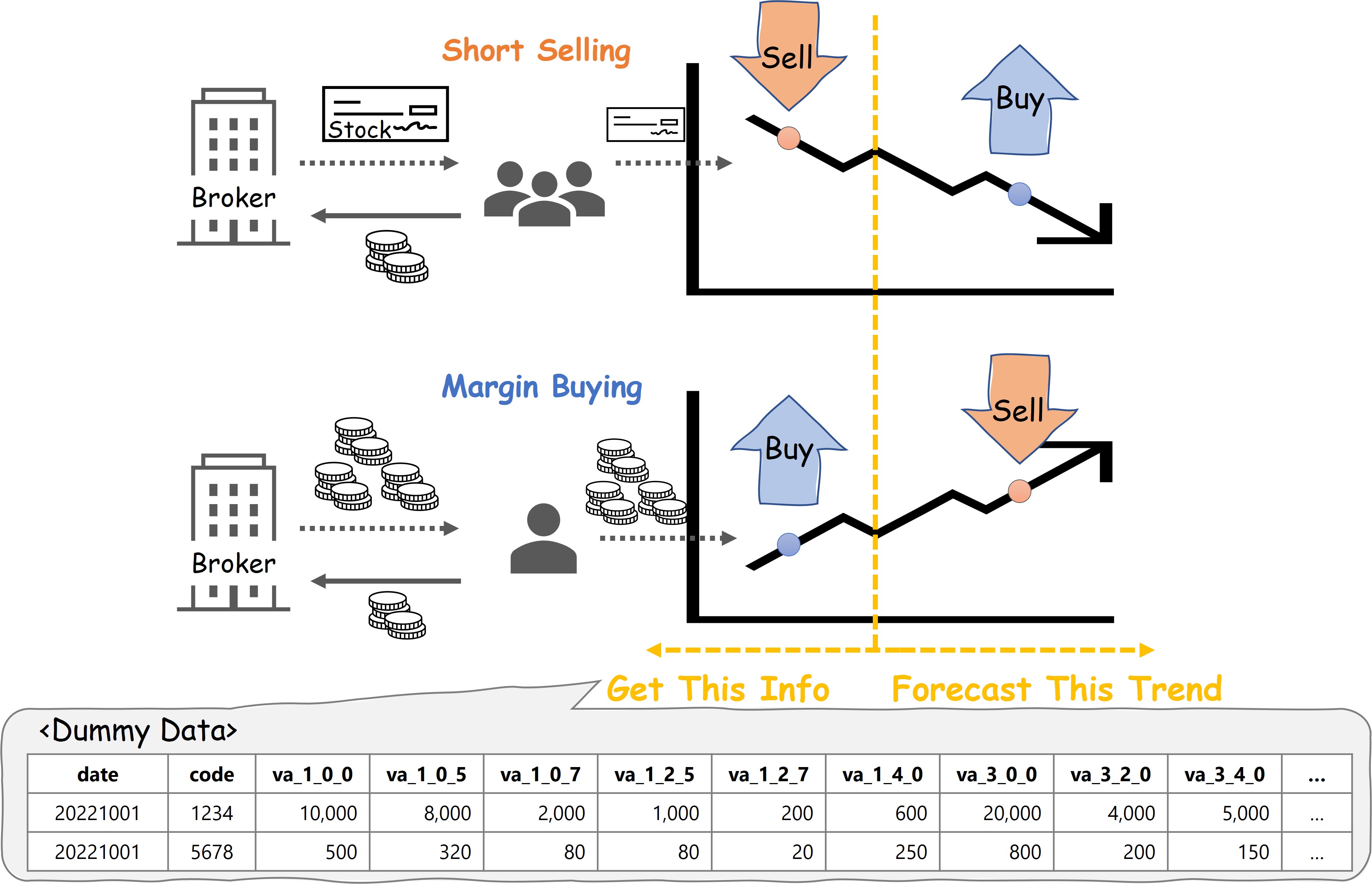

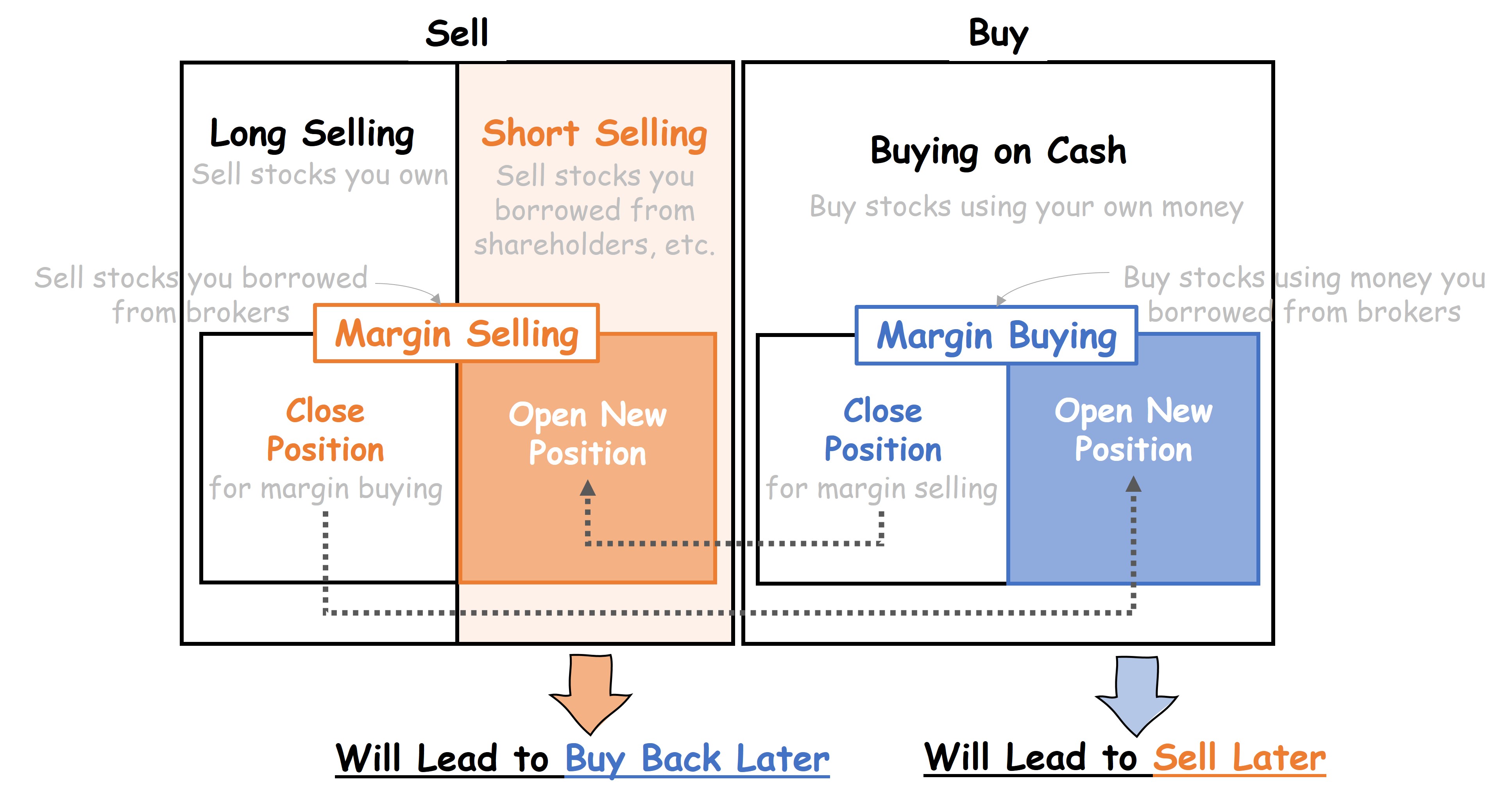

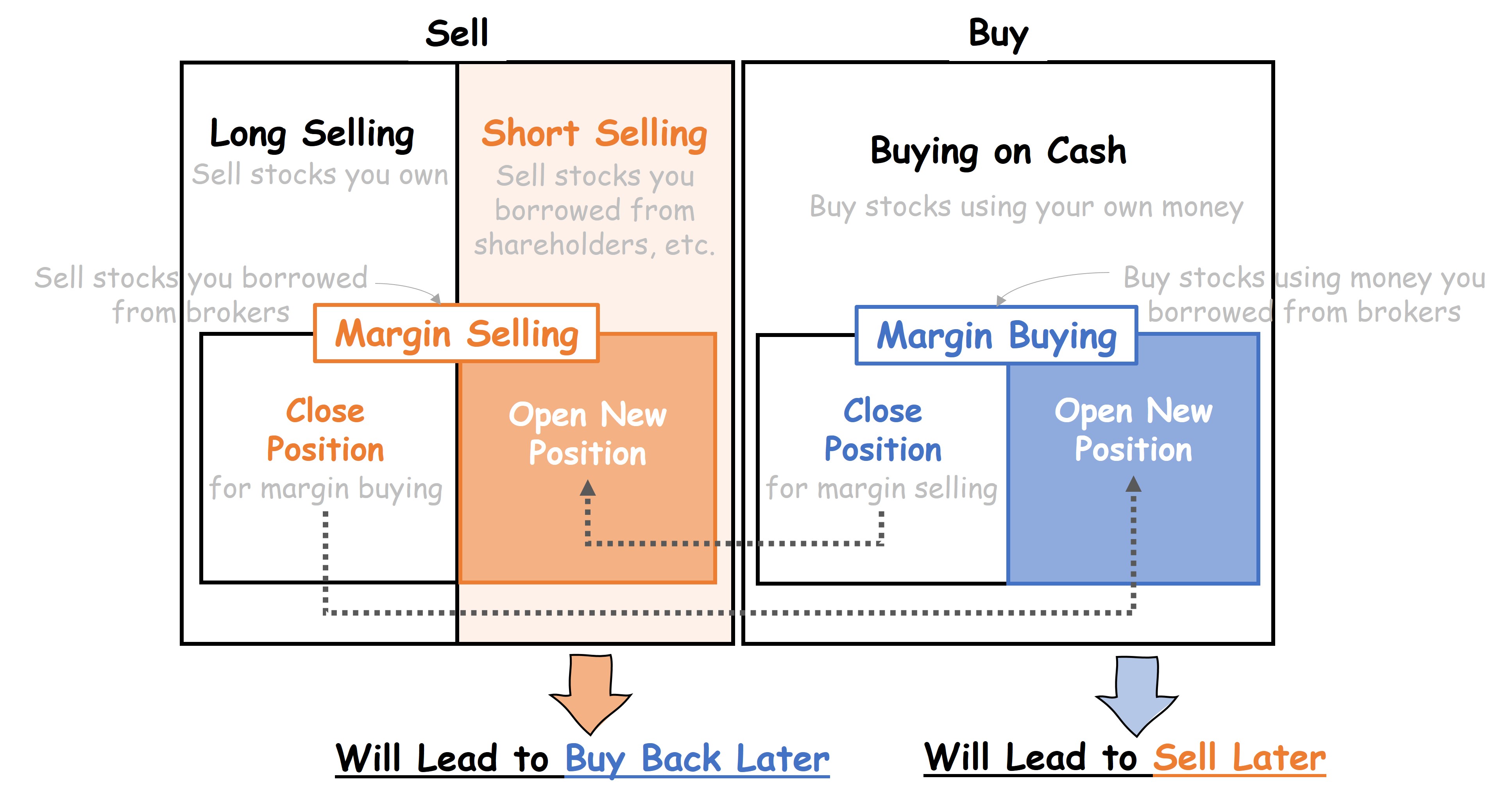

Margin trading is an investment activity that allows investors to deposit a certain amount with a broker and then borrow money or shares enough to trade more than 3 times the deposit amount. This requires closing of positions within a certain period. According to a survey conducted by TSE in 2021, retail investors account for 94% and other investors account for 6% of margin trading on TSE by trading value. Margin trading is an investment activity that allows investors to deposit a certain amount with a broker and then borrow money or shares enough to trade more than 3 times the deposit amount. This requires closing of positions within a certain period. According to a survey conducted by TSE in 2021, retail investors account for 94% and other investors account for 6% of margin trading on TSE by trading value. |

On the other hand, short selling is an investment activity that is commonly used by institutional investors when they think a stock’s price will fall. This works by borrowing shares from brokers or other shareholders with the intention of selling them on the market and buying them back at a lower price in the future. On the other hand, short selling is an investment activity that is commonly used by institutional investors when they think a stock’s price will fall. This works by borrowing shares from brokers or other shareholders with the intention of selling them on the market and buying them back at a lower price in the future. |

Use Cases

quantitative analyst, investor, or trading strategist, and you… quantitative analyst, investor, or trading strategist, and you…

act on your prediction that stock prices will go up. act on your prediction that stock prices will go up.

Check trading value/volume with margin buying flags for each stock to forecast selling activity in the future. Check trading value/volume with margin buying flags for each stock to forecast selling activity in the future.

act on your prediction that stock prices will go down. act on your prediction that stock prices will go down.

Check trading value/volume with short selling flags for each stock to forecast buyback activity in the future. Check trading value/volume with short selling flags for each stock to forecast buyback activity in the future. |

data scientist, algorithm developer, or quantitative engineer, and you… data scientist, algorithm developer, or quantitative engineer, and you…

improve your trading algorithm. improve your trading algorithm.

Use this dataset to refine your buy-sell signal indicators from other investors’ trading activity. Use this dataset to refine your buy-sell signal indicators from other investors’ trading activity. |

business planner at an information vendor, and you… business planner at an information vendor, and you…

expand your institutional or retail customer base. expand your institutional or retail customer base.

Redistribute information in this dataset to enhance your data services. Redistribute information in this dataset to enhance your data services. |

Coverage & Features

| Contents |

Features |

| (1) Trading value per ticker symbol (with/without short selling flag) |

Data for buy and sell sides in units of JPY.

Helps you to grasp the trends of what stocks are expected to drop in price and to forecast future buying demand or capital flow into stocks. Helps you to grasp the trends of what stocks are expected to drop in price and to forecast future buying demand or capital flow into stocks. |

| (2) Trading volume per ticker symbol (with/without short selling flag) |

Data for buy and sell sides in units of number of stocks.

Helps you to grasp the trends of what stocks are expected to drop in price and to forecast future buying demand or price movements. Helps you to grasp the trends of what stocks are expected to drop in price and to forecast future buying demand or price movements. |

| (3) Trading value per ticker symbol (with/without margin trading flag) |

Data for buy and sell sides in units of JPY.

Provides you hints into investor preferences to forecast future buying/selling demand. Provides you hints into investor preferences to forecast future buying/selling demand. |

| (4) Trading volume per ticker symbol (with/without margin trading flag) |

Data for buy and sell sides in units of number of stocks.

Provides you hints into investor preferences to forecast future buying/selling demand. Provides you hints into investor preferences to forecast future buying/selling demand. |

Basic Infomation

| Service |

Detail Breakdown Trading Data |

| Description |

This EOD dataset with short selling and margin trading flag information can be used to track investors’ trading activity and find future demand for over 3,800 Japanese stocks and gives you a daily view into market sentiment and price movements.

In addition, over 10 years of historical data is available for you to backtest. |

| Data Updated |

Once a day at 6:00pm JST |

| Delivery Method |

CSV file via FTP |

| Dataset Type |

Statistics, Historical (From Apr. 1, 2010 for internal use, Apr. 1, 2015 for external distribution) |

| Price |

Internal Use (single entity*): JPY 250,000/month

External Distribution*: JPY 100,000 ~ 500,000/month

*For more options, please contact us by clicking on the Request Info button below. |

| Sample Enabled |

Free sample and free trial are available.

Please contact us by clicking on the Free Sample button below. |

| Expected Users |

Quantitative investors, investment management firms, information vendors, fintech firms, brokerage firms |

| Use Cases |

– Analysis of market fluctuation factors or investor sentiments

– Prediction of future buying/selling demand

– Verification of trading algorithms/strategies

– Advancement of risk management for margin trading |

| Redistribution |

Permitted |

| Webpage |

https://www.jpx.co.jp/english/markets/paid-info-equities/alternative/01.html |

Detail Breakdown Trading Data

Detail Breakdown Trading Data