Update of ETF Market Making Incentive Scheme Version 2.0

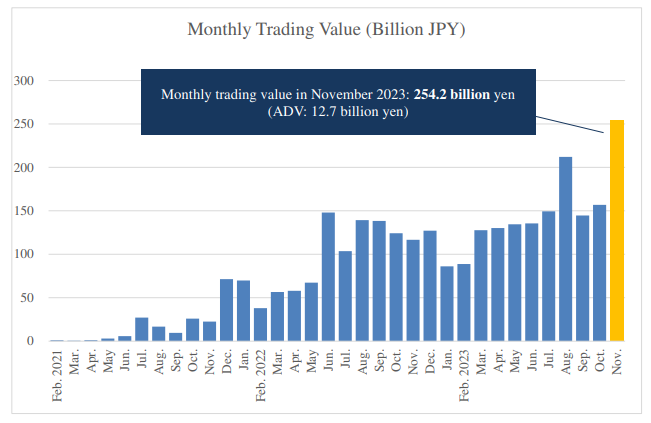

Tokyo Stock Exchange, Inc. (TSE) introduced an ETF Market Making Incentive Scheme in order to improve liquidity in the ETF market in July 2018. Thereafter, TSE launched ETF Market Making Scheme Version 2.0 (Ver.2.0) in April 2019 and will now be updating said scheme on October 1, 2023.

In this Ver. 2.0, TSE will set additional quoting obligations and incentives for limited time spans and ETFs, requiring market makers to display quotes in sufficient amounts to match the scale of trades by investors with the aim of developing Star ETFs that represent each asset class. The revision will designate sector REITs and actively managed ETFs linked to domestic public and corporate bonds, which are in high demand among investors, to the list in order to further improve convenience.

In addition, TSE REITs will be excluded from the target, and the number of ETFs eligible for some categories, such as foreign equites and foreign bonds, will be reviewed. There are still some categories that do not have any ETFs listed yet, but as soon as the specific ETFs are determined, we will announce them in the “List of ETFs Eligible for ETF Market Making Incentive Scheme Ver.2.0” section below.

The revisions are expected to result in deeper liquidity for the ETF market while facilitating swift trading at fair prices. More details can be found in the appendix.

TSE remains committed to promoting the growth of a convenient market for investors.

Revision of ETF Market Making Incentive Scheme Ver2.0 (From October 2023)

Related links