OSE Derivatives

Why is hydrogen an important new demand segment for platinum?

Summary

Platinum’s importance to the hydrogen economy makes it one of the only established commodities offering the prospect of significant growth in demand from a new end-use segment. The need to decarbonise is more acute than ever and platinum-based proton exchange membrane (PEM) technologies have a significant role to play in the energy transition.

Due to its unique chemical and physical properties, platinum is at the forefront of PEM applications. PEM technology is used in both electrolysers to produce hydrogen and in hydrogen fuel cells which can power, for example, an emissions-free fuel cell electric vehicle (FCEV).

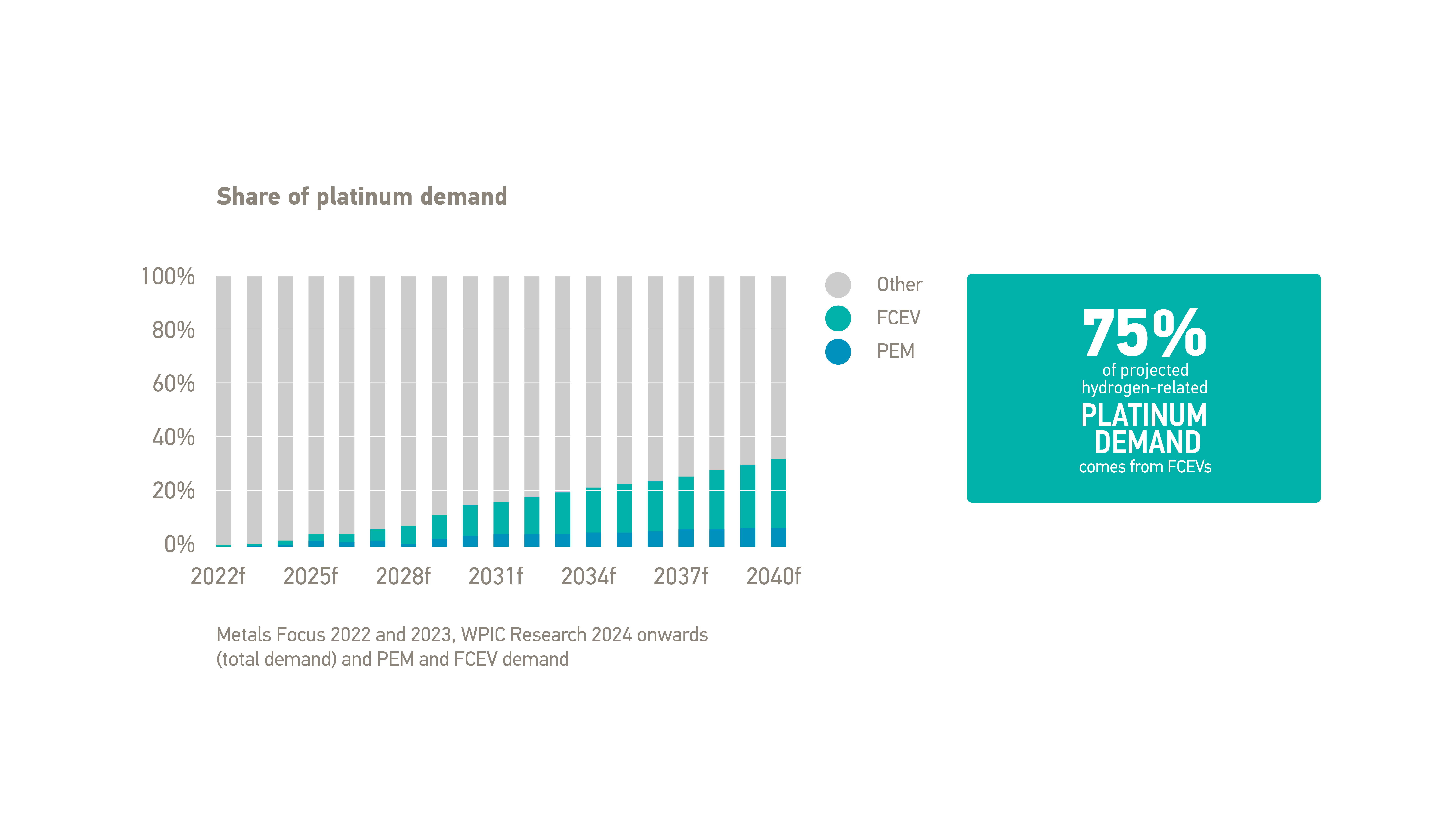

While hydrogen-related demand for platinum is relatively small in 2023, it is expected to grow substantially through the 2020s and beyond, reaching as much as 35 per cent of total annual platinum demand by 2040.

PEM electrolysis

Hydrogen – the most abundant element on earth – is already used as a key input in a number of important industries, for example it is increasingly being used as an alternative to natural gas and coking coal in steel manufacturing, and it is a critical input in the Haber-Bosch process for the production of ammonia (albeit mostly using hydrogen derived from natural gas).

One of the ways of producing hydrogen is through the electrolysis of water. During this process, an electric current is used to separate water into its component elements – hydrogen and oxygen. When the electric current is derived from a renewable source – solar photo voltaic panels or a wind turbine, for example – it is known as green hydrogen.

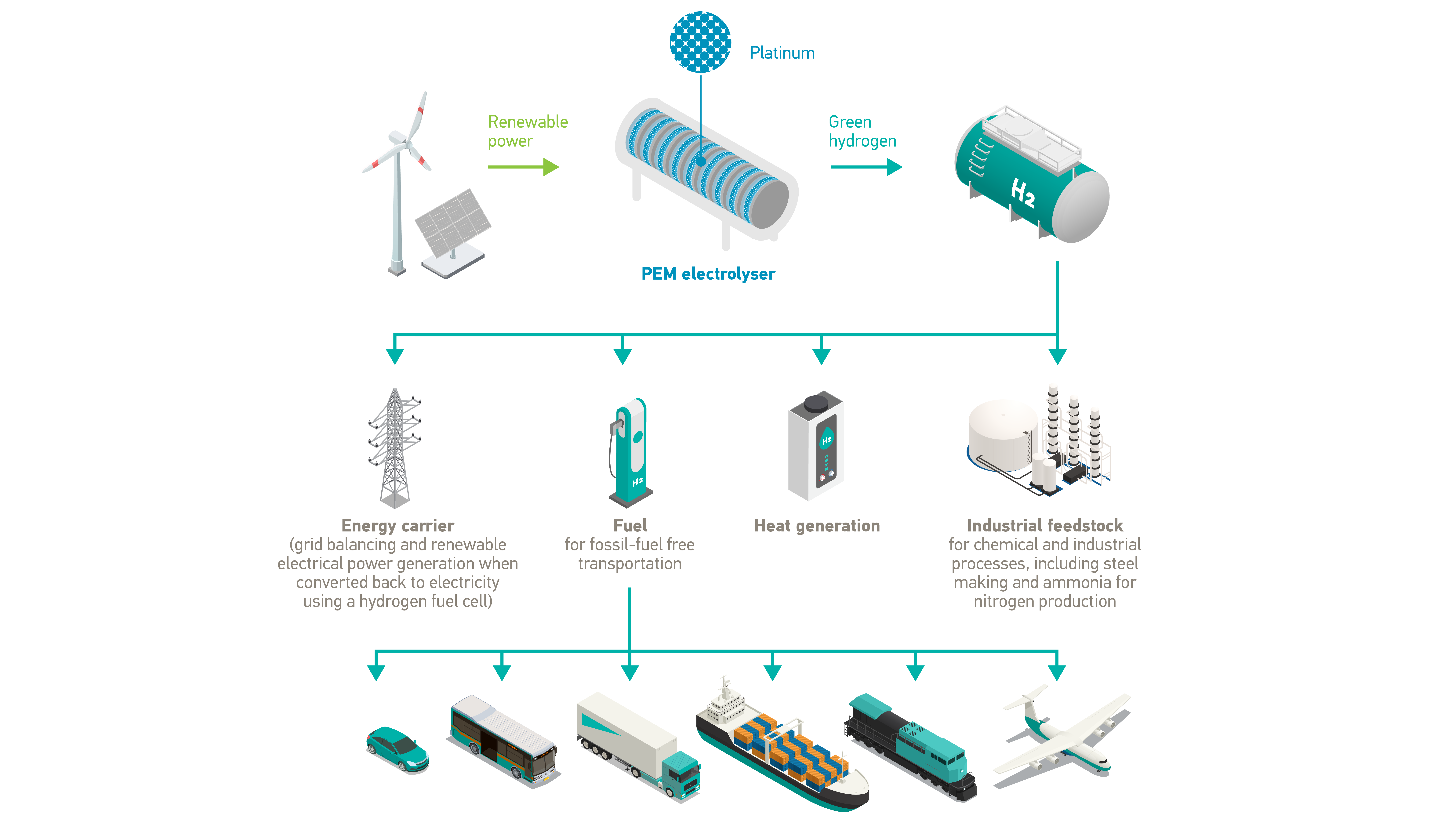

Green hydrogen is an energy carrier that enables ‘sector coupling’, allowing decarbonisation of the wider economy through the integration of renewable power generation with consumers of energy, providing the medium by which renewable energy is transferred across the supply chain, displacing fossil fuels (figure 1).

Figure 1: Platinum is critical for the production and end use of green hydrogen, a key enabler of the energy transition

Crucially, green hydrogen overcomes constraints such as proximity to renewable infrastructure, delivering the emissions-free benefits of renewable energy beyond traditional hubs, reaching locations where it would have previously not been available. Even hard-to-abate industries – e.g. industry and heavy transport, which account for around 40 per cent of global carbon emissions and where direct electrification or battery technology is not optimal – can benefit.

Effectively, through green hydrogen, excess renewable energy can be harnessed and supplied to end-users, for example to be used in refuelling networks for FCEVs. It has the potential to become a global commodity that is traded in much the same way as oil and gas is today. However, this depends on the availability of the necessary, scalable infrastructure to store and transport it.

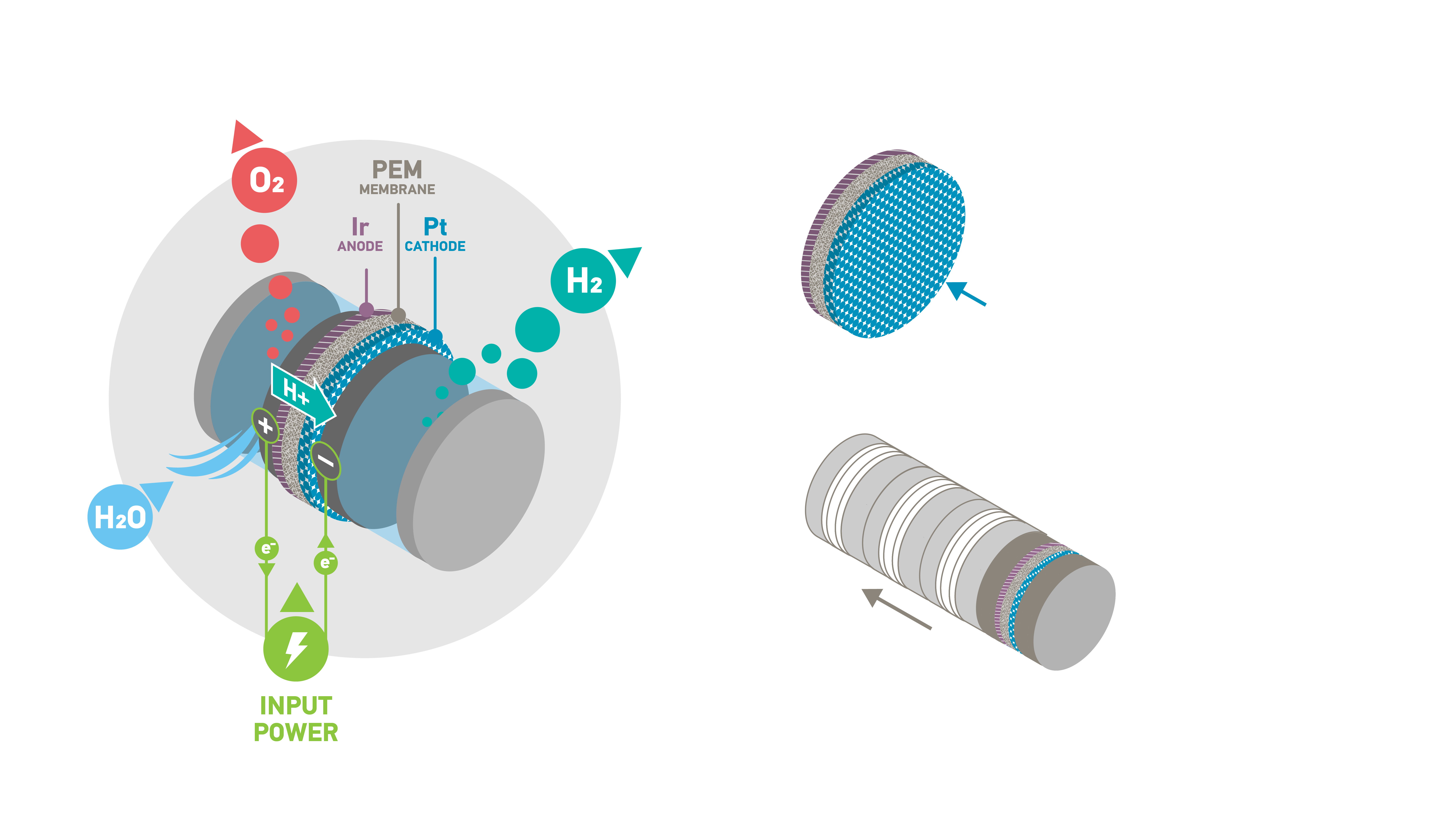

Platinum, in conjunction with iridium, is used as a catalyst in PEM electrolysers (figure 2), which use a solid polymer electrolyte, one of the two leading electrolysis technologies available in the market. PEM electrolysis offers advantages over other electrolysers, being compact and more able to cope with the intermittent nature of electricity from wind or solar sources, providing the performance and durability necessary for commercial scale systems.

Figure 2: A platinum catalyst at the cathode of PEM electrolyser facilitates the separation of water, releasing hydrogen

PEM fuel cells

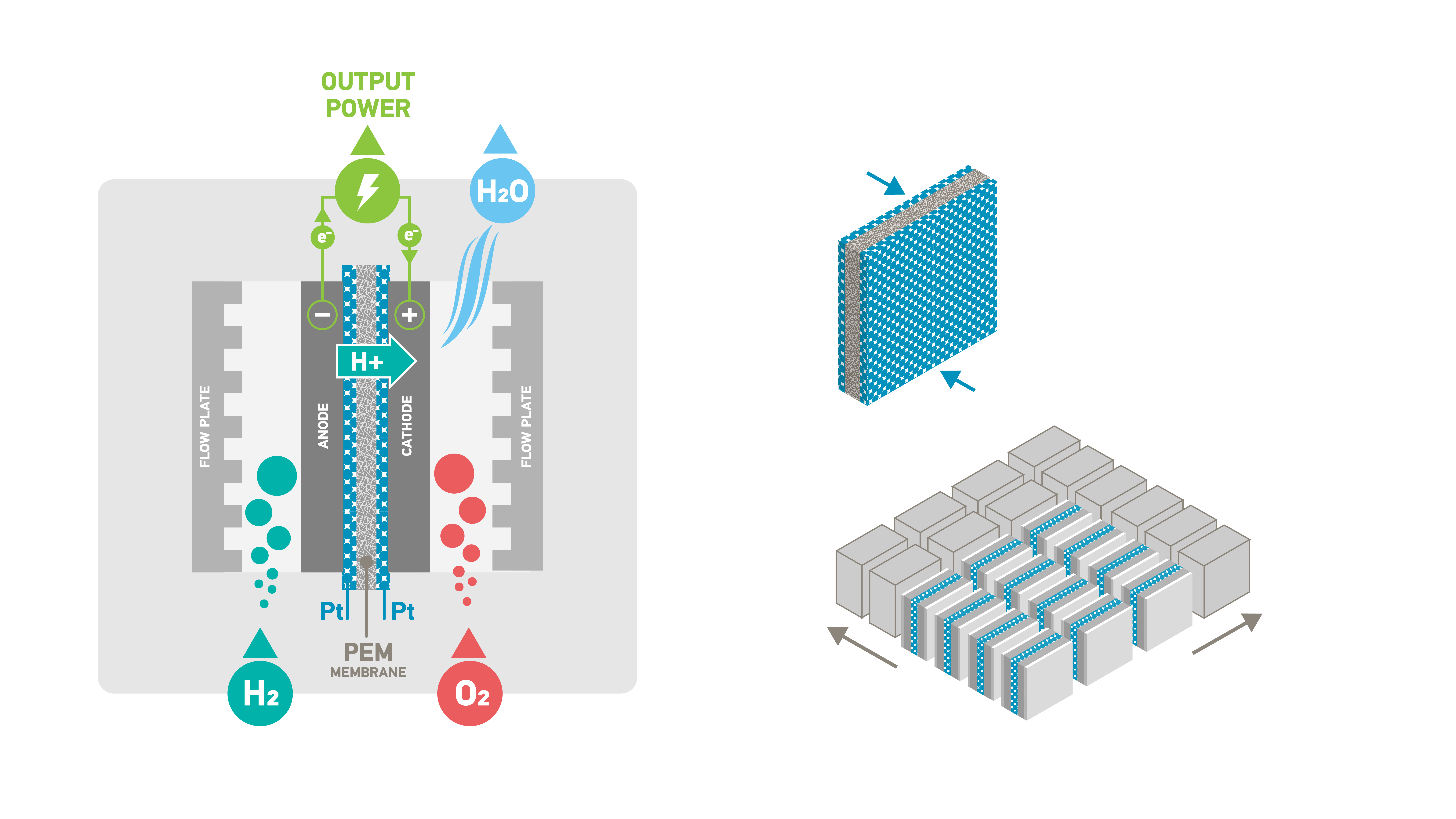

Electrolysis of water consumes electricity to produce hydrogen and oxygen. The PEM fuel cell works in reverse and here hydrogen and oxygen are combined to generate electricity, with heat and water as the only by-products. Molecules of hydrogen and oxygen react and combine using a PEM which is coated with a platinum catalyst (figure 3).

Figure 3: Inside a PEM fuel cell electricity is generated through an electrochemical reaction facilitated by a platinum catalyst at both the anode and cathode

Platinum is especially suited as a fuel cell catalyst as it enables the hydrogen and oxygen reactions to take place at an optimal rate, while being stable enough to withstand the complex chemical environment within a fuel cell, as well as the high electrical current density, performing efficiently over the long-term.

Fuel cells share many of the characteristics of a battery – silent operation, no moving parts and an electrochemical reaction to generate power. However, unlike a battery, PEM fuel cells need no recharging and will run indefinitely when supplied with hydrogen. A fuel cell can have a battery as a system component to store the electricity it is generating.

A single fuel cell alone only produces a few watts of power; therefore, several fuel cells can be stacked together to create a fuel cell stack. When combined in stacks, the fuel cells’ output can vary greatly, from just a few kilowatts of power to multi-megawatt installations. Fuel cell stacks that do not use platinum-based PEM technology need to be much bigger to achieve similar power outputs. This makes platinum essential to the efficiency of end-user mobile applications and its use ensures that the fuel cells are compact enough for FCEVs.

PEM fuel cells applications

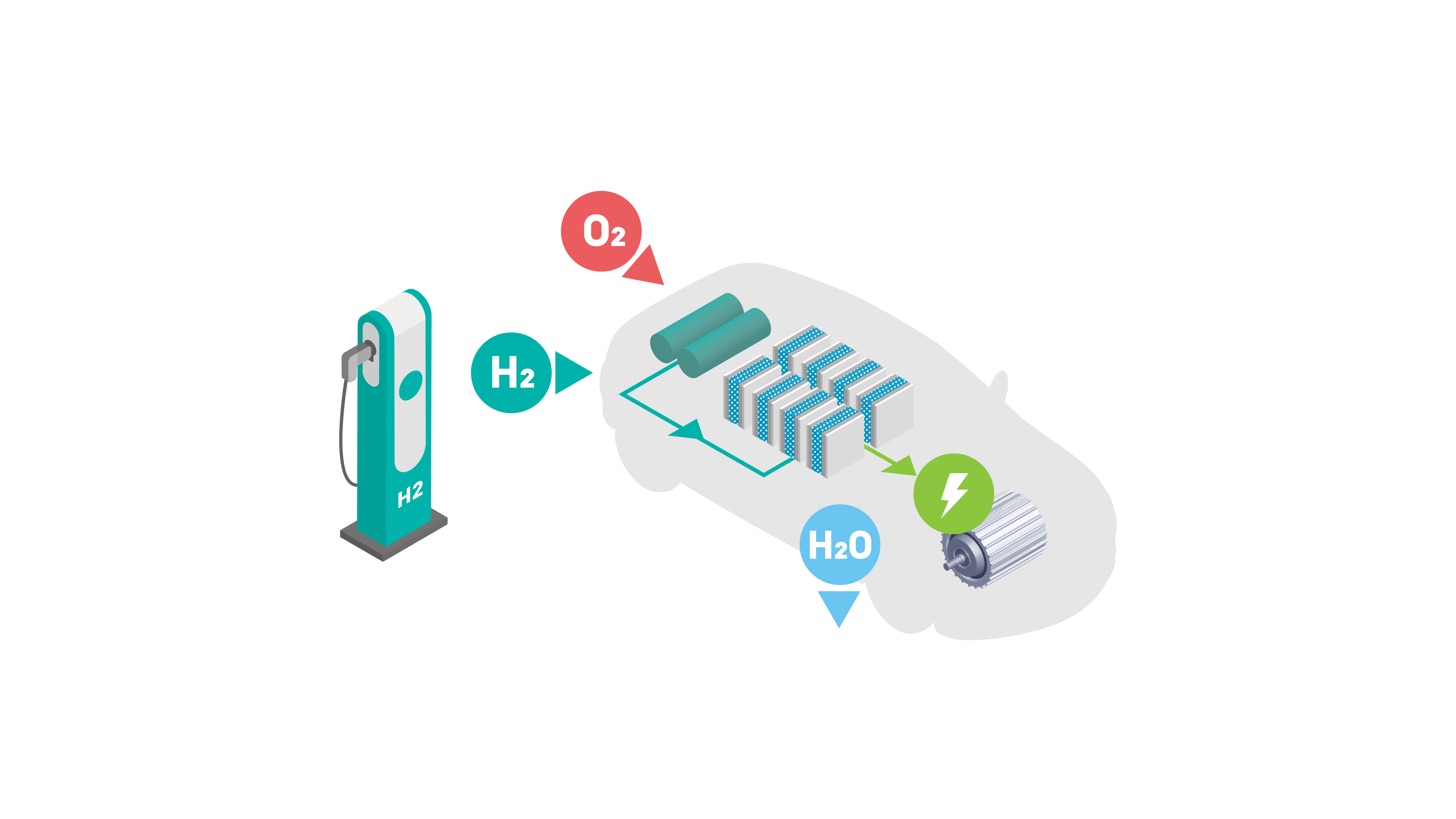

Hydrogen fuel cells can power a range of applications, providing energy to homes and backup power to businesses, for example data centres. Platinum-based hydrogen fuel cells are especially suited to providing fossil-free electric mobility in FCEVs and are already being used to move goods across supply chains – from hydrogen-powered trucks to fork-lift trucks moving goods around a warehouse. When fuelled by green hydrogen, FCEVs offer ‘well to wheel’ emissions-free transport (Figure 4).

Passenger transportation is also using fuel cells, with the numbers of hydrogen-fuelled buses, trams and trains growing globally. In addition, shipping and aviation are turning to hydrogen fuel cells as they look to decarbonise.

Many of the world’s leading automotive companies are developing, or have developed, platinum-based FCEVs as a preferred technology in response to the challenge of improving air quality and reducing tail-pipe emissions to zero.

FCEVs combine the emissions-free driving of battery electric vehicles with the quick refuelling times and range of traditional gasoline or diesel vehicles. FCEVs have a weight advantage over BEVs which is especially significant in heavy-duty applications as it means less of the payload is sacrificed to accommodate the weight of the battery.

Figure 4: When fuelled by green hydrogen, FCEVs offer ‘well to wheel’ emissions-free transport

Key drivers behind growth in PEM technologies and platinum demand

Global action on climate change has accelerated. Over ninety countries, representing more than 80 per cent of the world’s GDP, are now committed to net zero targets.

The 2021 Glasgow Climate Pact, agreed by nearly 200 participating countries in the closing stages of COP26, is a global agreement to accelerate action on climate change this decade. It consolidates aspects of the 2015 Paris Agreement, keeping the possibility of limiting temperature rise to 1.5°C alive, a goal that is increasingly viewed as necessary to mitigate the effects of climate change. Significantly, the Glasgow Climate Pact is the first ever climate deal to explicitly plan to reduce the use of fossil fuels, although it stopped short of making a commitment to phase them out altogether at this stage.

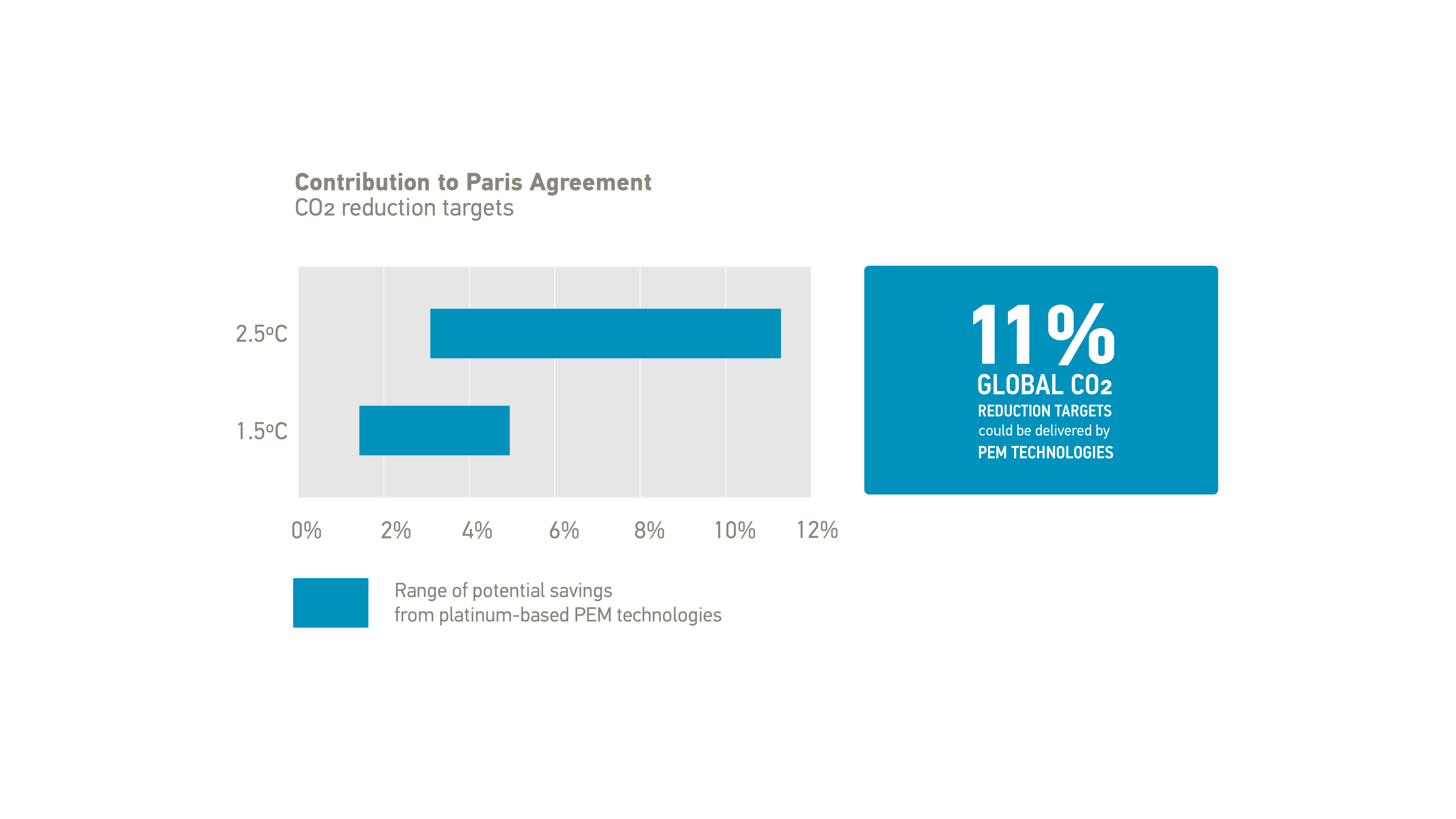

WPIC research indicates that, given proposed PEM electrolyser build-out, platinum’s role in enabling the achievement of global decarbonisation targets could be highly significant. In fact, if fully deployed in line with current targets, platinum-based PEM technology could deliver up to 11 per cent of global CO2 emissions-reduction targets as set out in the Paris Agreement by 2030 (figure 5).

Figure 5: PEM technologies can contribute meaningfully to emissions reduction targets as set out in the Paris Agreement

As climate change commitments are gaining momentum, the use of hydrogen is increasingly regarded as a key pillar of the energy transition (figure 6). Over 30 countries now have hydrogen strategies in place, notably well advanced are those of the US and the EU.

Figure 6: Markets for platinum-based PEM technologies are growing

Of key significance is the US Inflation Reduction Act (IRA), 2022, which is considered a gamechanger for the growing green hydrogen sector. By offering a US$3 per kilogram tax credit for lower carbon hydrogen, subject to certain requirements, it is expected to make green hydrogen produced in the US the most cost competitive in the world. At the same time, the IRA also includes a variety of grants supporting the domestic production of clean transportation technologies, including FCEVs.

Further, the US government released its National Clean Hydrogen Strategy earlier this year, with the stated ambition of enabling multi-giga-watt scale electrolyser manufacturing capacity. In parallel, the US’s Infrastructure Investment and Jobs Act (IIJA), enacted on 15 November, 2021, has a variety of initiatives to stimulate new markets for clean hydrogen, including US$1 billion of funding for a clean hydrogen electrolysis programme, aimed at improving the efficiency and cost-effectiveness of electrolysis technologies by supporting the entire innovation chain—from research, development, and demonstration to commercialisation and deployment to enable US$2/kg clean hydrogen from electrolysis by 2026. The IIJA also provides US$8 billion of funding for the provision of Regional Clean Hydrogen Hubs.

As part of its energy independence strategy developed in the wake of the Russian invasion of Ukraine, the EU is deploying its “REPowerEU: Joint European action for more affordable, secure and sustainable energy” plan. Among other actions, REPowerEU calls for the creation of a “Hydrogen Accelerator” to develop integrated infrastructure, storage facilities and port capacities. It estimates that, with the right investment, green hydrogen could replace between 25 and 50 billion cubic metres per year of imported Russian gas by 2030. This would require a doubling of the five million tonnes of green hydrogen production already targeted for 2030 under the European Green Deal, bringing the new target to 10 million tonnes. It is expected that the balance would come from imports of green hydrogen.

Meanwhile, plans in China under its NEV Industry Development Plan & Energy Saving and New Energy Vehicle Technology Roadmap 2.0 are helping to stimulate the market for FCEVs. By 2035, the market share of NEVs in China is expected to exceed 50 per cent, with the number of FCEVs reaching around one million.

While PEM electrolysers are a key technology to produce green hydrogen, fuel cells have higher platinum loadings and are expected to be a far bigger driver of hydrogen-linked demand for platinum. In 2023 demand from fuel cells is estimated to increase by around 24 per cent and PEM electrolyser demand by as much as 129 per cent, albeit from low bases. Throughout the decade and beyond, demand for platinum from PEM technologies is expected to grow substantially and could reach as much as 35 per cent of total annual platinum demand by 2040 (figure 7).

Figure 7: Projected growth in hydrogen-related demand for platinum

This publication is general and solely for educational purposes. The publisher, The World Platinum Investment Council, has been formed by the world’s leading platinum producers to develop the market for platinum investment demand. Its mission is to stimulate investor demand for physical platinum through both actionable insights and targeted development, providing investors with the information to support informed decisions regarding platinum and working with financial institutions and market participants to develop products and channels that investors need.

The research for the period since 2019 attributed to Metals Focus in the publication is © Metals Focus Copyright reserved. All copyright and other intellectual property rights in the data and commentary contained in this report and attributed to Metals Focus, remain the property of Metals Focus, one of our third-party content providers, and no person other than Metals Focus shall be entitled to register any intellectual property rights in that information, or data herein. The analysis, data and other information attributed to Metals Focus reflect Metals Focus’ judgment as of the date of the document and are subject to change without notice. No part of the Metals Focus data or commentary shall be used for the specific purpose of accessing capital markets (fundraising) without the written permission of Metals Focus.

The research for the period prior to 2019 attributed to SFA in the publication is © SFA Copyright reserved.

This publication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. With this publication, neither the publisher nor its content providers intend to transmit any order for, arrange for, advise on, act as agent in relation to, or otherwise facilitate any transaction involving securities or commodities regardless of whether such are otherwise referenced in it. This publication is not intended to provide tax, legal, or investment advice and nothing in it should be construed as a recommendation to buy, sell, or hold any investment or security or to engage in any investment strategy or transaction. Neither the publisher nor its content providers are, or purports to be, a broker-dealer, a registered investment advisor, or otherwise registered under the laws of the United States or the United Kingdom, including under the Financial Services and Markets Act 2000 or Senior Managers and Certifications Regime or by the Financial Conduct Authority.

This publication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor. You are solely responsible for determining whether any investment, investment strategy, security or related transaction is appropriate for you based on your investment objectives, financial circumstances, and risk tolerance. You should consult your business, legal, tax or accounting advisors regarding your specific business, legal or tax situation or circumstances.

The information on which this publication is based is believed to be reliable. Nevertheless, neither the publisher nor its content providers can guarantee the accuracy or completeness of the information. This publication contains forward-looking statements, including statements regarding expected continual growth of the industry. The publisher and Metals Focus note that statements contained in the publication that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect actual results and neither the publisher nor its content providers accept any liability whatsoever for any loss or damage suffered by any person in reliance on the information in the publication.

The logos, services marks and trademarks of the World Platinum Investment Council are owned exclusively by it. All other trademarks used in this publication are the property of their respective trademark holders. The publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the publisher to any rights in any third-party trademarks.

© 2022 World Platinum Investment Council Limited. All rights reserved. The World Platinum Investment Council name and logo and WPIC are registered trademarks of World Platinum Investment Council Limited. No part of this report may be reproduced or distributed in any manner without attribution to the publisher, The World Platinum Investment Council, and the authors.

Related links

World Platinum Investment Council - WPIC®

World Platinum Investment Council - WPIC®