OSE Derivatives

Platinum jewellery demand

Executive Summary

Research has shown platinum to be the precious metal most associated with love and the evolution of platinum as a jewellery metal has been rooted in buyer behaviour in the bridal sector, although self-purchasing is becoming an increasing trend.

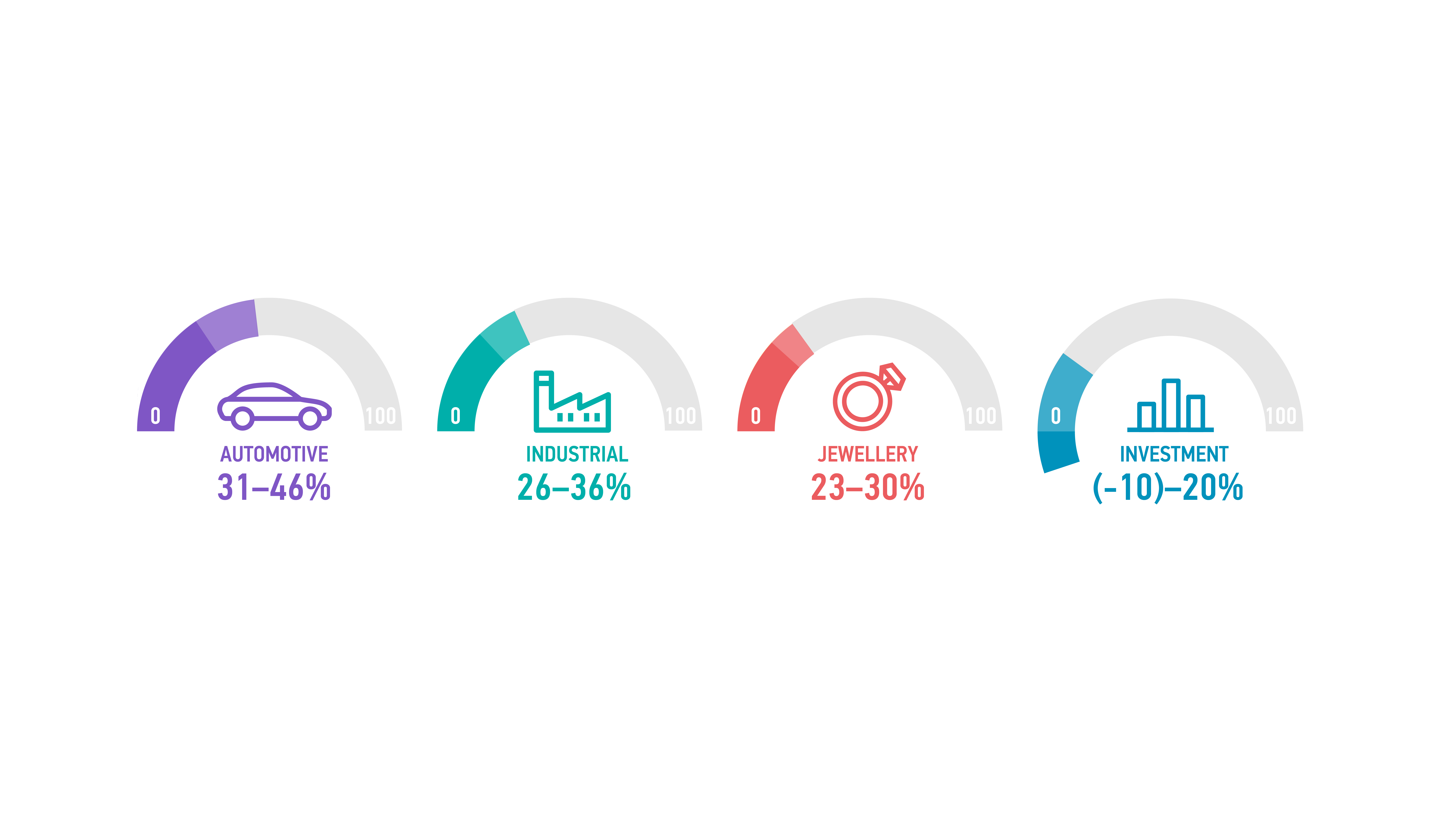

Jewellery is the third largest demand segment for platinum, accounting for between 23 and 30 per cent of total annual platinum demand (figure 1). Platinum’s rarity and precious metal status has led to strong, long-standing associations with the luxury goods market, especially in western markets and Japan.

China was for many years the largest market for platinum jewellery, although this has been on a declining trend since the peak of this market in 2013 when demand in China reached 1,990 koz and accounted for almost 68 per cent of total jewellery demand for platinum. In 2022, its market share was 25 per cent, or 484 koz. Meanwhile, growth in demand for platinum jewellery has come from the US and India, although this has not been enough to compensate for the loss of market share in China.

This article provides an insight into the characteristics of platinum jewellery, the development of the platinum jewellery market, and the dynamics of platinum jewellery retail demand. It also provides an overview of platinum demand in key jewellery markets in 2023 and an outlook for 2024.

Figure 1: Sources of platinum demand

Source: WPIC Platinum Quarterly, minimum and maximum ranges over period 2018-2022

Characteristics of platinum jewellery

It is no co-incidence that some of the world’s most famous diamonds – the Hope, the Koh-i-Noor and the Jonker, for example – are set in platinum; the platinum setting greatly reduces the risk of these irreplaceable gemstones becoming dislodged and falling out, due to platinum’s durability and strength. Even where the shank of a diamond ring is made from white or yellow gold, the setting and prongs are frequently fabricated from platinum for the same reason.

Platinum jewellery is also renowned for its purity. Unlike white gold, which achieves its whiteness as a result of being alloyed or coated with other metals, platinum is a naturally white precious metal that never needs re-plating. It is also denser than gold; fine platinum jewellery weighs 40 per cent more than 18 carat gold, giving it a quality feel when worn.

What is more, it only needs to be mixed with the smallest amount of other platinum group metals to create an alloy that can be moulded, cast and shaped. As a result, platinum is one of the purest jewellery metals available; in most markets it is 90 or 95 per cent pure. Compare this to white or yellow gold: 18 carat is only 75 per cent pure; 14 carat only 58 per cent. Platinum’s purity means that it is hypoallergenic and so highly unlikely to cause skin irritation, whereas the alloys used in white gold – especially nickel – are not always so well tolerated.

Development of the platinum jewellery market

Unlike gold, which has been melted, moulded and worked for thousands of years, platinum was only identified as a separate element in the mid-18th century due to its scarcity and its unique physical properties. Platinum’s high melting point proved especially challenging, until a breakthrough came in 1782 which saw platinum melted for the very first time, eventually paving the way for platinum casting.

Platinum’s position as a pre-eminent jewellery metal was established by the great jewellers of the Edwardian and Art Deco period, such as Cartier and Tiffany. Due to its strategic importance, it became a controlled material during World War II and its use as a jewellery metal declined until the 1960s, when it became popular in Japan due to its purity and colour. European interest in platinum jewellery returned, initially in Germany, where jewellers gave platinum a distinct identity characterised by stark modern design and the prevalent use of a satin finish. Demand began to grow in Italy in the 1980s and in Switzerland, the United States and the United Kingdom in the 1990s. By the mid-1990s, demand for platinum in China was growing, spurred on by GDP growth and the emergence of a new middle class with greater spending power.

Since 1975, Platinum Guild International (PGI) has been working to develop the global platinum jewellery market as a demand source for platinum. PGI is a marketing organisation created by the major platinum producers, who – identifying parallels with the jewellery market for gold – saw an opportunity to create a demand segment that was more price elastic than industrial demand, providing useful upside protection against potential falls in industrial demand. PGI’s market development has resulted in annual platinum jewellery demand growing from almost zero to almost 1.9 moz in 2022, having peaked at 3 moz in 2014.

Dynamics of platinum jewellery retail demand

Key dynamics of platinum jewellery retail demand are detailed below:

Economic growth – this can see rising incomes and living standards, especially as the proportion of middle-class households grows, meaning greater spending on non-essential and luxury purchases, including jewellery. However, the relationship is seldom this simple, and is moderated by further factors below.

Social changes – traditionally, a large proportion of platinum jewellery demand comes from the bridal market. A growing population can result in an increase in platinum demand due to more weddings over time; additionally, wedding seasons, e.g. in China, can provide a seasonal uplift in platinum jewellery demand. Conversely, an ageing population, or one where the marriage rates are declining for another reason, could lead to a decline in platinum jewellery demand.

Consumer trends – platinum jewellery exists within the luxury market, and therefore is correlated to growth in the global luxury goods market. For example, in 2023, in European jewellery markets, strong demand from platinum jewellery from the high-end, luxury goods sector was behind the modest growth achieved in this region.

Advertising and promotion – Where there is a growing middle class with disposable income, advertising can be very effective in stimulating platinum jewellery demand, helping it to compete more effectively against other potential uses of disposable income.

Platinum value perception (especially relative to gold) – jewellery spend is generally value rather than weight driven. For example, if shopping for a wedding band, the consumer is more likely to have a specific budget in mind rather than be looking for a five-gram wedding band. Additionally, in jewellery markets, platinum is perceived to be a premium product, with retail prices higher than that of gold. This leads to higher margins for jewellery retailers and, as such, it can be an additional incentive to offer platinum jewellery products versus gold or other jewellery products.

Availability of platinum jewellery products – the platinum jewellery market is almost ten times smaller than that of gold. This means that in many locations, platinum jewellery is not available, which restricts platinum jewellery demand. The drivers above consider retail or consumer demand only. However, the jewellery value chain is complex. Inventory builds and unwinds at different points in the value chain, which can result in platinum jewellery manufacturer demand as represented in platinum supply/demand data differing materially from platinum retail jewellery demand (though this effect should be temporary).

For example, in 2016, China platinum jewellery manufacturer demand was down 20 per cent year on year as consumer demand was met with material flowing from a reduction in inventory through the manufacturing chain. Therefore, although in the long-term manufacturer demand should be broadly equal to retail demand, on a year-by-year basis there can be changes in platinum inventory that can obscure trends at the retail level. This appears to have occurred in reverse in 2020 as manufacturers in China increased stock levels at the low platinum prices triggered by the COVID-19 pandemic.

Overview of key platinum jewellery markets in 2023

Global platinum jewellery demand in 2023 fell an estimated 3 per cent (48 koz) year-on-year, to reach 1,852 koz, against a challenging economic environment globally and with ongoing issues in the key China market in particular continuing to weigh heavily on overall platinum jewellery demand. Gains in Japan and India were not enough to offset weakness in China.

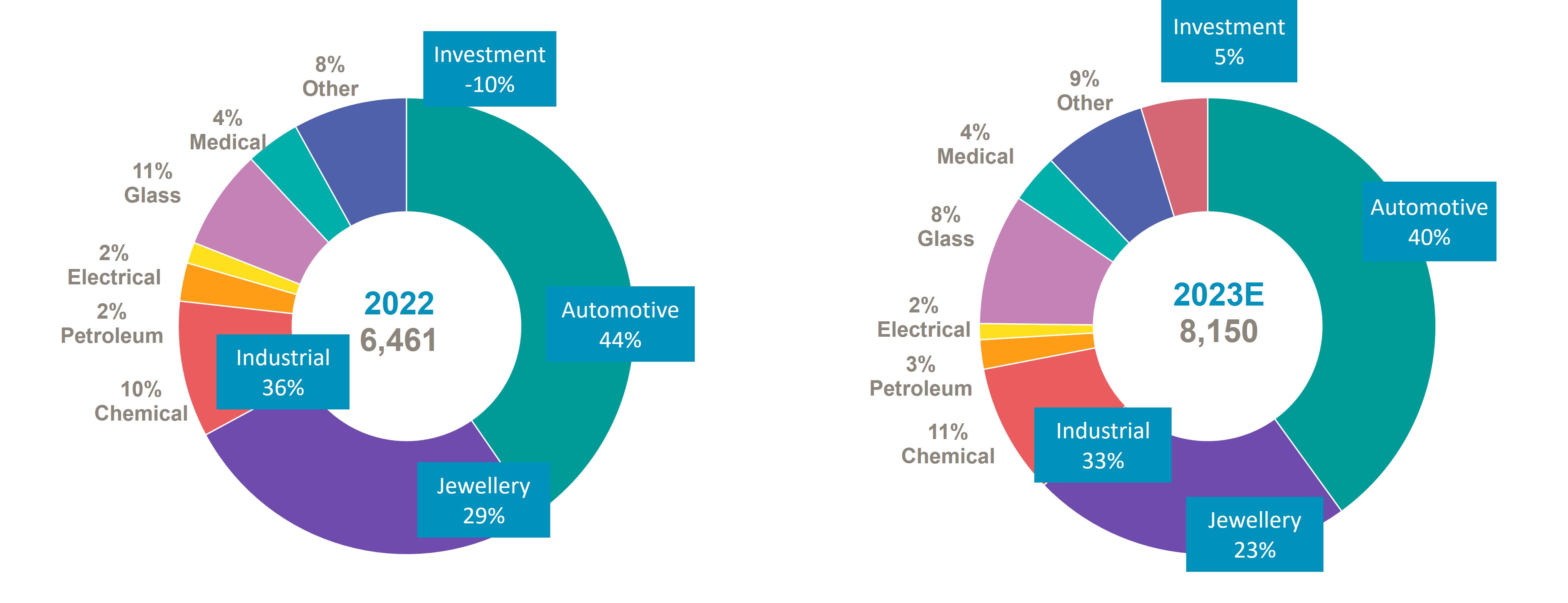

Platinum jewellery demand as a proportion of total demand for platinum declined from 29 per cent in 2022 to 23 per cent in 2023 (figure 2), despite a significant 26 per cent year-on-year increase in total demand for platinum due to stellar automotive and industrial demand.

Figure 2: Platinum jewellery demand as a proportion of overall demand for platinum

Source: Metals Focus

China saw its tenth consecutive year-on-year drop in jewellery demand in 2023, with a 13 per cent reduction to 420 koz; more than 1.5 moz lower than the peak levels of 2013.

Even prior to the pandemic, which impacted the platinum jewellery market in China to a greater extent than in other regions due to prolonged lockdowns, platinum faced increased competition from other precious metals, especially gold. However, the industry is taking active steps to develop new products and further broaden the appeal of platinum jewellery in the China market.

In North America, platinum jewellery demand saw strong growth post-pandemic, due to pent-up demand, reaching 448 koz in 2022, some 31 per cent higher than the pre-pandemic, 2019 level of 341 koz. While this peak tailed off slightly in 2023 as the number of weddings normalised, the market here has nevertheless benefited from sustained growth in platinum’s share of the bridal market.

In Europe, modest two per cent year-on-year growth was achieved in 2023 with strong demand from platinum jewellery from the high-end, luxury goods sector offsetting weakness in the bridal segment, mainly the result of fewer weddings.

Jewellery demand in Japan, the most mature market for platinum in terms of consumer understanding, benefited from the return of tourists and stronger exports and experienced reasonable growth in 2023, although the key bridal market here is facing challenges.

Since the pandemic, platinum jewellery demand in India has rebounded strongly. In 2023 it grew by an estimated eight per cent year-on-year to 184 koz. Here retail chains have started to actively promote platinum jewellery in order to help improve their profits by offering high-margin products. They are also focusing on the younger generation by offering innovative, light-weight everyday wear, and bi-metal (gold and platinum) jewellery options.

Outlook platinum jewellery demand in 2024

A modest, three per cent lift in platinum jewellery demand to 1,903 koz is forecast in 2024, and the expectation is that China will see low-level growth as economic factors improve and consumer spending resumes.

Platinum sales in North America are expected to dip due to unfavourable price moves (in the context of the jewellery industry) and fewer engagements. Europe is forecast to be flat year-on-year, with a continuation of the trends seen in 2023 within different market segments.

Consumer demand in India is expected to remain strong as platinum gains wider acceptance across the country, particularly in smaller cities and towns.

The research for the period since 2019 attributed to Metals Focus in the publication is © Metals Focus Copyright reserved. All copyright and other intellectual property rights in the data and commentary contained in this report and attributed to Metals Focus, remain the property of Metals Focus, one of our third-party content providers, and no person other than Metals Focus shall be entitled to register any intellectual property rights in that information, or data herein. The analysis, data and other information attributed to Metals Focus reflect Metals Focus’ judgment as of the date of the document and are subject to change without notice. No part of the Metals Focus data or commentary shall be used for the specific purpose of accessing capital markets (fundraising) without the written permission of Metals Focus.

The research for the period prior to 2019 attributed to SFA in the publication is © SFA Copyright reserved.

This publication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. With this publication, neither the publisher nor its content providers intend to transmit any order for, arrange for, advise on, act as agent in relation to, or otherwise facilitate any transaction involving securities or commodities regardless of whether such are otherwise referenced in it. This publication is not intended to provide tax, legal, or investment advice and nothing in it should be construed as a recommendation to buy, sell, or hold any investment or security or to engage in any investment strategy or transaction. Neither the publisher nor its content providers are, or purports to be, a broker-dealer, a registered investment advisor, or otherwise registered under the laws of the United States or the United Kingdom, including under the Financial Services and Markets Act 2000 or Senior Managers and Certifications Regime or by the Financial Conduct Authority.

This publication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor. You are solely responsible for determining whether any investment, investment strategy, security or related transaction is appropriate for you based on your investment objectives, financial circumstances, and risk tolerance. You should consult your business, legal, tax or accounting advisors regarding your specific business, legal or tax situation or circumstances.

The information on which this publication is based is believed to be reliable. Nevertheless, neither the publisher nor its content providers can guarantee the accuracy or completeness of the information. This publication contains forward-looking statements, including statements regarding expected continual growth of the industry. The publisher and Metals Focus note that statements contained in the publication that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect actual results and neither the publisher nor its content providers accept any liability whatsoever for any loss or damage suffered by any person in reliance on the information in the publication.

The logos, services marks and trademarks of the World Platinum Investment Council are owned exclusively by it. All other trademarks used in this publication are the property of their respective trademark holders. The publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the publisher to any rights in any third-party trademarks.

© 2024 World Platinum Investment Council Limited. All rights reserved. The World Platinum Investment Council name and logo and WPIC are registered trademarks of World Platinum Investment Council Limited. No part of this report may be reproduced or distributed in any manner without attribution to the publisher, The World Platinum Investment Council, and the authors.

Related links

World Platinum Investment Council - WPIC®

World Platinum Investment Council - WPIC®