TOCOM Energy

2023 recap & 2024 outlook on global oil markets

Price movement: Oil price may average lower compare to 2023, Brent/Dubai spread seen upward momentum

Crude oil prices remained rangebound and finished 2023 about 10% lower than where they stood one year earlier with benchmarks Brent and Dubai settled at around 77$/b and 76$/b respectively. Oil prices were supported by an OPEC+ effort to cut output, while non-OPEC+ supply growth and lingering recession fears weighed on price gains.

Global oil markets are still slowly recalibrating after three turbulent years in which they were hit by the pandemic and then Russian and Ukraine war. With the pace of global oil demand growth expected to decelerate in 2024 and the supply outlook remain robust, oil price may average lower compare to 2023.

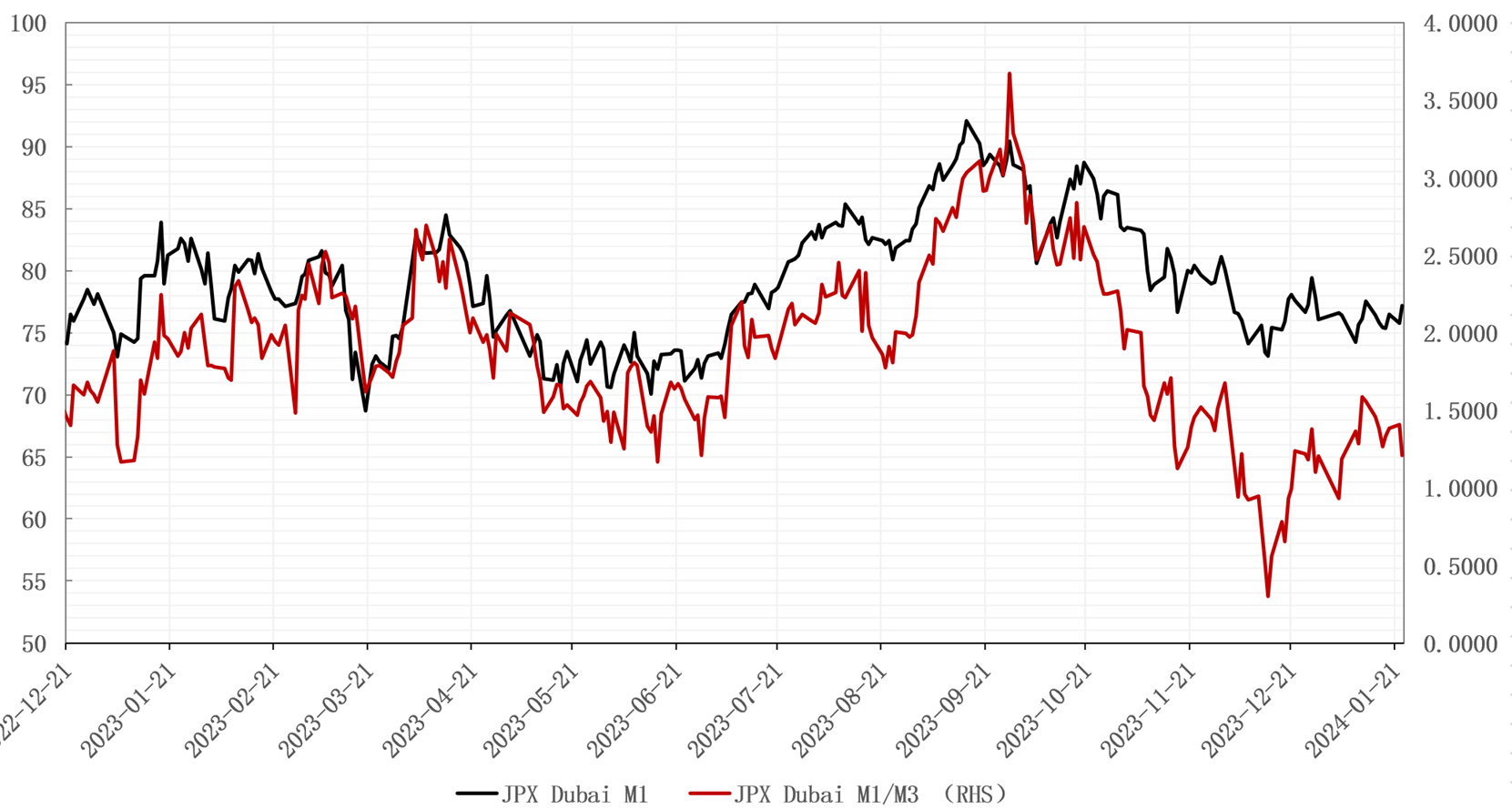

Figure 1: JPX Dubai crude oil flat price and intermonth price spread movement

Source: JPX

Source: JPX

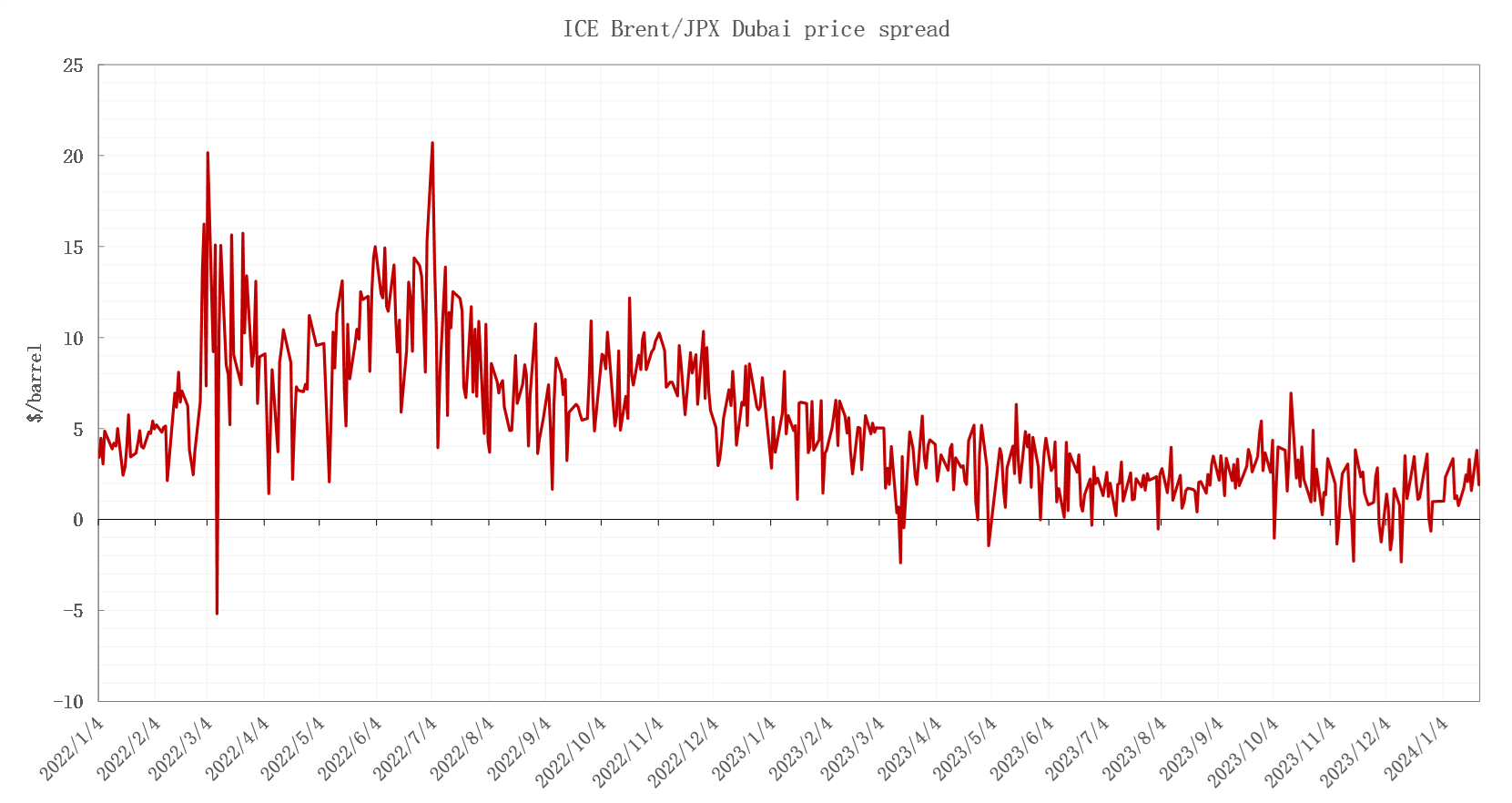

Market also witnessed a dramatic shift in Brent/Dubai spread. The narrowing Brent/Dubai spread can be attributed to, but not limited to, OPEC+ supply cuts, increasing U.S. crude oil output and increasing demand for Middle East crude from Asia refineries. For 2024, with U.S. crude oil output growth to slow and further output cut from OPEC+ group unlikely, oil product demand growth to shift from middle distillates to light distillates, the price spread gains upward momentum in 2024.

Figure 2: ICE Brent/JPX Dubai futures price spread(continuous)

Source: JPX, ICE

Source: JPX, ICE

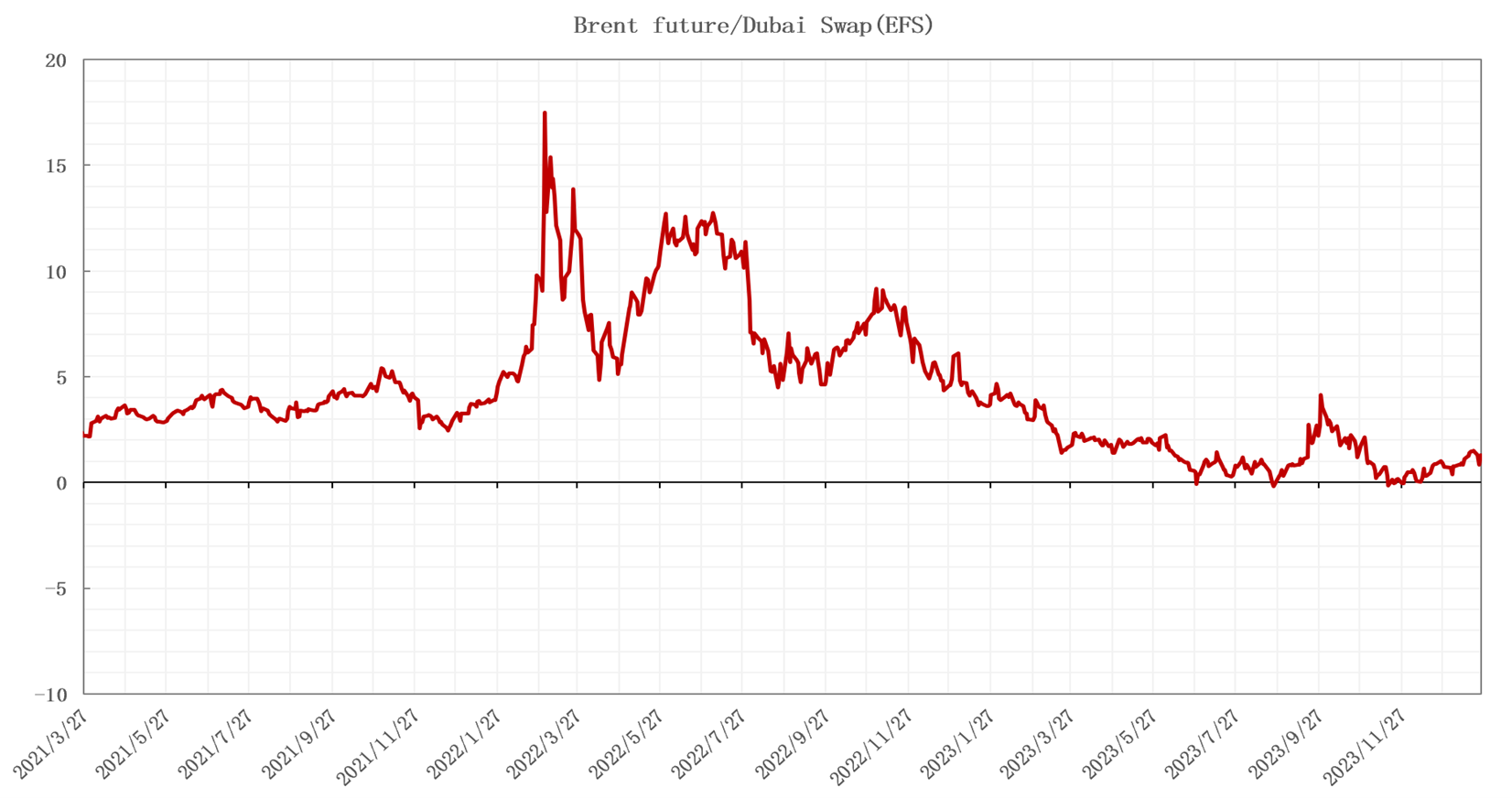

Figure 3: ICE Brent/Dubai swap price spread (EFS)

Source: Platts, ICE

Source: Platts, ICE

Demand: Major international agencies are divided on the oil demand outlook for 2024 amid macroeconomic uncertainty

World oil demand is estimated to rise 2 mb/d in 2023 with China accounting more than for half of the projected growth as travel patterns normalized following the post-COVID rebound earlier in 2023. With respect to refined products, kerosene type jet fuel accounts more than half of 2023 gains followed by petrochemical feedstock needs.

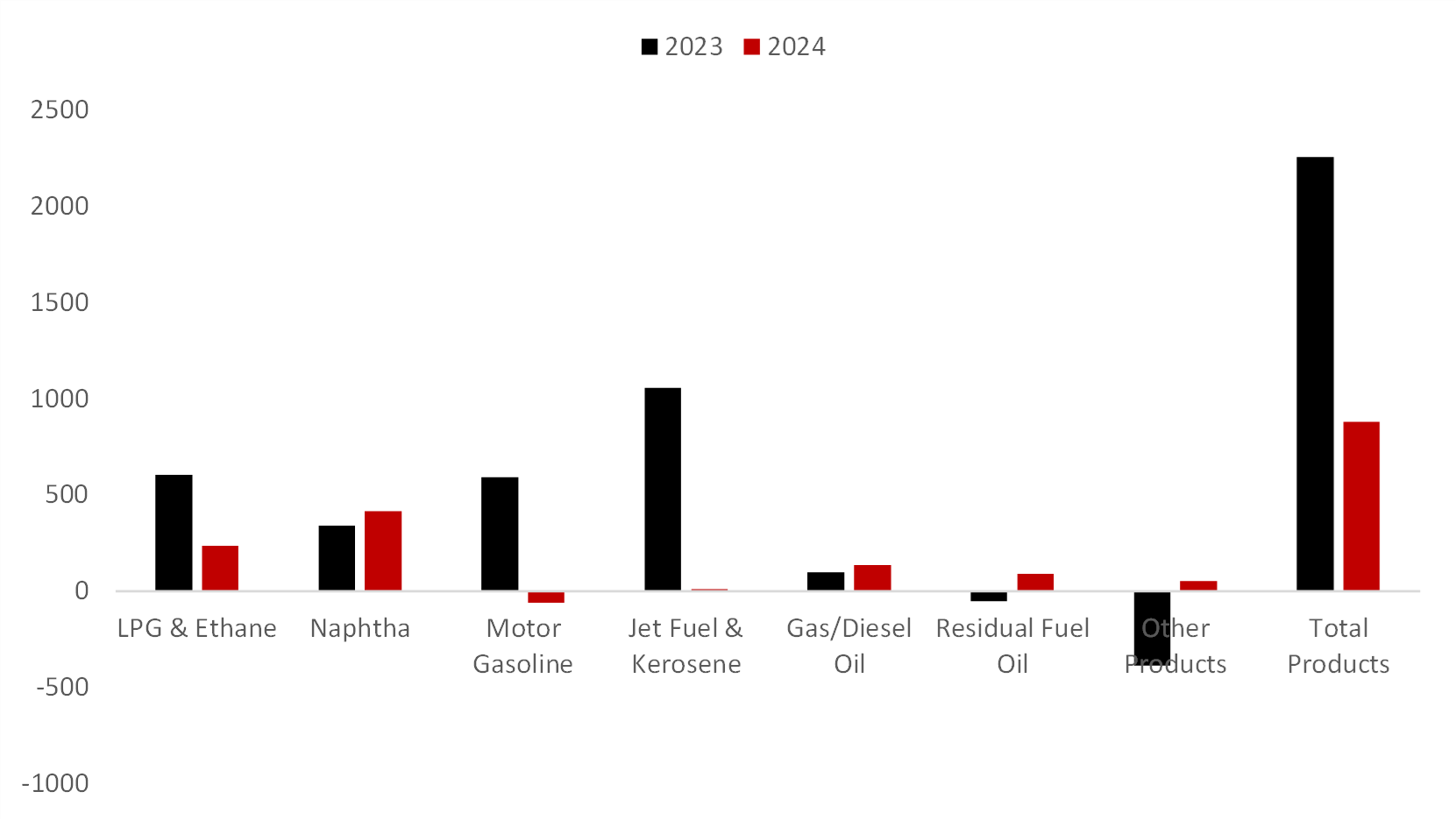

Figure 4: global demand by product (thousand barrels per day)

Source: IEA OMR

Source: IEA OMR

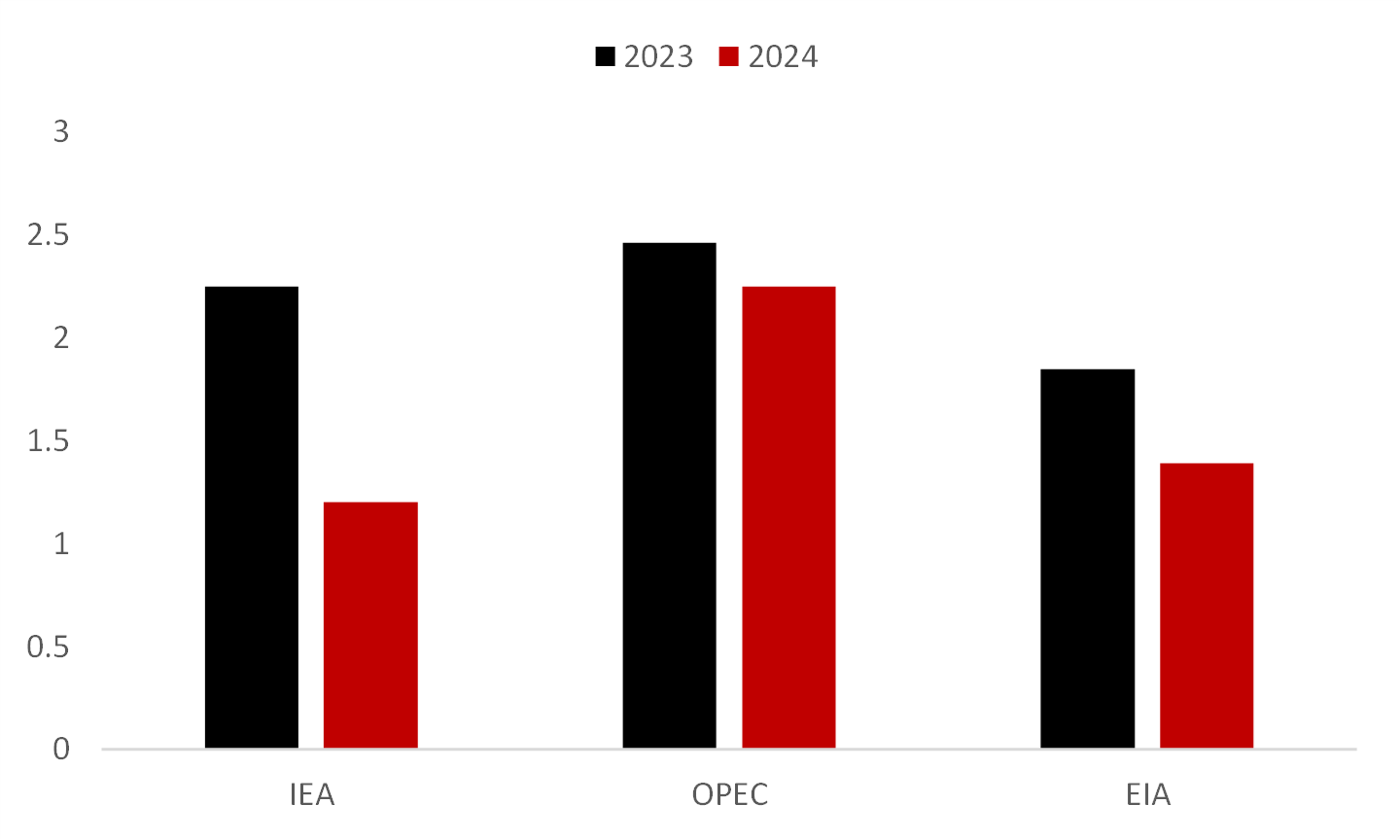

There are significant difference around demand forecast for 2024 among major international agencies. OPEC sticks to its forecast for relatively strong growth in global oil demand in 2024 at roughly 2.2 mb/d in the latest monthly report, while IEA is expecting a much lower growth rate at around 1 mb/d. EIA on the other hand, has forecasted a relative medial growth rate at 1.4 mb/d. The gap among these forecasts reflect the uncertainty over global economic growth outlook.

Figure 5: global oil demand (million barrels per day)

Source: IEA,OPEC,EIA

Source: IEA,OPEC,EIA

For oil products, demand for petrochemical feedstocks such as naphtha, liquefied petroleum gas (LPG) and ethane is likely to dominate demand growth in 2024 with new petrochemical capacity coming online. Demand growth for middle distillates, an area that has been bullish this year because of better-than-expected business activity and a rebound in international air travel may be lower as the post-Covid rebound runs out of steam while the GDP growth stays below trend in major economies.

Supply and trade flows: Non-OPEC+ dominate oil supply growth, oil supply and trade flow is greatly influenced by sanctions and geopolitics risk

Growth in global oil supply is expected to reach 2 mb/d, reduced production targets from OPEC+ countries partly offset production growth by non-OPEC+ producers.

Figure 6: Global oil supply (barrels per day)

Source: IEA

Source: IEA

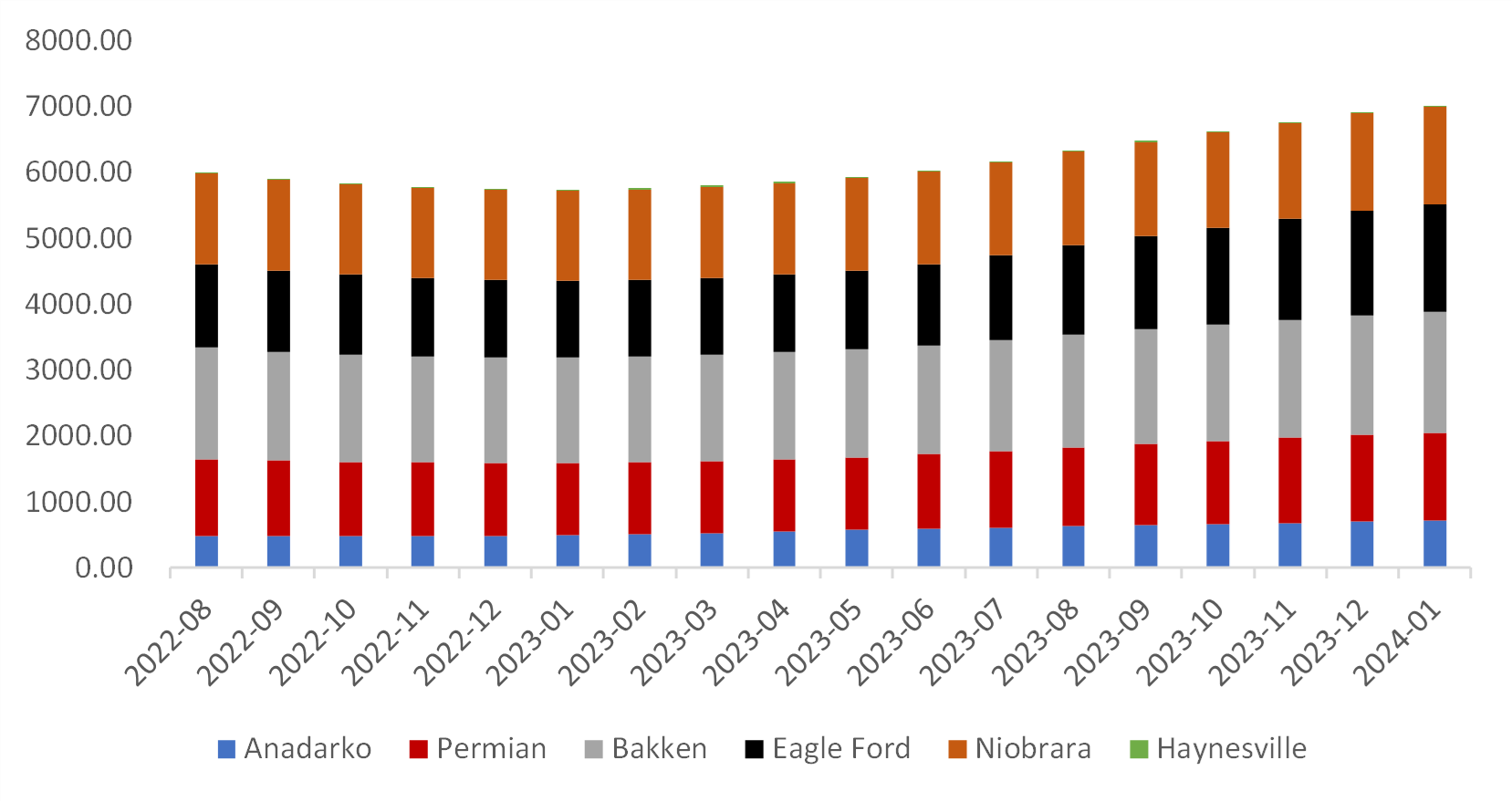

The US remains the key driver of non-OPEC+ supply increments. US oil supply growth continues to defy expectations because of improved drilling efficiencies. After hitting an all-time high in 2023, U.S crude oil supply is predicted to continue rising, but at a slower clip, together with supply growth from Brazil and Guyana, Non-OPEC+ will again drive global supply gains in 2024, projected at around 1 mb/d.

Figure 7: U.S. new-well production per rig by region (barrels per day)

Source: EIA drilling report

Source: EIA drilling report

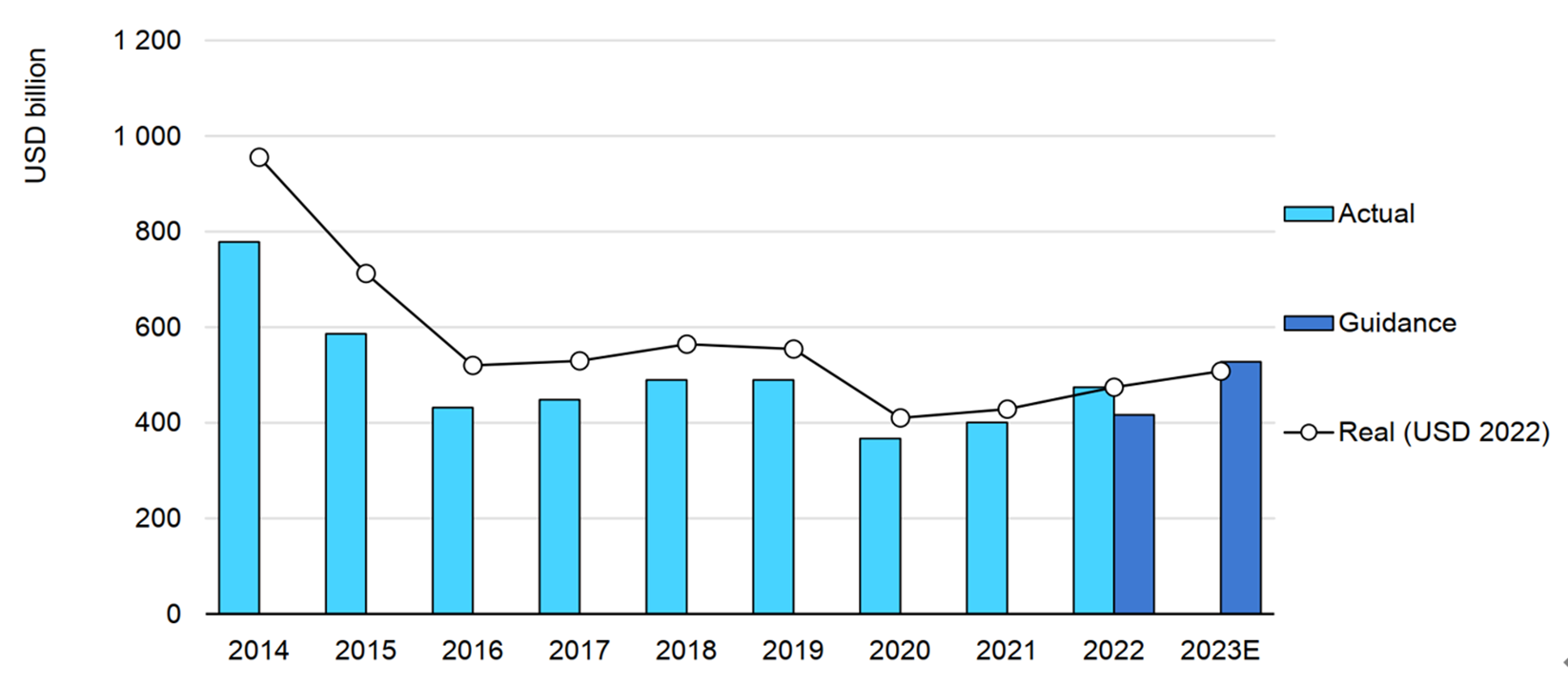

Investments in the oil and gas upstream sector continued to recover in 2023, the current global annual investment of around $500 billion into upstream oil and gas is expected to be sufficient to meet peak oil demand in the 2030s.

Figure 8: Global oil and gas upstream capital spending (IEA analysis based on company reports)

Source: IEA oil 2023

Source: IEA oil 2023

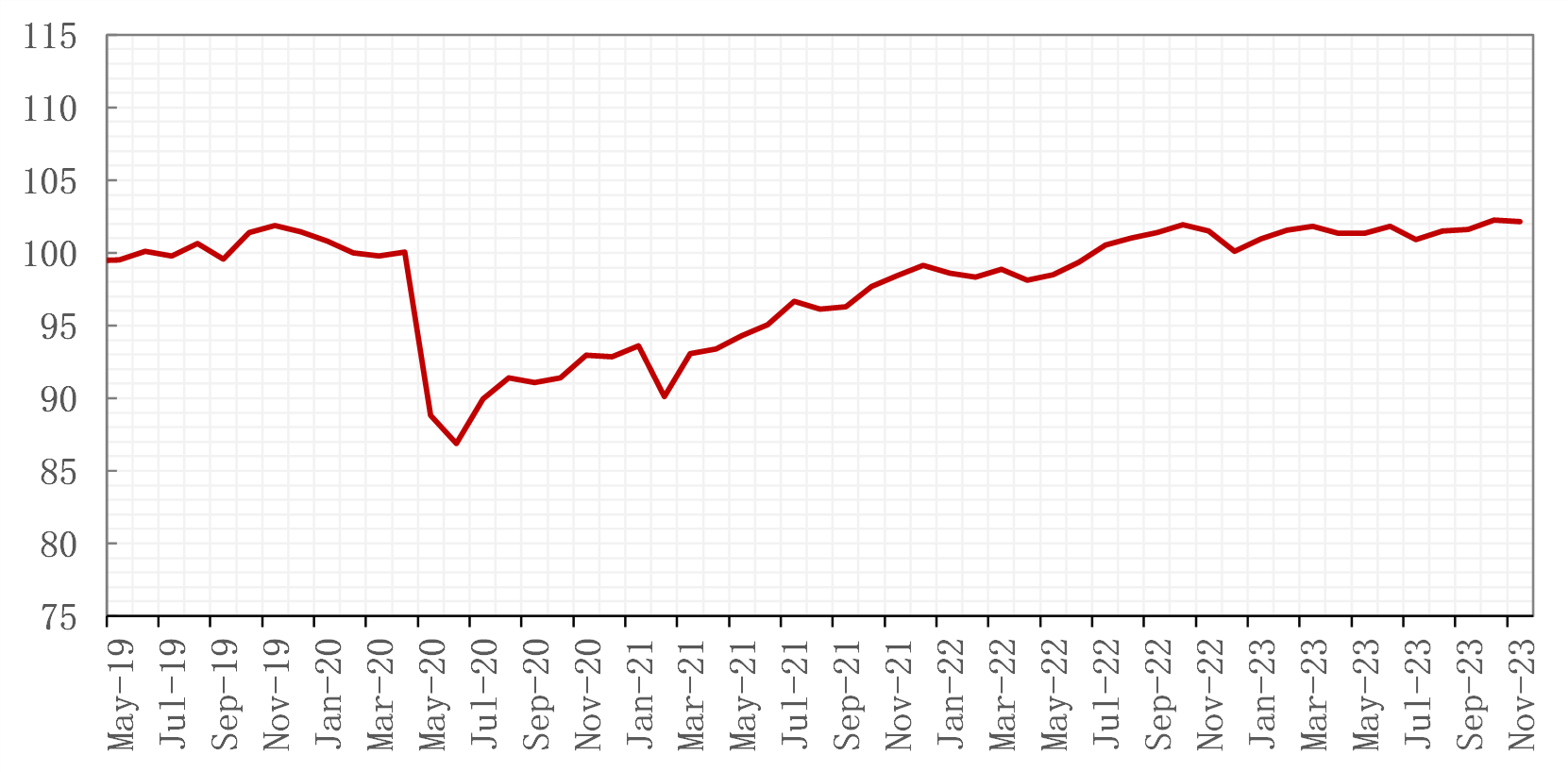

World oil supply and trade flow is also greatly influenced by sanctions and geopolitics of war. Over the last 18 months, output has risen in both Iran and Venezuela as the US turns a blind eye on Iran and eased sanctions on Venezuela.

Sanctions imposed on Russia to date have not reduced Russian oil supply but has led to massive shifts in trade flows. In 2023, Russia has successfully diverted flows from Europe to China and India while European refiners were able to source crude oil from new suppliers, most notably from the United States, the Middle East and North Sea crude.

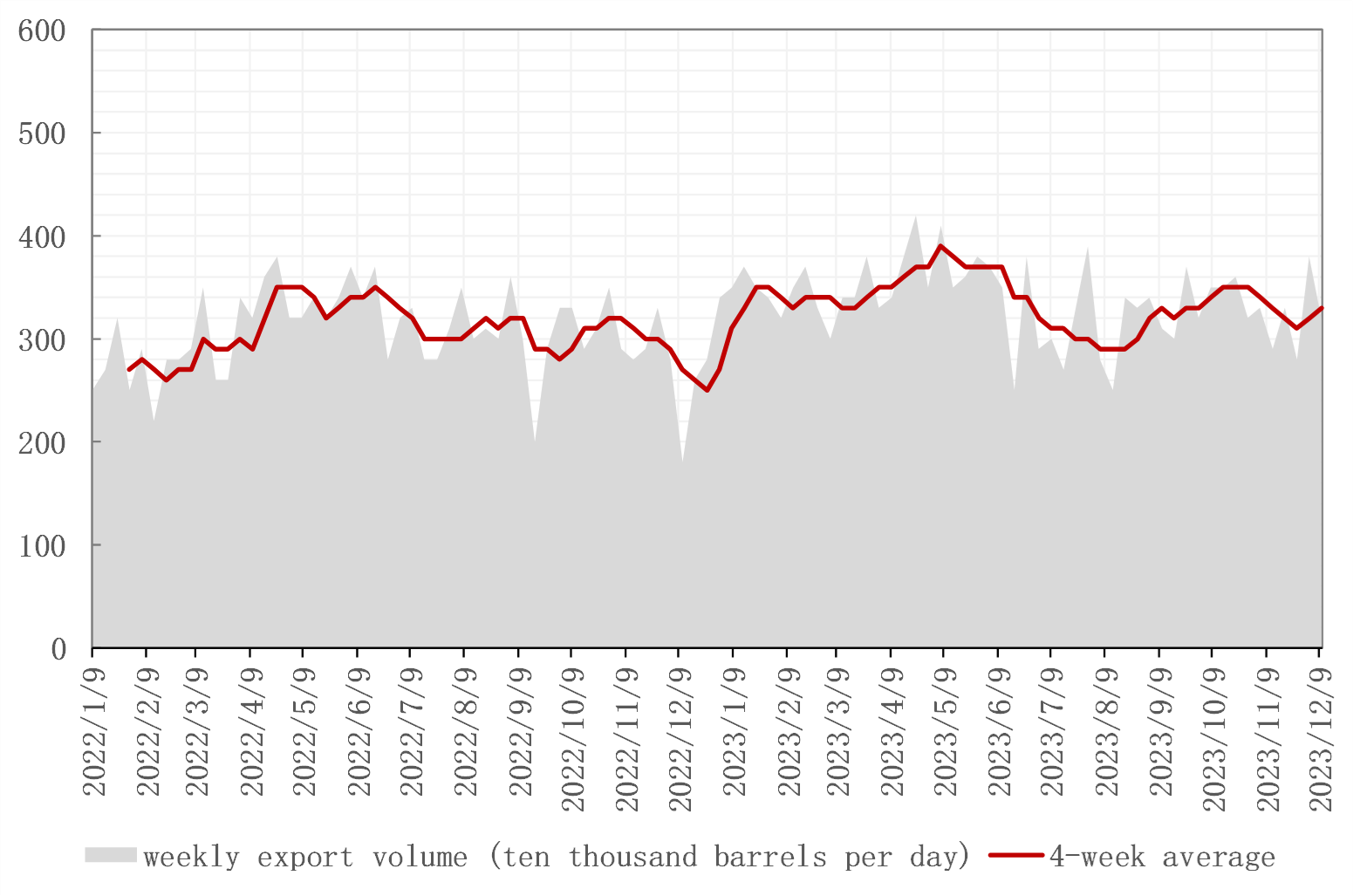

Figure 9: Russia seaborne crude export

Source: Bloomberg

Source: Bloomberg

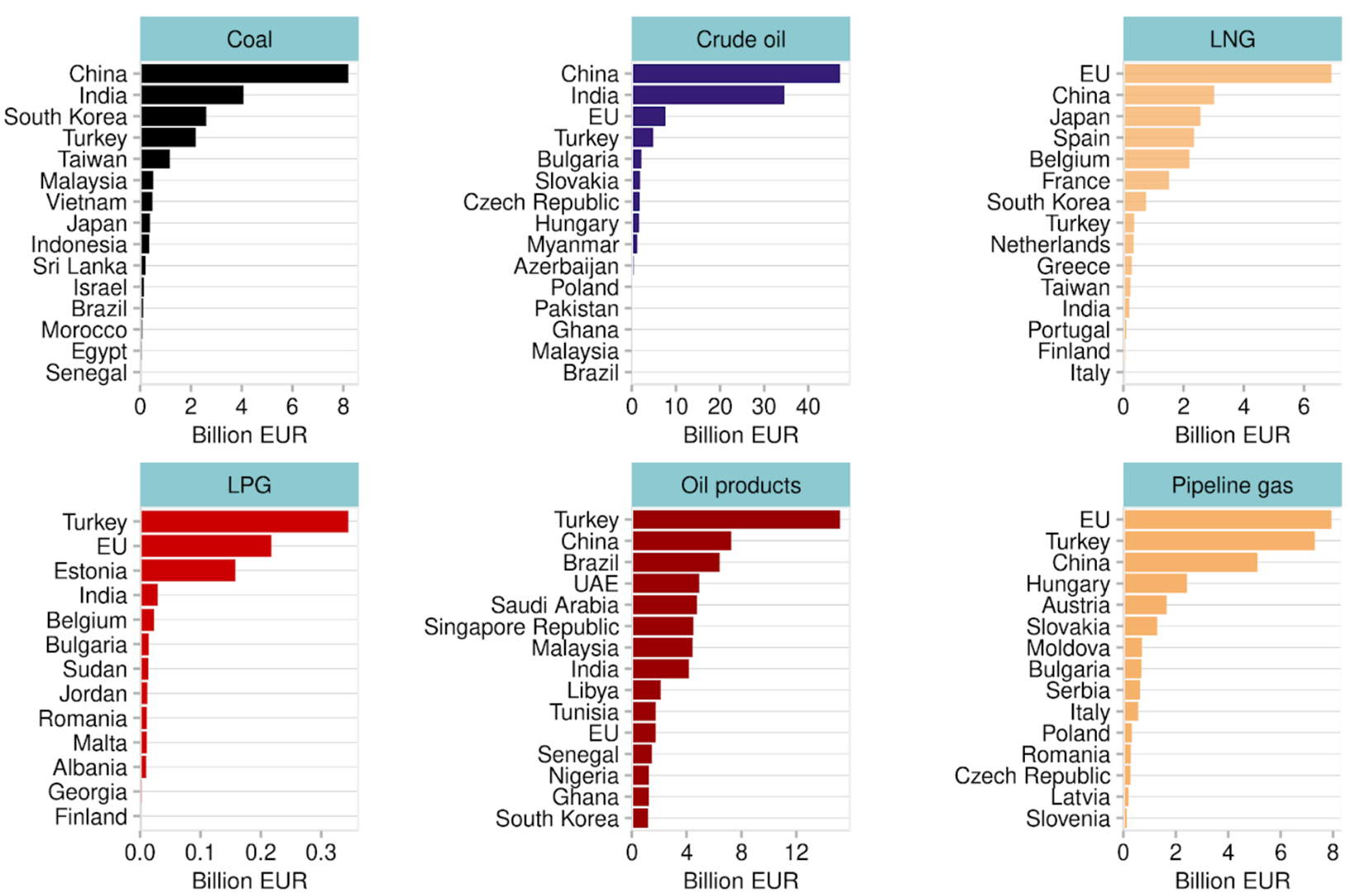

Figure 10: Shipments arriving is EU oil ban until end 2023

Source: Energy and clean air.com

Source: Energy and clean air.com

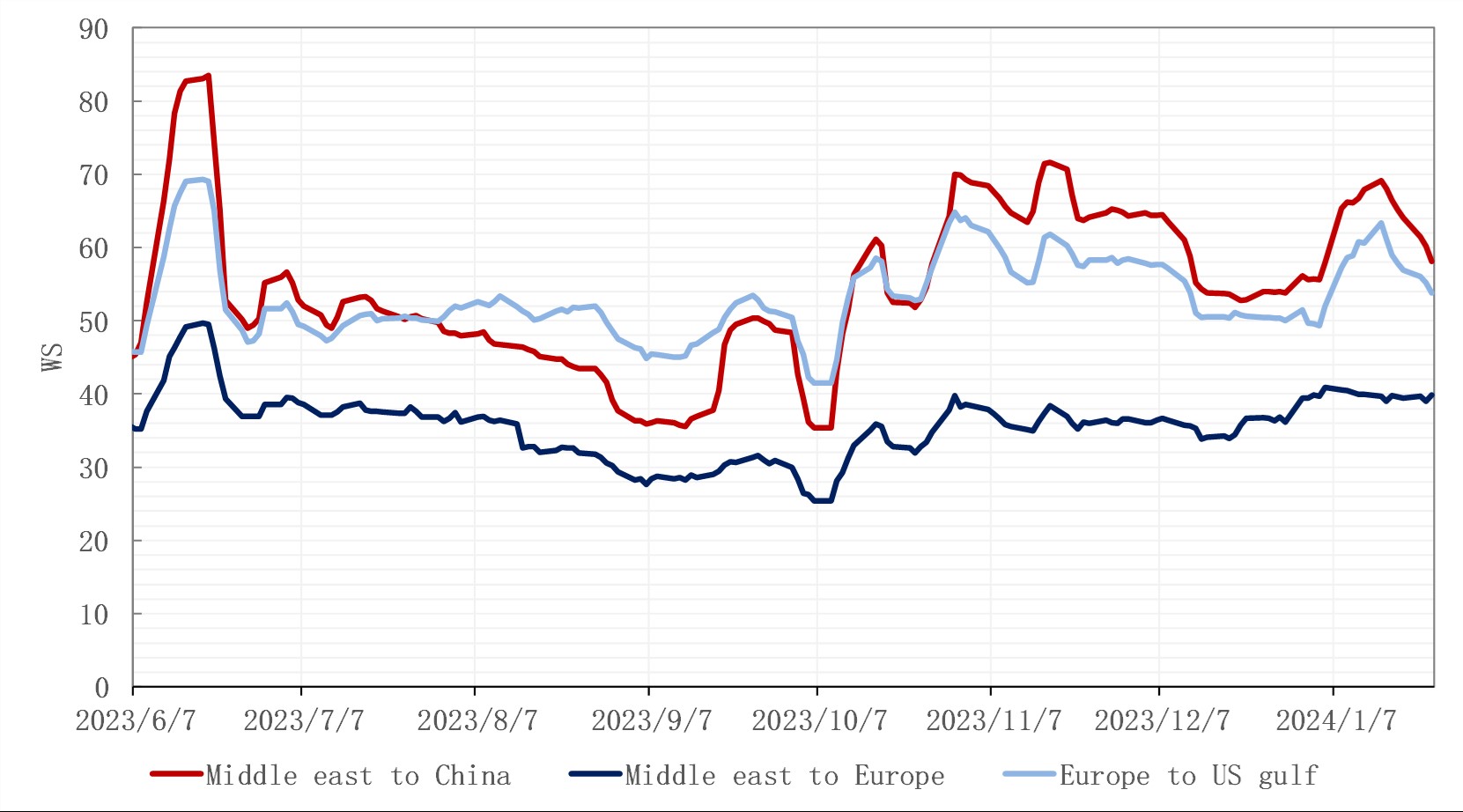

The Israel–Hamas war followed by a string of recent attacks by Yemeni Houthi militia on ships in the Red Sea highlighted a unpredictable situation in the Middle East. If current situation worsens, global oil trade flows may be reconfigured again as the Red Sea route remains the preferred option for East-west oil trade, some of the world’s largest tanker operators confirmed they would avoid the region, in a move that could add significant time and costs to shipments from the Middle East to Europe as tankers reroute around Africa. There appear to be no diversions of Russian vessels carrying crude oil bound for Asia for now, however, recent data suggests that European oil consumers are avoiding the Red Sea by purchasing from the US instead of the Middle East. In the longer term, US elections in 2024 could impact sanctions policy and by extension production volumes Iran and Venezuela.

Figure 11: Where is the Red sea and the Suez Canal

Source: Author

Source: Author

Figure 12: VLCC oil tanker freight rate boosted by Middle East unrest

Source: Refinitiv

Source: Refinitiv

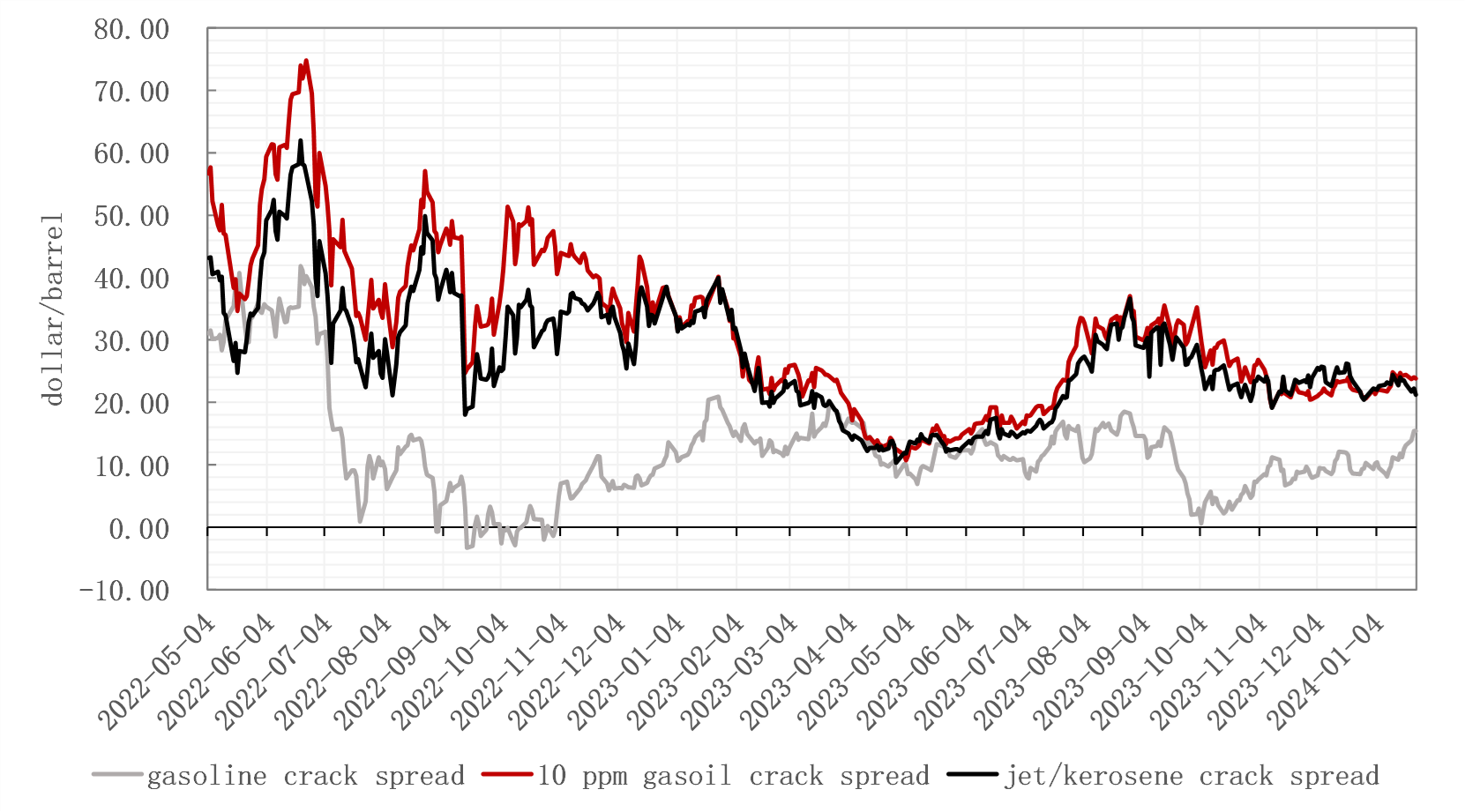

Refining margins:Refining margin face downward pressure in 2024

Global refining margins have been volatile in 2023 due to low product inventories and tight refining capacity. Gross margins witnessed significant strength over the northern hemisphere summer, but weakened somewhat in the latter part of September and slides into the fourth quarter.

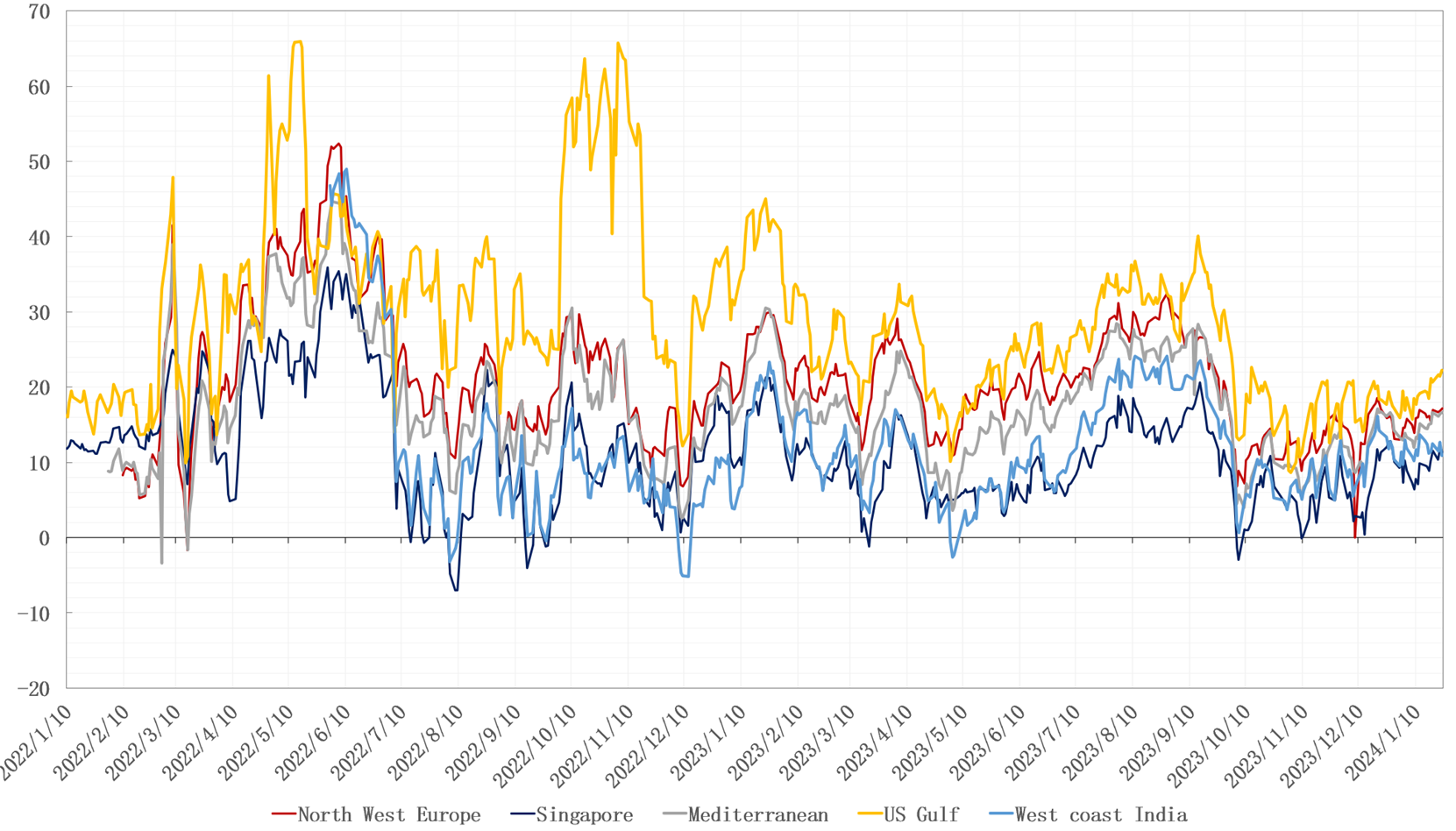

Figure 13: Crude slate cracking margin at major hub

Source: Refinitiv

Source: Refinitiv

Weakness has been largely driven by gasoline as we come to the end of the summer driving season, still-elevated middle distillate (diesel and jet fuel) cracks offset weakness in gasoline and even losses for naphtha.

Related sanctions on Russian oil product, constrained refinery capacity, and lower refined product exports from China, along with still resilient economy, recovering international air travel has led to tight inventories and renewed strength seen in middle distillates.

Figure 14: Oil product crack spreads at Singapore

Source: Platts

Source: Platts

For 2024, global refinery margins are expected to soften with new capacity comes on stream. At the same time, the global refining industry are faced with a more challenging and complex market as demand growth across different products diverge, middle distillate refining margin is expected to converge to its historical range while gasoline margin could average lower in 2024. With most of the recent refining capacity addition taking place in Asia, the area could face more pressure compare with its counterparties. Opposite from the situation in 2022(Russia-Ukraine war), oil product flows between regions may be driven by lower prices in order to squeeze the surplus out of the market.

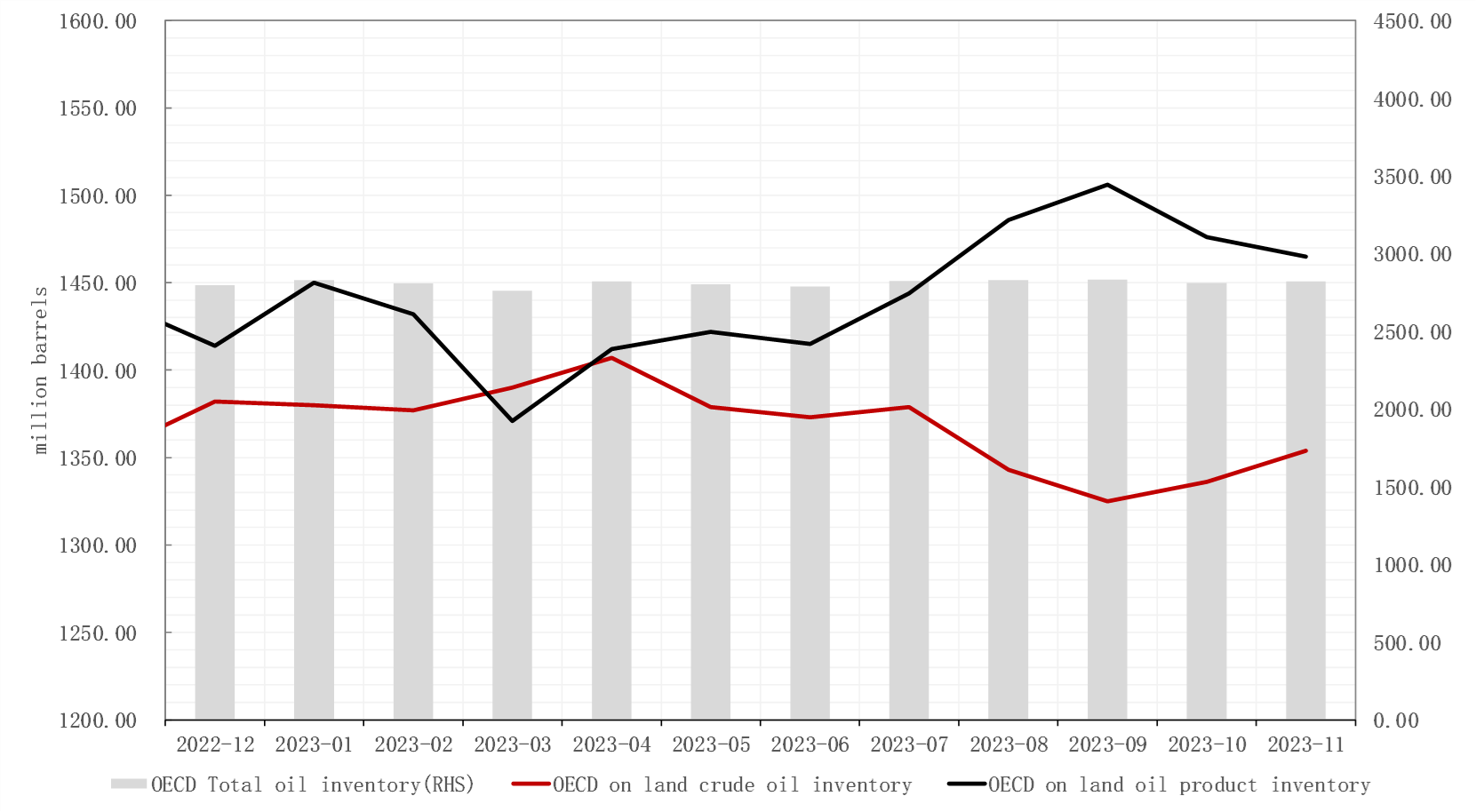

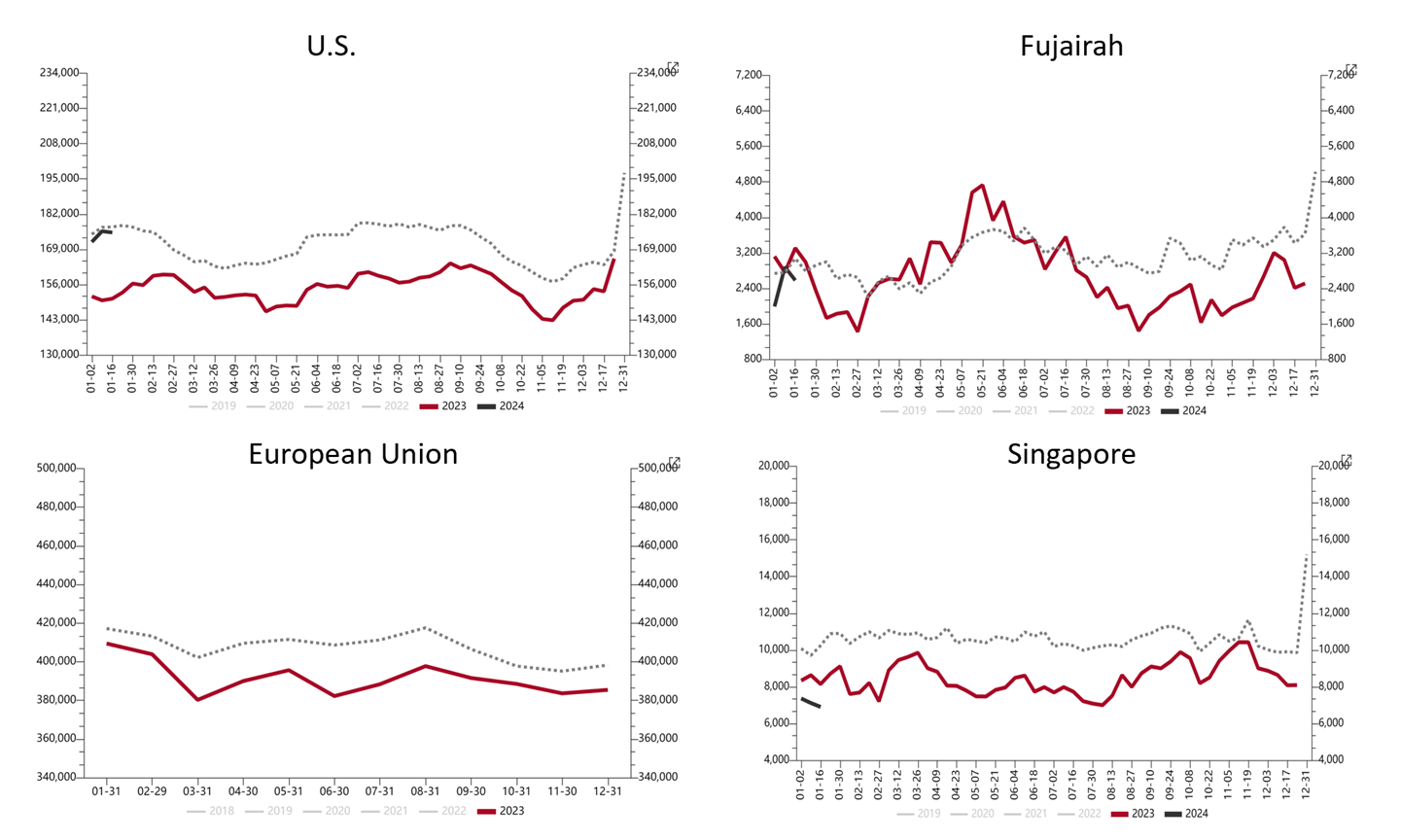

Global oil inventories: Oil product stock build is expected to continue into 2024

For 2023, OECD on-land oil inventories largely remain stable, decline in crude oil inventories was largely offset by higher oil product builds, the oil product builds have been skewed more towards middle distillate.

Figure 15: OECD oil stock movements

Source: OPEC OMR

Source: OPEC OMR

Oil product market start the year 2023 with middle distillate inventories significantly lower than 5-year seasonal averages in most trading hubs, the deficit had narrowed slightly since end August as high prices curbed consumption and strong refining margins encouraged maximum middle distillate fuel production. By the end of 2023, middle distillate inventories at EU, US, Middle east and Singapore were still below their 5 -year seasonal average.

Figure 16: Middle distillate stocks at major hubs (thousand barrels)

Source: EIA, ESG, Platts, Euroilstocks

Source: EIA, ESG, Platts, Euroilstocks

For 2024, OPEC+ supply cut should be enough to keep the crude oil market in tight balance in 1Q24, however, a surplus could emerge if OPEC+ unwind output cuts as scheduled in the second quarter. Oil product stock build is expected to continue into 2024, a sign that may indicate that downstream markets are rebalancing after several years of wild fluctuations.