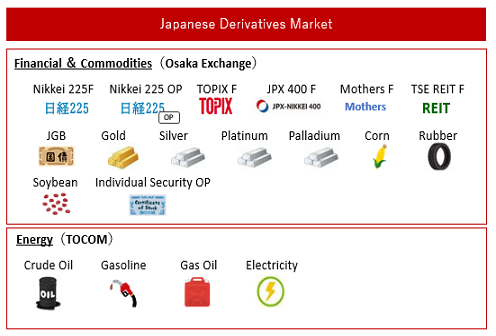

OSE Derivatives

Japanese Government Bonds: The Next Wave of Opportunity

Long beset by tepid market activity, the prospect of policy normalization could spur Japanese Government Bonds (JGBs) and their derivatives, creating exciting opportunities for investors.

Japan’s yield curve has remained relatively stable over the past decade—a result of the Bank of Japan’s (BOJ) efforts to stimulate the economy through a combination of quantitative and qualitative easing (QQE) and yield curve controls (YCC). In turn, domestic and foreign investors found little incentive to trade in one of the world’s largest and most liquid bond markets.

The liquidity of the JGB market has proven vital in managing national debt. Through the smooth and secure issuance of JGBs, the government deploys debt in a way that best supports the economy. Amid the global rout stemming from Covid-19, for instance, stable yields gave the government the means to revitalize the economy and secure a path to fiscal consolidation – though monetary policy has reduced market liquidity and undermined the JGB function.

While recent comments from the BOJ suggest policy continuity for the time being, the triple threat of inflation, yen depreciation, and divergence from hawkish central banks, including the Federal Reserve, has ramped up speculation that it will soon need to normalize policy. The path to normalization could inject much-needed volatility into the JGB market, thereby reviving the market function, moving away from fixed yields, and enabling investors to take advantage of structural market moves.

The Path to Normalization

Recent action from the BOJ is perhaps the first sign of a longer-term move towards policy normalization. On December 20, 2022, central bank governor Haruhiko Kuroda said that he would allow Japan’s 10-year bond yields to rise to around 0.5%–double the previous upper limit of 0.25%.1 Meanwhile, the BOJ kept short- and long-term interest rates unchanged even at the monetary policy meeting on January 18, 2023.2

“This isn’t a rate hike,” Kuroda said when making the annoucement.3 “Through improving the market function, we believe that the effects of monetary easing, starting with yield curve control, will spread more smoothly through corporate finance and other means as a result.”

The move came sooner than all 47 economists surveyed by Bloomberg had expected. Unsurprisingly, markets responded, with the 10-year yield rising as 0.46% from 0.25% after the decision.4

Regardless of how the BOJ’s longer-term policy shift plays out, it will lead to adequate volatility in JGBs and their derivatives, bringing more investors back into the market.

Opportunity on the Horizon

As JGB volatility increases, investors are likely to follow bond yields more closely, boosting demand for more liquid trading instruments that will enable them to hedge against the risk of higher interest rates (lower prices) without unwinding their positions. This could spur greater demand for 10-year JGB Futures, which are derivatives of underlying interest-bearing 10-year JGBs that typically have a remaining term-to-maturity of seven years.

In June 2022, for instance, the price gap between spot JGBs (CTD) and JGB Futures increased after four straight days of declines in futures, mainly due to the undermining basis-risk appetite of existing market players. On the other hand, the gap is a good arbitrage opportunity for investors able to bear the risks.

To revive the market function and stimulate the lowered basis-risk appetite, Osaka Exchange (OSE) announced the revision of an immediately executable price range for the closing auction of 10-year JGB Futures. The change became effective on November 21, 2022.5

In addition, longer-duration, fixed-income tools are very much in demand around the world given the prevailing macroeconomic backdrop and global shift to hawkish monetary policy. A relaunch of the 20-year JGB Futures could also meet evolving investor needs, especially after the OSE launched a stimulus program in April 2022 to improve market liquidity.6

Morgan Stanley MUFG Securities Co., a participant in the market-maker program for 20-year JGB Futures, believes that the product has strong potential to become a prominent hedging instrument.

“There should be inherent demand for a liquid-listed product in the super long-end of the JGB curve from our global client base,” said Shinya Yamamoto, Head of Fixed Income Macro Trading at Morgan Stanley MUFG Securities. “While we remain in a chicken-and-egg situation regarding liquidity and participation, we will continue to promote the product to achieve critical mass in volume and drive the situation beyond the tipping point in activity.”

Broadly, JGB Futures provide a convenient tool for investors seeking trading opportunities through short or mid-term buying and selling. In recent years, for instance, pension funds and other investors that hold bonds over the long term have increasingly used bond futures to leverage their investment positions.7 The re-launch of 20-year JGB Futures provides them with another tool for their portfolios if they successfully get the market liquidity.

A New Future for Japan’s Interest Rate Derivatives

In addition, OSE will introduce 3-Month TONA (Tokyo Over Night Average Rate) Futures on May 29, 2023.8 This is the first-ever short-term interest futures product from OSE and will give investors another useful tool for hedging amid the normalization process.

“OSE’s soon-to-be launched 3-Month TONA Futures enable investors to access the market through the same platform for OSE derivatives trading and to increase margin efficiencies by offsetting exposures with existing JGB futures,” said Kensuke Yazu, General Manager at OSE. “Furthermore, we are considering providing cross-margining between OSE’s 3-Month TONA Futures and OTC interest rate swaps cleared at Japan Securities Clearing Corporation (JSCC) following the launch. We have received strong interest from margin-conscious investors and several market makers who will provide initial market liquidity.”

The success of newly launched products depends on getting initial market liquidity and paving the way for a positive market growth cycle. The BOJ’s path to normalization would support that, and investors could enjoy the next wave of opportunities to trade JGB derivatives. This development of the JGB derivatives market would enhance the efficiencies of the JGB market as a whole, as MOF mentioned that they “expect enhancement of the JGB market’s liquidity by JGB derivatives markets functioning properly.”