OSE Derivatives

CQG Offers Roll Dashboard of JPX 3-Month TONA Futures and 10-year JGB Futures

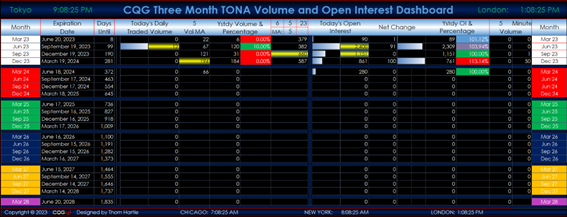

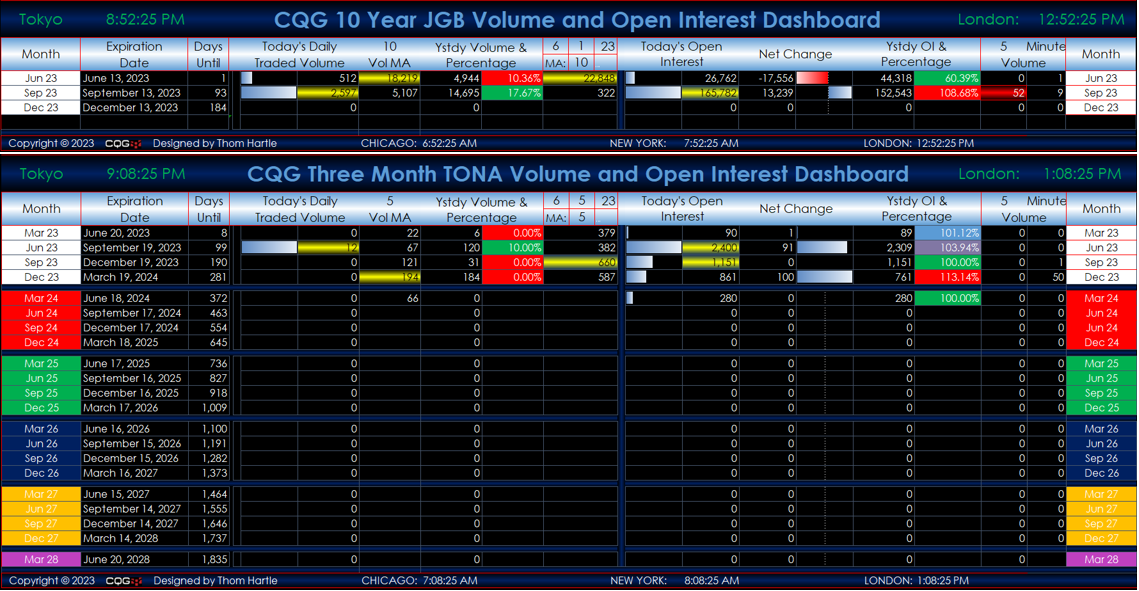

JPX 3-Month TONA Roll Dashboard

This Microsoft Excel® dashboard displays all of the JPX-traded Three-Month TONA contracts including volume and open interest data.

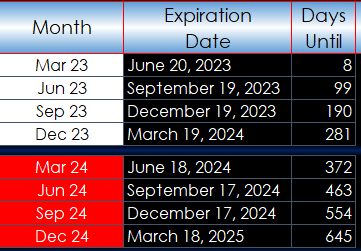

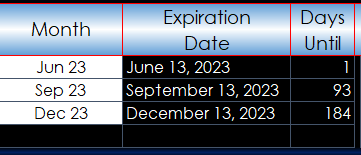

The first three columns detail the contract month and year, the expiration date and the number of days until the expiration.

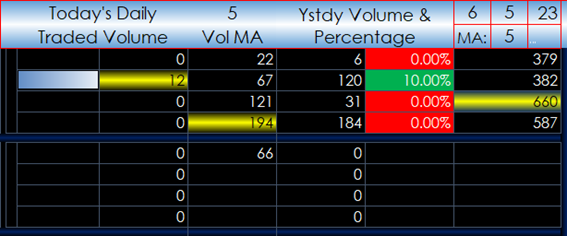

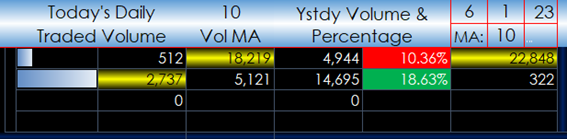

Next, is current volume details. Today’s traded volume with condition based data bars to the left showing relative values. The top volume traded is highlighted in yellow. The next column is a user select moving average of the volume. If today’s volume is greater than the moving average today’s volume is highlighted in red. Next is yesterday’s volume and next is the current percentage ratio of today’s volume to yesterday’s volume. The last column is a user selected moving average of the volume with the top one highlighted in yellow.

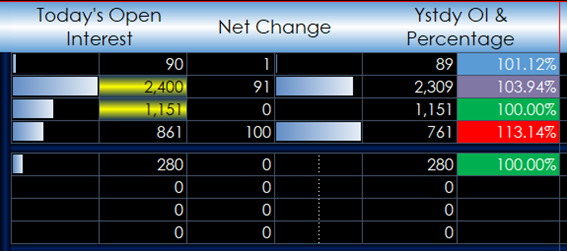

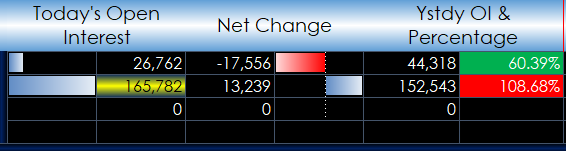

The next group is open interest data. Today’s open interest is displayed with the largest two contracts highlighted in yellow. The net change is displayed. Yesterday’s open interest and the percentage ratio of today’s open interest to yesterday’s open interest is displayed.

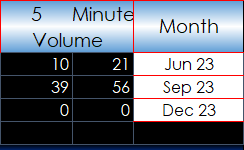

The last group allows a user input for bar time frame and the current bar’s volume is displayed. If today’s current bar’s volume is larger than the same bar in the previous session the bar is highlighted in red.

Requirements: CQG Integrated Client or QTrader, data enablements for all symbols displayed in this spreadsheet, and Excel 2010 or more recent.

JPX 10-year JGB Roll Dashboard

This Microsoft Excel® dashboard displays all of the JPX-traded Japanese Government Bonds (JGB) contracts including volume and open interest data.

The first three columns detail the contract month and year, the expiration date and the number of days until the expiration.

Next, is current volume details. Today’s traded volume with condition based data bars to the left showing relative values. The top volume traded is highlighted in yellow. The next column is a user select moving average of the volume. If today’s volume is greater than the moving average today’s volume is highlighted in red. Next is yesterday’s volume and next is the current percentage ratio of today’s volume to yesterday’s volume. The last column is a user selected moving average of the volume with the top one highlighted in yellow.

The next group is open interest data. Today’s open interest is displayed with the largest contract highlighted in yellow. The net change is displayed. Yesterday’s open interest and the percentage ratio of today’s open interest to yesterday’s open interest is displayed.

The last group allows a user input for bar time frame and the current bar’s volume is displayed. If today’s current bar’s volume is larger than the same bar in the previous session the bar is highlighted in red.

Requirements: CQG Integrated Client or QTrader, data enablements for all symbols displayed in this spreadsheet, and Excel 2010 or more recent.

Disclaimer

Trading and investment carry a high level of risk, and CQG, Inc. does not make any recommendations for buying or selling any financial instruments. We offer educational information on ways to use our sophisticated CQG trading tools, but it is up to our customers and other readers to make their own trading and investment decisions or to consult with a registered investment advisor. The opinions expressed here are solely those of the author and do not reflect the opinions of CQG, Inc. or its affiliates.