TOCOM Energy

JPX & INE Crude Oil Futures Study

Abstract

JPX crude oil futures refer to futures contracts listed on the Tokyo Commodity Exchange that are linked to the price of Dubai crude oil. INE crude oil futures refer to futures contracts for medium sour crude oil traded on the Shanghai International Energy Exchange. Although the underlying assets of the two are not exactly the same, we believe that due to the universal value of crude oil itself, there should be a certain correlation and trading opportunities between them.

After calculations, it was found that the price movements of the two have a high correlation, suitable for statistical arbitrage, and the final strategy performance is good. Furthermore, this article has considered (1) liquidity, (2) trading hours, (3) holidays in both countries, and (4) exchange rates, but moving from the research findings to actual trading still requires consideration of more factors.

The crude oil futures contracts listed on JPX are based on the Dubai Crude Oil Index, and the delivery method is cash settlement; while the crude oil futures contracts listed on INE are based on medium sour crude oil stored in Shanghai delivery warehouses, with physical delivery as the settlement method. Although the underlying assets of the two are not entirely the same, we believe that due to the universal value of crude oil, there should be a certain degree of correlation and trading opportunities between them. In the following text, we will discuss this in detail through statistical methods. However, before discussing the correlation between the two, we want to emphasize the following details first.

We select the Dominate Contract as the representative. Since the last trading day and the liquidity distribution of JPX and INE crude oil contracts are not entirely consistent, it is difficult to compare JPX and INE contracts of the same term. To approximate real trading, we constructed a price series for the dominate contracts of JPX and INE (considering the price jump when switching contracts). Although the expiration terms of the dominate contracts for JPX and INE at the same moment are not guaranteed to be the same, we believe that as the contracts with the best liquidity and the most active trading atmosphere, they fully reflect all types of information related to global crude oil market. Therefore, it is feasible to perform statistical calculations and construct strategies based on the dominate contracts of both.

The criteria for determining the Dominate Contract are:

- Among contracts of various expiration terms, the one with the largest open interest for three consecutive days is the dominate contract;

- For a given dominate contract, it can only switch to a contract with a later expiration date, not to a contract with a nearer expiration date, even if it meets condition one.

The trading hours of JPX and INE crude oil contracts are not entirely consistent. JPX’s trading hours are from 08:45 to 15:15, and from 16:30 to the next day 06:00 (Tokyo time), while INE’s trading hours are from 09:00-10:15, 10:30-11:30, and 13:30-15:00, 21:00-next day 02:30 (Beijing time). Considering there is a one-hour time difference between the two, and that JPX’s trading volume is mainly distributed at the close of the afternoon session. Therefore, we use the closing price of JPX crude oil at 15:15 (Tokyo time) and compare it with the closing price of INE crude oil at 14:15 (Beijing time) for subsequent analysis, to ensure that the data used is consistent in real time.

We use the intersection of the trading days of both contracts. Due to the misalignment of holidays in Japan and China and considering that crude oil prices may experience significant fluctuations during long holidays, we use the intersecting period to avoid a situation where one market is open while the other is closed.

We use CNYJPY.FX to adjust the original prices. JPX crude oil futures are priced in Japanese yen, while INE crude oil futures are priced in Chinese yuan, creating a difference due to exchange rates. In the long term, the prices of both will inevitably be affected by changes in exchange rates. We have standardized the prices using CNYJPY.FX.

JPX & INE Crude Oil Futures Statistic Analysis

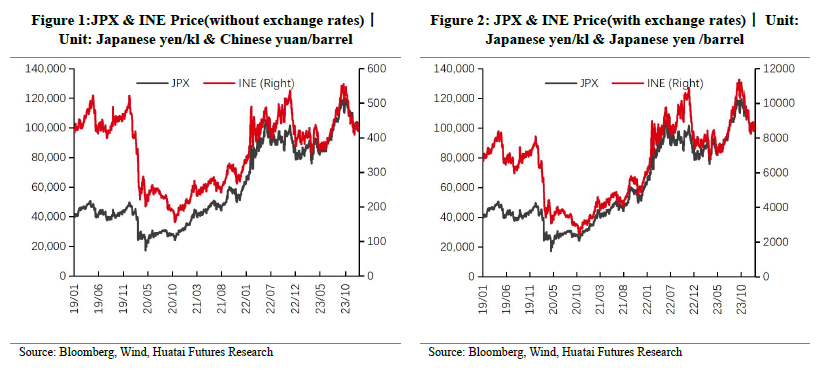

From Figures 1 and 2, it is evident that the overall trends of the closing prices of JPX and INE crude oil are consistent, showing a high correlation. After incorporating the exchange rate calculation, the price movements of the two become even more similar.

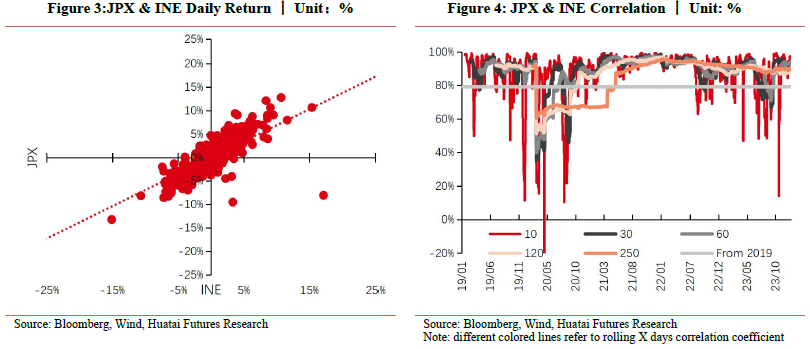

After calculation, from 2019 to the present, the correlation coefficient of the daily returns of JPX and INE is 0.79. When dynamically calculating the correlation with a rolling window, it can be found that the rolling correlation of the returns of both in the short to medium term is relatively high, while the rolling correlation over the medium to long term (such as 120 days and 250 days) decreases.

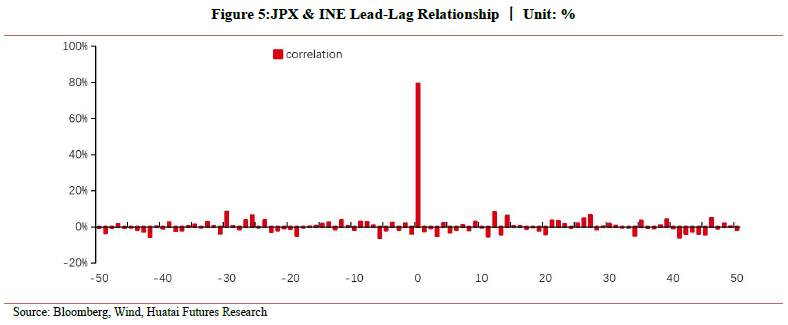

High correlation is the basis for ensuring the feasibility of arbitrage. At the same time, we also found that there is no significant lead-lag relationship between the two, so it is not feasible to predict the price movements of one based on the price movements of the other. The following text will analyze from the perspective of statistical arbitrage on how to explore trading opportunities between JPX and INE crude oil.

Based on the above analysis, since JPX and INE price movements are highly correlated without a clear lead-lag relationship, we can focus on exploring trading opportunities when the price difference between the two deviates significantly.

Basic logic: If the current yield difference between INE and JPX exceeds a certain threshold, we define a trading opportunity. Specifically, when INE’s yield is higher than JPX’s, we hold long position on JPX and short position on INE; otherwise, we hold long position on INE and short position on JPX.

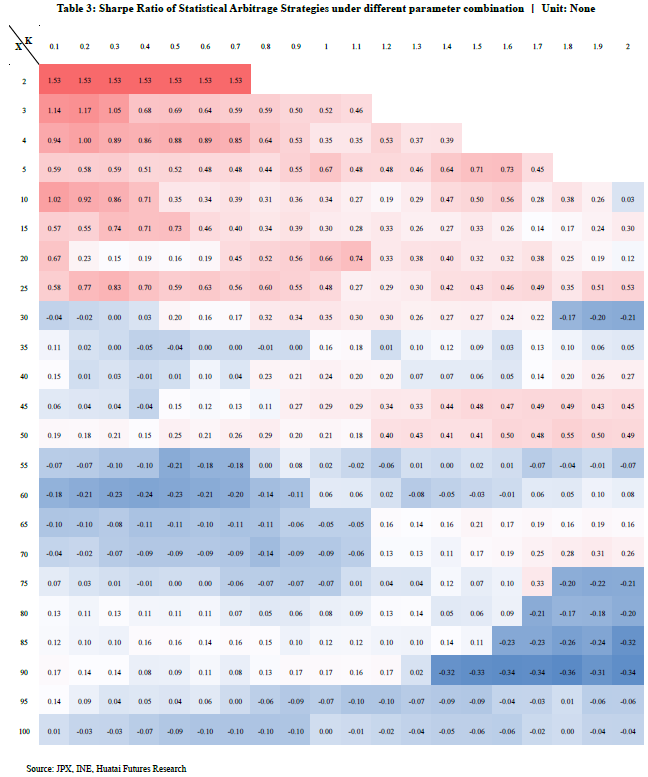

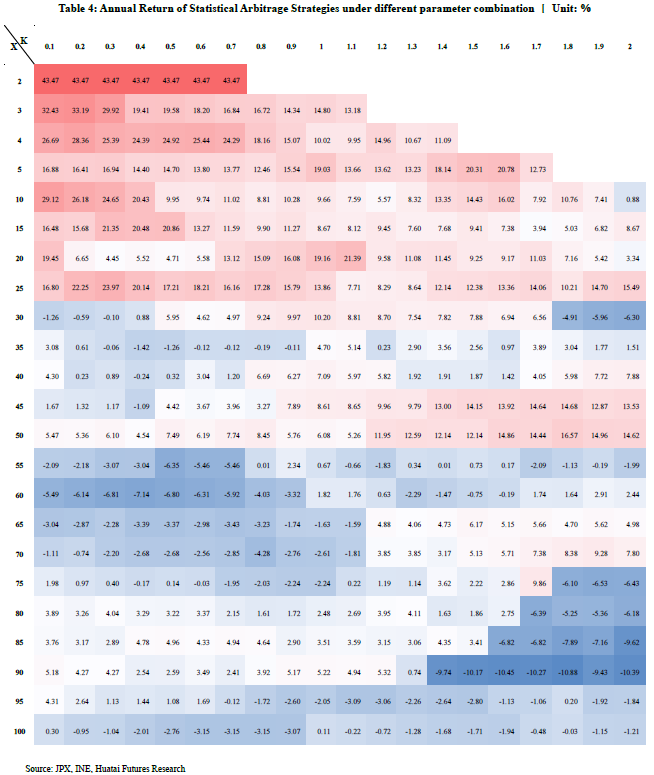

Parameter settings:

(1) Observation window (X): Look back at the cumulative yield difference (spread) between INE and JPX over X days.

(2) Threshold setting (K):

When (spread – rolling average spread of X days) > K times the rolling standard deviation of spread -> Long JPX and short INE.

When (spread – rolling average spread of X days) < – K times the rolling standard deviation of spread -> Long INE and short JPX.

Strategy setting: Once a long or short signal is generated, open a position and hold until a different signal appears, then close the position and open a new one. The strategy’s performance is evaluated from January 2019 until now, with compound interest calculation, and ignoring slippage and commission.

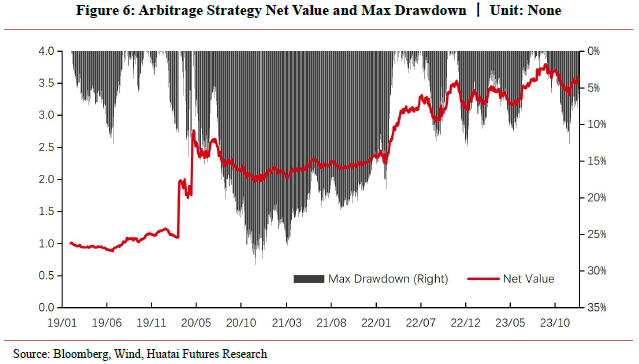

Taking an observation window X of 10 days and a threshold setting of 0.1 times the standard deviation as an example, we constructed an arbitrage strategy between JPX and INE. The figure below shows the net value performance and drawdown of the strategy.

Conclusion

Although JPX and INE crude oil futures are linked to different benchmarks, calculations have shown that their price movements are highly correlated, suitable for statistical arbitrage, and the final strategy performance is quite good.

This paper has considered (1) liquidity, (2) trading hours, (3) holidays in both countries, (4) exchange rates, but moving from the research findings to actual trading still requires consideration of more factors.

————————————————————————————————————-

If you require the complete report or have any inquiries , please do not hesitate to contact Huatai Futures. Below is your contact person.

Contact: Yuan Xin, CFA (QFII Sales Director,International Business Department)

Email: yuanxin@htfc.com

LinkedIn: https://www.linkedin.com/in/yuan-xin-cfa-24b41a52/