OSE Derivatives

Electrical demand, data proliferation and platinum

Executive summary

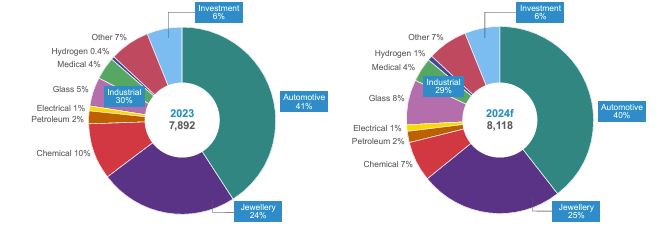

Electrical is a small sub-sector of platinum industrial demand that is growing in importance. In 2023 it accounted for around 1% of total platinum demand (figure 1). Historically, electrical demand has mainly comprised of the use of platinum in hard disk drives (HDDs) in a cobalt, chromium and platinum alloy which is the storage layer in an HDD stack.

However, platinum is now also finding increasing uses in the semiconductor and sensor industries. All three applications are growing due to rising demand for Artificial Intelligence (AI), and, in the case of HDDs, the associated need for more data storage capacity. The AI market is projected to grow steeply, growing to around US$1.3 trillion over the next decade from a market size of US$40 billion in 2022*.

This year, electrical demand for platinum is forecast to grow by a modest 1% to 90 koz as the HDD market recovers following a period of weakness between 2019 and 2023 which saw it on a declining trend, due to competition from solid-state drives (SSDs) and, more latterly, a post-pandemic downturn in the consumer electronics market.

Trends in the electronics market also have the potential to affect platinum demand in other sectors. For example, platinum used in the manufacture of liquid crystal display (LCD) screens for use in products such as televisions, computers, games consoles and smart phones, which is reflected in glass demand. Accounting for 5% of total platinum demand in 2023, glass is also a sub-sector of platinum industrial demand. Total glass demand for platinum is due to increase by 47% year-on-year in 2024.

Elsewhere, platinum-based hydrogen fuel cells are being used to provide zero emissions, off-grid power solutions for energy-intensive AI applications.

Figure 1: Share of platinum demand by end-use, 2023 v. 2024f

Source: Metals Focus

Market developments

HDDs

HDDs have been a market in decline, losing market share to solid state SSDs, especially in consumer applications such as personal computers and gaming consoles. HDDs are data storage devices comprised of magnetic platters coated with a platinum alloy media to improve thermal and magnetic stability, whereas SSDs use memory chips to store data, typically using a flash memory. However, the market for HDDs is showing signs of a rebound due to the growth in machine learning and AI driving the need for expanded data storage.

Superior speed and increasing cost competitiveness with HDDs are two of the key drivers behind the growth in SSD adoption in recent years. Yet HDDs are still lower cost than SSDs on a per gigabyte basis, meaning they remain the preferred option for organisations needing to store vast quantities of data. What is more, HDDs are benefiting from the introduction of heat-assisted magnetic recording (HAMR) technology, an innovation that is improving storage, or ‘areal’ density and so growing storage capacity without increasing HDD size or power requirements. These latter two features are of particular interest to the data centre segment which is deploying a broad range of solutions to better manage energy efficiency and storage capacity to reduce its carbon footprint.

At the same time, cloud computing, AI, and machine learning are leading to rapidly growing demand for data storage capacity. Indeed, it is estimated that between 2024 and 2025, 30 zettabytes – a trillion gigabytes – of data will be generated, while only two zettabytes of storage capacity will be manufactured.

New HDD products are being developed to address this shortfall. For example, Seagate, a leading innovator of sustainable mass-capacity data storage solutions, has launched a new HAMR HDD equipped with a pioneering ‘superlattice’ platinum-alloy media, which significantly enhances disk performance, providing over three terabytes of storage density per platter and enabling its groundbreaking Seagate ‘Exos’ 30 terabyte hard drive. The hard drive areal density improvements achieved will enable its customers to store more data within the same footprint, economically and efficiently expanding the installed capacity of hard drive-based mass storage facilities, especially data centres.

Computer drive manufacturer and data storage company Western Digital is also pushing 30-terabyte territory with its new generation of drives built with technology specifically designed for data centre customers who are looking for the highest capacity storage to help them achieve the lowest possible total cost of ownership. Western Digital’s high-capacity 28 terabyte and 24 terabyte HDDs are built with 40% (by weight) recycled content and are around 10% more energy efficient per terabyte compared to its earlier generation products.

Semiconductors

The expansion of AI applications is also leading to strong global demand for semiconductors, tiny electronic devices designed to enable functions such as processing, storing, sensing, and moving data. According to some forecasts**, revenues from semiconductors used in AI could increase from around US$44 billion in 2022 to US$120 billion in 2027. Moreover, the industry is benefiting from the build-out of new semiconductor fabrication facilities to accommodate the expansion of advanced process (less than 10 nanometre) production capacity.

Metals Focus, a leading precious metals consultancy, believes that platinum demand will benefit from AI – and semiconductor – proliferation through the use of platinum alloys in sputtering targets.

Sputtering is an established technology which enables a thin film to be applied to an underlying layer (substrate) by eroding or ejecting particles from a source material known as a sputtering target. The process is repeatable and can be scaled up from small research and development projects to production batches involving medium-to-large substrate areas of different shapes and sizes. Sputtering allows films that are only a few atomic or molecular layers thick to be deposited on to a surface.

By using thin film technology, materials can be produced with specific, customised properties that are often difficult or impossible to achieve with other technologies; thin films have assisted with the development of microelectromechanical systems (MEMS) and nanotechnologies within the field of electronics. In addition, thin film technology can often help to save material and costs, as only very small quantities of expensive or rare materials are required. The semiconductor industry uses platinum sputter targets as platinum’s conductivity and stability make it an ideal material for creating the thin films necessary to ensure efficient electron flow within a semiconductor.

Sensors

Platinum sputtering targets are also used to produce platinum thin-film for sensors in a wide variety of uses, including AI, where models need to be trained with large amounts of data. By combining AI models with sensors, such as thermal cameras, ultrasonic sensors, photocells, inductive sensors, radar sensors, and motion sensors, the amount of data needed to train a model can be reduced.

In battery electric vehicles, temperature management is one of the keys to maximising battery life and making electric vehicles more reliable, efficient, and durable. Here, platinum thin-film sensors can improve battery life by providing precise temperature measurements that allow operation close to performance limits, achieving high charging and discharging currents.

Due to their flexibility and durability, platinum sputtering targets are also used to produce thin films in the manufacture of sensors for the fast-growing and rapidly evolving market for wearables, such as smartwatches and fitness and health trackers, that provide continuous, non-invasive monitoring of vital signs like glucose levels and blood pressure.

Last year, Bosch, a pioneer and market leader in sensors, announced plans to invest three billion euros in its semiconductor business and in sensor development and manufacturing, by 2026.

Other sectors of platinum demand impacted by trends in the electronics market

Glass

Glass is also a sub-sector of platinum industrial demand, accounting for 5% of total platinum demand in 2023.

Glass is made by melting its raw materials at temperatures up to 1,700°C. Platinum is one of the ‘refractory’ metals – a group of metallic elements that are highly resistant to heat and wear. It is an essential material in the production of glass, due to its high melting point (1,769°C) and excellent oxidation resistance, corrosion resistance and chemical stability, meaning that it does not require coating protection when used at high temperatures.

Platinum alloys are used in the linings of vessels that contain, channel and form molten glass. They are also used to coat equipment such as ceramic stirrers and bowls that are used to mix the molten glass to ensure a consistent composition, especially when a high-quality end product is required.

The use of platinum alloys – typically platinum and its sister platinum group metal rhodium – brings many benefits to glass manufacturers by enabling increased output, reduced downtime and minimising impurities in the glass. This latter aspect is crucial for LCD glass, which needs to be of high-quality with minimal defects.

Production of LCD glass used in consumer electronics is one of the most intensive uses of platinum within the glass sector. LCD glass is used for screens in electronic products such as televisions, laptop computers, games consoles and smart phones.

In recent years, China, in particular, has seen a substantial increase in its glass production capacity in response to growing demand and in pursuit of the goal of domestic self-sufficiency. This year, total glass demand for platinum is due to increase by 47% year-on-year to 635 koz, largely driven by LCD glass capacity expansion in China.

Hydrogen fuel cells

The power required to train AI models is immense. For example, ChatGPT, one of the widely used Generative AI tools, uses as much electricity on a daily basis as 17,000 average US households.

The environmental impact of this energy consumption is a growing concern as AI models become more complex and widespread. The demand for electricity in data centres hosting AI operations is expected to increase significantly, highlighting the need for sustainable solutions.

In the US, Plug Power, producer of platinum-based proton exchange membrane (PEM) electrolysers and hydrogen fuel cells, is using its technology to provide sustainable stationary power for energy-intensive AI applications and the data centres needed to run them.

Unlike energy sources that rely on the combustion of fossil fuels, hydrogen fuel cells generate power through an electrochemical process that combines hydrogen and oxygen to produce electricity, water and heat. This process produces zero emissions at the point of use, with water vapour being the only by-product.

Further, the hydrogen used by fuel cells can be produced through the electrolysis of water, powered by renewable energy sources such as wind and solar, making the energy provided completely fossil-free. The WPIC estimates that around a third of the global electrolyser market will rely upon platinum-containing PEM electrolysers.

* 2023 Generative AI Growth Report, Bloomberg Intelligence

** Forecast: AI Semiconductors, Worldwide, 2021-2027, 2Q23 Update, Gartner

IMPORTANT NOTICE AND DISCLAIMER: This publication is general and solely for educational purposes. The publisher, The World Platinum Investment Council, has been formed by the world’s leading platinum producers to develop the market for platinum investment demand. Its mission is to stimulate investor demand for physical platinum through both actionable insights and targeted development, providing investors with the information to support informed decisions regarding platinum and working with financial institutions and market participants to develop products and channels that investors need.

The research for the period since 2019 attributed to Metals Focus in the publication is © Metals Focus Copyright reserved. All copyright and other intellectual property rights in the data and commentary contained in this report and attributed to Metals Focus, remain the property of Metals Focus, one of our third-party content providers, and no person other than Metals Focus shall be entitled to register any intellectual property rights in that information, or data herein. The analysis, data and other information attributed to Metals Focus reflect Metals Focus’ judgment as of the date of the document and are subject to change without notice. No part of the Metals Focus data or commentary shall be used for the specific purpose of accessing capital markets (fundraising) without the written permission of Metals Focus.

The research for the period prior to 2019 attributed to SFA in the publication is © SFA Copyright reserved.

This publication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. With this publication, neither the publisher nor its content providers intend to transmit any order for, arrange for, advise on, act as agent in relation to, or otherwise facilitate any transaction involving securities or commodities regardless of whether such are otherwise referenced in it. This publication is not intended to provide tax, legal, or investment advice and nothing in it should be construed as a recommendation to buy, sell, or hold any investment or security or to engage in any investment strategy or transaction. Neither the publisher nor its content providers are, or purports to be, a broker-dealer, a registered investment advisor, or otherwise registered under the laws of the United States or the United Kingdom, including under the Financial Services and Markets Act 2000 or Senior Managers and Certifications Regime or by the Financial Conduct Authority.

This publication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor. You are solely responsible for determining whether any investment, investment strategy, security or related transaction is appropriate for you based on your investment objectives, financial circumstances, and risk tolerance. You should consult your business, legal, tax or accounting advisors regarding your specific business, legal or tax situation or circumstances.

The information on which this publication is based is believed to be reliable. Nevertheless, neither the publisher nor its content providers can guarantee the accuracy or completeness of the information. This publication contains forward-looking statements, including statements regarding expected continual growth of the industry. The publisher and Metals Focus note that statements contained in the publication that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect actual results and neither the publisher nor its content providers accept any liability whatsoever for any loss or damage suffered by any person in reliance on the information in the publication.

The logos, services marks and trademarks of the World Platinum Investment Council are owned exclusively by it. All other trademarks used in this publication are the property of their respective trademark holders. The publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the publisher to any rights in any third-party trademarks.

© 2024 World Platinum Investment Council Limited. All rights reserved. The World Platinum Investment Council name and logo and WPIC are registered trademarks of World Platinum Investment Council Limited. No part of this report may be reproduced or distributed in any manner without attribution to the publisher, The World Platinum Investment Council, and the authors.

Related links

World Platinum Investment Council - WPIC®

World Platinum Investment Council - WPIC®