TOCOM Energy

Crude prices lose steam as slowdown fears overshadow tight supplies

Macroeconomic concerns about the world’s largest and second-largest economies persist

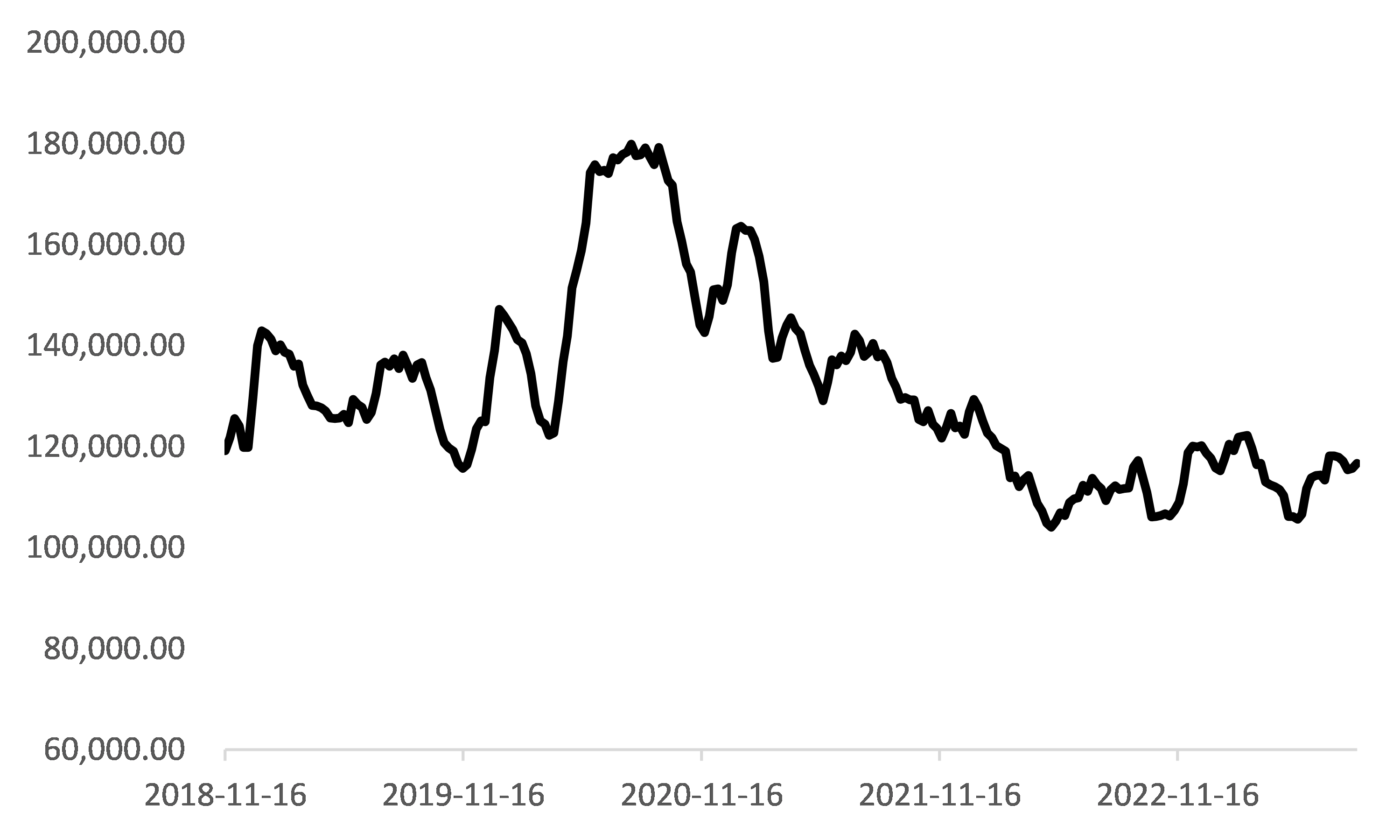

Oil hit a three-week low last week as traders grows nervous with the outlooks for the world’s two largest economies — the US and China. Having run out of steam last week, a long overdue period of consolidation may now emerge.

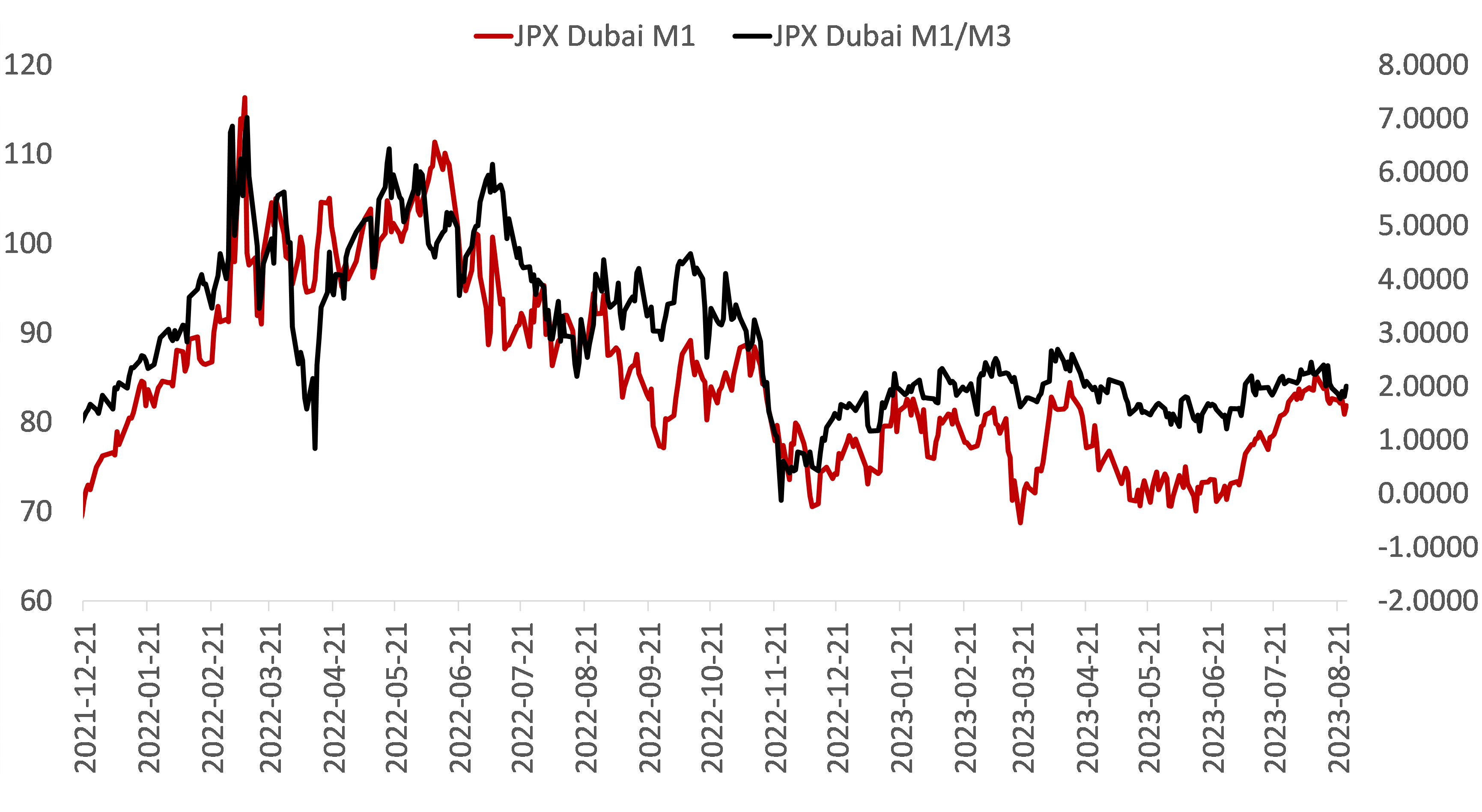

Before last week’s retreat, oil had surged for more than a month on supply cuts from OPEC+ linchpins Saudi Arabia and Russia, as well as estimates that worldwide crude consumption is running at a record pace. While time spreads have narrowed in tandem with crude benchmarks, they remain backwardated, implying near-term supply tightness.

Figure 1: JPX Dubai crude prompt month and intermonth spread(M1/M3)

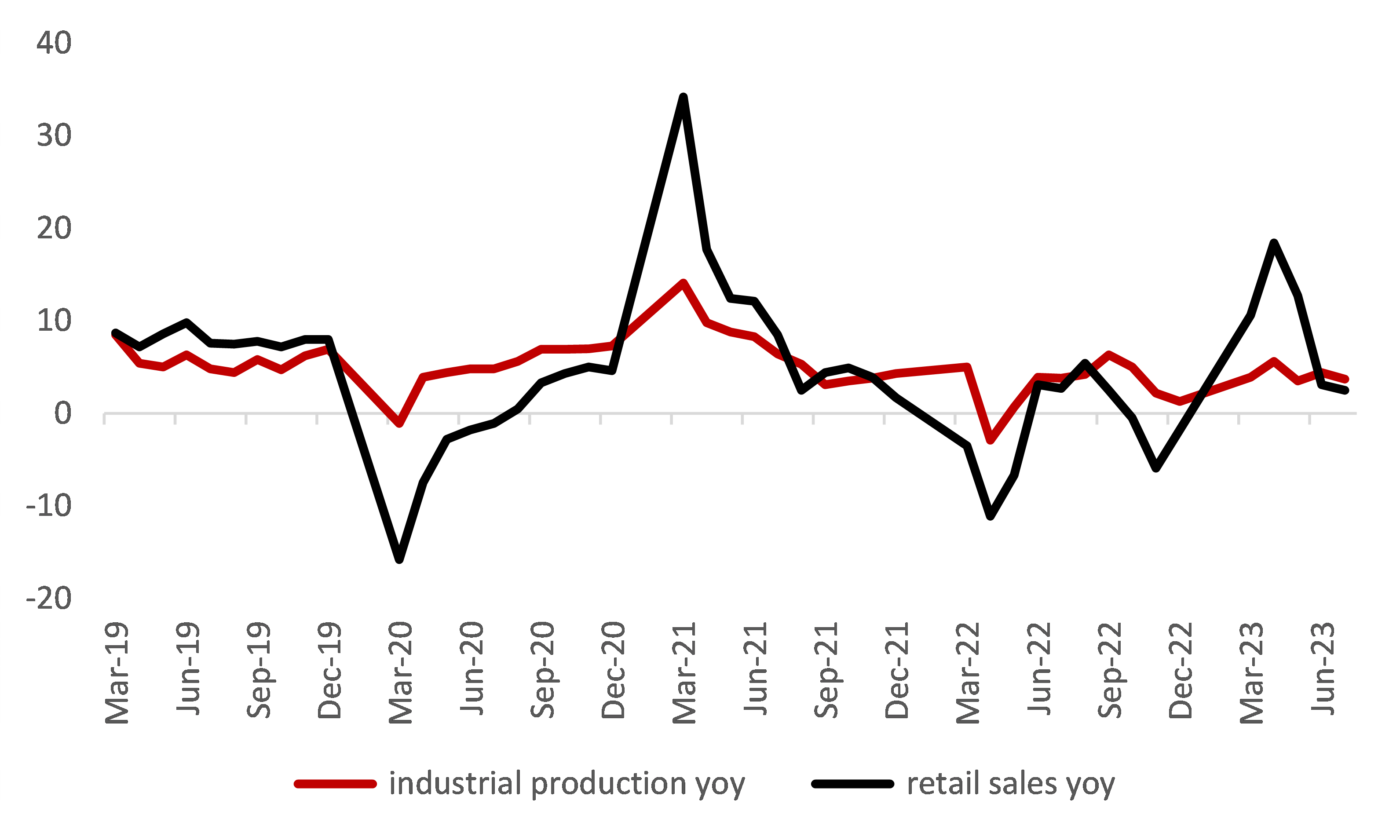

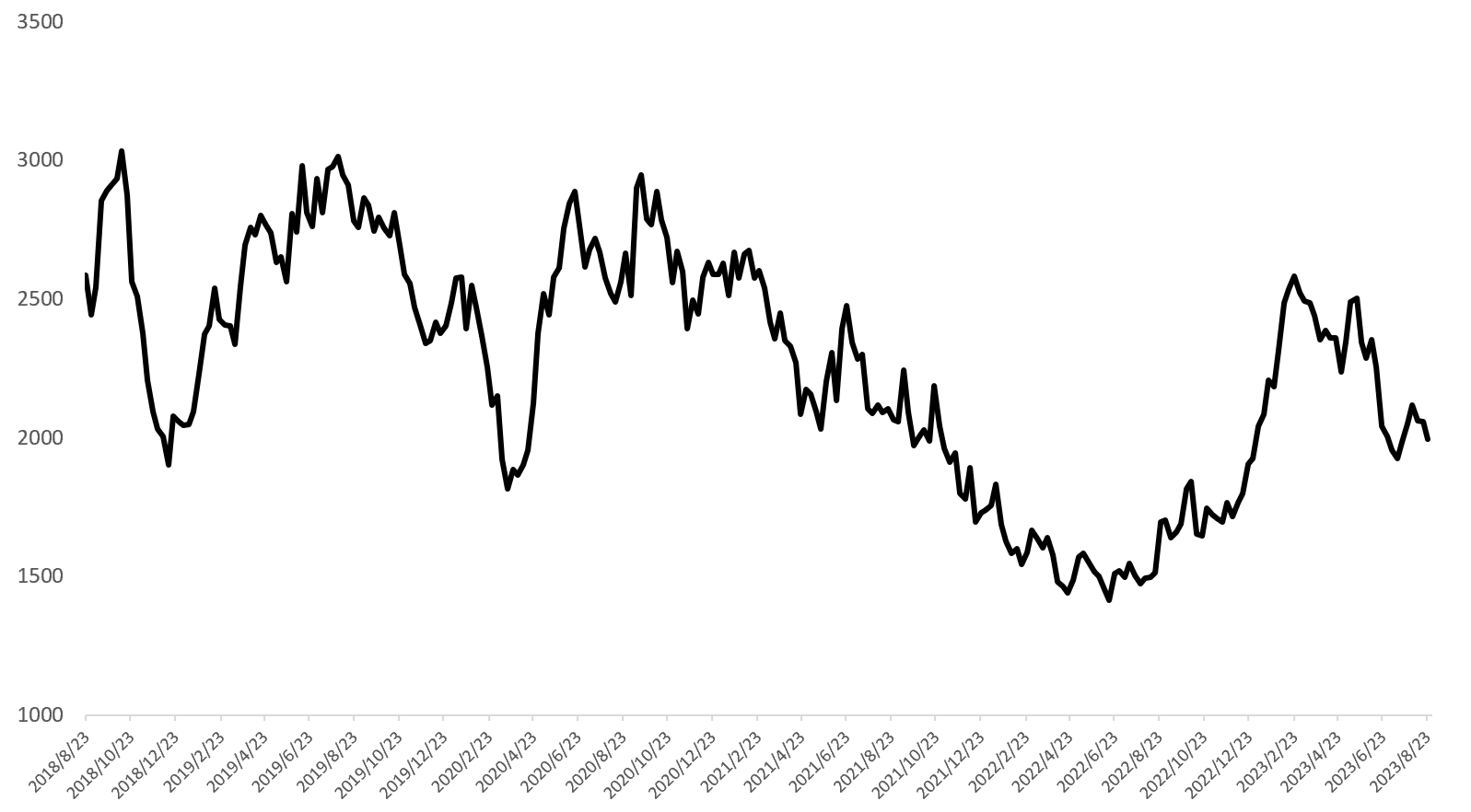

Chinese industrial production rose by 3.7% in July year over year which was below estimates of a 4.4% increase, official data showed last week, retail sales also disappointed, increasing by only 2.5% compared to expectations of 4.5% growth and slowing from a 3.1% rise in June.

Considering that China is expected to account for more than 70% of this year’s global oil demand growth, weaker-than-expected economic data out of China is depressing sentiment and are top of the bearish factors for oil market since last week.

Figure 2 : Chinese industrial production and retail sales (yoy)

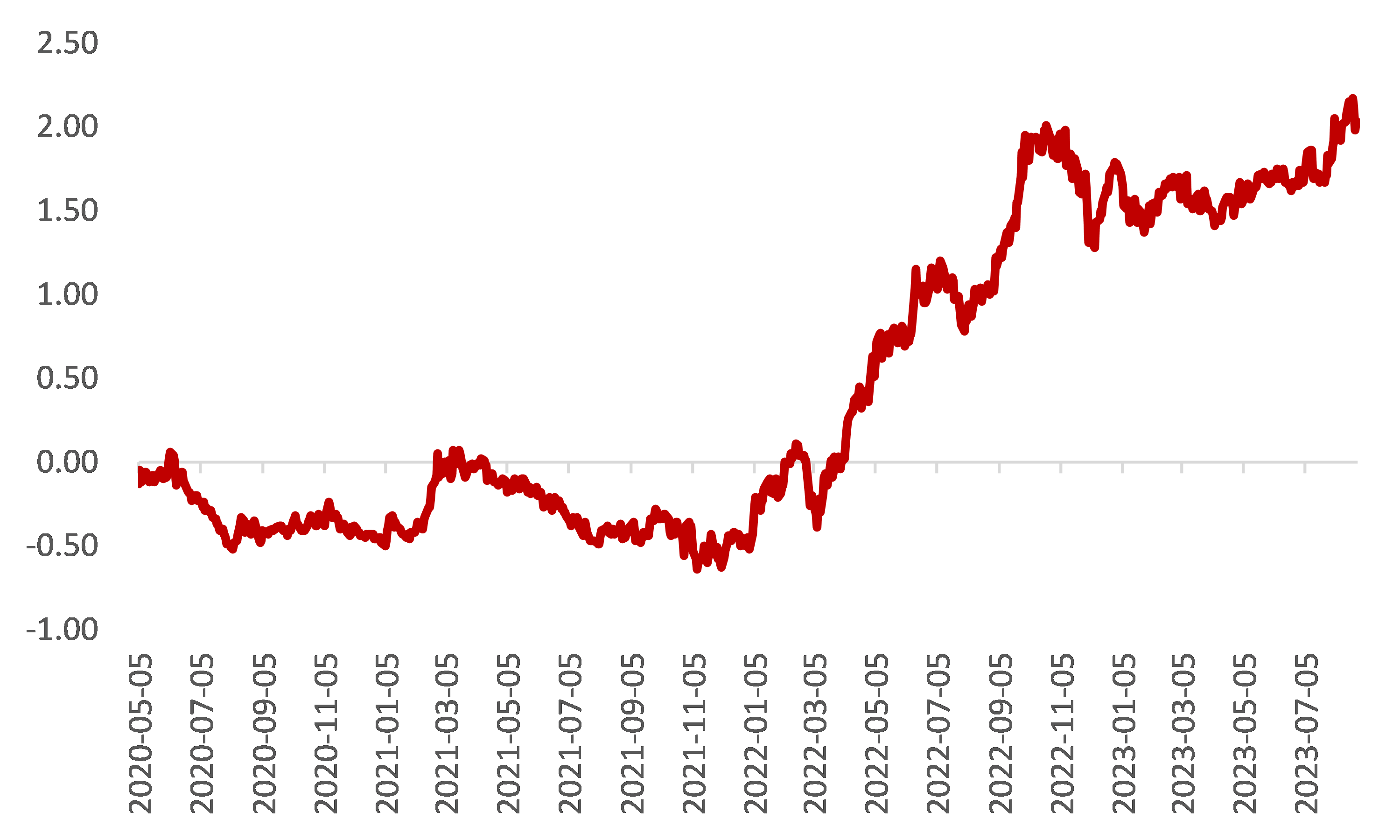

Investors are focusing on a high-profile gathering of the world’s central bank chiefs in Wyoming. Traders appeared to shake off fears of future rate hikes, and instead focused on the positive parts of Powell’s speech where he applauded strong economic growth. The market may have been comforted by Powell acknowledging that recent inflationary data has been encouraging and thus, interest rates are unlikely to move much higher from here.

The Federal Reserve raised rates by 25 basis points last month and left the door open to another hike in September. Flash U.S. August PMI data that revealed both parts of the economy cooled compared to recent months. Normally, this would be of some concern to the market, but in this case, a weakening economy could at least mean a peak in interest rates is near. However, volatility is likely to persist until investors get clarity on the U.S. Federal Reserve’s next moves.

Figure 3 : US 10-Year Real Interest Rate

Oil refining margins climb, Europe heading for tight winter diesel market

Despite lingering concerns about the economy, global oil demand hit a record high in June and could be on track for another record in August, the International Energy Agency said in its latest monthly report.

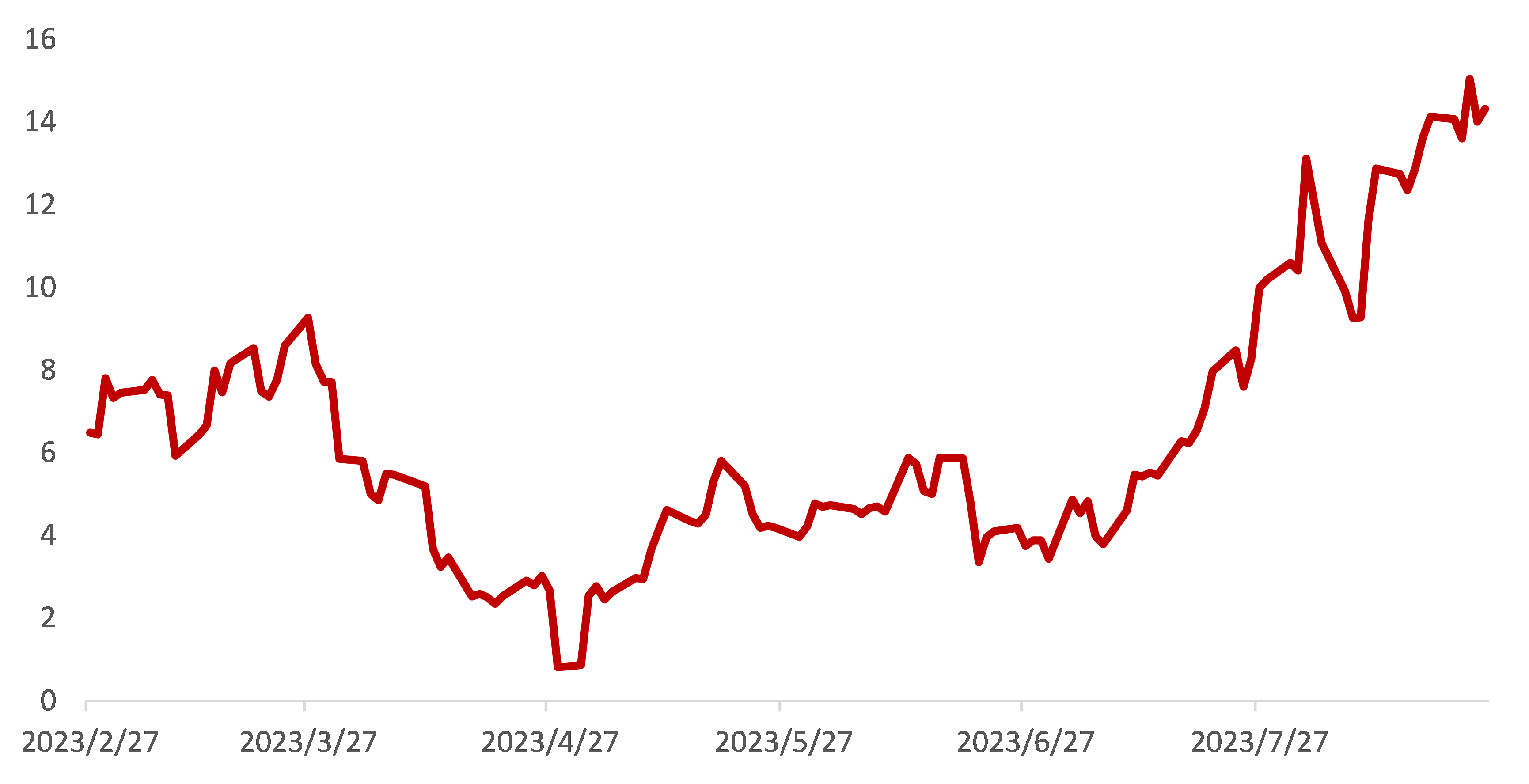

Resilient demand and tight product inventories have led to much a higher refining margins, the total margin for processing a barrel of Dubai crude at a typical Singapore refinery climbed back to around $15 last week, the highest since last July. The healthy margins reflect the bull market for diesel and jet fuel oil combined with still strong gasoline cracks.

Figure4 : Singapore refinery gross margin

As the summer driving season nears its end, and with winter heating demand looming, now much of the focus has been on the gasoil market. Portfolio managers and speculators are increasingly betting on higher diesel prices amid seasonally low inventories of middle distillates in the United States and Europe, at a time when stocks typically build ahead of the winter heating season.

Insights Global posted data showed that gasoil stocks held in independent storage in the Amsterdam-Rotterdam-Antwerp (ARA) refining and storage hub declined by 3% in the latest week and it’s well below the five year seasonal average. U.S. Diesel inventories are not as low as they were at this time last year, but they are also still well below historical averages, leaving a thin buffer to absorb the seasonal dip in refinery output during the upcoming Autumn maintenance schedule.

Europe has struggled to pull in supplies from east of Suez in recent months, and may continue to rely on supply east of Suez to replenish its inventory before winter. In the midst of the existing supply crunch, markets are closely watching China as its refiners await a fresh round of fuel export quotas from the government.

Figure 5: US distillate fuel oil inventory level

Figure 6: Gasoil inventory level at ARA ports

Global imports of Saudi crude grades are showing signs of recovery in August, after hitting fresh lows last month. The quick swing in import activity underlines the speed at which Asia’s especially China’s imports can increase, but also suggest firm competition for Medium-heavy sour crudes (which usually have a higher gasoil yield) going forwards.

Related links