TSE Cash Markets

Further increase in the quality of listed companies is required for development of the stock market

By Hidetaka Kawakita, Professor Emeritus, Kyoto University. Distinguished Professor, Graduate School of Management, Kyoto University

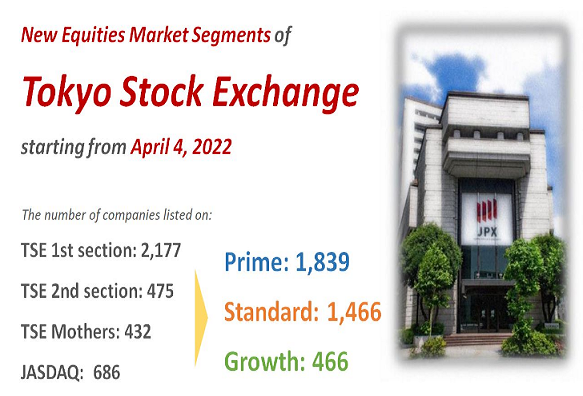

On April 4, 2022, Japan’s stock market will be restructured into new market segments. The highlight of this reform is the creation of the Prime Market for global investors, and the Growth Market intended for start-up companies. The Standard Market will serve as a foundation for the entire stock market.

It is easy to become listed on the Growth Market, if only a company can draw a necessary and sufficient blueprint for its growth, and clearly explain it to investors. In this sense, it is an open market that can support start-ups.

The Prime Market seems to have taken the first step toward the market reform in consideration of global investors. In other words, there still is much demand from investors to make Japan’s stock market more attractive. I’d like to refer to just two points.

One is the company size. With respect to the listing criteria for the Prime Market, I appreciate the requirement that market capitalization of tradable shares should be 10 billion yen or more. However, 10 billion yen is still small. I am wondering if global investors will actively invest in a small-sized company which accounts for less than one ten-thousandth of the total market capitalization in Japan.

Another is the market quality. If you look at Price Book-value Ratios (PBR) of companies listed on the TSE First Section, you will find that PBR of almost half of the companies is less than 1. PBR represents the quality of business management in a straightforward manner. If PBR of a company remains below 1 for a long time, it is highly likely that either the company or the industry where the company operates has a structural problem. At any rate, it is fair to consider that investors have doubts about business management of such a company. In this connection, I’d like to add that PBR is below 1 among more than half of smaller cap companies. I assume that the quality of business management significantly affects market capitalization – it is a huge barrier to overcome.

Once the Prime Market is institutionalized, it is true that the listing criteria cannot be easily changed. As such, stock price index can be utilized for global investors. While the current Tokyo Stock Price Index (TOPIX) is comprised of all companies listed on the TSE First Section, the new TOPIX, which will be introduced soon, does not have such a one-on-one relationship with a specific market segment.

As index-based investments are increasingly becoming important, roles of stock price indices are significantly changing. After the period of the transitional measures, the flexibility of designing new TOPIX will increase. I hope it will become an index which is appealing to investors. For that purpose, it is necessary to thoroughly select constituent listed companies based on their size and quality. In this regard, it is never too early to start the preparation now. It will likely motivate listed companies to make further improvement.