OSE Derivatives

Platinum Jewellery Outlook

Executive summary

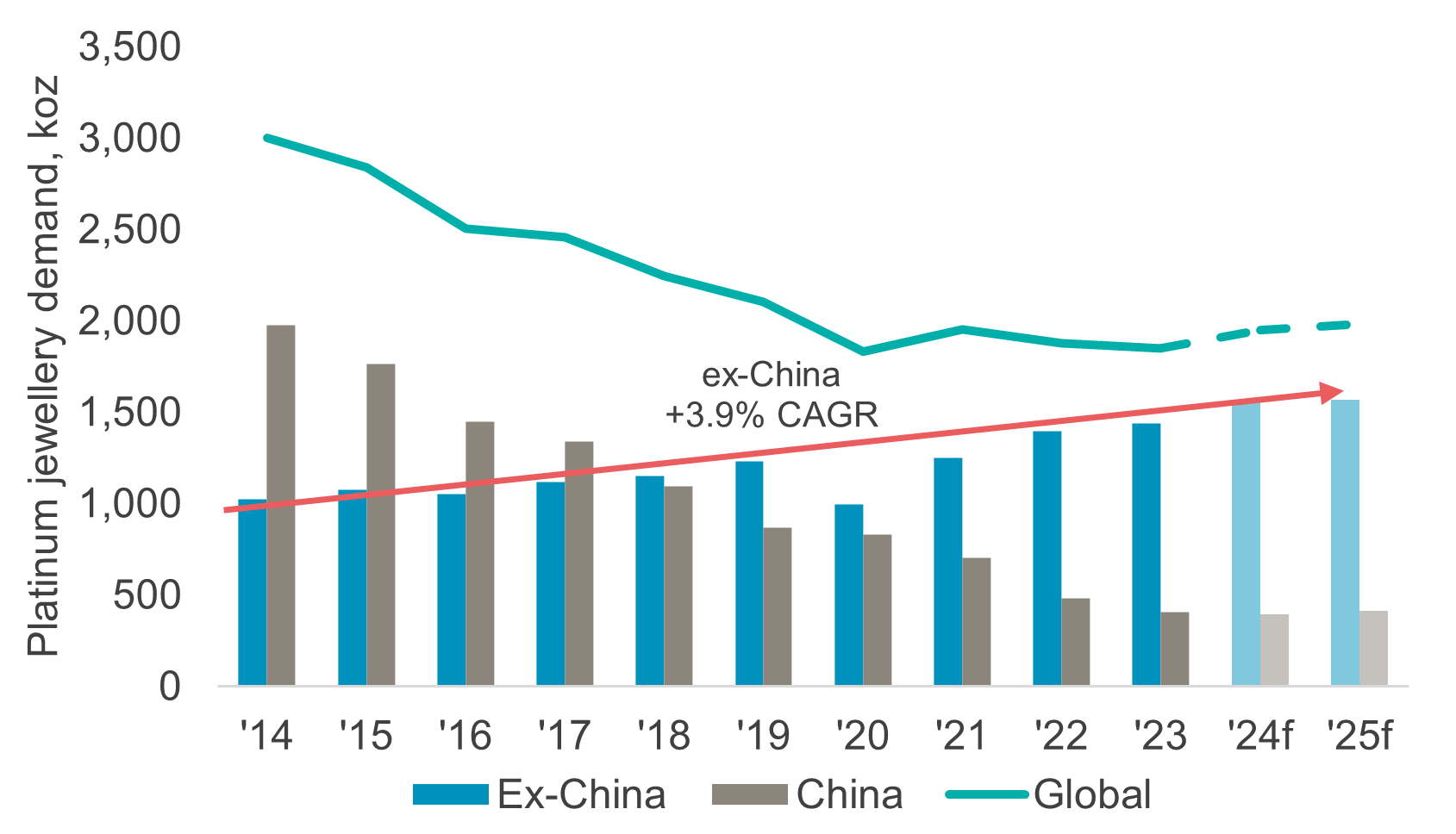

Jewellery is a key component of the platinum market, which today stands at around 25% of total demand. As recorded in WPIC’s quarterly supply and demand data series, platinum jewellery demand peaked at 3.0 Moz in 2014 before declining to 1.8 Moz in 2023.

This erosion was entirely due to declining demand in China, which had previously, and for many years, been the largest market for platinum jewellery, peaking in 2014 at 2.0 Moz of demand (figure1).

The platinum jewellery market decline now appears to have stabilised, with year-on-year growth of 5% estimated for 2024 and 2% year-on-year growth forecast for 2025, when total platinum jewellery demand is expected to reach 1,983 koz.

A key factor in the recovery of the platinum jewellery market is the scale of growth in demand outside of China over the last decade. This is estimated at 1.6 Moz in 2024 as compared to 1.0 Moz in 2014, which is now compensating for the loss of demand in China. Furthermore, China itself is showing signs of a recovery – albeit fragile – with a narrow return to growth forecast for 2025.

Figure 1. Platinum jewellery demand in China versus ex-China 2014-2025f

Source: SFA (Oxford) 2014-2018, Metals Focus 2019-2025f, WPIC research

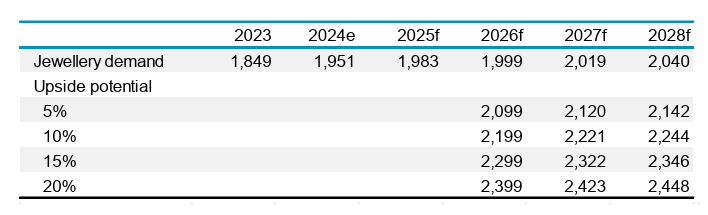

In its latest two- to five-year forecast, WPIC expects platinum jewellery demand growth of 2.0% CAGR from 2023 to 2028 as these trends continue. Added to this, further upside is possible should platinum gain share from the estimated 1.7 Moz white gold market. For each 5% of white gold demand that is switched into platinum demand, this would increase total platinum demand by an incremental average of 100 koz or 1.3% of total demand p.a. through the years 2025-2028 (figure 2).

Figure 2. Platinum jewellery demand (koz)

Source: Metals Focus 2023 – 2025f, WPIC research thereafter

Platinum jewellery demand in China

The decline in platinum jewellery demand from 3.0 Moz in 2014 to 1.9 Moz in 2023 can be attributed to China (figure1); China’s platinum jewellery demand declined from 2.0 Moz to 0.4 Moz over the same period (-14% CAGR).

The China market has undoubtedly been affected by broader trends, such as declining marriage rates and changing consumer preferences as evidenced by stronger competition for discretionary spend from growing consumer spending in other areas, such as experiences (travel and dining) and on alternative luxury goods (cars, wine and art etc.).

In China, platinum jewellery has also faced strong competition from karat gold due to the latter’s shorter process time and affordability, diverging prices of the underlying metals (supporting gold’s quasi-investment interest), fashion trends including the patriotic consumer trend of “China-Chic” (“Guochao”) and platinum jewellery’s higher buy/sell spreads.

Platinum jewellery demand outside of China

Excluding China, platinum jewellery demand has increased by a 3.9% CAGR from 2014 to 2023 with growth in markets outside of China now typically offsetting lost China demand on a year-on-year basis. This growth reflects a combination of strong growth from the luxury market and successful promotion in India. Regionally, demand in the US has benefited from strong economic growth, while the EU’s luxury goods houses are incorporating more platinum into their products (e.g. watches) and, in India, market development initiatives and fabrication for export have spawned a rapidly expanding market.

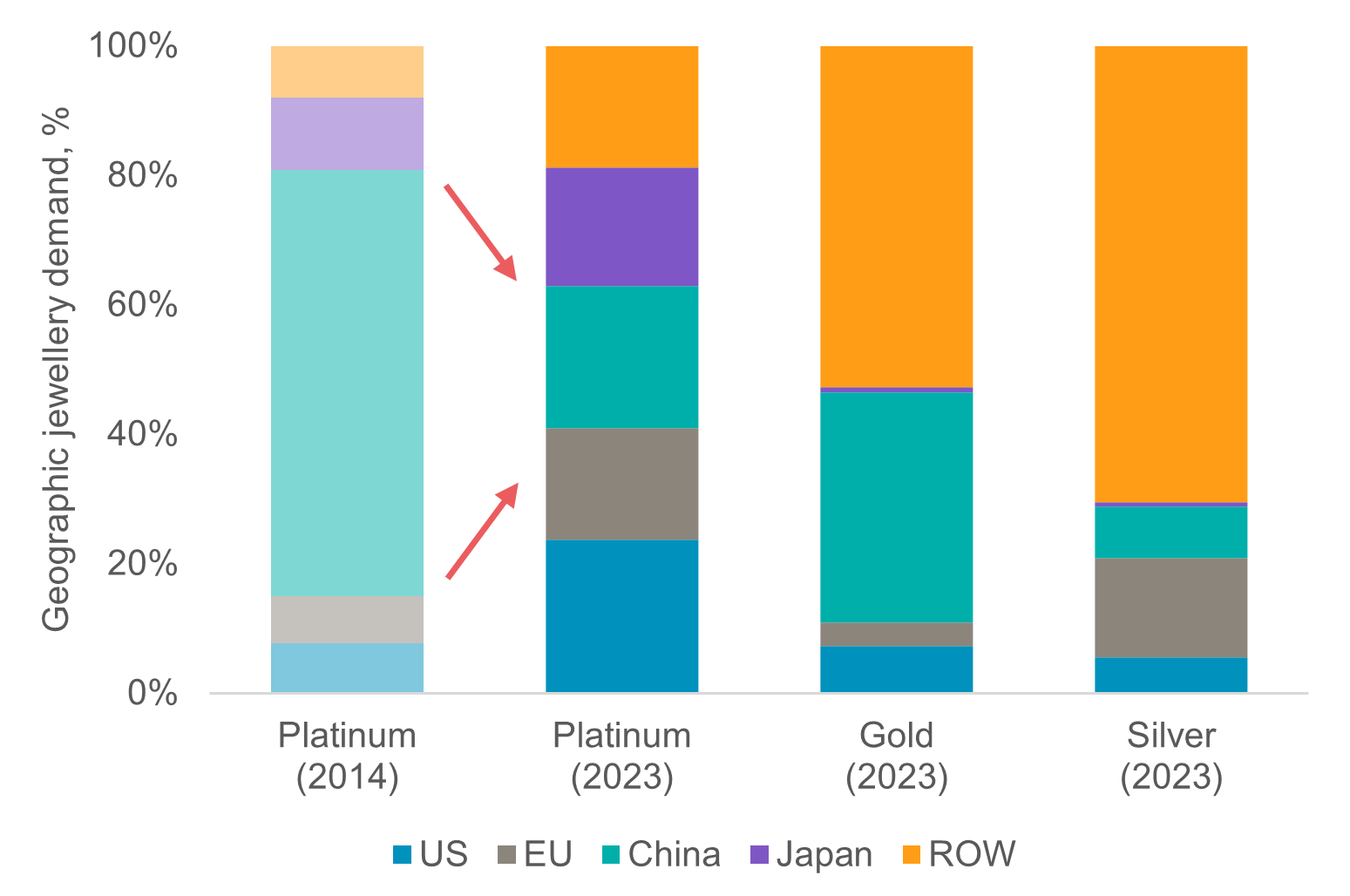

Notably, diverging demand trends between China and the rest of the world have led to a rebalancing of geographical diversification within platinum jewellery compared to the previous situation of being overly reliant on China (figure 3).

Figure 3. Since 2014, platinum jewellery demand has become more geographically diversified

Source: SFA (Oxford) 2014, Metals Focus 2023, World Gold Council, Silver Institute

Diversifying demand away from China has led to an inflection in platinum jewellery markets. Total demand has been broadly stable from 2021 to 2023 and is estimated to have increased 5% year-on- year in 2024, with 2% year-on-year growth forecast this year, due to steady ex-China demand growth. The geographic balance in platinum jewellery demand stands in contrast to the gold and silver jewellery markets, which are heavily dominated by ‘Rest of the World’ demand, which is predominantly India.

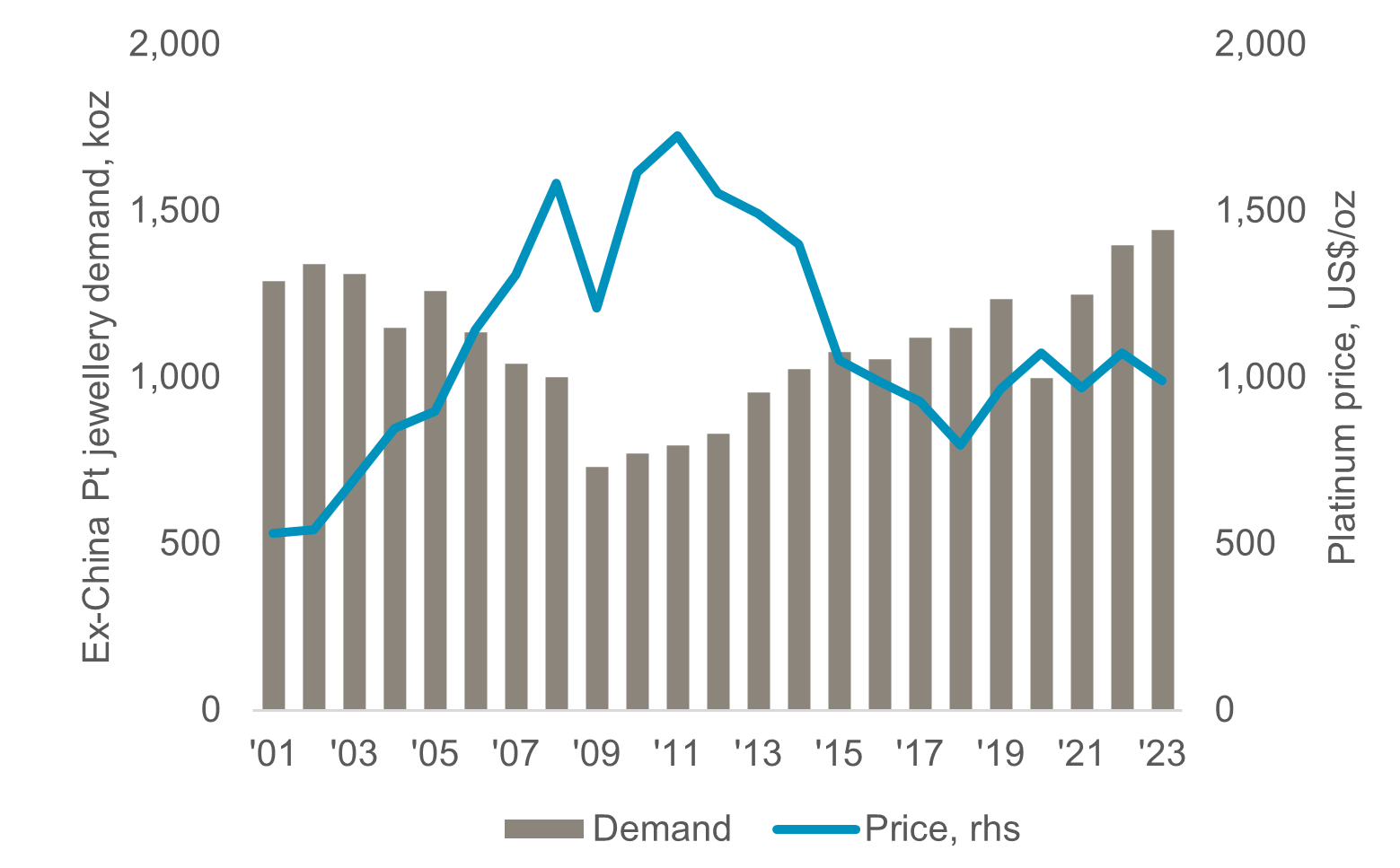

The impact of price on platinum jewellery demand

Platinum jewellery demand (ex-China) shows a pronounced negative relation to price (figure 4). The negative correlation between demand and prices demonstrates that the jewellery trade is price conscious, with demand decreasing as prices rise, until such time that higher prices are seen as normal and value expectations reset.

Figure 4. Platinum jewellery fabrication (ex-China) is negatively correlated to price

Source: Johnson Matthey 2001-2012, SFA (Oxford) 2013-2018, Metals Focus 2019-2023, Bloomberg, WPIC research

However, it is not accurate to assume that fluctuating platinum prices translated directly to retail jewellery prices. Given the structure of the jewellery trade, varying underlying metal prices should be interpreted as impacting input costs which support larger or smaller margins for the fabricators and retailers depending upon if the platinum price declines or increases, respectively. Hence, when lower underlying platinum prices over the past decade are taken into consideration, the ex-China jewellery trade has been incentivised to increase platinum jewellery fabrication due to higher margin opportunities. In contrast, the spot gold price has risen 32% year-to-date compared to a -2% decline in the platinum price. On this basis, the jewellery trade may switch some of its inventory from gold to platinum due to better relative value and the ability to release working capital (figure 5).

Figure 5. Higher gold prices have led the price of gold jewellery to the price of a like-for-like platinum equivalent which could support switching to platinum

Source: Bloomberg, Various UK retailer prices, WPIC research, *Like-for-like ring designs used with prices Inclusive of implied fabrication and retail margins

Prospect of market-share gain from white gold

The rise in gold prices over the past two years has led to a narrowing and convergence of the retail price of white gold and platinum jewellery. The WPIC estimates that the jewellery trade, which may ordinarily have carried more affordable white gold, could switch to platinum alternatives given margin advantages.

There are added benefits in switching from white gold to platinum which could provide further motivation. Platinum’s physical properties make it a superior metal for gem-set jewellery due to its strength – an especially important consideration in the bridal market. While its appearance is similar to that of white gold, platinum is a purer jewellery metal that is less likely to tarnish, unlike white gold jewellery that may need re-plating, depending on wear and tear.

Assuming 5% of white gold demand is switched into platinum demand, this would increase total platinum demand by an average of 100 koz or 1.3% p.a. through the years 2025-2028.

While it may be too early to tell whether or by how much platinum jewellery demand could benefit from switching, any demand uplift would act to deepen WPIC’s forecasts for already substantial platinum market deficits out to 2028. Our base case forecasts are for platinum market deficits to average 712 koz per annum, or 9% of annual demand, between 2026 and 2028.

IMPORTANT NOTICE AND DISCLAIMER: This publication is general and solely for educational purposes. The publisher, The World Platinum Investment Council, has been formed by the world’s leading platinum producers to develop the market for platinum investment demand. Its mission is to stimulate investor demand for physical platinum through both actionable insights and targeted development, providing investors with the information to support informed decisions regarding platinum and working with financial institutions and market participants to develop products and channels that investors need.

The research for the period since 2019 attributed to Metals Focus in the publication is © Metals Focus Copyright reserved. All copyright and other intellectual property rights in the data and commentary contained in this report and attributed to Metals Focus, remain the property of Metals Focus, one of our third-party content providers, and no person other than Metals Focus shall be entitled to register any intellectual property rights in that information, or data herein. The analysis, data and other information attributed to Metals Focus reflect Metals Focus’ judgment as of the date of the document and are subject to change without notice. No part of the Metals Focus data or commentary shall be used for the specific purpose of accessing capital markets (fundraising) without the written permission of Metals Focus.

The research for the period prior to 2019 attributed to SFA in the publication is © SFA Copyright reserved.

This publication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. With this publication, neither the publisher nor its content providers intend to transmit any order for, arrange for, advise on, act as agent in relation to, or otherwise facilitate any transaction involving securities or commodities regardless of whether such are otherwise referenced in it. This publication is not intended to provide tax, legal, or investment advice and nothing in it should be construed as a recommendation to buy, sell, or hold any investment or security or to engage in any investment strategy or transaction. Neither the publisher nor its content providers are, or purports to be, a broker-dealer, a registered investment advisor, or otherwise registered under the laws of the United States or the United Kingdom, including under the Financial Services and Markets Act 2000 or Senior Managers and Certifications Regime or by the Financial Conduct Authority.

This publication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor. You are solely responsible for determining whether any investment, investment strategy, security or related transaction is appropriate for you based on your investment objectives, financial circumstances, and risk tolerance. You should consult your business, legal, tax or accounting advisors regarding your specific business, legal or tax situation or circumstances.

The information on which this publication is based is believed to be reliable. Nevertheless, neither the publisher nor its content providers can guarantee the accuracy or completeness of the information. This publication contains forward-looking statements, including statements regarding expected continual growth of the industry. The publisher and Metals Focus note that statements contained in the publication that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect actual results and neither the publisher nor its content providers accept any liability whatsoever for any loss or damage suffered by any person in reliance on the information in the publication.

The logos, services marks and trademarks of the World Platinum Investment Council are owned exclusively by it. All other trademarks used in this publication are the property of their respective trademark holders. The publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the publisher to any rights in any third-party trademarks.

© 2025 World Platinum Investment Council Limited. All rights reserved. The World Platinum Investment Council name and logo and WPIC are registered trademarks of World Platinum Investment Council Limited. No part of this report may be reproduced or distributed in any manner without attribution to the publisher, The World Platinum Investment Council, and the authors.

Related links

World Platinum Investment Council - WPIC®

World Platinum Investment Council - WPIC®