20-year JGB Futures Market Stimulation Program

Context on 20-year JGB Futures

The BOJ introduced QQE from April 2013 and the issuance and trading volume of super long-term JGBs have expanded.

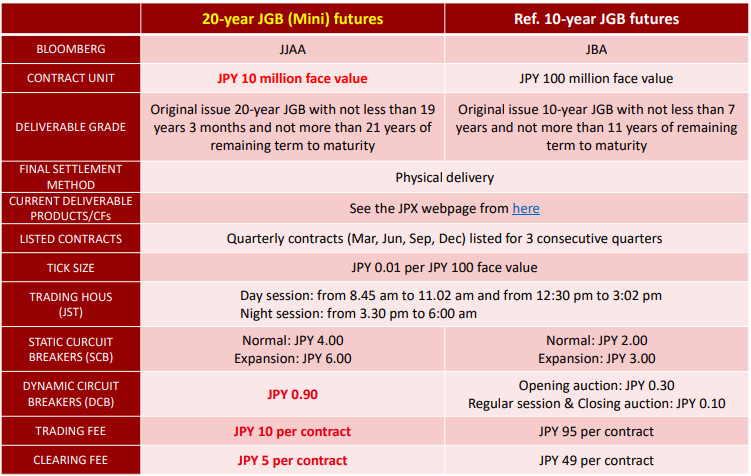

• To offer a hedging tool for super long-term JGB exposure, OSE resumed 20-year JGB futures trading with changes in its product specs and the tick size in 2014 and improved them in 2015.

• To enhance further investor convenience, from the

Day session of April 4, 2022, OSE is going to 1) change the size of the contract unit to JPY 10 million face value and 2) widen the threshold of Dynamic Circuit Breakers.

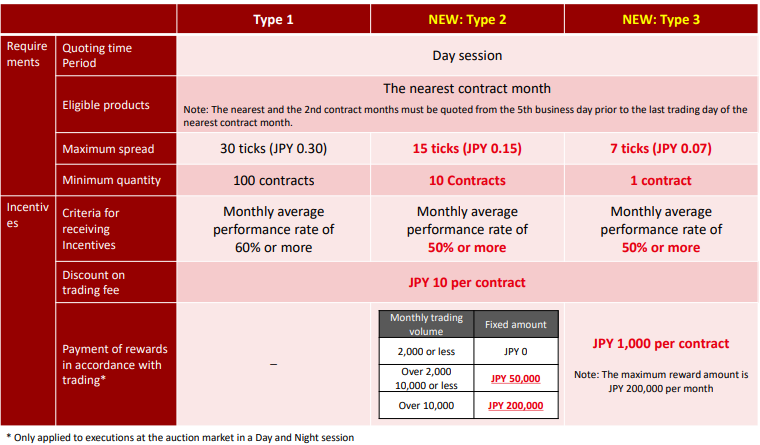

• The 20-year JGB futures market is expected to secure continuous quoting with tighter spread to be placed by market makers through introducing new market maker programs starting from April 4, 2022.

Introducing a New Market Maker Program

To realize tighter spread environment on the screen, OSE is going to add two new types to the market maker incentive

program for 20-year JGB (Mini) futures contracts at the same timing of the changes in product specs on April 4, 2022. For details of the quote obligations and incentives of the Market Maker Program, please refer to Appendix 2 and 3.

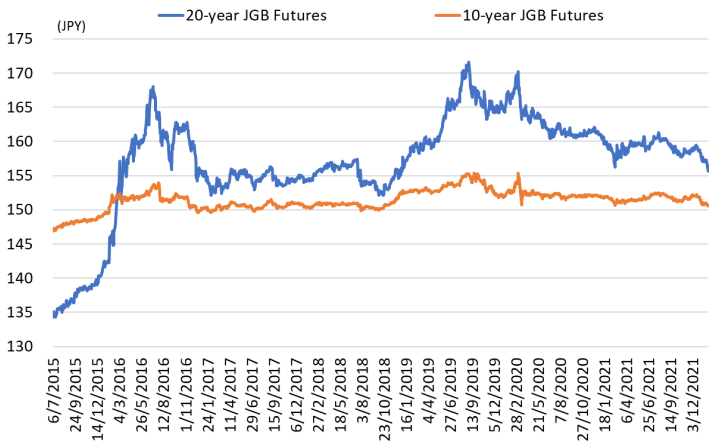

Appendix : 20-year JGB Futures (Synthetic) Price History

Related links

OSE launched a 20-year JGB Futures Market Stimulation Program from April 4, 2022, with the aim of increasing convenience for investors by improving market liquidity.

OSE launched a 20-year JGB Futures Market Stimulation Program from April 4, 2022, with the aim of increasing convenience for investors by improving market liquidity.