OSE Derivatives

Platinum medical demand

Executive Summary

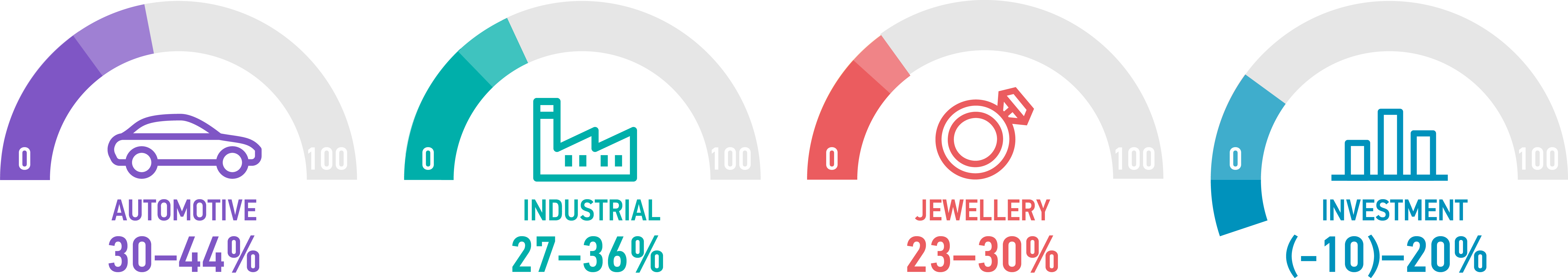

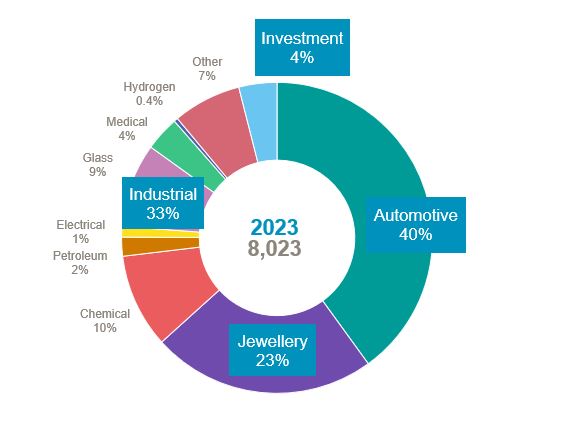

Platinum benefits from diversity of demand, with around 32% of total demand coming from a wide range of industrial applications (figure 1). Platinum’s uses are so wide ranging that for the purposes of simplification, medical demand is categorised as part of industrial demand. Medical and biomedical demand for platinum, though relatively small, is a significant and growing component, accounting for 11% of total industrial demand in 2023.

Figure 1: Sources of platinum demand

Platinum has a range of unique properties that make it especially suited to medical use (figure 2). It is known for its excellent biocompatibility, radiopacity (visibility in x-rays) and electro-conductivity, and is used extensively in permanent, implantable medical devices such as pacemakers, cochlear implants and neuromodulators. It has also been at the forefront of cancer treatment for more than forty-five years since the introduction of the first platinum-based anti-cancer drug, cisplatin.

Platinum medical demand is projected to grow 3% to 299 koz in 2024. Its use in cancer treatment drugs will see the most significant growth, driven by double-digit increases in oncology investment, outpacing other medical fields. Meanwhile, the use of platinum in medical devices will also grow, albeit more slowly, driven by ongoing, long-term factors such as an ageing population and improving access to healthcare in emerging markets.

Figure 2: Why platinum is well-suited to medical applications

Introduction

In 2023, platinum demand from medical and biomedical applications was 289 koz and it accounted for 4% of total platinum demand (figure 3) and 11% of platinum industrial demand. Today, platinum plays a major role in combating some of the most serious health issues facing the world, including cardiovascular diseases and cancer.

Figure 3: Medical platinum demand as a proportion of total platinum demand in 2023

With the highest atomic number of all medically-used materials it is platinum’s high density that enables it to be seen clearly in X-ray imaging as this makes it extremely effective at absorbing X-rays rather than allowing them to pass through it. Platinum’s radiopacity is put to great use when performing delicate, life-saving procedures to treat patients with neurovascular disorders.

Platinum’s excellent mechanical strength means it can be made into tiny, complex shapes. It is ductile and can be pulled into thin and delicate wires, as well as being inert, therefore it does not corrode easily and is unlikely to cause an allergic reaction. Treatment of aneurysms, which are a bulging or ballooning of a blood vessel wall that is at risk of rupture, uses platinum wire braiding techniques.

Many of the medical and biomedical procedures that rely on platinum components also provide a wider social and economic benefit, reducing health spending costs and enabling better management of valuable healthcare resources. For example, platinum wire braiding techniques used in the treatment of cardiovascular disorders have facilitated the development of less invasive procedures with quicker recovery times (e.g. keyhole surgery).

Platinum-based treatments for cancer

Platinum has been at the forefront of cancer treatment for more than forty-five years; the introduction of the first platinum-based anti-cancer drug, cisplatin, in 1978 revolutionised the treatment of certain cancers. Cisplatin has been especially successful in the treatment of testicular cancer, and today, with surgery and combination chemotherapy treatment, there is a cure rate approaching 99 per cent for patients with stage one of this disease.

Cisplatin is a platinum compound and, when administered through an intravenous injection directly into the blood stream, it works by interacting with DNA to destroy cancer cells and preventing them from multiplying.

The ability of platinum compounds to kill off cancer cells was an accidental discovery. In 1965, US biochemist Barnett Rosenberg conducted research into the effects of an electrical field on bacterial growth. Inexplicably, the bacteria cells responded by failing to divide and dying off.

Initially, Rosenberg thought this was because of the effects of the electrical field, but further investigation led to the conclusion that the platinum electrodes used to create the electric circuit were themselves reacting with the test solution. This reaction created a platinum compound that was, in fact, responsible for killing the cells.

Building on this knowledge, scientists found that cancer cells behaved in a similar way – the platinum compound causing them to die off. From here, several years of intense research led to the development of cisplatin, selected from a range of possible molecular combinations to create an optimal compromise between toxicity and efficacy.

Cisplatin, with a 65 per cent platinum content, has well known side effects and certain cancers can develop a resistance to it. Despite these drawbacks, it is still a front-line cancer treatment, although additional platinum-based therapies have since been developed to mitigate against these issues. Carboplatin, containing 52.5 per cent platinum, was approved in 1986 and is used mainly to treat ovarian and lung cancers. Available since 1996, Oxaliplatin with 49 per cent platinum is used to treat colorectal cancer.

Today, around half of all patients undergoing treatment for cancer receive platinum-based chemotherapy as a first-line treatment that can work alongside newer technologies such as hormonal therapy and immunotherapy.

Platinum in medical devices

Pacemakers

A pacemaker is a small electrical device, fitted in the chest or abdomen, used to treat certain types of abnormal heart rhythms. The electrodes, wires and pins in pacemakers are made using platinum or, sometimes, its sister platinum group metal, iridium. Invented in 1926, today’s pacemakers can be fitted in under two hours and have an average life of 20 years. Those implanted to treat slow heart rhythm restore life expectancy to normal levels. It is estimated that 700,000 pacemakers are fitted each year around the world.

Cochlear implants

Cochlear implants are medical devices that provide a sense of sound to a person who is profoundly deaf or severely hard of hearing. Instead of making sounds louder, like hearing aids, implants use electrical signals to directly stimulate the auditory nerve.

The cochlea is part of the inner ear. Shaped like a snail, it contains thousands of tiny hairs that vibrate in response to sound. These vibrations are converted into electrical signals which the auditory nerve carries to the brain, where they are interpreted as sound.

Many people suffer hearing loss because the hair cells in the cochlea are damaged. A cochlear implant is a substitute that bypasses the damaged part of the ear, and, although it does not ‘cure’ hearing loss, it replaces the function of the damaged inner ear.

Surgically implanted, a cochlear implant is comprised of two parts, an external sound processor and an internal implant. The sound processor receives sound waves and processes them into digital information, while the implant converts the digital information into electrical signals, which are sent to the auditory nerve from an electrode array placed inside the cochlea. Platinum is used to fabricate the contacts and wires responsible for carrying the electrical signals within the electrode array.

Neuromodulation devices

Neuromodulation or neurostimulation is a therapy that acts directly on the nervous system, often using implantable devices that deliver electrical impulses to nerves or within the brain itself. It can also work by allowing targeted doses of pharmaceuticals to be applied directly to the site within the body where they are needed. It is used to treat and alleviate symptoms across a wide range of conditions, for example: epilepsy; stroke; migraine; chronic pain; and movement disorders such as Parkinson’s disease.

Neurostimulation devices work by applying electrodes to the brain, the spinal cord or the peripheral nerves, depending on the condition being treated. These then connect to a pulse generator and a power source which generates the necessary electrical stimulation. Certain neuromodulation devices use platinum-iridium electrodes and can also incorporate platinum components in pulse generators.

Glucose monitors

Continuous glucose monitors comprise a wearable glucose biosensor that sends information to a mobile app or other device that can read the data output from the sensor, allowing diabetes patients to keep track of their glucose levels at all times, without having to scan or take a finger prick blood test. The glucose biosensor can be attached to either a person’s arm or stomach and it works by sensing how much glucose is in the fluid under the skin.

The glucose biosensor uses an enzyme to catalyse the oxidation of glucose to generate a current. The enzyme used in most glucose biosensors is glucose oxidase, which oxidizes glucose to gluconic acid and hydrogen peroxide. The hydrogen peroxide is then reduced to water by a catalyst, usually platinum, with the current generated being proportional to the concentration of glucose.

Outlook for medical platinum demand

Longer-term trends – changing demographics and increasing access to advanced medical care in both developed and developing countries, spurred on by policy initiatives – are supportive of future growth in platinum medical demand.

According to the United Nations’ Environment Programme, the world’s population is set to grow to over 9.7 billion by 2050, with the number of those aged 65 or older forecast to double by then. What is more, the World Health Organization is committed to tackling non-communicable diseases such as cardiovascular disease and cancer through targets set out in the United Nations’ Sustainable Development Goals for 2030. In addition, the United Nations has the goal of achieving universal health coverage, reaffirming ‘the right of every human being, without distinction of any kind, to the enjoyment of the highest attainable standard of physical and mental health’, also by 2030.

Meanwhile, over the next 30 years, the over-65 population in emerging markets is predicted to grow 2.7% annually, more than double the rate of developed countries. This increased longevity will also drive higher demand for healthcare services. Healthcare expenditure in emerging economies is predicted to grow and ultimately catch up with that of developing nations; currently, the US spends approximately 19% of its GDP on health, while Europe allocates roughly 12%. In India and Southeast Asia, healthcare expenditures currently range from only 3 to 5% of GDP*.

Platinum medical demand is projected to grow 3% to 299 koz in 2024. Its use in cancer treatment drugs will see the most significant growth, driven by double-digit increases in oncology investment, outpacing other medical fields. Meanwhile, the use of platinum in medical devices will also grow, albeit more slowly, driven by ongoing, long-term factors such as an ageing population and improved access to healthcare in emerging markets.

*Morgan Stanley: Navigating Emerging Markets Healthcare Trends, October 2023

The research for the period since 2019 attributed to Metals Focus in the publication is © Metals Focus Copyright reserved. All copyright and other intellectual property rights in the data and commentary contained in this report and attributed to Metals Focus, remain the property of Metals Focus, one of our third-party content providers, and no person other than Metals Focus shall be entitled to register any intellectual property rights in that information, or data herein. The analysis, data and other information attributed to Metals Focus reflect Metals Focus’ judgment as of the date of the document and are subject to change without notice. No part of the Metals Focus data or commentary shall be used for the specific purpose of accessing capital markets (fundraising) without the written permission of Metals Focus.

The research for the period prior to 2019 attributed to SFA in the publication is © SFA Copyright reserved.

This publication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. With this publication, neither the publisher nor its content providers intend to transmit any order for, arrange for, advise on, act as agent in relation to, or otherwise facilitate any transaction involving securities or commodities regardless of whether such are otherwise referenced in it. This publication is not intended to provide tax, legal, or investment advice and nothing in it should be construed as a recommendation to buy, sell, or hold any investment or security or to engage in any investment strategy or transaction. Neither the publisher nor its content providers are, or purports to be, a broker-dealer, a registered investment advisor, or otherwise registered under the laws of the United States or the United Kingdom, including under the Financial Services and Markets Act 2000 or Senior Managers and Certifications Regime or by the Financial Conduct Authority.

This publication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor. You are solely responsible for determining whether any investment, investment strategy, security or related transaction is appropriate for you based on your investment objectives, financial circumstances, and risk tolerance. You should consult your business, legal, tax or accounting advisors regarding your specific business, legal or tax situation or circumstances.

The information on which this publication is based is believed to be reliable. Nevertheless, neither the publisher nor its content providers can guarantee the accuracy or completeness of the information. This publication contains forward-looking statements, including statements regarding expected continual growth of the industry. The publisher and Metals Focus note that statements contained in the publication that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect actual results and neither the publisher nor its content providers accept any liability whatsoever for any loss or damage suffered by any person in reliance on the information in the publication.

The logos, services marks and trademarks of the World Platinum Investment Council are owned exclusively by it. All other trademarks used in this publication are the property of their respective trademark holders. The publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the publisher to any rights in any third-party trademarks.

© 2024 World Platinum Investment Council Limited. All rights reserved. The World Platinum Investment Council name and logo and WPIC are registered trademarks of World Platinum Investment Council Limited. No part of this report may be reproduced or distributed in any manner without attribution to the publisher, The World Platinum Investment Council, and the authors.

Related links

World Platinum Investment Council - WPIC®

World Platinum Investment Council - WPIC®