CONNEQTOR Starts Providing Direct Connection With NRI’s Order Management System, SmartBridge Advance (SBA)

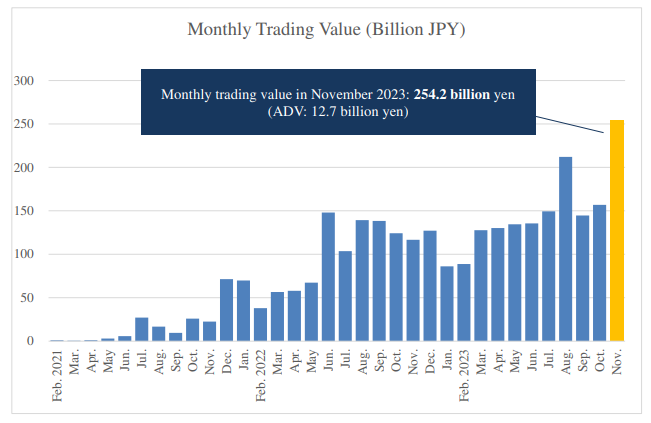

Tokyo Stock Exchange, Inc. (“TSE”) launched the CONNEQTOR service, a RFQ (Request For Quote) platform, in February 2021 with the aim of improving liquidity in the ETF market, and since then, based on the needs of our users, CONNEQTOR has been continuously developed and new features have been added. Today, we are pleased to announce the start of providing direct connection between CONNEQTOR and SmartBridge Advance* (“SBA”), a securities order and execution management system (a system for institutional investors who trade stocks and ETFs on a large scale to register and place orders) provided by Nomura Research Institute, Ltd. (“NRI”).

With this new connection, order data entered into SBA by traders of asset management firms and others will be directly allocated to CONNEQTOR, enabling traders to execute trades quickly and reliably with market makers around the world on CONNEQTOR. As a result, ETF trading costs will be reduced and the time required for trading will also be shortened, which is expected to contribute to operational efficiency at asset management firms and others.

TSE will continue our efforts to develop a market that is highly convenient market environment that enables to execute smoothly and better price for investors.

- NRI’s system solution to support overall front operations of asset management companies such as operations for fund managers and trading operations as well as coordination with back-office operations.

SmartBridge Advance (Japanese site)

Related links