Insights

More hints from the BOJ

By Harry Ishihara, Macro Strategist

More hints from the BOJ

Top BOJ officials continue to drop hints about a lift-off from negative rates – a symbol of deflation. Consensus is centered around April. According to Governor Ueda, the Shunto spring wage offensive and the outlook for service inflation are the two key triggers. After lift-off, the Kishida administration may try to declare victory over deflation, but four conditions may need to be met first.

The hints get louder

The hints about a possible lift-off from BOJ’s Negative Interest Rate Policy (NIRP) seem to be getting louder and more detailed. They are also coming from BOJ Governor Ueda and Deputy Governor Uchida themselves. Note that Uchida led the powerful monetary affairs department – which proposes monetary policy – when QQE (Quantitative and Qualitative Monetary Easing) began in 2013, and is seen as one of its architects.

Here are some noteworthy comments from Ueda and Uchida as reported by the Nikkei[i] and NHK[ii] [iii] [iv] from late Dec through this Feb:

“The Shunto spring wage offensive and the effects of recent wage growth on service inflation are the two key triggers” (Ueda, Dec 26)

“Even if we achieve lift-off from NIRP, it is hard to imagine it will be followed by a series of rate hikes” (Uchida, Feb 8)

“At the moment, we expect to continue an easy monetary environment even if lift-off occurs” (Uchida, Feb 8 and Ueda, Feb 9)

“Shunto will be a major determinant of whether we achieve 2% inflation via a wage-price spiral” (Uchida, Feb 8)

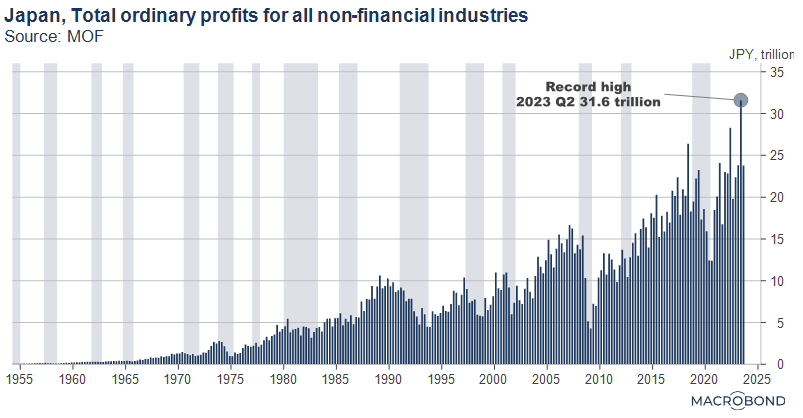

“The conditions surrounding Shunto this year are better than last year”, “The labor shortage is tighter, corporate profits are at record highs, and both corporates and unions are relatively positive about Shunto” (Uchida, Feb 8)

Rate hikes following lift-off “will be swayed by how wages affect inflation” (but) “at the moment we expect to continue an easy monetary environment” (Uchida, Feb 8)

“(If lift-off means returning to pre-NIRP levels) That means a hike of[v] 0.1 percent” (Uchida, Feb 8)

Even if YCC is ceased, “A sudden stop to bond purchases is unimaginable and purchases will continue” to prevent interest rate spikes (Uchida, Feb 8)

If aggressive easing measures are slowed, ETF purchases “can naturally be expected to end” (Uchida, Feb 8)

The two triggers

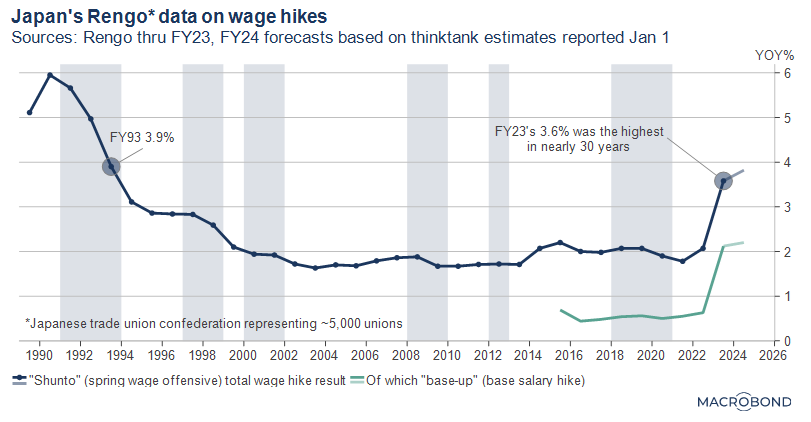

As we noted above, Ueda cited Shunto and service inflation as the two key triggers for lift-off. Initial Shunto results are expected in mid-March, and major thinktanks expect them to be strong (graph). Nikkei’s Shunto expectations survey of “100 CEOs” (reported Dec 27 last year) resulted in 35 percent expecting a 5 handle and 19 percent expecting a 4 handle[vi] for total growth.

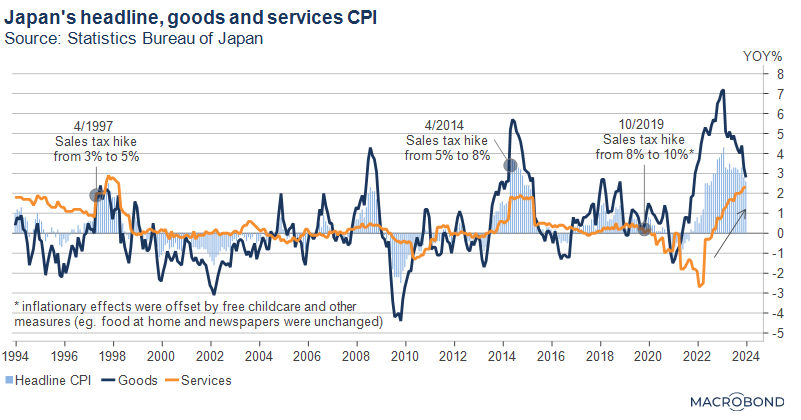

Meanwhile, service inflation has passed the benchmark of 2 percent, probably helped by a labor shortage in accommodations, retail and healthcare (graph).

Why Consensus in April?

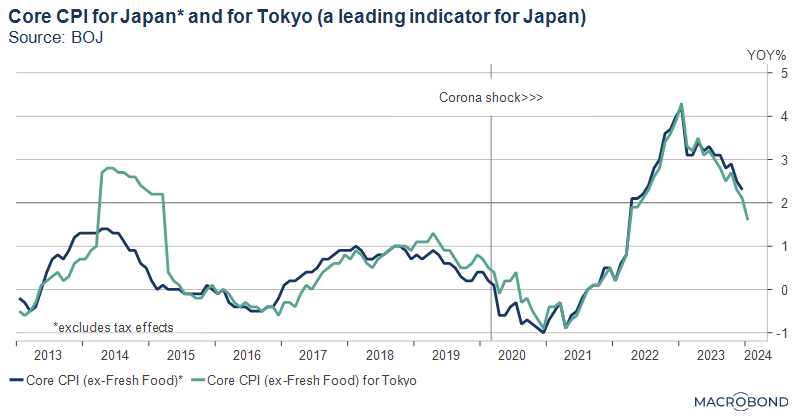

The consensus for lift-off remains centered around April. Although the initial Shunto results are expected in mid-March, a hike in March might rattle the March 31 fiscal year end corporate and bank balance sheets. Also, April should provide even more evidence of wage growth, including BOJ’s regional branch manager’s reports on local businesses and a fresh Tankan wage survey of corporates. April also brings the quarterly BOJ Outlook Report, which historically has tended to coincide with major policy changes. The April report will reveal BOJ’s consensus outlook on core inflation for FY26 – the Jan report had FY23 at 2.8 percent, FY24 at 2.4 percent, and FY25 at 1.8 percent. Note that Core CPI has been slowing since early 2023 helped by energy subsidies, and Tokyo’s index – a leading indicator – has already slipped below 2 percent (graph).

Victory over deflation?

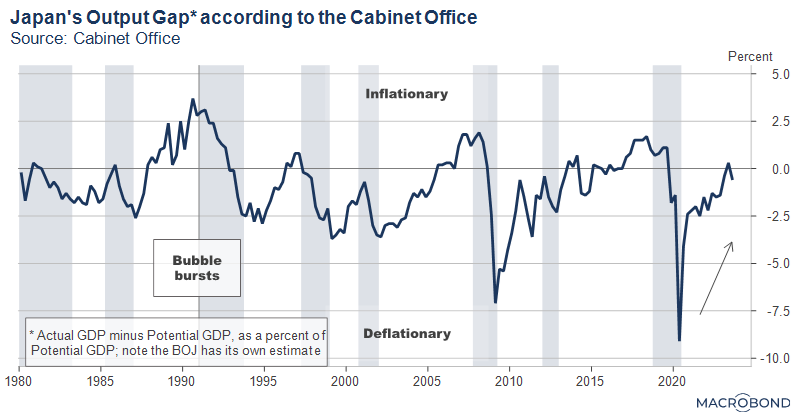

The Kishida administration reportedly is seeking to declare a victorious exit from deflation, a “huge” feat according to the prime minister[vii]. On Feb 9, the Nikkei quoted a BOJ official as saying, “Hopefully the government will announce it sometime around lift-off”[viii]. Speculation is rife as the Cabinet Office’s 4 conditions (from 2006![ix]) to announce victory have almost been met[x]:

- Inflation above 2 percent

>>>Core CPI has been above 2 percent

- A positive GDP deflator

>>>currently positive

- A positive output gap (GDP gap)

>>>recently a touch negative (graph)

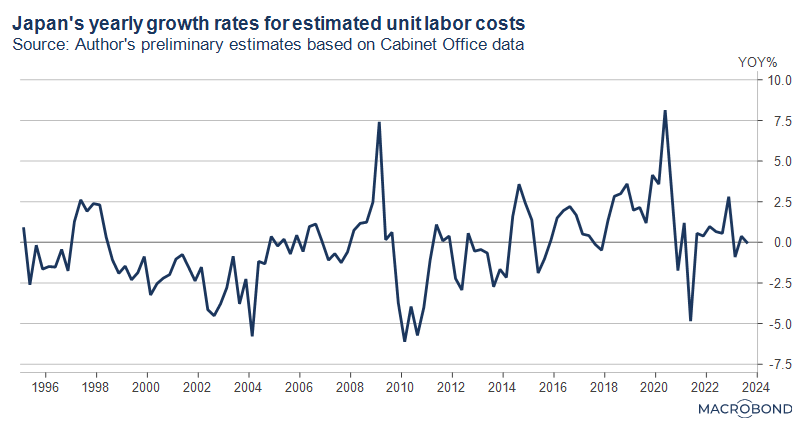

- Positive growth in unit labor costs

>>>recently a touch negative (graph)

Conclusions

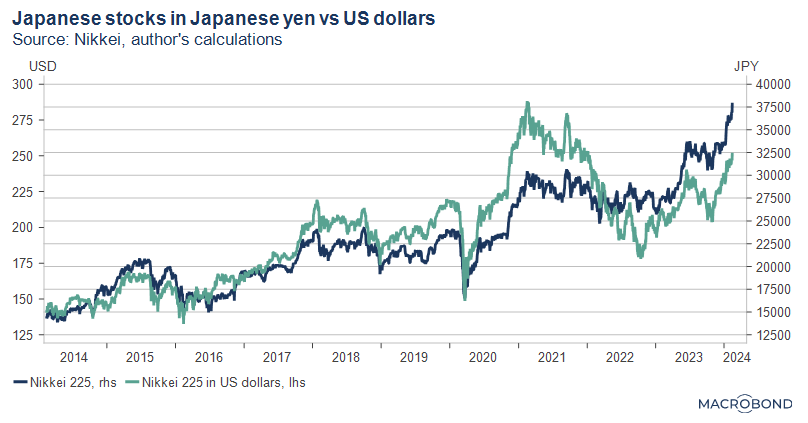

With such clear and detailed comments surrounding lift-off coming from BOJ’s top leadership, the market would be surprised if it does NOT occur by April. If lift-off occurs it would mean their first hike since Feb 2007, or 17 years ago. Along with appreciating the homegrown activism[xi] to push corporate valuations higher, the markets appear to like the prospects of Japan’s inflation revolution, which has helped achieve record corporate profits.

Related posts:

Can Japan exit deflation? (available here or here)

Japan’s inflation revolution (available here or here)

[i] https://www.nikkei.com/article/DGXZQOUB077IK0X00C24A2000000/

[ii] https://www3.nhk.or.jp/news/html/20231227/k10014301591000.html

[iii] https://www3.nhk.or.jp/news/html/20240209/k10014353441000.html

[iv] https://www3.nhk.or.jp/news/html/20240208/k10014351801000.html

[v] A hike OF 0.1 percent implies a return to zero rates, or ZIRP, while a hike TO 0.1 percent implies positive rates. I believe the correct translation is OF and not TO.

[vi] https://www.nikkei.com/article/DGXZQOUC229JV0S3A221C2000000/

[vii] https://www.nikkei.com/article/DGXZQOUA013WY0R01C23A2000000/

[viii] https://www.nikkei.com/article/DGKKZO78360020Y4A200C2EA2000/

[ix] https://www5.cao.go.jp/keizai3/2006/1208nk/06_0400.html

[x] https://diamond.jp/articles/-/330490

[xi] Japan stock exchange adopts name and shame regime to boost corporate valuations, Financial Times, Oct 16, 2023

Related links