OSE Derivatives

Why US inflation will slow and help the BOJ

By Tetsuo Harry Ishihara

US inflation drivers

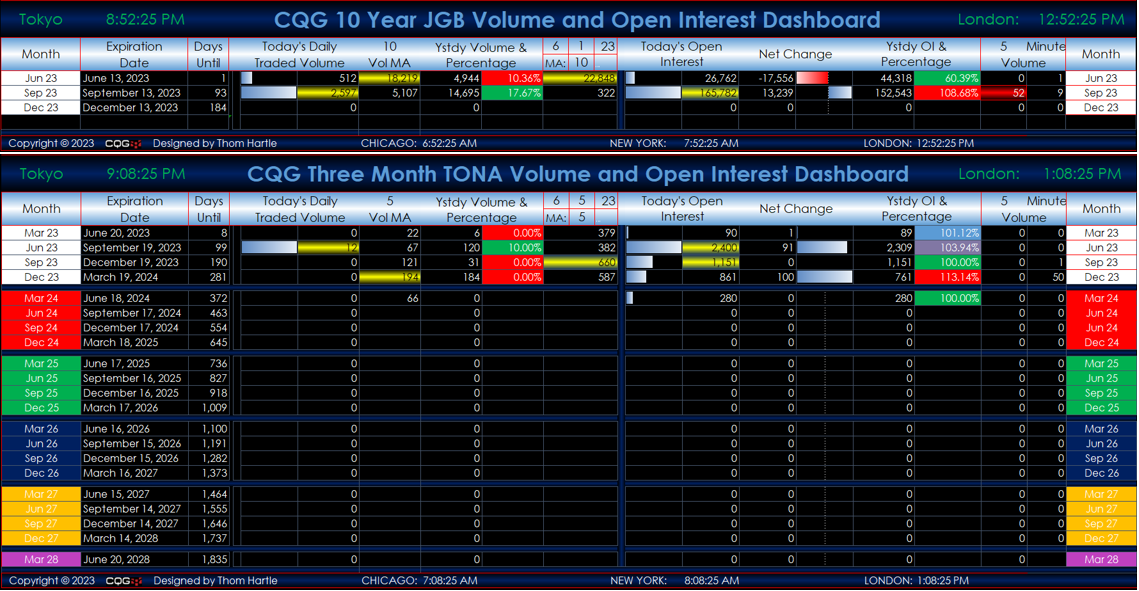

US Core CPI has been slowing, mostly led by goods. As the first chart shows, the biggest drag has been the slowdown in used auto prices. At its peak about a year ago, used auto prices were surging by over 40% year on year, driven by semiconductor shortages in NEW autos. However, as those bottlenecks eased, growth rates have plunged into negative territory. Besides autos, Kansas City Fed data shows supplier delivery times have improved overall, leading to slower goods inflation.

Baton passed to health insurance

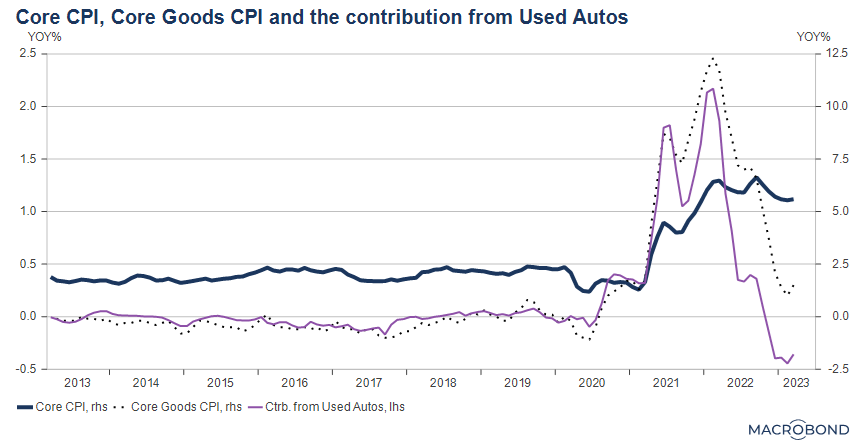

In recent months however, plunging health insurance has become the main drag. From a 30bp positive contribution to Core CPI last September, it will trough at a deeply NEGATIVE contribution this September. It is not that health insurance is getting cheaper, but a reflection of Bureau of Labor Statistics (BLS) updates every October using insurance industry’s retained earnings (retained profits) – thus Septembers tend to be the turning point as the dots in the next chart show.

The current plunge mostly reflects adjustments for the “quality” of the insurance, or “bang for the buck”. Similar quality adjustments, known as hedonic adjustments, are made for televisions and computers. The bang-for-the-buck logic means lower retained earnings=more benefits paid out=more bang=lower Core CPI.

Upcoming drag from rent

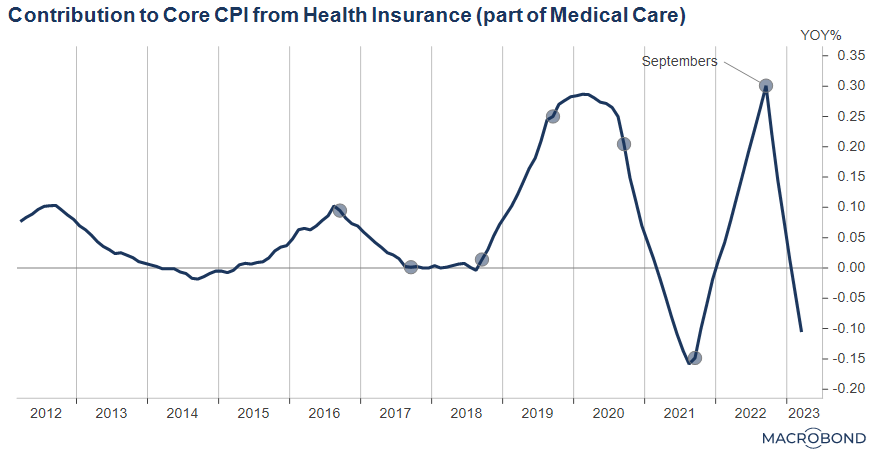

According to Chair Powell and Cleveland Fed research, another upcoming drag should come from rent related items, which feed into the Shelter line. Shelter makes up approximately 40% of Core CPI and has by far the largest weight. However, the data is very backward looking, and heavily affected by EXISTING tenant leases. As the next chart shows, Fed research revealed that inflation data for NEW tenant leases have hooked down, and that NEW leases lead the BLS data by about a year. Thus, a sharp slowdown in Shelter should appear later this year, dragging Core CPI down by a point or two. Core PCE will also be affected via the near equivalent Housing line, but to a lesser extent as the weight of Housing is approximately 20%.

How about inflation in Japan?

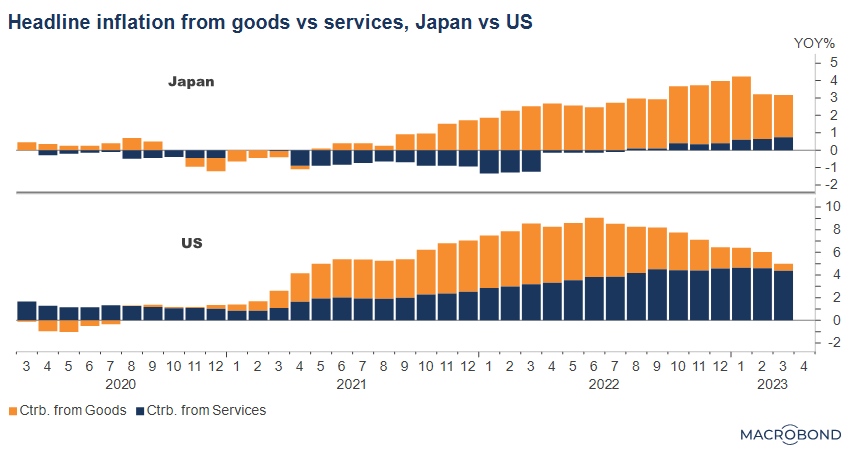

Switching to headline CPI for easier comparisons, Japanese Statistics Bureau data vs BLS data show that inflation in Japan is largely led by GOODS. As the next chart shows, this is in contrast to US inflation where goods have hooked down and SERVICES dominate. The low service inflation in Japan has been driven by decades of low wage growth, but according to the BOJ this may change – wages this year are set to rise at the highest rates in 30 years (detailed in our last post, “Sustainable monetary easing and record wage hikes” – links attached at the end of this article). Meanwhile, the services component in the US is driven by strong rent growth, while rent growth in Japan has hovered around zero since 2000.

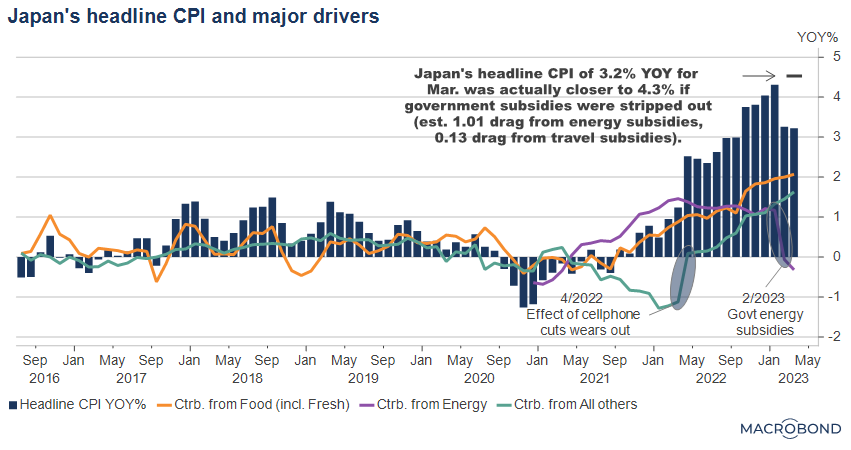

Food, not used autos

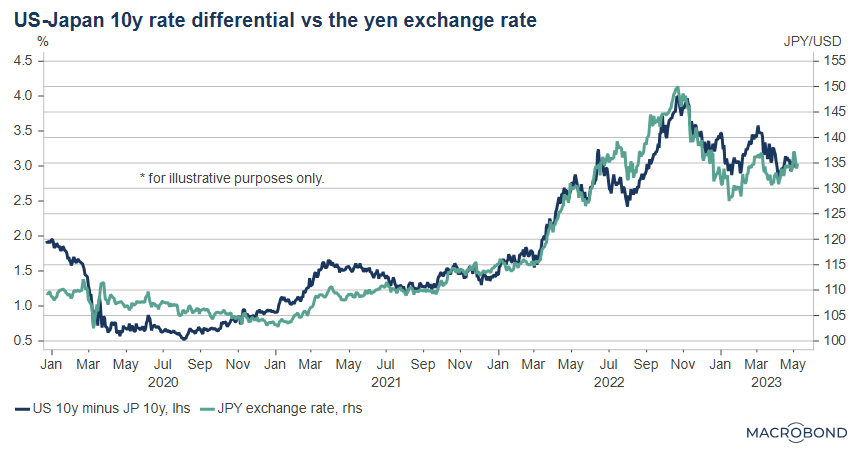

Post-corona, Japan’s goods inflation was initially led by Energy but is currently led by Food, especially imported food. As Japan imports about 90% of its energy and 70% of its calories, a weaker yen aggravated energy and food prices post Ukraine. The weaker yen was driven by a widening 10-year interest rate differential with the US. Thus, consumers blamed the BOJ for maintaining ultra loose policies as the Fed tightened. Since the BOJ tweaked its yield curve control policy in December[1] , the yen has strengthened, helping to tame inflation.

[1] For details, please see either of the related posts at the end of this article

Massive energy subsidies

Besides that tweak, another recent downward driver has come from the government’s massive energy subsidies of 15 trillion yen (about USD 115 billion). These kicked in from around February, just in time for important local elections in late April. As indicated in the chart, they so far have shaved off over 1% from inflation in February and March, mostly in the form of lower utility bills for consumers. A slowdown in imported energy prices and the stronger yen is also helping.

Reverse “J” inflation outlook

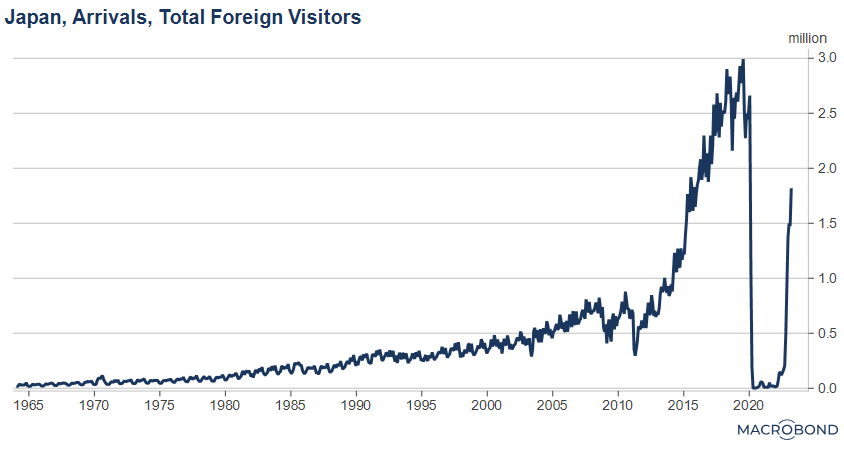

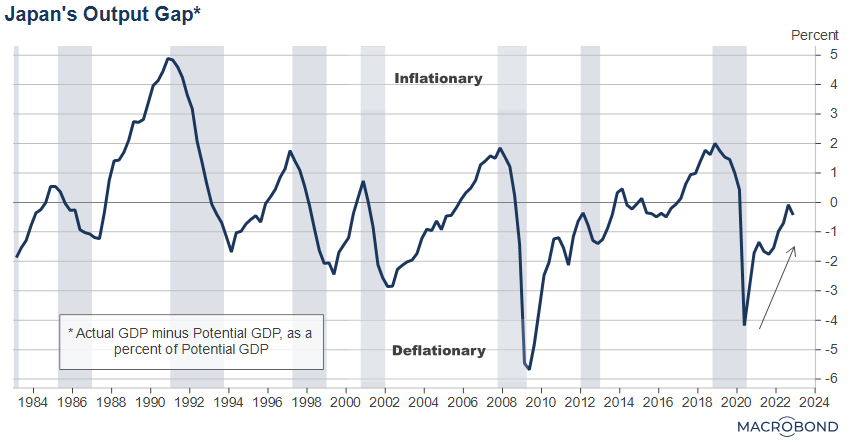

BOJ policy focuses on their version of Core CPI, defined as Headline CPI excluding fresh food (but including energy). Based on comments from Governor Ueda after the policy meeting on April 27-28, their inflation outlook would look like a reversed “J” (not a “U” or a “V”)[2] . Inflation is expected to slow through September on the back of slower import costs, a stronger yen and the subsidies. However, as the two following charts imply, green shoots are expected to push inflation back UP later in the year. Foreign visitors to Japan have rebounded strongly, helping close the output gap from being deflationary towards being inflationary. That growth, combined with record wage growth, is expected to hook inflation back up from October onwards, but NOT all the way back. Put another way, the BOJ is hoping that the current bout of “bad” cost-push inflation will change to “good” demand-pull inflation [3].

[2] The reversed “J” analogy is the author’s, not the BOJ’s

[3] For details, please see either of the related posts at the end of this article

Why slower US inflation helps

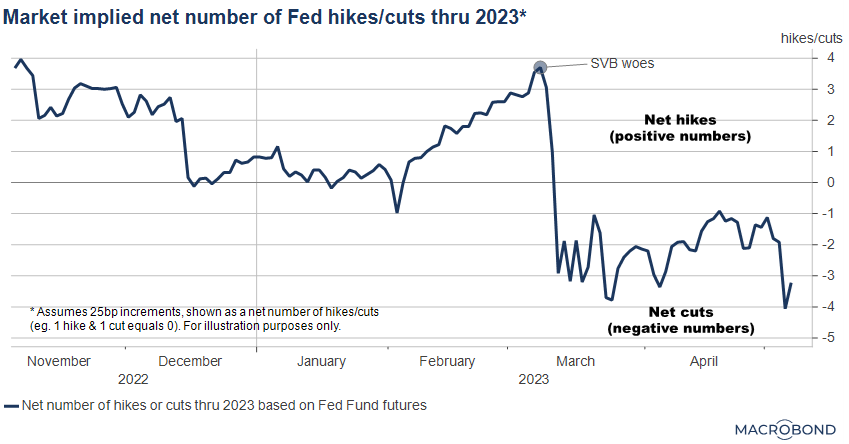

By lowering or at least capping US long term rates, the US inflation slowdown should help the BOJ via a stronger yen from a tighter US-Japan rate differential. Uncertainty around credit conditions stemming from the recent US small bank failures would lower US rates as well. In fact, after the Silicon Valley Bank crisis in early March, the market went from implying rate hikes to rate cuts, perhaps implying that credit is a bigger driver of US rates than inflation or jobs now. Importantly, the May FOMC statement even hinted at a PAUSE in hikes, which will prevent the differential from widening again. (In theory, long term rates are driven by market expectations of the average monetary policy rate over the period)

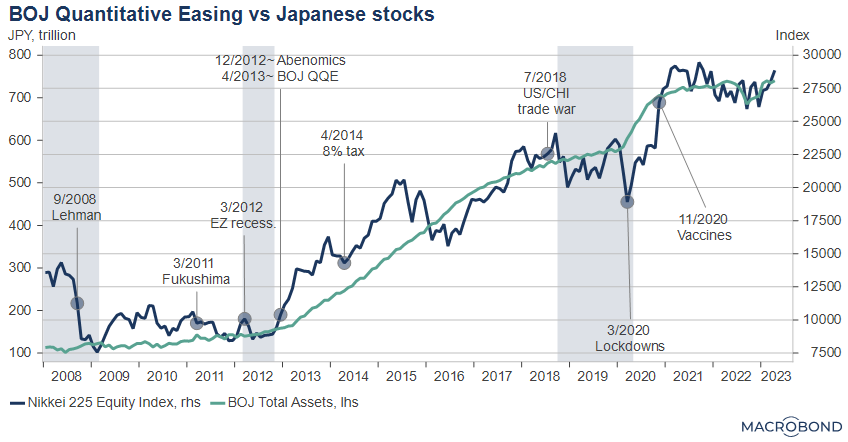

Why does a stronger yen help again? As we implied earlier, a stronger yen will cut import prices, including food and energy, the important drivers of “bad” inflation. Of course, a severe strengthening of the yen could hit Japanese stocks, but Ueda has implied that easy policies will continue until “good” inflation has been attained. Although market functioning remains a challenge [4] , the priority is to nurture the green shoots, ie. the higher wages, the foreign visitors, and the output gap improvement. It also means that Japan’s financial markets will continue to be supported by BOJ policies.

[4] For details, please see either of the related posts at the end of this article

Related posts from this author:

“Sustainable monetary easing and record wage hikes”, April 3, https://market-news-insights-jpx.com/ose/article004638/

“As Ueda takes the helm of the Bank of Japan, do record wage hikes finally portend ‘good inflation?’”, April 5, https://www.macrobond.com/blog/as-ueda-takes-the-helm-of-the-bank-of-japan-do-record-wage-hikes-finally-portend-good-inflation