OSE Derivatives

The Osaka Exchange (OSE) offers a wide range of investment opportunities across multiple types of futures and options underlying equity indices, fixed income or commodities. One of the prosperous derivatives products in JPX is Nikkei 225 mini Futures, the third-largest trading volume of equity index futures contracts in the world in 2020. Please refer to the OSE Tips for our market regarding regulations, etc.

-

Helixtap Rubber Market Outlook Report 2023: Historical oversupply likely to start easing from 2023

Helixtap

11月 11, 2022 5 min read

-

50% drop in premiums for LTC, changing dynamics increase anticipation

Helixtap

10月 27, 2022 5 min read

-

Revision of Immediately Executable Price Range for Closing Auction of 10-year JGB Futures, etc.

OSE

10月 24, 2022 1 min read

-

CME Group Launches U.S. Dollar-Denominated TOPIX Futures

JPX

10月 18, 2022 1 min read

-

Introduction of Short-Term Interest Rate Futures

OSE

10月 6, 2022 2 min read

-

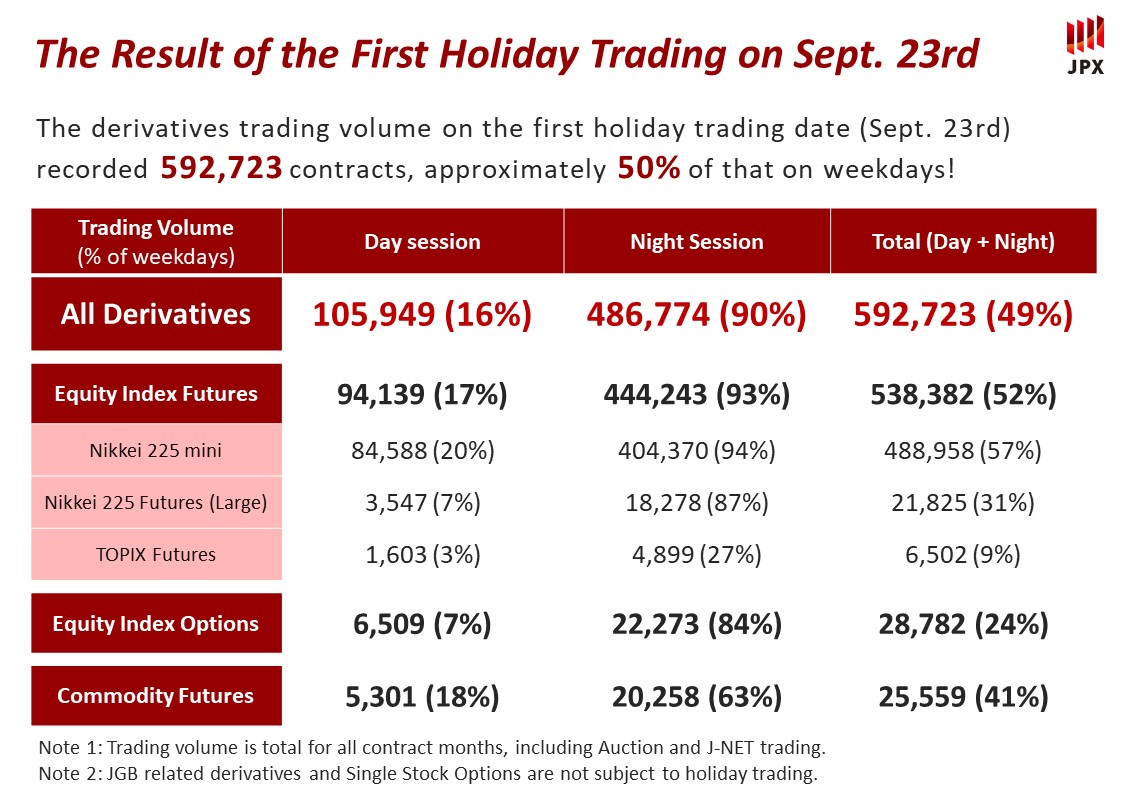

The Result of the First Holiday Trading on Sept. 23rd

OSE & TOCOM

9月 27, 2022 2 min read

-

Navigating the rubber market: Today & Tomorrow

Helixtap

9月 2, 2022 3 min read

-

Launch of Nikkei 225 micro Futures and Nikkei 225 mini Options

OSE

8月 31, 2022 3 min read

-

Tire major pulls back, spot rubber hits 20-month low

Helixtap

8月 16, 2022 4 min read

-

How does standardization work in derivative markets?

Takahiro Hattori

6月 30, 2022 1 min read

-

Global natural rubber supply up, profit outlook bleak

Helixtap

6月 23, 2022 3 min read

-

STR20 prices tend to fall less than SIR20 prices during wintering months

Helixtap

6月 21, 2022 4 min read