Insights

BOJ holds steady while bonds/stocks look attractive

Written by Harry Ishihara, Macro Strategist

Summary

On March 19, the Bank of Japan (BOJ) decided to hold interest rates steady at 0.5%. US policy uncertainty was cited as a primary reason to wait and see. Meanwhile, bonds are the cheapest since 2008, stocks look historically cheap relative to the US , and a contrarian signal of yen weakening has appeared.

BOJ Holds Rates Steady

After hiking in January, the BOJ’s decision to hold rates at 0.5% was widely anticipated. Many continue to expect a rate hike approximately every six months. Although a key election is approaching in July, 48% of economists surveyed by Bloomberg in early March currently expect the next hike to be that month.

Cheapest bonds since 2008

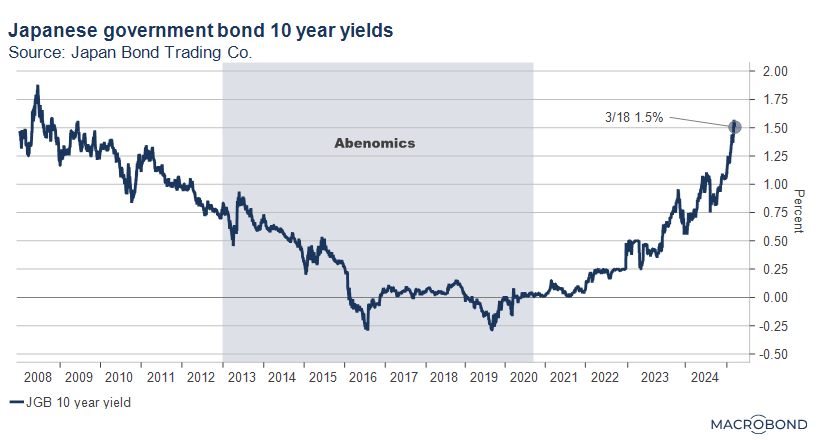

Despite the BOJ’s steady hand on interest rates, yields have been climbing to their highest levels since 2008 as the next graph shows.

The benchmark 10-year yield recently hit its highest point since October 2008, triggered by a weak 20-year bond auction on February 18 followed by other weak auctions. This surge in yields has been further fueled by regional banks reducing their “rate risk”.

“Somewhere between 1% and 2%” (Ueda)

How high will the BOJ go? The terminal rate – the peak policy rate this cycle – has been a hot topic. On March 19, BOJ Governor Ueda hinted he personally thinks the neutral rate – a benchmark for the terminal rate – as being “somewhere between 1% and 2%.

Separately, a Bloomberg survey of 52 economists in early March showed a median expected terminal rate of 1.25%, up from 1% in January and 0.5% last March. Similarly, a QUICK market survey released March 3 showed an average expectation of 1.2%[i]. The rise in 10-year yields reflects this sea change, as they reflect the average expected policy rate over 10 years plus a term premium.

Other factors include expected increases in defense spending, BOJ’s quantitative tightening (QT), and banks trying to avoid unrealized losses at their March 31 fiscal year end. Possible pressure from the US to strengthen the yen via rate hikes is also cited as a driver of yields.

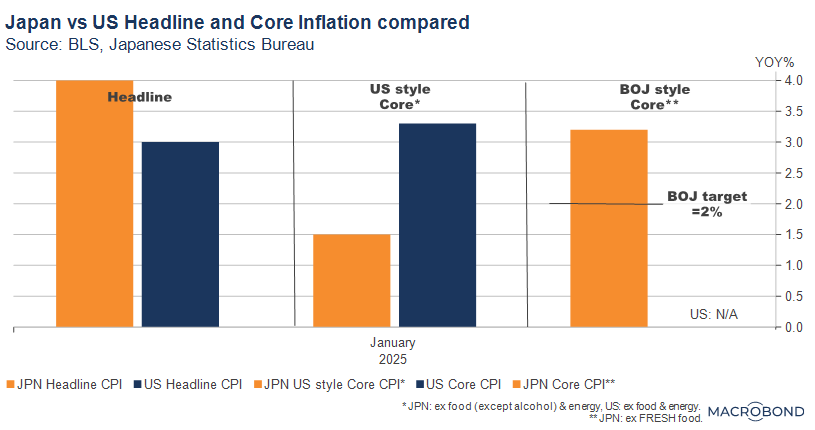

Headline inflation higher than the US

Headline inflation in Japan remains higher than in the US as the left side of this bar graph shows.

While corporate sentiment remains high, consumers are feeling the pinch, with one BOJ survey indicating that on average consumers feel inflation of about 17 percent. The price of rice has doubled over the past year. The weak yen has exacerbated this situation by increasing import prices for food and energy.

Price hikes no longer taboo, the Inflation Revolution continues

As we noted in “Japan’s Inflation Revolution” and “Japan’s Inflation Revolution – an update”, inflation is leading to notable changes in corporate behavior. For instance, Toyota, which traditionally required its parts makers to cut prices twice a year, has started to factor in higher wage costs at their parts makers as part of their input costs. Similarly, Secom, a security firm, is passing through security guards’ wage inflation to the fees it charges. Meanwhile, in a new column titled “Growth amid inflation[ii],” the Nikkei News highlighted how Gen Z – who have not experienced the “lost decades” – are now leading personal consumption and enjoying the highest wage growth among all age groups. A headline in February explained, “Price hikes no longer taboo: labor shortages driving structural reform”[iii].

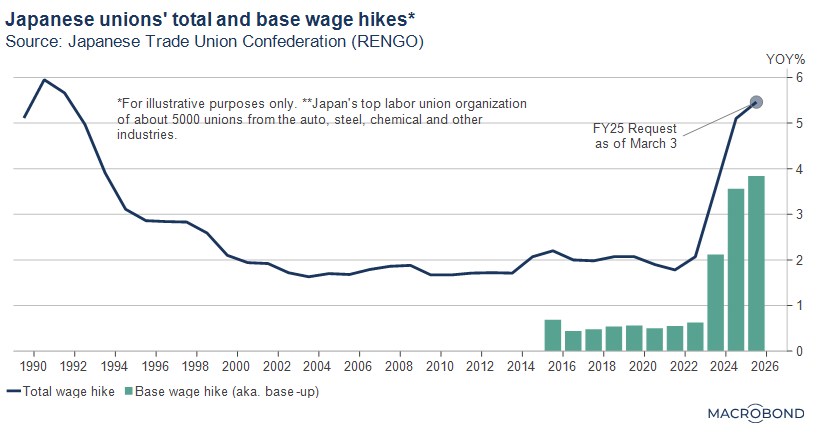

Wage hike demands rise above 6%, the highest in 32 years

Data from the Ministry of Health, Labor and Welfare (MHLW) for January showed real wage growth turning negative, despite nominal base salary growth hitting a 32-year high.

However, this year’s “Shunto” spring wage negotiations were hot. According to Rengo[iv], which represents about 5,000 unions in Japan, the average wage hike demand for FY25 was 6.09%, above the 6% threshold and the highest in 32 years as the next graph shows[v]. Corporate responses as of March 12 are looking very good, as many now see wage hikes as a necessity to remain competitive[vi].

Wait and see

External factors, such as US tariff policies and President Trump’s calls for a stronger yen, are also a BOJ focus. Ueda noted on March 19 that US tariff policies could offset the positives of strong wage growth, and that announcements in early April will be carefully analyzed. Many participants agree that US tariffs could delay BOJ rate hikes. The US yield curve inversion (2-10 year spread) signals potential recession risks in the US, yet another reason to wait and see.

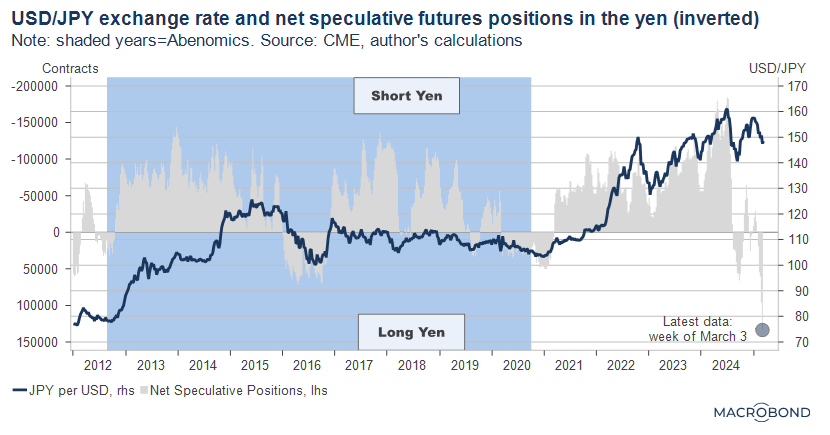

Additionally, long yen positions are at record high levels as the next graph shows. Directionally it points to further yen strength and is another reason for the BOJ to hold, but contrarians (including this author) will see it as a sign that a correction in the yen is due.

Stocks Remain Relatively Cheap

Amid these challenges, Japanese stocks remain relatively cheap. Corporate profits are near record highs, providing a buffer against potential US tariffs. Japan’s trade surplus with the US is only the eighth largest, reducing the risk of trade tensions. Reforms led by the Tokyo Stock Exchange(TSE) continue to enhance corporate valuations, with “the second highest number of shareholder proposals in the world” according to the Nikkei on March 11.

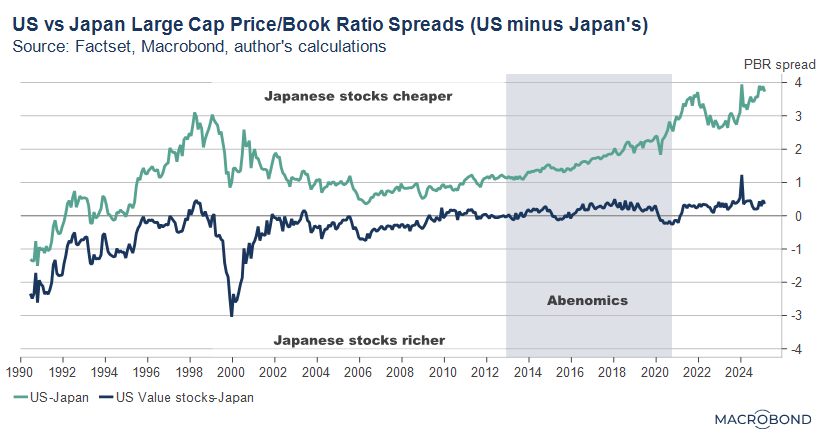

Meanwhile Japan’s price-to-book ratios (PBR) look historically attractive versus the US and even versus US value stocks as the following spreads show[vii]. Japanese stocks are also cheap vs the Eurozone (not shown).

Looking to dip buy?

With a supportive BOJ, the historically cheap valuations of stocks and the cheapest bonds since 2008 should present opportunities for investors. Japan’s inflation revolution supports the nominal profits used in equity valuations. On the bond side, yields are already above the consensus for the terminal rate, and both international and domestic investors are looking to dip buy, according to the Nikkei. Interestingly, the rise in yields – which weighs on stock valuations – is also spurring covered call transactions in Japan’s SSO (Single Stock Option) market, with institutional investors selling call options while owning Japanese equities.

[i] https://www.nikkei.com/article/DGKKZO87328020T10C25A3ENG000/

[ii] https://www.nikkei.com/article/DGKKZO86933260U5A220C2MM8000/

[iii] https://www.nikkei.com/article/DGXZQOUA063B70W5A200C2000000/

[iv] https://www.jtuc-rengo.or.jp/activity/roudou/shuntou/2025/yokyu_kaito/yokyu/press.pdf?1967

[v] Similarly, demands from SME unions of 6.57% were the highest in 30 years.

[vi] In March BOJ board member Tamura pointed to labor shortages – instead of weak demand – as the primary factor behind a weak output gap.

[vii] Absolute PBR’s in February were 1.6x for Japan, 5.3x for US, 2.0x for US value, and 1.9x for the Eurozone (Factset/Macrobond).

Related links