ETFs also have active

The first “active ETF” was listed on the Tokyo Stock Exchange. Active ETFs are exchange-traded funds (ETFs) that aim to outperform the market average. In the US and other foreign countries, individual investor purchases are also increasing. The characteristics of the products and how they are utilized are summarized.

ETFs invest funds collected from investors in stocks and other securities. Because it invests in a diversified range of stocks, it has the same effect as investing in a broad range of stocks in a single product. The type of assets to be managed, such as stocks and bonds, and the investment policy differ for each product. Some products can be purchased for as little as a few thousand yen, making them easy to use for individual investors.

The most important difference from regular unlisted investment trusts is that prices move during trading hours. There is one base price per day for a regular investment trust, and the trading price is not known at the time the trade is applied for. ETFs, like stocks, also allow “limit order” to specify the price at which you want to buy (or sell) and “market order” to prioritize the execution of transactions. It is easy to take a flexible response, such as buying when the market plunges.

Investment policy can be broadly divided into passive and active types. The passive type aims to achieve performance linked to indices such as the Nikkei 225. In the active type, the investment manager (fund manager) selects stocks to invest in, makes trading decisions, and aims for investment performance that outperforms the index. While regular investment trusts have a large number of active types, domestic ETFs have so far been only passive types.

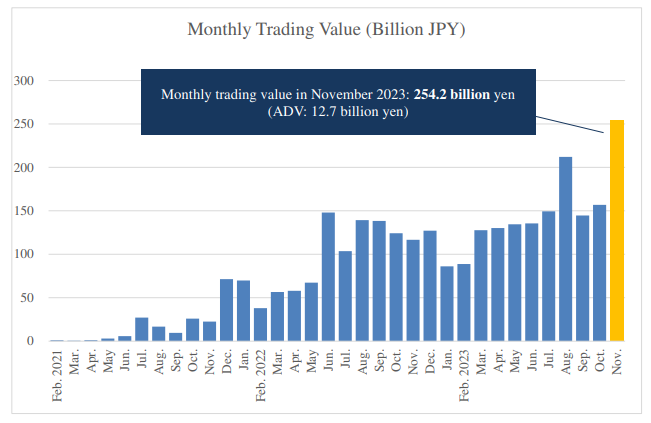

Active ETFs are spreading abroad. According to ETFGI, an UK-based research firm, it is traded in 25 countries around the world, and its total asset balance reached $628 billion (about 90 trillion yen) at the end of July. Although it is still only about 6% of all ETFs, it has increased about 25-fold over the past decade.

In the US, it is penetrated by INDIVIDUAL INVESTORS. Hirotaka Sugioka of JPMorgan Asset Management says, “I often hold low-cost active ETFs as part of diversifying my investment destination.” Some products that invest intensively in growing stocks have assets in the trillions of yen.

The first six active ETFs listed on the Tokyo Stock Exchange on September 7 are all managed by domestic equities. Nomura Asset Management‘s “NEXT FUNDS Japan growing stock active exchange-traded fund” invests in stocks that are expected to maintain or increase high return on equity (ROE). ROE is an indicator of how efficiently a company uses shareholders’ money to generate profits. As of 7th, the top stocks included in the list were NTT, M3, a medical information website operator, and JCR Pharma, a mid-sized pharmaceutical company.

Mitsubishi UFJ Kokusai Asset Management‘s “MAXIS High Dividend Japan Equity Active Exchange Traded Fund” selects the top stocks in terms of projected dividend yield, taking into account dividend trends and credit risk. Included in the index are Japan Post Holdings, Softbank, a major telecommunications company, and LIXIL, a major housing equipment company, all of which have dividend yields in excess of 4%.

One of the attractions of active ETFs is that the trust fees and other costs incurred during ownership are lower than those of regular active investment trusts. Active investment trusts aim to outperform the market average, but often actually underperform. One reason is that investment destination research and other costs are required, and trust fees and other costs tend to be higher than those of passive investment trusts, which are linked to an index.

If the investment performance is the same, the lower the cost, the greater the investor’s profit. Trust fees for the six ETFs listed on 7th range from 0.41% to 0.99% per year. Although there are aspects that cannot be simply compared, it can be said to be lower than many of the regular active investment trusts.

It is also characterized by the ease with which the operations can be understood. Active ETFs can be found on the Tokyo Stock Exchange website and are updated daily. Normal investment trusts generally disclose their results at the end of the fiscal year or in monthly reports. ETFs may be easier to make trading decisions when the market moves significantly.

On the other hand, be careful how you handle dividend. ETFs distribute all dividends earned from the stocks they include to investors (excluding fees). Although it can be said to be easy to understand in a similar sense to stocks, it is easy to get into trouble when reinvesting dividend and aiming for a compounding effect. Regular investment trusts often allow for automatic reinvestment of dividend. ETFs may not be able to accumulate a fixed monthly amount.

The number of active ETFs in Japan is expected to increase. It is the same as regular investment trusts that you should check the investment policy and costs before purchasing. Some commodities are prone to large price movements depending on the market environment. It is also essential to be creative by not concentrating too much of the assets in specific products.

Related links