TOCOM Energy

An overview of the refining process and refining margins

Refining is the key link in the global supply chain extending from the production of crude oil to end-use consumption of refined products like gasoline, diesel, aviation fuel. The details of refinery operations differ from location to location, but virtually all refineries share three basic processes for separating crude oil into the various product components.

1 .Separation

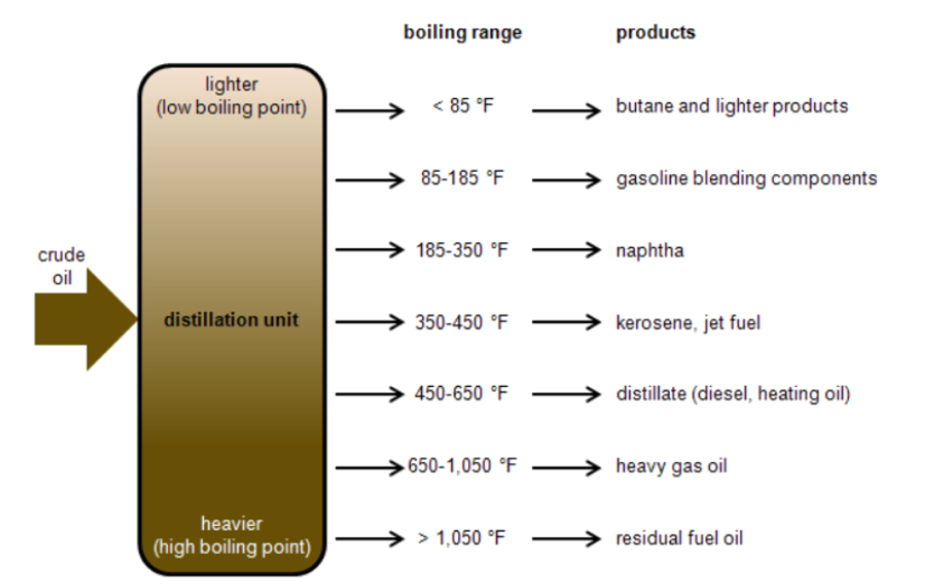

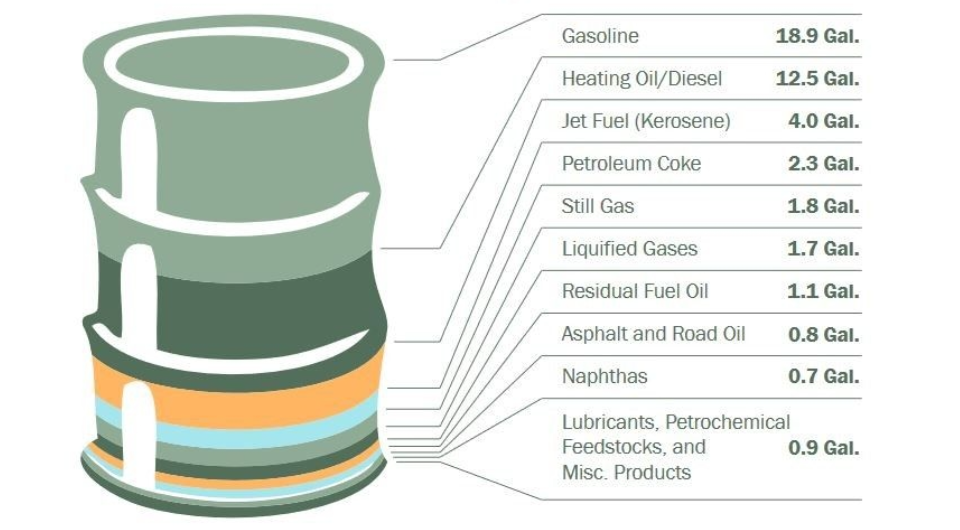

The diagram above presents a stylized version of the distillation process. Crude oil is made up of a mixture of hydrocarbons, and the distillation process aims to separate this crude oil into broad categories of its component hydrocarbons, or fractions. Crude oil is first heated and then put into a distillation column, also known as a still, where different products boil off and are recovered at different temperatures. Heavy fractions like fuel oil are on the bottom and light fractions like gasoline are on the top. Medium weight liquids, including kerosene and distillates, stay in the middle of the distillation tower. A refinery’s capacity usually refers to the maximum amount of crude oil designed to flow into the distillation unit of a refinery, also known as the crude unit.

Figure 1: Crude oil distillation unit and products

Source: EIA

2. Conversion

After distillation, heavy, lower-value distillation fractions can be processed further into lighter, higher-value products such as gasoline and diesel. At this point in the process, fractions from the distillation units are transformed into streams (intermediate components) that eventually become finished products.

Conversion is also called secondary processing where chemical reactions take place and the structure of the molecules is changed. All the units involved are the secondary conversion capacity of the refinery.

The most widely used conversion method is called cracking because it uses heat, pressure, catalysts, and sometimes hydrogen to crack heavy hydrocarbon molecules into lighter ones. Complex refineries may have one or more types of crackers, including fluid catalytic cracking (FCC) units and hydrocracking/hydrocracker units. Cracking is not the only form of crude oil conversion, coking processes is also a preferred approach in many refineries that upgrades material called bottoms from the distillation column into higher-value products. Other refinery processes rearrange molecules rather than splitting molecules to add value. Reforming, for example, uses heat, moderate pressure, and catalysts to turn naphtha, a light, relatively low-value fraction, into high-octane gasoline components.

Figure 2-3: FCC unit and Coker unit

Source: Valero

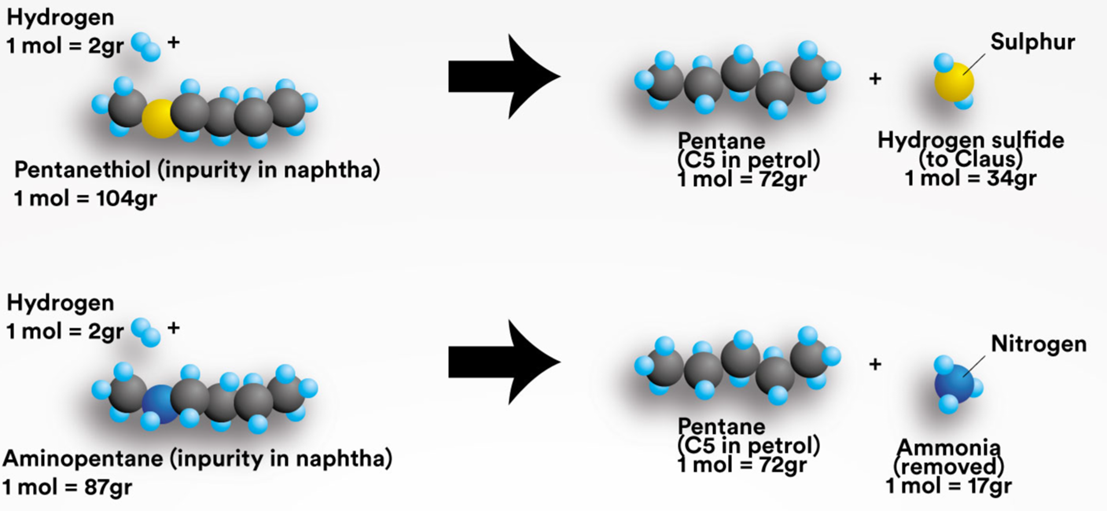

3. Treatment

Treating can be accomplished at an intermediate stage in the refining process, or just before sending the finished product to storage. Petroleum refiners have a choice of several different treating processes, but the primary purpose of the majority of them is the elimination of unwanted impurities such as sulfur compounds.

Figure 4: hydrogen treatment

Source: wikipedia.org

To sum up the above process, initially, the process starts with the crude feedstock which is first run through the atmospheric distillation unit. The initial yields from this are then either re-routed to secondary units or used in a blending pool for a particular product. After all relevant streams have been re-processed and no further conversions can take place, the product streams are pooled together for blending and optimization purposes so as to produce marketable volumes of refined products.

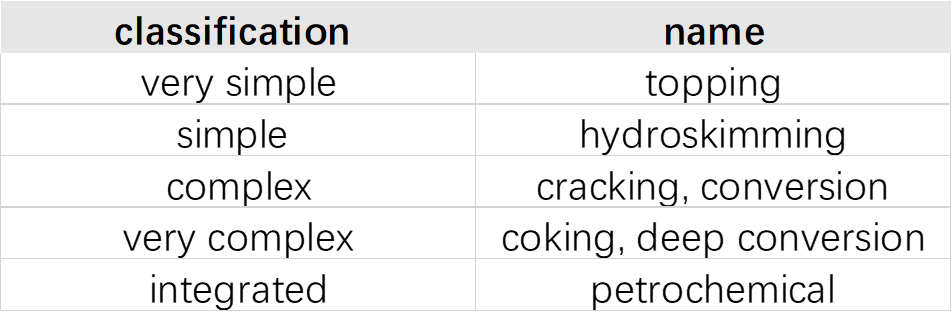

What differentiates one refinery from another are their capacities and the types of processing units used to produce these petroleum products. A refinery’s level of complexity is often based on how much secondary conversion capacity it has and can be divided into several main categories shown in the following table:

The simplest refineries have a distillation column and nothing else. These refineries are also referred to as topping refineries.

A hydroskimming refinery is defined as a refinery equipped with atmospheric distillation, naphtha reforming and necessary treating processes. A hydroskimming refinery is therefore more complex than a topping refinery. Topping and hydroskimming refineries are categorized as simple refineries since they only split crude oil into its main components and perform basic finishing operations. Simple refineries maintain a high straight run fuel oil production and produce a high straight run heavy fuel oil.

Refineries with cracking and coking capacity are generally referred to as “cracking” and “coking” refineries, or as “complex” or “very complex” refineries respectively. Most coking facilities have cracking capacity, but not all cracking facilities have cokers. Coking refineries can upgrade most of the heavy fuel oil to lighter products.

An integrated refinery, where refining and petrochemical units are interconnected, is an approach designed to make refinery operations more sustainable. Feedstocks for the production of petrochemicals originate from refineries with processes similar to those described earlier to produce fuels. In the last ten years, there’s growing trend of refinery-petrochemical integration. The energy transition will reduce demand for oil products but increase opportunities to capture the growing demand for petrochemicals.

The supply chain of a typical petroleum refining company involves a wide spectrum of activities, the primary goal of a refinery is to maximize its profit by finding a combination of crude slate, products, unit operating rates, and operating parameters such as product yields.

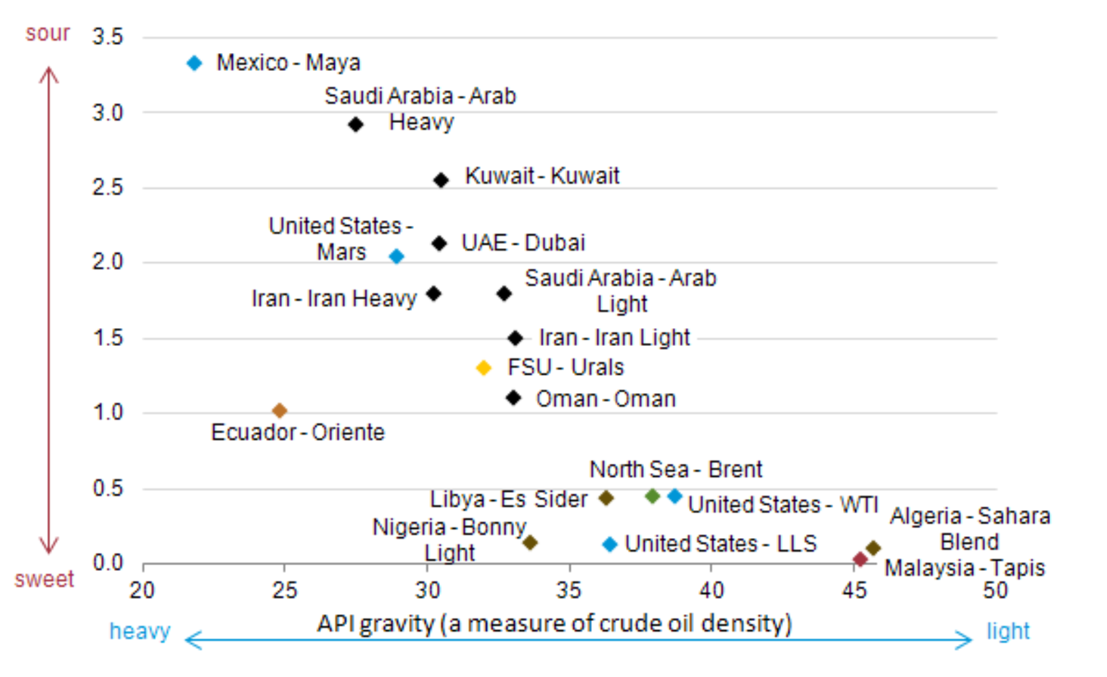

Figure 5: Crude oils have different quality characteristics

Source: EIA

Relative value for a crude is largely determined by its yields. Crude oils that are light (lower density) and sweet (low sulfur content) are usually priced higher than heavy, sour crude oils. This is because lighter and sweeter crude oil grades produce larger yields of more valuable petroleum products such as gasoline, naphtha, distillates, and jet fuel which tend to sell at a premium crude oil while heavier sour grades which produce more asphalt and residual fuel oil and tend to sell at a discount, and these light and sweet grades can be processed with far less sophisticated and energy-intensive processes (Less effort and treatment will be needed to remove impurities). As a result, wider discounts are needed for medium and heavy sour crudes to break even with light sweets.

Figure 6: what does one barrel of crude oil yield?

Source: EIA

The net product value from processing a particular crude grade is calculated by estimating the yields produced for refined products and tying them to market prices. More specifically, the margin is calculated on a forward basis so that front month product swaps are used as pricing references against spot crude and freight prices so as to replicate the typical delay in processing crude after purchase and the time taken to produce the correct specification of products.

The refinery margin is defined as the Gross Product Worth from processing after accounting for crude, freight and operating costs. The gross product worth the weighted average value of all refined product components of a barrel of the marker, computed by multiplying the price of each product by its percentage share in the yield of the total barrel of crude. The model typically generates yields for the following products across most markets: LPG, Naphtha, Gasoline, Jet, Diesel, Fuel Oil, Gasoil, Asphalt and Petroleum Coke.

Trading refined products and product cracks on JPX energy futures market Crude oil constitutes by far the largest component of any refinery’s direct (variable) operating costs, and refined product sales are essentially the sole source of revenue. Hence, refining profits are closely linked to the crack spread which represent the price difference between products and crude oil, can be used to determine the relative value of various petroleum products for refineries to produce and they are a direct representation of the profitability of refining companies. The price action in crack spreads can yield critical clues about demand for oil products which translates directly to demand for crude oil which is the primary input in the refining process.

Because the price of a barrel of crude oil and the prices of the different products derived from it are not always in sync, leading to the fluctuation in oil products crack spreads. A trader, often a refiner, can hedge against the risk of adverse price movements by simultaneously entering into futures contracts to buy crude oil and sell refined products. This practice allows them to lock in their refining margin and secure potential profit.

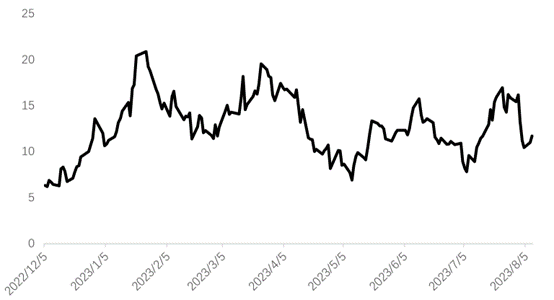

Figure 7: motor gasoline (92#) 1:1 crack spread at Singapore

As the leading platform for trading global crude and refined oil markets, the JPX gasoline, gasoil and kerosene futures contracts are designed to provide traders with an effective hedging instrument and trading opportunities. Contract specifications are listed below:

Gasoline Futures: https://www.jpx.co.jp/english/derivatives/products/energy/gas-oil-futures/01.html

Gasoline Futures: https://www.jpx.co.jp/english/derivatives/products/energy/gasoline-futures/01.html

Kerosene Futures: https://www.jpx.co.jp/english/derivatives/products/energy/kerosene-futures/01.html

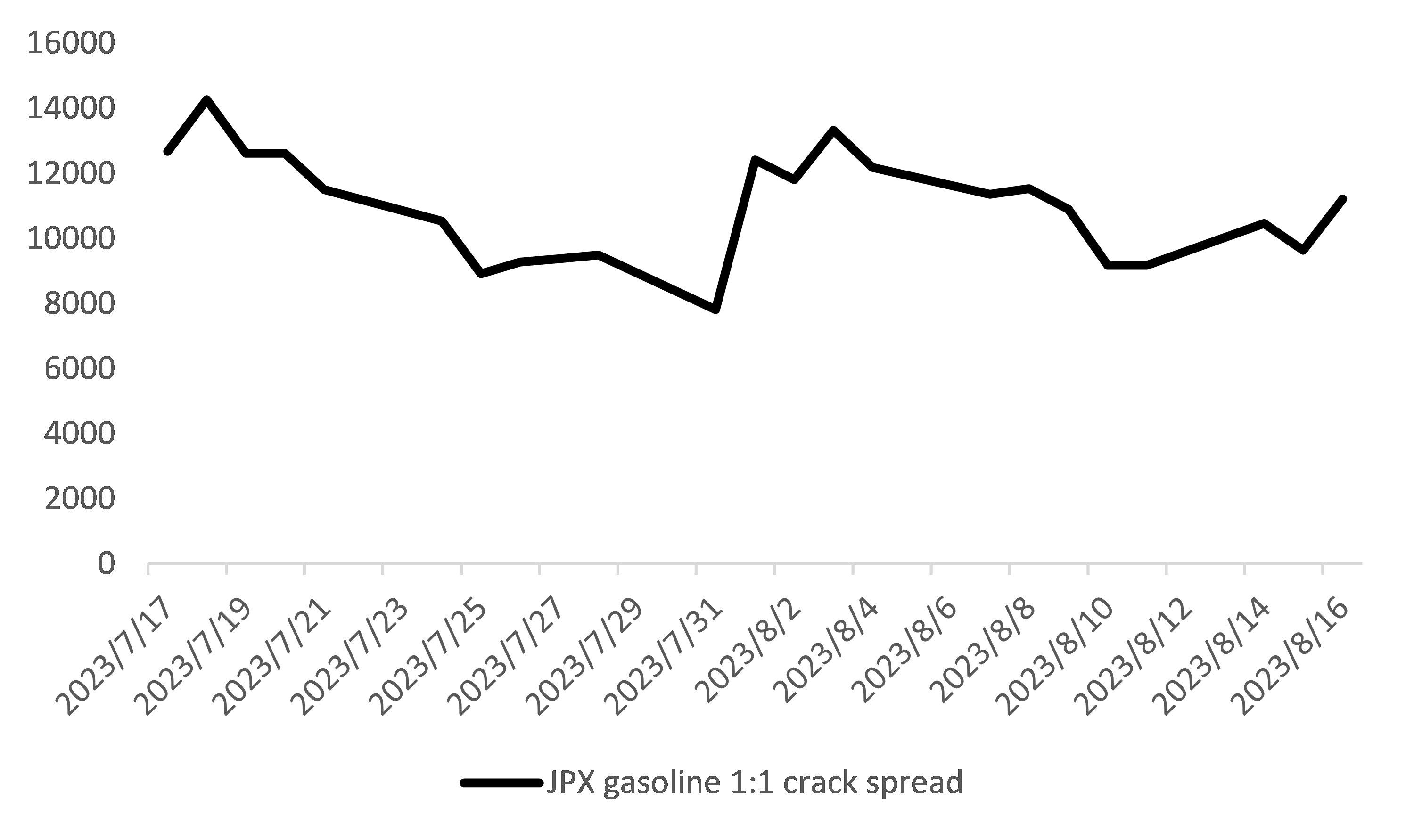

To find out if there is a positive crack spread, you take the price of a barrel of crude oil—in this case, JPX Dubai December contract at 73780 yen/ kiloliter, and compare it to your chosen refined product for example 85000 yen/ kiloliter, so there’s a crack spread of 11220 yen/kiloliter that can be locked in with futures contracts. This is the most common portfolio, and it is called the 1:1 crack spread.

Figure 8: JPX motor gasoline 1:1 crack spread

There are more complex hedging strategies for crack spreads that are designed to replicate a refiner’s yield of refined products. The common combination is 3:2:1 crack spread -three crude oil futures contracts versus two gasoline futures contracts and one gasoil futures contract. For most traders, however, the 1:1 crack spread captures the basic market dynamic they are attempting to trade on.