Insights

Japanese tax exempted program (NISA) Renewal 2024

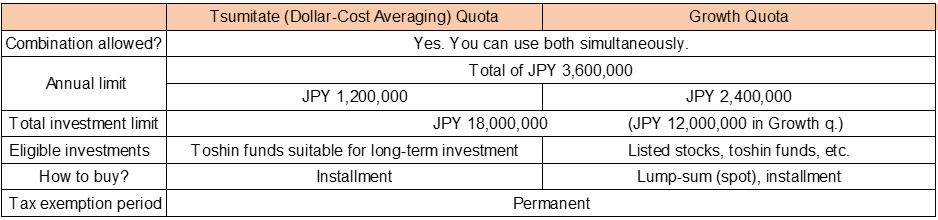

Japan’s small investment tax exemption program, known as NISA (Nippon Individual Saving Account), will be overhauled in January to offer expanded benefits. Until the end of 2023, NISA provides individual investors a five-year tax exemption on dividends and capital gains derived from investments of up to JPY 1.2 million per year in listed shares and mutual funds. Starting in 2024, NISA gives permanent tax exemptions to individuals on annual investments up to JPY 3.6 million per year on total investments up to JPY 18 million. The change seeks to encourage investment over savings and increase the proportion of household funds diverted from savings to income-producing investments.

NISA’s revision is an integral part of Japan’s Doubling Asset-based Income Plan which seeks to double the asset income of Japanese households by encouraging a shift from cash and deposits to securities, and increasing overall investments in stocks, mutual funds, and other securities. Under the plan, Japan’s government hopes to build individual investment experience by doubling the total number of NISA accounts from the current 17 million to 34 million in five years, and to increase investment by doubling total NISA purchases from the current JPY 28 trillion to JPY 56 trillion in five years.

A Japanese version of ISA

NISA was modeled after the UK’s Individual Savings Account (ISA) introduced in April 1999 to address critically low household savings rates. It was also intended to correct an imbalance between the Personal Equity Plan and the Tax-exempt Special Savings Account, two existing preferential tax regimes meant to support asset building. ISA’s success led to a permanent extension of its tax exemption in 2008, which inspired Japan’s move to do the same.

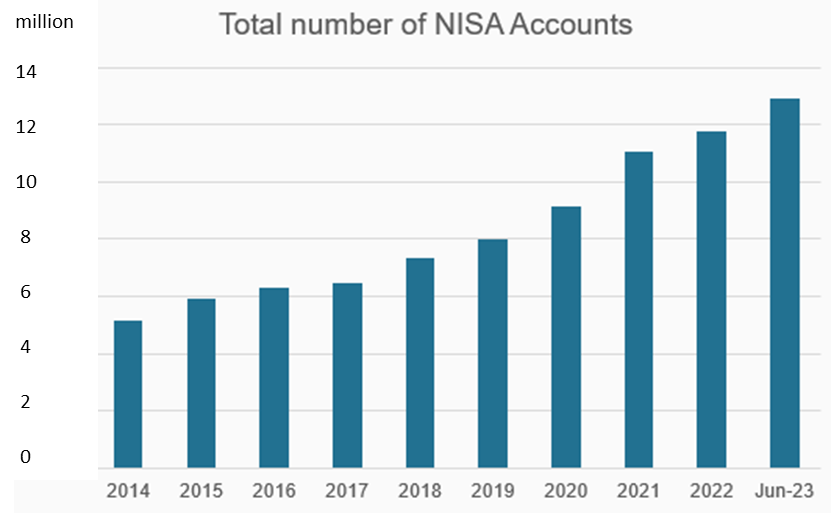

The full-scale launch of Japan’s NISA dates from January 2014. Various tax reforms have been implemented to expand the range of individual investors with the objectives of “supporting stable asset formation by households” and “providing funds for growth”. With so many qualifying investment products to choose from, individual investors have embraced NISA by opening new accounts and increasing investments year by year. (See “Growth in NISA” below.)

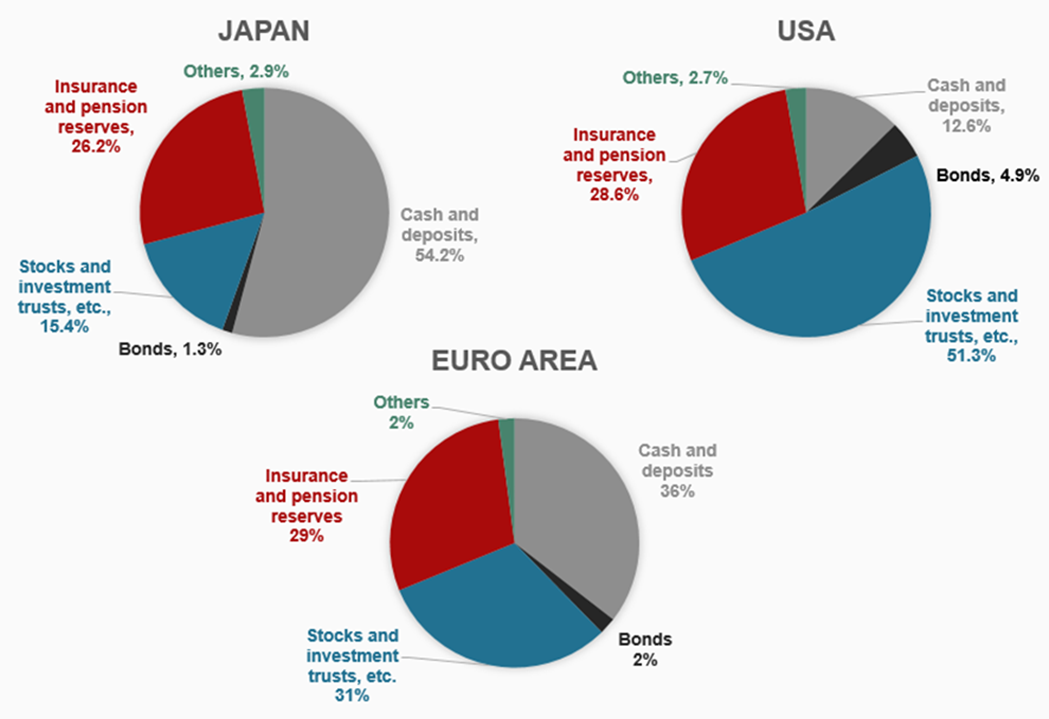

The move to revise NISA was driven by Japan’s continually high ratio of cash and deposits among household assets relative to other countries. As seen below, cash and deposits account for about half of total household assets in Japan, while investment in stocks and other securities is about 15%, which is low compared to Europe and the US. The revised NISA and other programs are aimed at shifting the balance among Japanese household assets.

Growth in NISA

According to the Japan Securities Dealers Association (JSDA), the total number of NISA accounts* opened in Japan has increased steadily since the program was launched in 2014, reaching 12.9 million as of June 2023, an increase of 9.4% over YE 2022. More than half of those opening accounts are inexperienced investors, indicating an increase in the number of newcomers to the investment market.

*There are two types of NISA under the current program: Ordinal NISA with an annual investment contribution limit of JPY 1.2 million and a tax exemption period of five years; and, Tsumitate NISA (Dollar-Cost Averaging NISA) with an annual investment contribution limit of JPY 400,000 but a 20-year tax exemption period. The two NISA categories will be renewed in 2024 as “Growth Quota” and “Tsumitate (Dollar-Cost Averaging) Quota”.

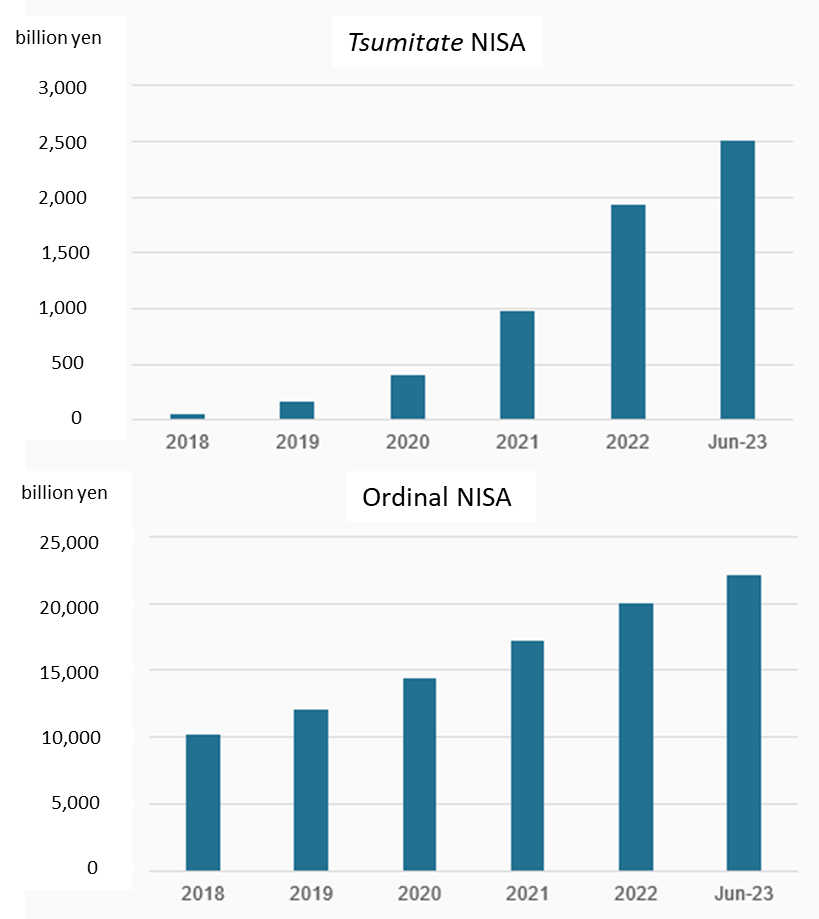

A total of JPY 565.5 billion was invested in Tsumitate (Dollar-Cost Averaging) NISA accounts in the first 6 months of 2023, bringing the cumulative total to JPY 2,504.5 billion, a 29.2% increase over YE 2022. Total purchases in Ordinal NISA accounts were JPY 2,146 billion in the first half of 2023, and the cumulative purchase amount since the start of the program was JPY 22,156.4 billion, an increase of 10.7% from the previous year.

NISA PURCHASE AMOUNT

Popular funds in Tsumitate (Dollar-Cost Averaging) NISA

According to a Nikkei survey on May 30, 2023, Tsumitate (Dollar-Cost Averaging) NISA accounts experienced large inflows into US and global equity funds. Products offered by Mitsubishi UFJ Asset Management, which aims for the lowest investment fee in the industry, are gaining popularity, with five of its top 10 products ranked among the top 10.

TOP 10 BEST-SELLING FUNDS among TSUMITATE (Dollar-Cost Averaging) NISA in LAST 5 YEARS (to April 30, 2023)

![[Source] https://www.nikkei.com/article/DGXZQOUB261BS0W3A520C2000000/](https://market-news-insights-jpx.com/wordpress/wp-content/uploads/2023/12/999.png)

While cash continues to flow unabated into foreign equity funds and others, interest in the Japanese market has grown considerably among domestic and overseas investors. In March 2023, Tokyo Stock Exchange notified its listed companies of its “Request Regarding Measures to Achieve Management Conscious of Capital Cost and Stock Prices”. In this context, Japan Exchange Group will continue its efforts to promote the Japanese market in anticipation of new entries by individual investors once NISA’s revised terms take effect in January 2024.