Empirical Research on Cross-border Arbitrage of Rubber Futures

Huatai Futures verifies the effectiveness of the long-term equilibrium model between JPX rubber and INE rubber, and design three robust statistical arbitrage trading strategies accordingly. The report is divided into two parts.

Abstract-Part I

Natural rubber, as a key agricultural product and industrial raw material, plays an indispensable role in many fields such as global transportation, industrial products and consumer goods. Since the Shanghai International Energy Exchange launched the No. 20 rubber futures contract in 2019, the market size and the participation of overseas traders have significantly increased.

This paper selects the natural rubber futures (RSS3) of Japan’s Tokyo Commodity Exchange (JPX) and No.20 rubber futures (NR) of Shanghai International Energy Exchange (INE) as the research pair. Based on the actual trading data of the cross-border market, through a large number of statistical empirical studies, this paper deeply analyzes and verifies the long-term stable equilibrium relationship between the prices of the two markets, and excavates arbitrage opportunities which would generate when the price difference deviates from the reasonable range.

The report is divided into two parts. The first part outlines the current situation of the rubber market at home and abroad, and then elaborates the key steps and methods of data processing. In the empirical research part, the report gradually tested the linear correlation, cross correlation, excess correlation and its asymmetry between JPX rubber and INE rubber, providing a solid theoretical support for the feasibility of arbitrage trading. The second part will further explore the cointegration relationship between the two rubber futures, verify the effectiveness of the long-term equilibrium model, and design a robust statistical arbitrage trading strategy accordingly.

Through this paper, investors can better understand the cross-border arbitrage potential of rubber futures market.

■ Linear Correlation (Excerpt)

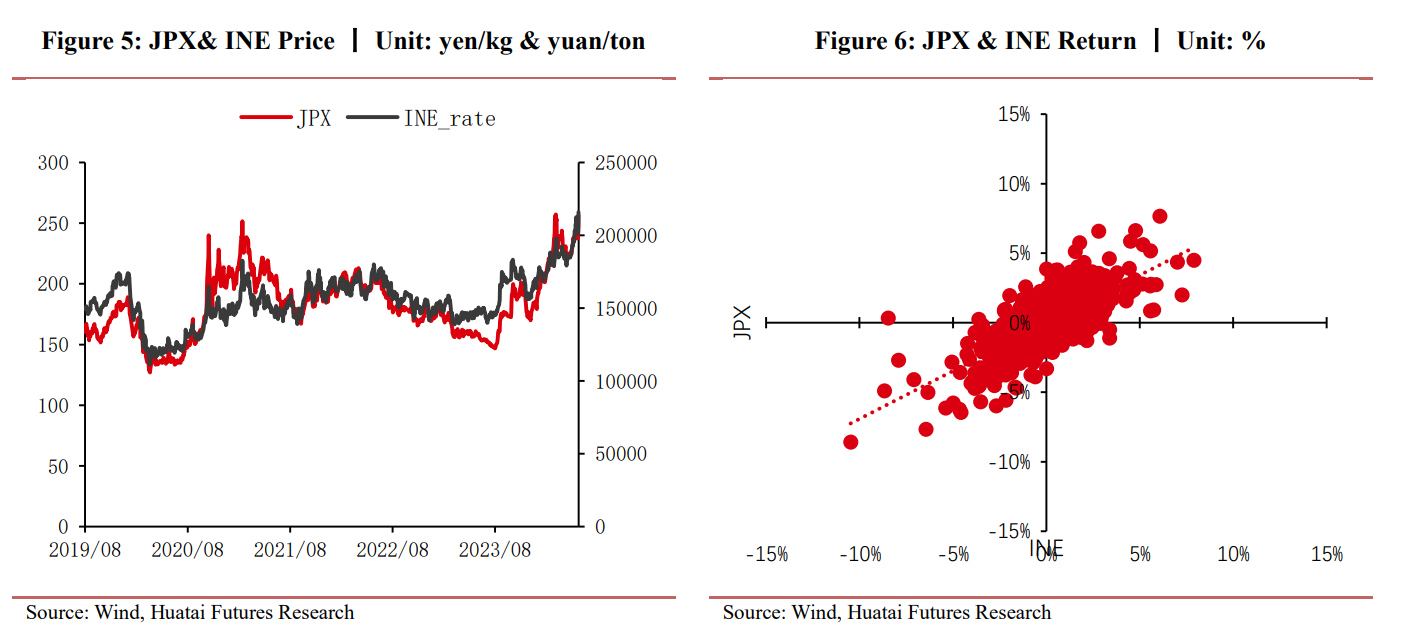

It can be seen intuitively from Figure 5 and Figure 6 that the overall trend of the closing prices of JPX rubber and INE rubber after the right recovery treatment is consistent, with a high correlation. It is estimated that the correlation coefficient of daily rate of return of the two main contracts after exchange rate conversion has reached 0.715 since the listing of the variety.

Full Report: 华泰期货量化专题报告20240619:Empirical Research on Cross-border Arbitrage Part I

Abstract-Part II

This paper is the second part of empirical research on cross-border arbitrage of rubber. The first part has already discussed and verified the (1) linear correlation (2) cross correlation (3) excess correlation and its asymmetry between JPX rubber and INE rubber, which provides a solid theoretical support for the feasibility of arbitrage transactions.

This part will further explore the cointegration relationship between the two rubber futures, verify the effectiveness of the long-term equilibrium model, and design three robust statistical arbitrage trading strategies accordingly. Among them, the Equal Value Allocation strategy provides a calculation method for the ideal position holding ratio. After deducting trading costs, the Sharpe ratio of this strategy reaches 1.35, with an annual return close to 10% and a maximum drawdown of 5.81%,offering the best profitability but with a relatively high difficulty in practical operation.

The Beta Coefficient Allocation strategy compensates for the limitations of the equal valueratio ratio in practical operation, making it more convenient to implement. The Dynamic Switching Allocation strategy, based on the beta coefficient allocation, is more flexible in capturing changes in the strength of the rubber correlation between JPX and INE caused by shifts in rising or falling market trends, thus optimizing the performance of the strategy.

Full Report: 华泰期货量化专题报告20240627:Empirical Research on Cross-border Arbitrage Part II

————————————————————————————

If you have any inquiries , please do not hesitate to contact Huatai Futures. Below is your contact person.

Contact: Yuan Xin, CFA (QFII Sales Director,International Business Department)

Email: yuanxin@htfc.com

LinkedIn: https://www.linkedin.com/in/yuan-xin-cfa-24b41a52/