Insights

Will markets force the BOJ to lift-off?

By Tetsuo Harry Ishihara

A go/no-go decision could come as early as 2024 Q1, officials and bank executives say

A soft landing in the US is current market consensus. But with inflation and wage growth still above target and a hawkish Fed, markets are pricing in “higher for longer” policy rates. Meanwhile, in Japan, the BOJ remains sober after recent tweaks, implying “lower for longer” policy rates. The contrast with US policy is weakening the yen, and markets could pressure the BOJ to “lift-off” from its negative policy rate. Last month, at very different venues, a BOJ official and a mega-bank executive commented about the possibility of a go/no-go decision around 2024 Q1 (Reuters, Kyodo). And on September 6, BOJ policy board member and former economist Hajime Takata said, “Personally, I believe Japan’s economy is finally seeing early signs of achieving the BOJ’s 2% inflation target” (Nikkei).

A US soft landing

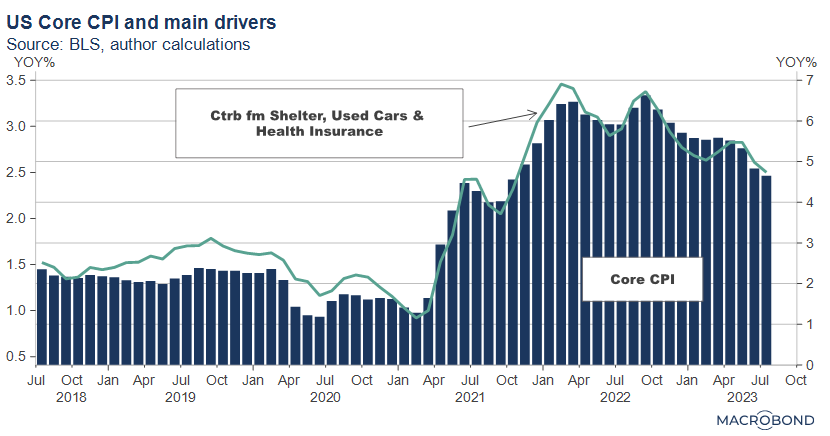

A US soft landing has become consensus in the markets, supported by slowing inflation, job growth and solid consumer and credit markets. The widely followed Core CPI remains above target at 4 to 5 percent but is slowing, led lower by rent (reflected in Shelter), used cars, and technical adjustments to health insurance (detailed in Why US inflation will slow and help the BOJ).

Job growth has been slowing, and for the past 2 months, about half of the growth came from one sector, health care. Part-time job growth outperformed full-time in both months. Yet with labor markets still tight, wage growth of 4 to 6 percent remains well above Chair Powell’s stated target of 3%.

Retail sales, even adjusted for inflation, are slower but resilient, led by online shopping, eating out, and autos. Despite slowing corporate loan demand and tighter lending standards, credit markets still look solid, with good fundamentals and investor demand supporting high yield spreads. Low equity market volatility and falling interest rate volatility are probably helping.

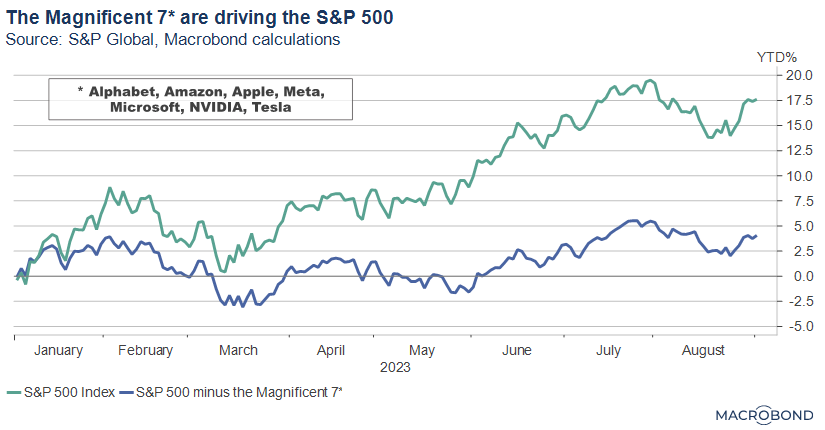

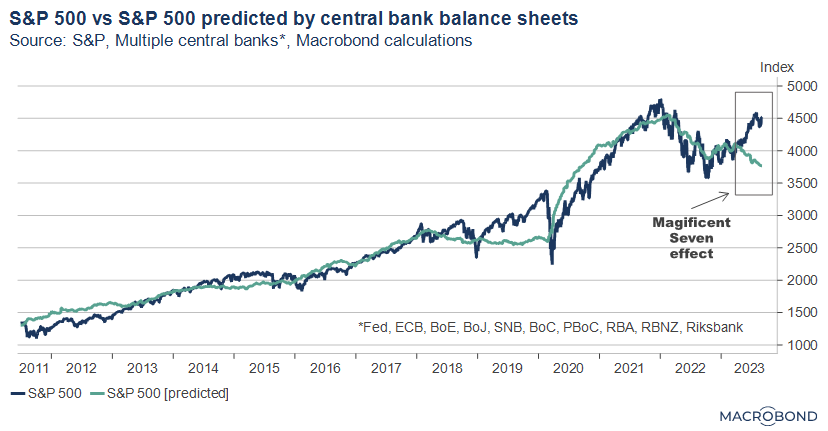

As the next two graphs show, the AI/tech theme in the equity market has also helped market sentiment, with the “Magnificent 7” mega-tech stocks (Alphabet, Amazon, Apple, Meta, Microsoft, NVIDIA, and Telsa) leading the way. Record equity short sellers are now on the retreat[1] according to CME futures, and hedge fund exposure to the Magnificent 7 is reportedly at record highs[2] .

They also appear to be beating the expected downdraft from global quantitative tightening.

Policy outlook

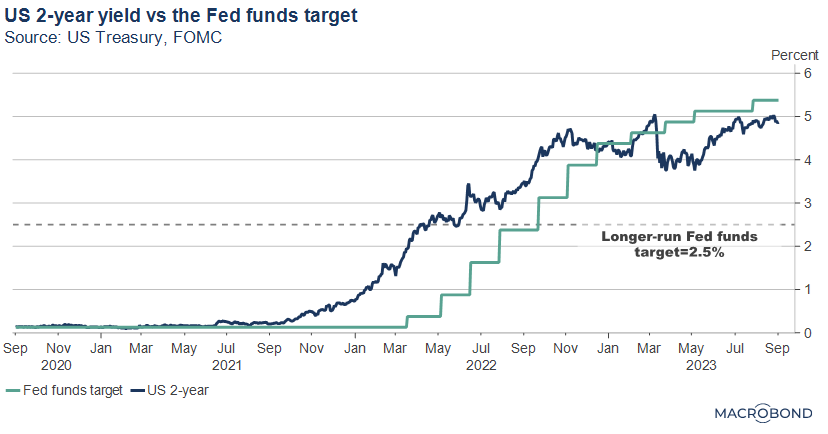

What about rates and the recession outlook? Fed fund futures now imply the Fed is more or less finished for the year, but still price in about 4 cuts next year. Meanwhile, 2-year yields also imply about 4 cuts to come, but they still express “higher for longer” by trading well above the neutral “longer-run” target as of this writing. (Note: 2-year yields largely reflect the expected policy rate averaged over the next 2 years)

Meanwhile, the yield curve remains inverted at record levels, which would normally imply a high probability of a recession instead of a soft-landing. However, recession calls are receding. Researchers point out that the post-2008 “QE” bond purchases by the Fed have suppressed 10-year yields, accelerating the inversion of 2-year versus 10-year yields, leading even the ECB to question the power of that recession signal last month[3] .

Japan’s inflation revolution

As we noted last month in “Japan’s inflation revolution”[4] , Japan appears to be a net beneficiary of inflation. Nominal GDP, wages and corporate revenues are growing at the fastest rate in 30 years, while the global semiconductor shortage has triggered a tech renaissance in Japan. Capex could hit a record soon, spurred by home grown activism to boost price to book ratios, while also boosting potential GDP. The Nikkei 225 remains close to 30+ year highs.

Deflation woes, still?

Yet policymakers still worry about deflation, even with effective inflation over 4%, and a labor market so tight that companies give forward guidance on wage growth[5] . Eg., “We will raise base salaries every year through 2030 ” as we wrote in a previous post, Forward wage guidance vs AI in Japan.

In the western world, such a tight labor market would raise concerns about inflation. However, the BOJ appears to be more lenient, as evidenced by previous BOJ governor Kuroda last year. In a speech in June 2022, he cited concerns about Japan’s “zero-inflation norm”, meaning companies terrified of raising prices and losing market share. That norm was basically a reality for decades. To break it, Kuroda suggested 1) a roughly 2 percent “constant contribution” to CPI from services, supported by goods inflation cyclically fluctuating around 2 percent, and 2) a prolonged period of labor market tightness sustained for a “long period ” [6].

Targets approaching

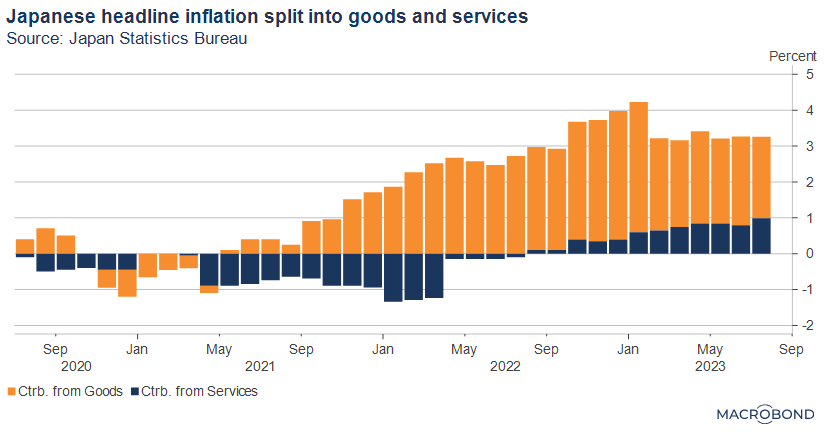

What is the service contribution to CPI now? Versus Kuroda’s 2 percent target, service contribution is RISING, but remains below target at around 1 percent as the next graph shows[7] . Meanwhile, goods contribution is currently around his target of 2 percent but would be closer to around 3 percent if energy subsidies were excluded.

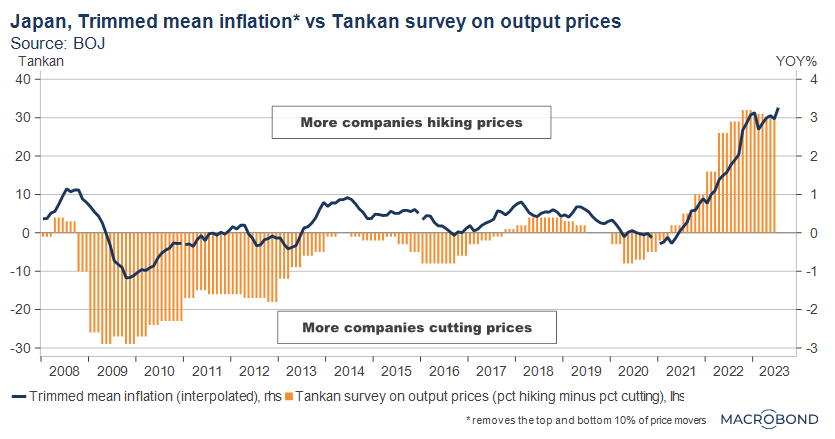

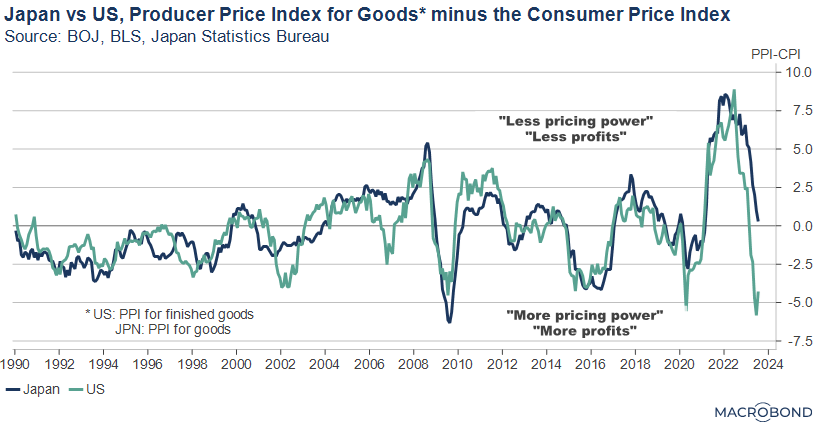

How about the zero-inflation norm? The Tankan corporate survey in the next graph suggests corporates may have BROKEN the norm, and that their behavior is driving the trimmed mean version of inflation, which cuts the top and bottom 10% of price changes to reduce noise. Japan’s rapidly shrinking spread between the producer price index and the consumer price index is yet another sign of increased corporate pricing power.

BOJ’s tweak worked well so far

At the end of July, BOJ Governor Ueda, Kuroda’s successor, effectively raised BOJ’s “yield curve control” cap on 10-year yields from 0.5 percent to 1.0 percent. Interestingly, this sparked corporate bond issuance, as investors found more buyers for long term bonds. A kink in the yield curve at around the 10-year tenor has also disappeared. Thus, it appears that Ueda succeeded with his goal of improving bond market functioning. The smaller 10-year rate differential with the US also slowed the weakening of the yen, which had been driving inflation via import prices of food and energy. Officially, the tweak made yield curve control (YCC) more sustainable.

Lift-off decision in 24Q1?

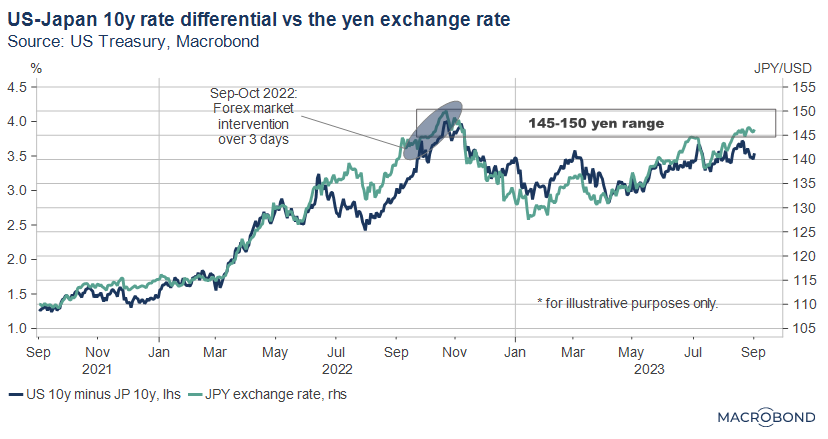

Ueda’s comments since the July YCC tweak suggest the BOJ remains conservative, implying “lower for longer” policy rates. However, the contrast to US policy tends to weaken the yen, eventually fanning import inflation in Japan’s inflation drivers, food and energy – Japan imports about 70% of its calories and 80% of its energy. Thus, the market has started speculating about 1) normalizing BOJ policy, meaning a lift-off from negative policy rates, or 2) another round of foreign exchange market intervention between 145-150 yen, similar to the intervention seen in Fall 2022.

An unusually large hike in the BOJ’s FY2023 inflation outlook from 1.8% in April to 2.5% in July has brought forward expectations about lift-off. On August 30, policy board member and former mega-bank executive Tamura commented that the BOJ’s 2% inflation target is “in sight” and lifting off from negative rates while keeping the policy rate low would still be an accommodative policy [8].

Data to determine whether the 2% inflation target is attainable -making lift-off an option- “could be ready around January to March 2024” he noted. Similarly, on August 16 in an interview with Kyodo News[9] , the head of markets at a different mega-bank said that “a lift-off (normalization) decision could come as early as January to March 2024”. And on September 6, BOJ policy board member and former economist Hajime Takata said, “Personally, I believe Japan’s economy is finally seeing early signs of achieving the BOJ’s 2% inflation target” .[10]

This year’s yen weakening from around 130 to 145 is much less drastic than last year’s move from around 115 to 150. Nevertheless, a prolonged weakening could eventually become a source of “bad” or “cost-push” inflation. A breather will be widely welcomed.

[4] https://market-news-insights-jpx.com/insights/article005508/

[5] https://market-news-insights-jpx.com/insights/article005303/

[6] https://www.boj.or.jp/en/about/press/koen_2022/ko220606a.htm

[7] Former Governor Kuroda was probably referring to Core CPI, meaning Headline CPI excluding fresh food, but the difference with Headline CPI is negligible.

[8] https://jp.reuters.com/article/jp-boj-tamura-idJPKBN3050EM

[9] https://news.yahoo.co.jp/articles/1b94bf888058261bd338112603bc971a540900dd

[10] https://www.nikkei.com/article/DGXZQOUB061L30W3A900C2000000/