OSE Derivatives

Key themes for the rubber market in 2024

Article Highlights

- EUDR introducing additional costs for processors’ price structure

- Growing Ivorian NR supply intensifies price competition in an oversupplied market

- Rubber demand in 2024 likely to see support in a lower interest rate environment

As the volatile 2023 year closed, this article aims to cover key themes relevant to summarising the rubber market in 2023. These themes are likely to have some influence on market dynamics heading into 2024, especially for factors such as the EU Deforestation Regulation (EUDR). The EUDR is expected to have a longer-term impact on market dynamics, such as cost-price structures, in addition to possible changes in trade flows.

Key theme 1: EUDR introducing additional costs for processors’ price structure

Earlier in the year, the European Union (EU) announced new regulations, which included rubber as one of the goods requiring traceability for exports into the EU. Given the deadline of 18 months by 31 December 2024 for medium and large-sized companies was relatively short, market participants shared concerns about meeting the guidelines in time. It was also mentioned that micro or small enterprises are subject to the same rules six months later, by 30 June 2025.

However, market intelligence suggests larger-sized processors in some countries, such as Africa, have already set up working systems to track each shipment to its origin. These processors seem confident that their systems would be sufficient, but specific guidelines on how checks will be conducted on shipments and documents have not yet been disclosed by the European Commission.

The United Kingdom (UK) has also announced similar regulations to restrict the imports of commodities produced on deforested land. However, the list excludes natural rubber. Data suggests the UK has recorded a declining trend in NR consumption over the past decade. For 2022, the UK only accounted for about 0.1% of the global share at about 13,157 tons consumed according to the International Rubber Study Group (IRSG). Hence, it is expected to have little impact on the NR market whether such regulations include or exclude NR.

Current market norms are that every year, consumers negotiate long-term contracts (LTC) to secure a steady supply of natural rubber for the next year. Otherwise, consumers rely on buying natural rubber on the spot market directly from producers and/or dealers.

Since the EUDR announcement, suppliers have started employing a tiered pricing strategy for physical rubber shipment offers. Contract premiums are generally higher than before with the addition of traceability costs and price uncertainty in a bearish economic climate.

Due to such volatility between physical rubber and rubber futures, more deals for physical rubber shipments were observed in the spot market in 2023. In 2024, this trend will likely continue due to the EUDR’s impact on pricing. The overall impact on pricing would be bullish as producers are expected to factor in traceability costs and pass that over to their consumers. The only caveat would be this bargaining power would be limited in an oversupplied market, which is the current situation.

Key theme 2: Growing Ivorian NR supply intensifies price competition in an oversupplied market

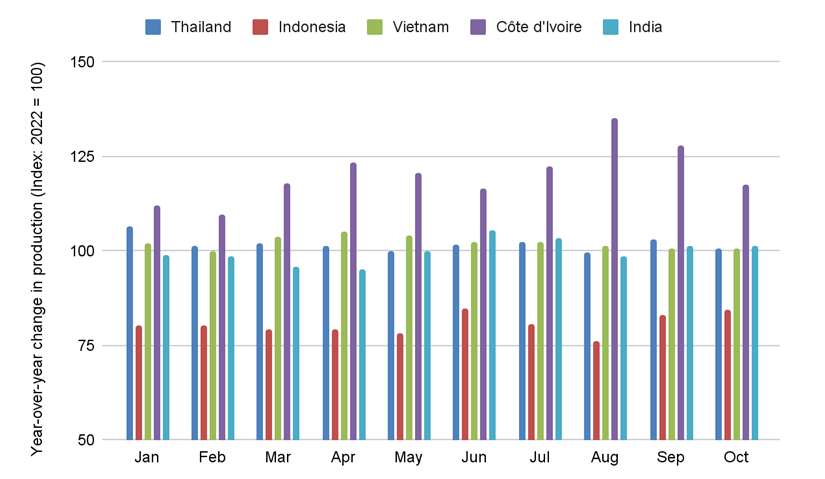

As of October 2023, production from the Ivory Coast reached its highest level since 2007. Across the five largest producing regions, Indonesia registered lower production over all months, while Thailand, Vietnam, and the Ivory Coast recorded an increase. Indian production up till October indicates no change in production levels from 2022.

Over these months, production across the top five regions globally shrank by 122,000 tons. Although three regions recorded higher output, they were outweighed by a larger reduction in Indonesian output. As of October 2023, Ivorian production levels were only about 20,000 tons lower than Indonesia.

Last year, the impact of a surge in Ivorian supply was observed in the physical rubber market in early April. Compared to Asian grade rubber such as STR20 and SIR20, African AFR10 was offered at discounts of more than US$100/mt for most months since then. Over a longer duration, more consumers could decide to buy African grades due to cost and supply considerations.

Following these production trends, new trade flows are expected to emerge from the Ivory Coast. For example, Japan’s trade statistics suggest a new trade flow, registering 92 tons of Technically Specified Rubber (TSR) imports from August through October 2023. Customs data from the Ivory Coast also shows about 113 tons of TSR exported to Japan over the same months. Consumer regions such as Japan have indeed been exploring new supply nodes.

Recently, the Ivory Coast also banned cup lump exports in an effort to limit a fall in prices last year. Information gathered from the market indicates some participants are looking for alternate sources. The data implies that less than 1% of monthly NR exports consist of raw materials like cup lumps. Overall, the impact on Ivorian export quantities is likely limited. However, participants reliant on cheaper cup lump imports will be phased out of the market if they are unable to source lower-cost alternatives.

At the current pace, the Ivory Coast will overtake Indonesia in 2024 as the world’s second-largest producer. However, considerations such as familiarity with established market contacts, quality and sustainability practices and freight cost and delivery time could slow the speed at which consumers accept supply from new sources. In an oversupplied market, higher supply results in intensified price competition from Africa. These dynamics would reflect a bearish price outlook for physical rubber, but its impact on futures is uncertain.

Key theme 3: Rubber demand in 2024 likely to see support in a lower interest rate environment

In 2023, major central banks around the world continued to implement contractionary monetary policies due to inflationary pressures. As of end-November, the US Federal Funds rate stands at 525-550 basis points (bps), the European Central Bank rate stands at 450 bps, and the Reserve Bank of India set rates at 650 bps. All of these rates are the highest since 2020 when the world experienced the COVID-19 pandemic, and these rate conditions undermined support for the global economy.

Previously, key central bank policy rates, such as the FF rate, were raised toward 525 bps in June 2006 before being adjusted downward in the following years. Price data from the World Bank indicates rubber futures trending from about US$2,350/mt in June 2006 to US$1,615/mt in November 2006 before recovering. The economic environment with interest rates at a relatively high level implies a bearish trend in rubber prices.

The downward trend for rubber prices was evident since the beginning of 2023, up till August when China implemented policies to support its economy. As the world’s largest consumer of natural rubber, such policies implemented by China supported prices across physical rubber and rubber futures and contributed to positive price sentiment since then.

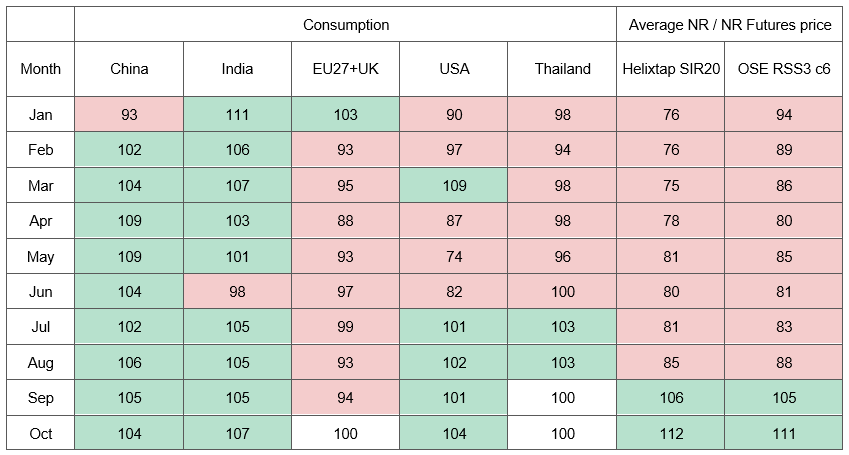

In 2023, consumption among the top five consumers grew instead. For this group, YoY consumption rose by 139,000 tons until October 2023 mainly due to Chinese consumption growth. This mismatch between increased consumption and lower prices is expected due to the oversupplied rubber market.

Matching both consumption and production for the above regions till October 2023, the oversupply was possibly brought down by more than 260,000 tons. However, data estimates placed the cumulative surplus since 2007 at 2.2 million tons at the end of 2022. At this pace, it would take more than eight years for the oversupply to clear and lead to a supply-driven price move.

The FOMC meeting in December 2023 also signalled the potential for rate cuts next year. Even in a high-interest rate environment, consumption in 2023 has shown an increasing trend over the months for the five largest consuming regions. With rate cuts expected over 2024, consumption could possibly continue growing. Hence, physical rubber and rubber futures are expected to be in a bullish environment. This scenario, however, depends on the pace and size of these rate cuts across major central banks, geopolitical tensions, and these regions’ economic policies.

The outcome of the 2024 United States presidential election will also have a significant impact on the market. Presidents exercising a veto on proposed bills could delay spending needed to support the US economy. As a major economy, such policies have a ripple effect on other economies through factors such as currency exchange rates, trade and consumption, and supply chains.

Concluding Thoughts

The rubber industry is entering 2024, with a lot of uncertainty around demand and supply; while some producers opted to play safe and book more volumes under LTC, the preference amid some producers to sell more on the spot market, does highlight the confidence of some improvement in the market situation at least in the mid-term period.