TOCOM Energy

Japan Markets: 2023 Summary and 2024 Outlook

EQUITIES: Significant rise in 2023 to new highs in 2024

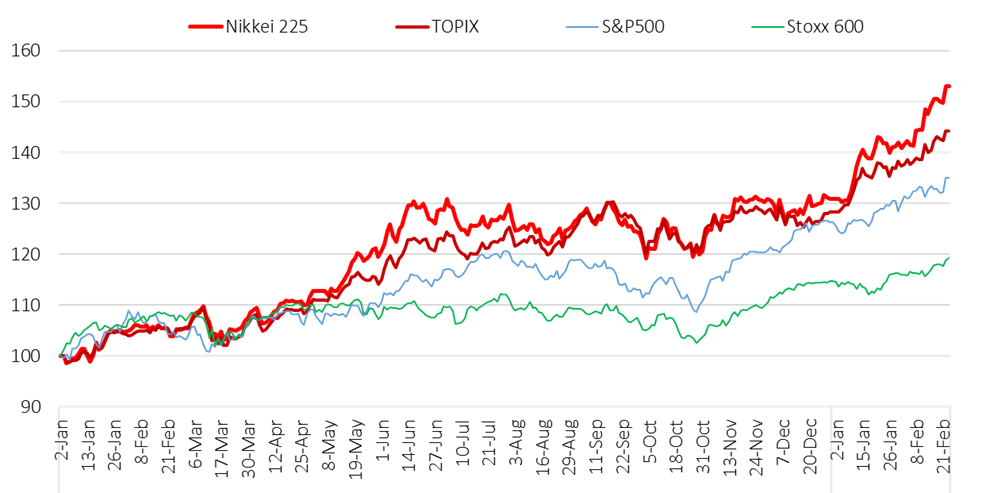

The Japanese stock market opened soft in 2023. At the beginning of the year, the yen appreciated to 129 against the dollar for the first time in seven months on speculation that the Bank of Japan (BOJ) would revise its easing policy. In March, stock prices were headed downward due to growing concerns about financial systems following the collapse of Silicon Valley Bank, a major US bank. Meanwhile, the Tokyo Stock Exchange (TSE) asked listed companies to take “Action to Implement Management That Is Conscious of Capital and Stock Price”, which resulted in announcements of planned operational changes to boost corporate value and an increase in share buybacks. Domestic investors and foreign activists took note. In May 2023, Berkshire Hathaway, the US investment firm led by well-known investor Warren Buffett, announced it would buy more shares of Japanese trading companies, attracting attention to Japanese stock investment. By year end, the yen’s depreciation to 151 to the dollar prompted investment of export-related companies. Moreover, expectations for the new NISA in 2024 and multiple other catalysts for Japanese stocks combined to push the Nikkei Stock Average up 28.2% (JPY 7369.67) and TOPIX up 25% over the year to their highest level since the burst of the Bubble Economy.

[Source] Bloomberg, Nikkei, JPX

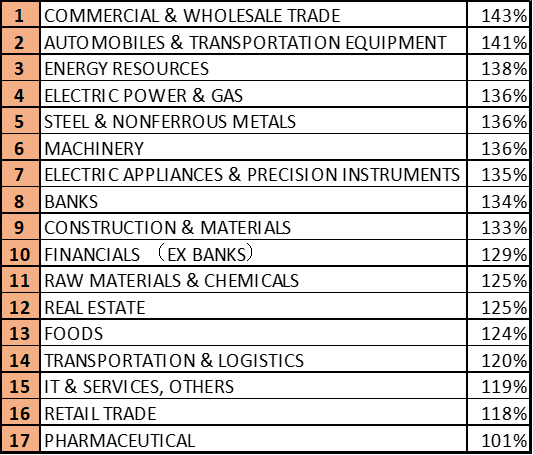

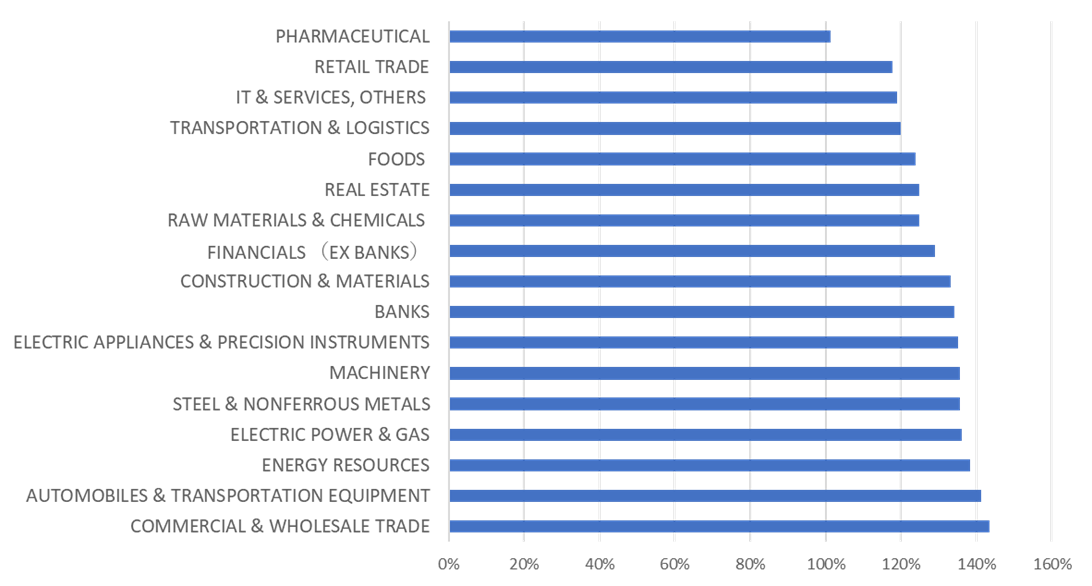

The chart below shows the year-over-year growth among TOPIX sector indexes between YE 2022 (set at 100%) YE 2023. At the end of 2023, the top performing sectors were Commercial & Wholesale Trade, Automobiles & Transportation Equipment, and Energy Resources.

INTEREST RATES: Japan’s monetary policy toward 2024

Since 2013, BOJ has endeavored via an unparalleled monetary easing policy to stimulate investment and consumption through massive purchases of Japanese government bonds (JGBs). In January 2016, BOJ implemented a negative interest rate policy. In September of the same year, the Bank introduced yield curve control (YCC), by which it controls short- and long-term interest rates through market operations, combined with long-term interest rate targeting (inflation-overshooting commitment). These efforts have kept long-term interest rates near 0%. In April 2023, new BOJ Governor Kazuo Ueda took office and put in place several changes while support monetary easing for the time being. In July he announced a revision to YCC, effectively expanding the target long-term interest rate (10-year JGB yield) from 0.5% to 1%. In October, the long-term interest rate was allowed to exceed the 1% target to a certain degree, thereby making YCC operation even more flexible and capable of responding to both upside and downside risks.

BOJ policies were validated by the “Outlook for Economic Activity and Prices (Outlook Report)” released by BOJ on January 24, 2024, which stated that “Japan’s economy has recovered moderately” (https://www.boj.or.jp/en/mopo/outlook/gor2401b.pdf). The report noted that business fixed investment (+12.6% YoY, BOJ Tankan December) and employment/income situation (unemployment rate: 2.4%, -0.1% MoM, Ministry of Internal Affairs and Communications (MIC), Jan. 30, 2024) have improved and that private consumption (2.9% real decline, 0.3% nominal increase in MoM, MIC, Jan. 9, 2024) is expected to continue to increase moderately despite the impact of rising prices (+2.3% YoY excluding fresh food, MIC, Jan. 19, 2024).

COMMODITIES: Rising prices

The 2023 gold market set a record in Japan, with gold futures listed on the Osaka Exchange (OSE) reaching their highest price since 1982. The market was allegedly fueled by investments in gold futures, which are backed by real assets that do not carry interest rates, on the assumption that the US Federal Reserve Board will end its interest rate hikes or shift to rate cuts within the next year. The demand from central banks around the world and inquiries from retail investors due to heightened geopolitical risks were also significant factors.

Platinum prices surged at the beginning of 2023 due to power shortages in South Africa and global financial instability. The market in Japan peaked in April, surpassing the previous high set in November 2022. Demand for platinum is soaring as automakers move to replace palladium with cheaper platinum under a global mandate to reduce carbon output.

DERIVATIVES: 2023 performance, new products, and changes in 2024

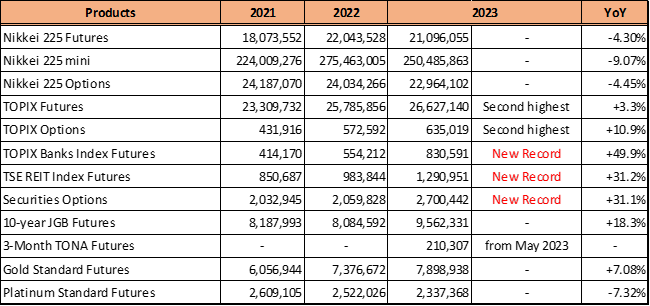

Several products recorded their highest and second-highest trading volumes in the 2023 futures market in Japan. The TOPIX Banks Index Futures and TSE REIT Index Futures posted record-high trading volumes due to the focus on interest rate trends, and trading in Securities Options reached their highest volume ever. Products with “NEXT FUNDS Nikkei 225 Exchange Traded Fund” as the underlying asset accounted for most of the trading volume in 2023.

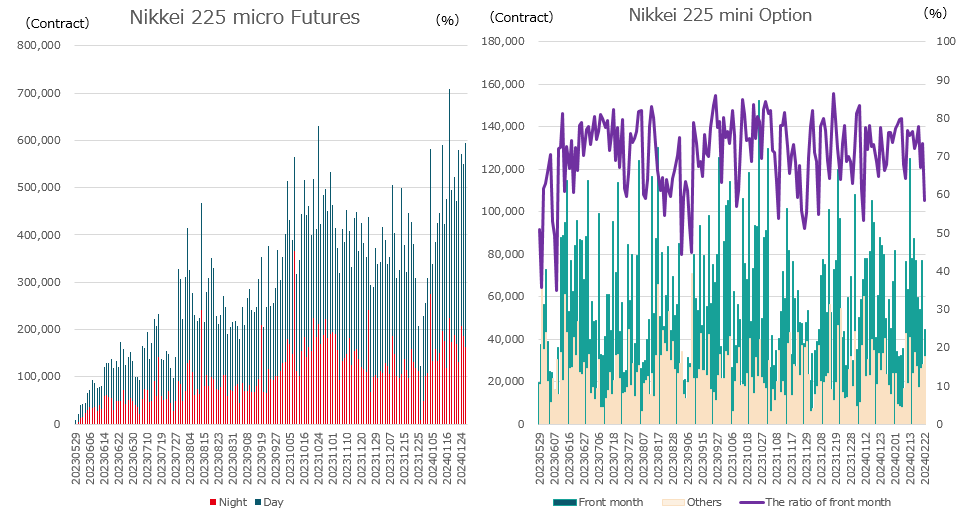

Nikkei 225 micro Futures and Nikkei 225 mini Options, both newly listed in May 2023, marked significant milestones. Nikkei 225 micro Futures reached a record high trading volume of 354,667 contracts (709,334 round trip) on Jan. 17, 2024, due to the rising market and Nikkei 225 mini Options showed stable trading volume.

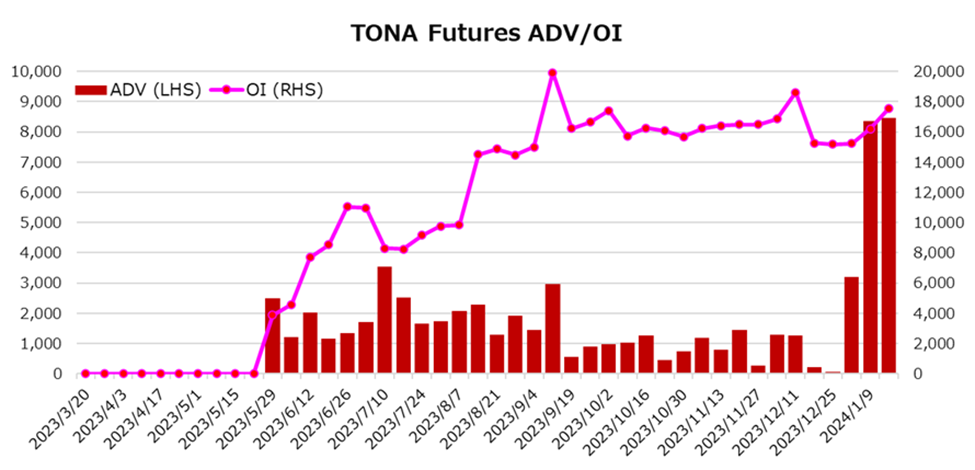

TONA Futures

Three-month TONA Futures (Tokyo Over-Night Average rate) was also newly listed in May 2023. In preparation for a movement in the short-term interest rate market, the product recorded its greatest monthly trading volume (119,839 contracts) in January 2024. Domestic institutional investors are increasingly participating in the market in anticipation of higher trading volume and interest rate trends.

For more information the products listed in May 2023, see https://market-news-insights-jpx.com/ose/article004446/

Carbon credit market

On October 11, 2023, TSE launched its carbon credit market as planned. The market has got off to a strong start: in the eight days between October 11 and 20, a total of 10,044 t-CO₂ credits were traded among five categories. Of these, 7,667 t-CO2 were in the “renewable energy (electricity)” category. TSE introduced a Trial Market Maker Scheme on November 27.

For more information, see https://market-news-insights-jpx.com/tse/article005977/ and https://market-news-insights-jpx.com/tse/article006279/.

VaR (Value at Risk)

Beginning November 6, 2023, Japan Securities Clearing Corporation (JSCC), a JPX company, applied a new margin calculation method to futures and options contracts. The new method, known as VaR (Value at Risk) replaces the previous SPAN🄬 calculation (Standard Portfolio Analysis of Risks), and the margin required to be deposited by member clearing brokers. The new calculation method is intended to shore up protections for both investors and clearing brokers by controlling sharp fluctuations in margin levels and improving risk management.

For more information, see https://market-news-insights-jpx.com/insights/article006195/.

Extension of trading hour in 2024

Starting on November 5, 2024, the current trading hours will change due to a system replacement of the cash equity market. Trading hours for the cash market will be extended by 30 minutes to 15:30. Trading hours on the derivatives market will be moved back by 30 minutes, with the day session ending at 15:45 and the night session starting at 17:00.

For more information, see https://market-news-insights-jpx.com/tse/equities/article004833/.

Looking ahead in 2024, we expect individual investors to increase cash flow via the new NISA, listed companies to respond to the TSE’s request to increase corporate value, and foreign investors to maintain their interest Japanese markets. JPX plans to implement various reforms in order to continue providing stable and attractive markets.