‘Price Amplification’ ETFs, 20 trillion yen, the largest balance, Market volatility risk

The market for exchange-traded funds (ETFs), which amplify the price movements of the stock index, is swelling. According to a British research firm, the global investment balance was the largest ever at more than $130 billion (about 20 trillion yen) at the end of July. In addition to individual investors who aim for short-term price gains, demand is also being attracted by institutional investors who are risk averse. The larger the outstanding amount of assets, the larger the size of the futures contract to be traded, which also carries the risk of market instability.

“Leveraged ETFs” are designed to have price movements several times the stock index. For example, if the Nikkei 225 goes up 1%, the Reva Electric Car ETF would go up 2%. Inverse ETFs are structured to profit when the index declines; a 1% decline in the Nikkei Stock Average results in a 1% gain in price. It is a product that makes profits mainly through short-term trading and is popular among individuals.

According to ETFGI (UK), the global balance of relevant ETFs under management stood at $132 billion at the end of July, up more than 20% since the beginning of the year. As of 2013, the situation was in the $50 billion range, a situation that has doubled in the last decade. Looking at the ETFs with the largest balances in the world, the US ones stand out.

This is represented by ProShares, a major US ETF provider, which offers several ETFs with more than $1 billion under management. Among these, “ProShares UltraPro Short QQQ (SQQQ)” has seen the largest inflow of $4.9 billion since the beginning of the year, making it the largest of all ETFs. It moves three times in the opposite direction to the US Nasdaq 100 index, which is composed of major high-tech stocks. The sharp rise in the index appears to have increased contrarian needs.

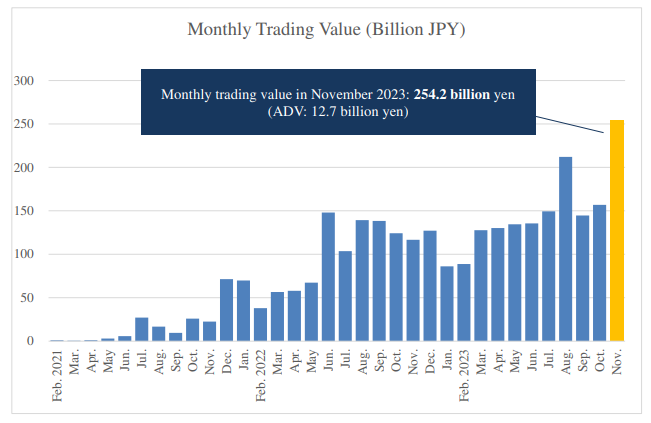

Among Japanese ETFs, Nomura Asset Management‘s “NEXT FUNDS the Nikkei Stock Average Double Inverse Index Linked Exchange Traded Fund”(with a balance of $1.5 billion) was the standout inflow. It is an instrument that moves twice as much in the opposite direction as the Nikkei Stock Average.

Masashi Watanabe, strategic director of Nomura Asset‘s ETF business, noted, “When the market is volatile, more investors see opportunities, and the outstanding amount of assets is likely to increase.”

It is also used for hedging (avoiding losses due to price fluctuations) of asset holdings. “In the US, many institutional investors as well as individuals use the inverse type,” according to Yukihide Imai, ETF Center and senior adviser at Nikko Asset Management. Even with the market downturn, it is possible to make a profit by investing in inverse type.

Outside of Japan and the US, trading is brisk in South Korea. Hibiki Muneta, Managing Director of Simplex Asset Management, analyzes, “Since the stock markets in both Japan and South Korea have been flat for many years, many investors were probably looking to make short-term gains.”

However, when the market moves unexpectedly, losses in these ETFs will mount.

If the underlying index falls 5% in one day, a typical Reva Electric Car-type ETF would fall 10%. A 3x price move would be 15% lower. A large investment of funds could be seriously hurtful.

The impact on the market is increasing day by day. Although the balance of 20 trillion yen may appear to be a low ratio compared to the global market capitalization, the impact on the market is not small, as futures of several times the balance, such as Reva Electric Car type, are traded in a short period of time.

Takayuki Ishibashi, Vice President at Goldman Sachs, estimates that in the US, if the stock market rises 1%, the total trading required to adjust positions in leveraged and inverse ETFs will amount to about $4 billion (590 billion yen). The person looks like this, “In times of market volatility, ETFs can provide greater amplification.”

It is inherently desirable to expand asset management options for individuals and others. However, it should be noted that the concentration of funds in ETFs, which amplify price movements, can also lead to increased market volatility.

Related links