OSE Derivatives

The BOJ ends negative rates, but the inflation revolution looks set to continue

By Harry Ishihara, Macro Strategist

Abstract

On March 19, the Ueda-BOJ hiked rates for the first time in 17 years, and ended negative interest rates, yield curve control and ETF purchases – all in one meeting. Although the moves were more sweeping and earlier than expected, markets absorbed the changes well thanks to detailed press reports on March 16 and 19 and a key wage survey on March 15. With short term rates still near zero even after the hike, Japan’s “Inflation Revolution” looks set to continue, supporting corporate profits and stocks.

Reverse bazooka?

The BOJ’s first hike in 17 years and other announcements on March 19 led by Governor Ueda marked an abrupt end to an era of extraordinary easing. That era was symbolized by predecessor Kuroda’s deflation fighting efforts centered around QQE (2013[i]), NIRP (2016) and YCC (2016) – sometimes collectively referred to as “Kuroda’s Bazooka(s)”.

Wage growth data was key

As the next graph shows, initial surveys released on March 15 imply another strong year for wage growth. The expected FY24 average for total wage growth is currently at 5.3 percent for major unions – the highest in 33 years – and backed by an impressive 3.7 percent in “base-up” base salary growth [ii]. Both results were well above earlier estimates. Separate data for smaller unions came in at 4.4 percent, the highest in 32 years – and backed by a 3.0 percent base-up [iii].

Ueda confirmed that the wage data, combined with anecdotal information from regional BOJ branches, were key to their decisions. As a result, they now believe that 2 percent inflation can be achieved and that the extraordinary measures have “fulfilled their roles”, leading to the following changes:

1) Negative Interest Rate Policy (NIRP) – discontinued

NIRP, which began in Feb 2016, was ended with a rate hike on the “Policy-Rate Balance” portion of bank reserves from -0.1 percent to +0.1 percent. Note that the BOJ – using diagrams and bold red fonts[iv] – is pitching this as a hike of “around 0.1 percent” (not 0.2!), as short term rates of near zero will now be guided to “around 0 to 0.1” percent.

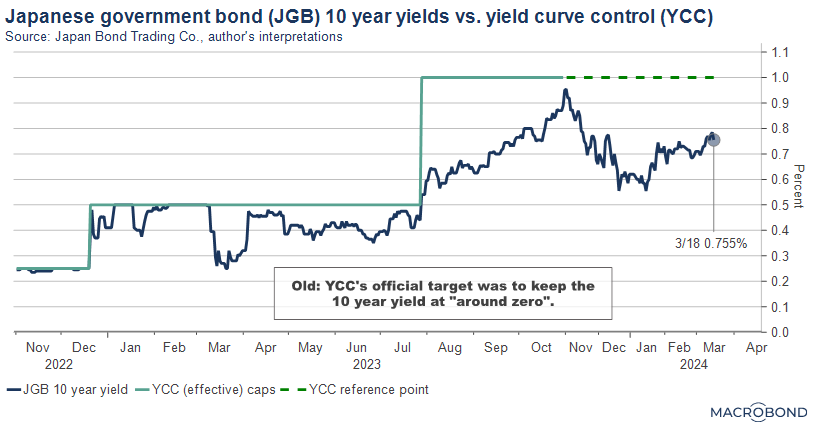

2) Yield Curve Control or YCC (part of QQE) – discontinued

YCC, which began in Sept 2016 as an add-on to QQE, was the policy of keeping 10-year Japanese government bond (JGB) yields at around zero. However, after multiple tweaks, the current effective cap was a “reference” point of 1 percent as the next graph shows. Although YCC will now be discontinued, the BOJ expects to continue purchasing JGB’s at “broadly the same amount as before” (about 6 trillion yen a month) and will make “nimble responses” to any surge in yields.

3) ETF purchases (also part of QQE) – discontinued

ETF (and REIT) purchases were started in 2010 under Governor Shirakawa, but were massively increased under Governor Kuroda when he took over in 2013. The BOJ will now discontinue their already limited amount of ETF (and REIT) purchases, while gradually reducing purchases of commercial paper and corporate bonds over the next year.

4) Back to basics?

Governor Ueda also noted that the BOJ will be returning to the “more normal” monetary policy tool of controlling short term interest rates, namely the unsecured overnight call rate. His comments and other BOJ post-meeting releases imply that this rate is now the official policy rate (instead of the NIRP rate).

Implications

Until the Nikkei blasted “NIRP to end – BOJ’s first hike in 17 years” on March 16, most participants probably expected only NIRP to be ended, not YCC and ETF’s as well. Also, the consensus was for any changes to be made NEXT month.

Another front pager followed on the morning of March 19 – “BOJ to end extraordinary easing – NIRP, YCC, ETF’s – decision today”. These articles, combined with recent comments from senior BOJ officials softened any adverse market impact, with the yen weakening and stocks rallying post BOJ.

Post-corona, Japan soon became the only country in the world left with NIRP. Now with NIRP, YCC and ETF purchases gone, what could change in the “new world of positive rates (Kinri no aru sekai)”?

Possible positives:

- Better bank profits

- More interest income for depositors

- Improved market functioning, especially for bonds

- Some purging of unproductive “zombie companies” (BIS)[v]

- More focus on corporate profits and innovation to “beat inflation”

- More fiscal responsibility

- Positive real wage growth as inflation slows while wages rise

Possible negatives:

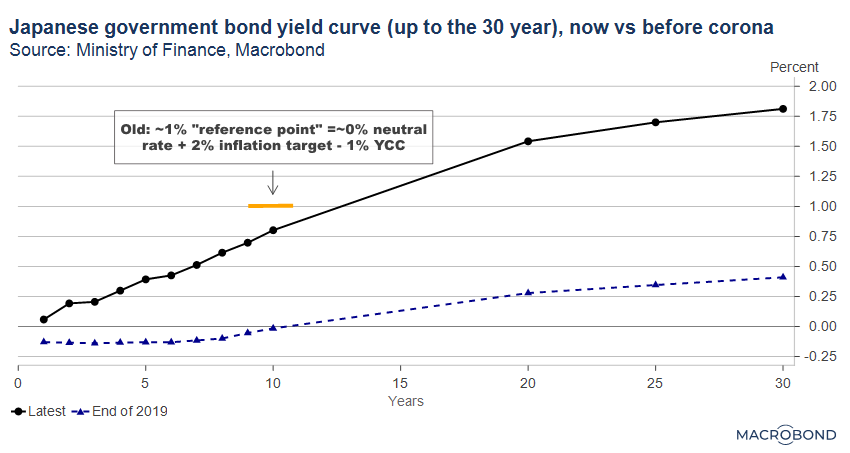

8, Less flows to US treasuries thanks to a steeper JGB yield curve (next graph) and prohibitive hedge costs

9. Less BOJ support for Japanese stocks via ETF’s

10. Higher lending rates slowing corporate and mortgage loans

One remaining issue is how the BOJ will “shrink its balance sheet” (Gov. Ueda). It owns over half of the JGB market[vi] and was sitting on 34 trillion yen of unrealized profits on its ETF’s at the end of last month[vii].

Is the “Inflation Revolution” helping sentiment?

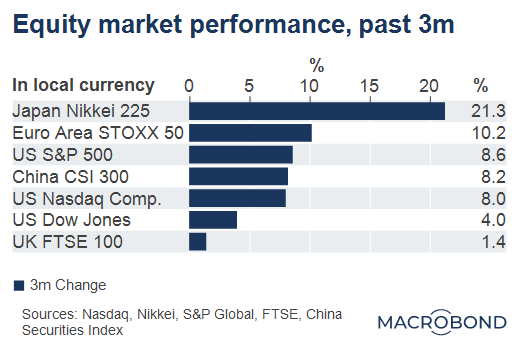

As the next chart shows, Japanese equities have been outperforming rival markets.

The performance is reportedly led by incoming non-Japanese flows, attracted by “lots of positives” including “record profits, record dividends, record buybacks and continued good valuation levels” according to a US fund manager [viii]. Japan’s inflation revolution, meaning the unique blend of public and private efforts to beat deflation has been a tailwind. Home grown activism to increase corporate valuations such as PBR have included massive educational activities led by the related organizations.

And a makeover of “NISA” tax-free investment accounts from Jan 2024 has reportedly tripled NISA flows, moving close to 2 trillion yen into the markets that month according to the Nikkei[ix].

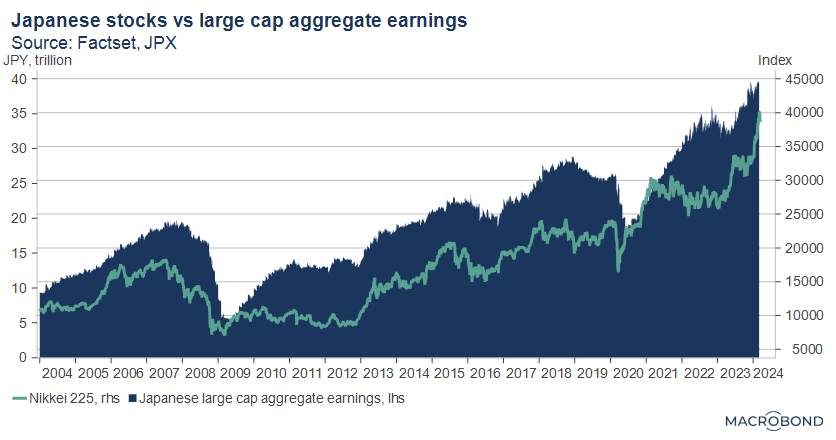

As Ueda stressed, monetary policy is still very easy, with short term rates at near zero. Meanwhile, the BOJ, the government, and much of corporate Japan continue their coordinated effort to “escape deflation”. As the final graph implies, Japan’s inflation revolution seems to be helping corporate profitability and stocks.

Related posts by this author:

More hints from the BOJ (available here or here)

Can Japan exit deflation? Governor Ueda seems to think so (available here or here)

[i] Quantitative and Qualitative Easing or QQE was a massive burst to the monetary base led by purchases of government bonds, and smaller purchases of corporate bonds, ETF’s and REIT’s among other risk assets. The jolt helped fight deflation and was one of the “3 arrows” of Prime Minister Abe’s “Abenomics”.

[ii] (Japanese) https://www.nikkei.com/article/DGXZQOUA138N50T10C24A3000000/

[iii] (Japanese) https://www.nikkei.com/article/DGXZQOUA1467U0U4A310C2000000/

[iv] https://www.boj.or.jp/en/mopo/mpmdeci/mpr_2024/k240319b.pdf

[v] BIS Working Papers, Jan 2022, “Zombies on the brink: Evidence from Japan on the reversal of monetary policy effectiveness”

[vi] (Japanese) https://www.bloomberg.co.jp/news/articles/2024-01-22/S7NDXJDWLU6800

[vii] (Japanese) https://www.nikkei.com/article/DGXZQOUB0476Q0U4A300C2000000/

[viii] (Japanese) https://www.nikkei.com/article/DGXZQOUB217FL0R20C24A2000000/

[ix] (Japanese) https://www.nikkei.com/article/DGXZQOUB09DPG0Z00C24A2000000/

Related links