TOCOM Energy

Quick Guide to Platts Dubai Crude Oil Futures on TOCOM

Japan relies on the Middle East for more than 80% of its crude oil, the price of which is pegged to the Platts Dubai Crude Oil futures listed on the Tokyo Commodity Exchange (TOCOM) market. Platts Dubai Crude Oil Future are cash-settled futures contracts for which physical delivery is not required, even if the position is held until the final trading deadline. Overnight trading (16:00 - 6:00 the following day) is also possible, allowing arbitrage trading with major exchanges overseas.

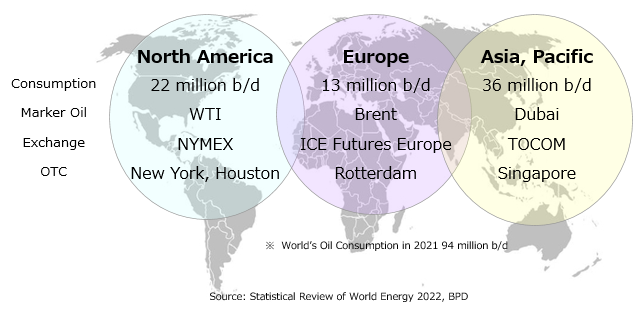

World Crude Oil Markets

The global crude oil market can be broadly divided into three regional production areas and their associated exchanges: WTI (West Texas Intermediate) on the NYMEX in the US, Brent crude on the ICE (Intercontinental Exchange) in Europe, and Middle Eastern on TOCOM. More than 80% of Japan's crude oil imports come from the Middle East (Dubai and Oman). Prices for Dubai crude futures on the TOCOM have a significant impact on the price of Middle Eastern crude oil imported by Asian countries.

Dubai crude oil, produced in Dubai, one of the constituent emirates of the United Arab Emirates (UAE), is highly liquid as it can be traded at absolute spot prices and without restrictions on its destination. The Dubai crude spot price was a component of OPEC’s basket price until 2005, when it was replaced by Abu Dhabi Murban crude . Nevertheless, it remains a benchmark for Middle Eastern crude oil. Among Asian markets, including Japan, the average monthly prices of Dubai and Oman crude oil serve as a price index for Middle Eastern crude oil.

Platts Dubai Crude Oil Futures

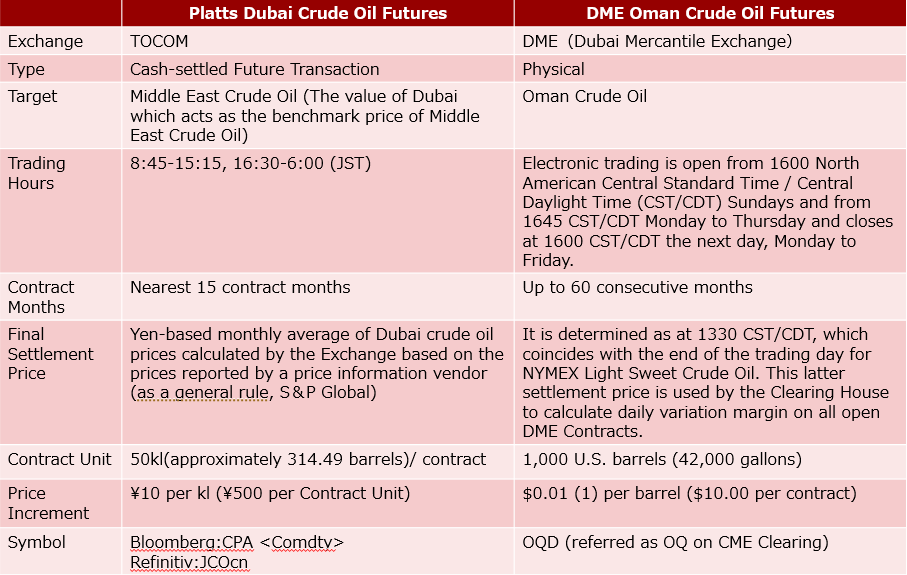

Dubai and Oman crude are markers for Middle Eastern crude prices in Asia. Spot prices for both commodities to Asia set the final settlement price for Platts Dubai Crude Oil Futures on TOCOM. Platts Dubai Crude Oil Futures specs are compared with DME Oman Crude Oil Futures in the table below. Dubai futures are cash-settled (traded in Japanese yen per kiloliter (kl)) rather than delivery contracts, and the ability to trade them during the night session allows for arbitrage trading with major European and North American markets .

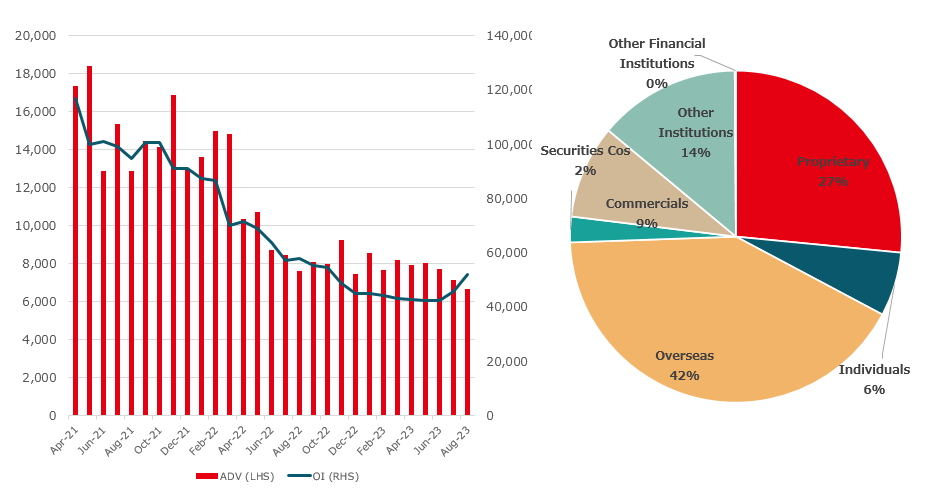

Average daily trading volume of Platts Dubai Crude Oil Futures on TOCOM in 2023 was 7,723 contracts, representing approximately 2.3 million barrels per day. Foreign investors make up around 40% of trading volume, followed by brokerage firms engaged in proprietary trading, commercial traders and individuals.

How Platts Dubai Crude Oil Futures Are Used

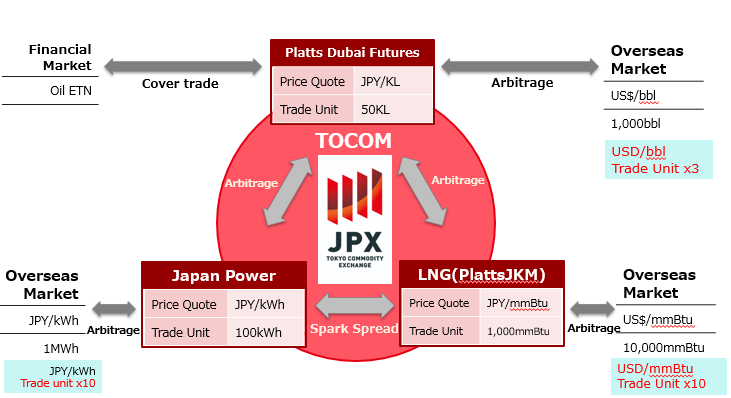

Platts Dubai Crude Oil Futures listed on TOCOM are traded mainly for three purposes.

Cover transactions hedge the risk of price fluctuations when commercial traders procure the physical commodity directly from an oil-producing country. Because Platts Dubai Crude Oil Futures do not involve physical delivery, the risk of price fluctuations is hedged by settling the difference.

Arbitrage allows hedging against price differentials between markets. For example, Dubai crude oil futures from the Middle East are listed on the ICE in London and other markets. Trades can be made for the price difference of the same futures contract on various markets.

Exchange Traded Notes (ETNs) are a security linked to the TOCOM crude oil price. Rather than trading crude oil futures directly, investors (primarily individuals) trade ETNs on the market when speculative money increases trading volume.

Other commodities listed on the TOCOM market include LNG futures, which are strongly influenced by crude prices and can be arbitrage traded.

TOCOM offers one-stop shopping for energy commodity futures, such as Platts Dubai Crude Oil Futures that play a major role in shaping prices for Asian crude oil and LNG futures, both of which are essential to Japan’s energy industry.

If you are interested in trading, please contact: Derivative Sales (Wholesale 1) deri-w1@jpx.co.jp

Related links