Insights

Japan’s Inflation Revolution – an update

Written by Harry Ishihara, Macro Strategist

Japan’s inflation revolution is continuing. Wage growth and corporate pricing power appear to be the highest in decades, while last year’s corporate profits were the highest ever. Retail investors are scrambling to beat inflation via equity investing, especially via “All Country” index funds. Meanwhile, the BOJ continued to normalize monetary policy on July 31, hiking rates and cutting bond purchases.

Carlyle CEO: “IRR of 28%”

Attracted by Japan’s exit from deflation and low interest rates, “the leaders of giant investment funds are flocking to Japan” (Nikkei, June 18). Carlyle’s CEO, Harvey Schwartz noted in an interview[i] that their “ROI in Japan is amazing”, with an “IRR of 28%” on their latest fund for Japan. He particularly praised the government’s efforts to revamp Japan – probably referring to the JPX-led push to increase corporate valuations combined with the expansion of tax-free NISA (Nippon Individual Savings Accounts).

Meanwhile, in the public equity markets, non-Japanese flows continue to make headlines. In April, Warren Buffet’s Berkshire Hathaway issued yen-denominated Samurai bonds in 3, 5, 7, 10 and 30 years to support their substantial equity investments here[ii]. Major pension funds such as the Canada Pension Plan Investment Board (CPPIB) are increasing their weighting, noting Japan’s relatively cheap valuations, and good EPS growth vs the US[iii].

A tech revamp is also boosting sentiment. After decades of losing market share following the 1986 US-Japan Semiconductor Agreement, Japan is attracting investments by TSMC in Kumamoto, Samsung in Yokohama, Intel in Toyama, Micron in Hiroshima, and Imec in Hokkaido (as noted in Japan’s Inflation Revolution). On July 9, the Nikkei News blared “5 Trillion Yen for Semiconductor Revamp”, referring to domestic chipmakers’ plans through 2029. The global semiconductor crisis was an obvious catalyst, as Japan became the safe – and experienced – alternative to other Asian nations.

Exit from deflation?

Japan seems to have finally exited deflation – due to the corona driven supply chain and semiconductor crisis, the spike in food and energy costs post Ukraine and a patient BOJ.

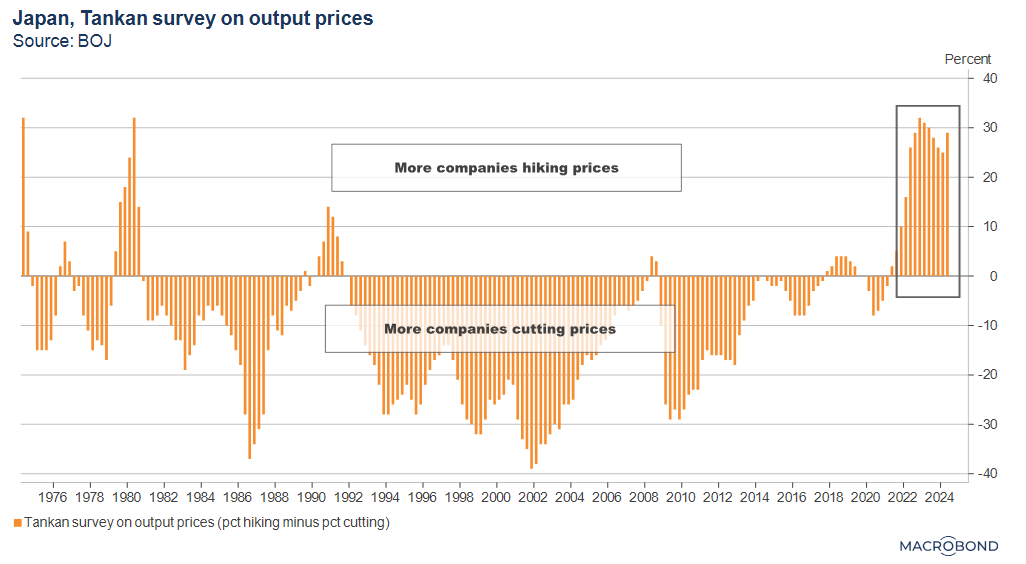

Corporate pricing power is at the highest level since the 80’s, as the upward bars in the next graph imply. In supermarkets, new products abound, as food manufacturers innovate and can finally charge for them. Note that this follows decades of what former BOJ Governor Kuroda called, “the zero inflation norm” – where flat prices were the optimal pricing strategy. The inflation revolution has helped FY23’s corporate profits for listed companies hit a record for the third consecutive year [iv].

Separately, the Tankan’s June survey about expected annual capex growth implied 18.4 percent at major manufacturers for FY24 – close to record levels for the June survey. Along with M&A and a rush to borrow before rate hikes, that capex demand drove loan growth at major banks to its highest level since 2001 [v].

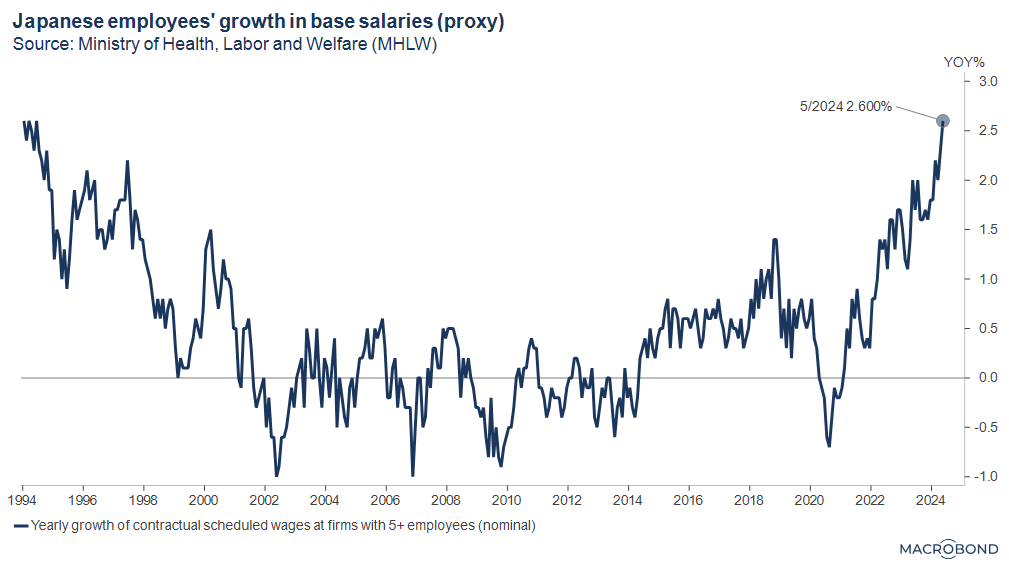

Finally, a widely watched proxy for base salaries also shows the highest growth since the 90’s, as the next graph shows. REAL growth (for total compensation including overtime and bonuses) is still negative, but with inflation slowing and wages rising, should turn positive soon.

Beating inflation with stocks?

The NISA expansion mentioned earlier is part of the government’s effort to shift household assets from bank deposits into the capital markets – aka. “Saving to Investing”. Another effort involves lowering the minimum stock trading units, which will be discussed among many stakeholders at TSE’s study group until March 2025.

The government’s “Saving to Investing” drive has continued for years, but why does this round feel different? Many retail investors now feel they have to “beat inflation” with stocks. Note that since the Jan 2024 expansion, many flows went overseas, but an estimated 45 percent of the Jan-April 2024 purchases went into Japan .

Interestingly, the expansion is reportedly driving three changes to retail flows: 1) increased automated purchases via NISA’s installment accounts, 2) a surge into “All Country” global equity index funds instead of fixed income funds with monthly distributions, and 3) a move away from “buying on dip” to “trend following” behavior [vi]. Jan to May this year saw a nearly 6 fold increase of inflows for the most popular “All Country” fund over the same period last year[vii]. June AUM at domestic mutual funds hit a record.

Yen’s “Yin and Yang”

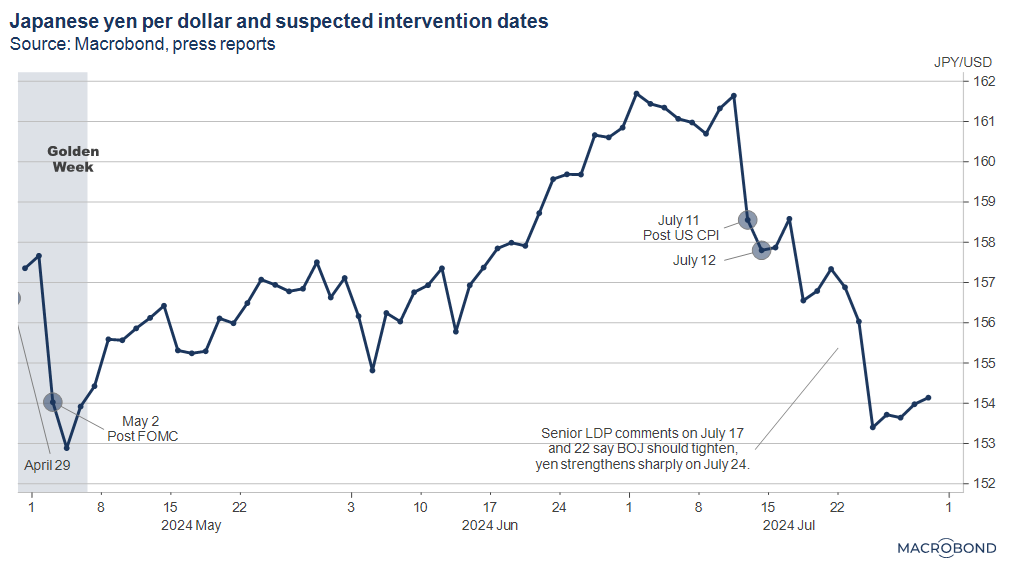

Just 13 years ago, the dollar yen was trading close to 70 yen per dollar; today – after suspected interventions and jaw-boning – it is still over 150 yen after piercing 160 yen earlier (next graph). Like “Yin and Yang”, there are both positives and negatives from the yen’s weakness – basically higher profits for multinational companies versus higher imported food and energy costs for consumers. Wages rise slower than inflation, putting pressure on the BOJ and the MOF to soften the rapid currency movement.

In our last post “Is the yen’s weakness more structural now” we noted that 1) the widened interest rate differential with the US, 2) the automated NISA outflows, 3) the reinvesting of interest, dividends and earnings abroad, and 4) the alarming “FAANG/GAFAM Digital Deficit” of payments for tech services are being cited as reasons.

We might add that 5) excellent US-Japan relations are another tailwind for a strong dollar/weak yen, which keeps the revamped chip industry – which has the backing of the US and EU – globally competitive.

BOJ accommodation means the revolution will continue

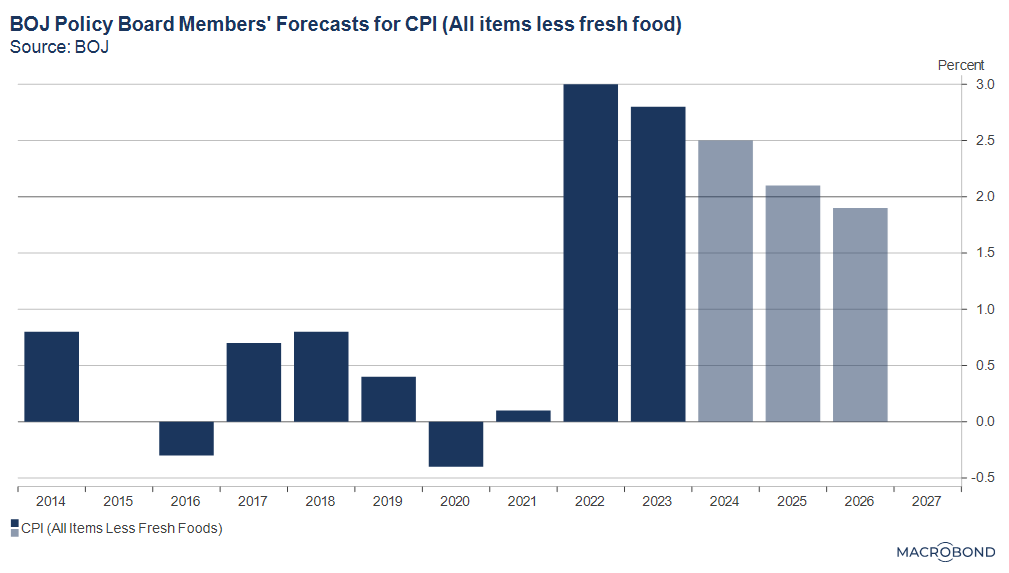

On July 31, the BOJ hiked the policy rate target to around 0.25 percent and announced that monthly bond outright purchases will slow from about 6 trillion yen a month to about 3 trillion yen by January-March 2026. Perhaps to prevent more yen weakening, their forward guidance was more hawkish than usual as they warned they could continue to raise rates and adjust the degree of monetary accommodation if their inflation outlooks are realized (graph). Expected upcoming Fed rate cuts could make BOJ rate hikes more difficult (e.g. due to yen moves), so the BOJ may have felt the need to move sooner rather than later. However, note that real rates are still negative, which will help Japan’s inflation revolution to continue.

[i] https://www.nikkei.com/article/DGXZQOUB057790V00C24A6000000/ and https://www.nikkei.com/article/DGXZQOUB2020S0Q4A720C2000000/ (Japanese)

[ii] https://www.bloomberg.co.jp/news/articles/2023-04-14/RT1EKBDWLU6H01 (Japanese)

[iii] https://www.nikkei.com/article/DGXZQOGN05EJH0V00C24A7000000/ (Japanese)

[iv] https://www.nikkei.com/article/DGXZQOUC2078U0Q4A520C2000000/ (Japanese)

[v] https://www.nikkei.com/article/DGXZQOUB131BI0T10C24A6000000/ (Japanese)

[vi] https://www.nikkei.com/article/DGKKZO79962740R10C24A4ENG000/ (Japanese)

[vii] https://www.nikkei.com/article/DGXZQOUA1422Z0U4A610C2000000/ (Japanese)

Related links