OSE Derivatives

EU Deforestation Regulation (EUDR) Updates and Implications to Trade: Focus on RSS3 Physical and OSE Futures

Article Highlights

- EU Deforestation Regulation: Could Have Unintended Consequences.

- 17 Countries Send Joint Letter to EU to “provide support to facilitate trade.”

- Traceability costs in a grey area could lead to opportunistic pricing and arbitrage opportunities.

- Pricing increments in physical RSS3 could have a spillover effect on Japan’s RSS3 futures.

EU Deforestation Regulation: A major policy in the rubber market

Executive Director of the International Trade Commission, Pamela Coke-Hamilton, has warned that the new EU Deforestation Regulation (EUDR) could have “catastrophic” impact on global trade because the traceability requirement, which seeks to protect indigenous land rights but may be a double-edged sword as producing countries can simply choose to not export to non-EU countries or eliminate smallholders from supply chains entirely to circumvent non-compliance.

On 7th September 2023, 17 producing countries conveyed their concerns to the EU. They were highlighting that the EU’s “one-size-fits-all approach ignores the different local conditions and impose immense costs on exporting, whilst not bearing a positive impact on deforestation rates, and may produce other adverse effects such as increased poverty [amongst smallholders who are especially vulnerable].” The joint letter ends with urging the EU to include “provide support to facilitate trade.” Most recently in December 2023, some organisations have been heard to be advocating for an “educational period” without penalties, but there has not been a decision yet.

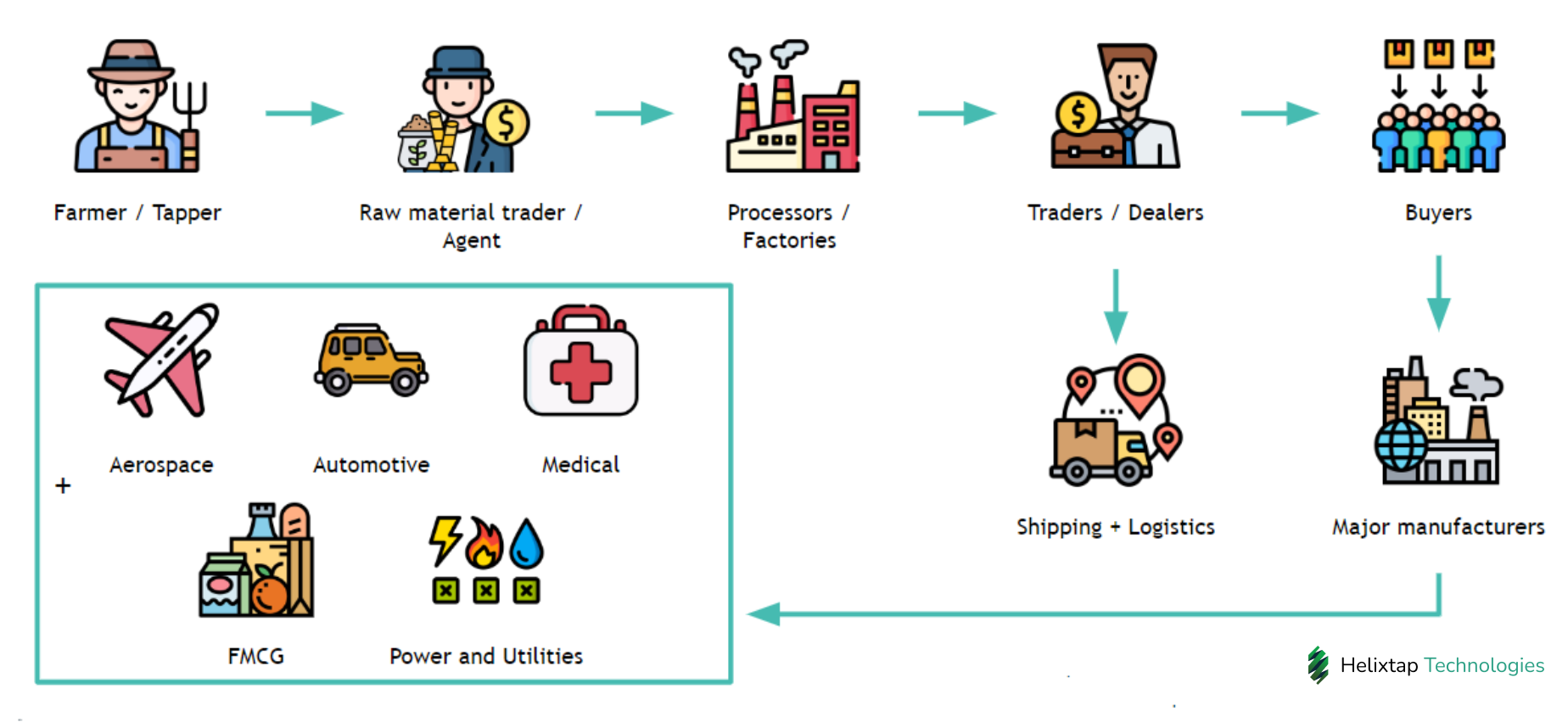

In the image above, is a typical rubber supply chain. Visibility on the upstream elements (farmer/tapper and raw material trader) is hard. From a compliance perspective, we are seeing many processors/factories come up with their own program, including those in industries not mandated by the EUDR. For example, CP Group in Thailand pledges to source sustainable corn. Their traceability project ensures corn is traced to land areas with title deeds and without forest invasions.

The Rubber Authority of Thailand has also set up a data recording system for rubber farmers that include plantation plots being added to the geographic information system. Examples of such data include contact information, plantation landholders’ names and annual production of plantation areas. Such a system allows for each registered member and plantation area to be identified through a unique code.

How would this impact RSS3 Prices and Japan’s RSS3 Futures Market?

The next section seeks to examine the potential impacts of the EU deforestation regulations on rubber pricing risks. The Osaka Exchange RSS3 (OSE, Ribbed Smoked Sheets of grade 3) futures contracts are used as a proxy for rubber futures while the Thai Rubber Association (TRA) RSS3 free on board (FOB) offer prices are used as a proxy for physical rubber pricing dynamics.

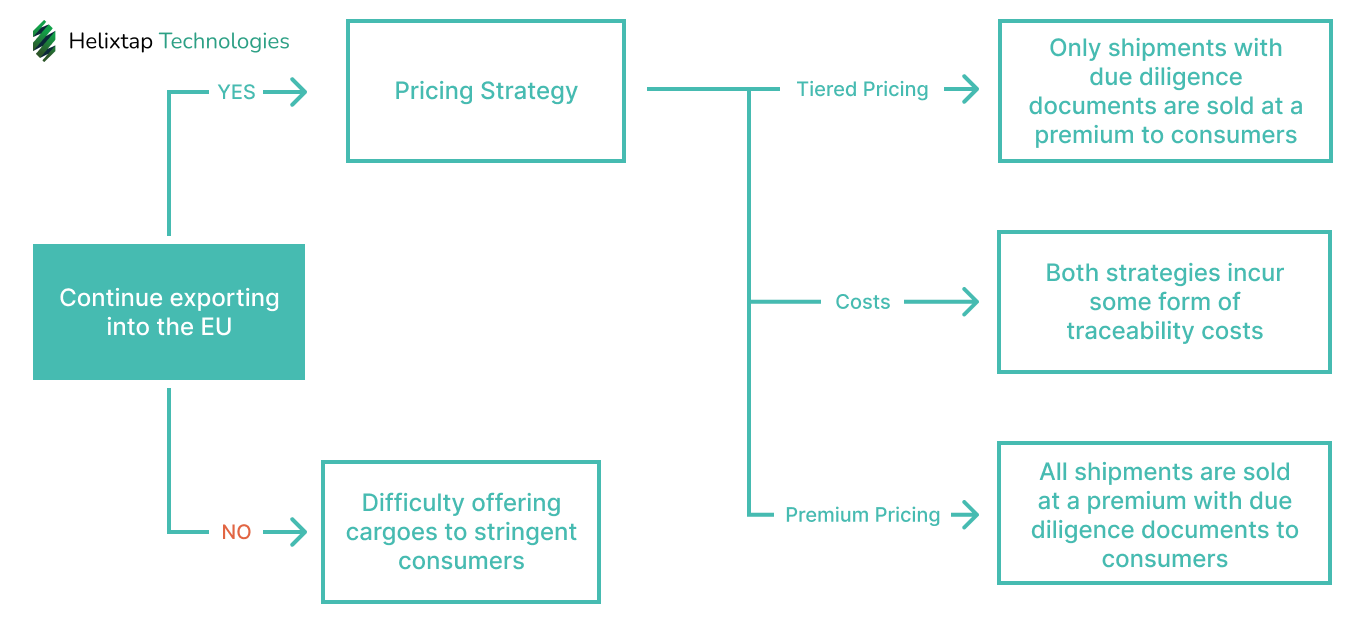

Decision tree diagram for market operators

We explore a few scenarios in which operators (such as processors, traders and tyre manufacturers) could choose within the physical market context in addition to the likely outcomes of each scenario. Once EUDR comes into effect in end-December 2024, operators could either choose to continue exports or cease exporting into the EU entirely.

Scenario 1: Continue Exporting to the EU

In the first scenario, operators choose to continue exporting into the EU. In doing so, they have to conduct due diligence in tracing rubber shipments back to its origin through geolocation. Because smallholders represent about 85% of the world’s NR production, operators are forced to work with these smallholders to address traceability issues and incur additional costs.

Scenario 2: Stop Exporting to the EU, find other outlets

The second scenario whereby operators decide not to export into the EU is unlikely, because intermediate consumers in the supply chain are committed to sustainable rubber initiatives. Some examples of members of the Global Platform for Sustainable Natural Rubber (GPSNR) are Bridgestone, BMW Group and Sri Trang, representing different groups across the supply chain. Processors and traders could possibly face difficulties in selling to stringent tyre makers without due diligence documents.

However, in reality, there may be grey areas where some suppliers use various intermediaries and HS code loopholes to indirectly sell to the EU.

Traceability costs in a grey area could lead to opportunistic pricing

Market intelligence over the past few months has indicated that processors in regions such as Indonesia and Africa claim to have implemented a system that traces each shipment of rubber to its source. Such activities naturally contribute to increased costs to ensure shipments are from sustainable origins. Some offers of “EUDR sustainable rubber” have emerged in the market recently at a price premium over ordinary rubber grades, as analysed by the Helixtap Technologies Market Intelligence.

Existing trends lean toward many large processors and traders currently employing a tiered pricing structure, offering “sustainable rubber” shipments at a premium to European consumers. There also exists a grey area in deciding on the traceability premium to tack onto offered cargoes, because costs may differ across different processors and traders.

The risk of seeing opportunistic pricing behaviour is possible, having some price spillover effect on rubber without traceability checks. However, this also pushes processors and traders toward implementing due diligence procedures with smallholder farmers at the start of the supply chain.

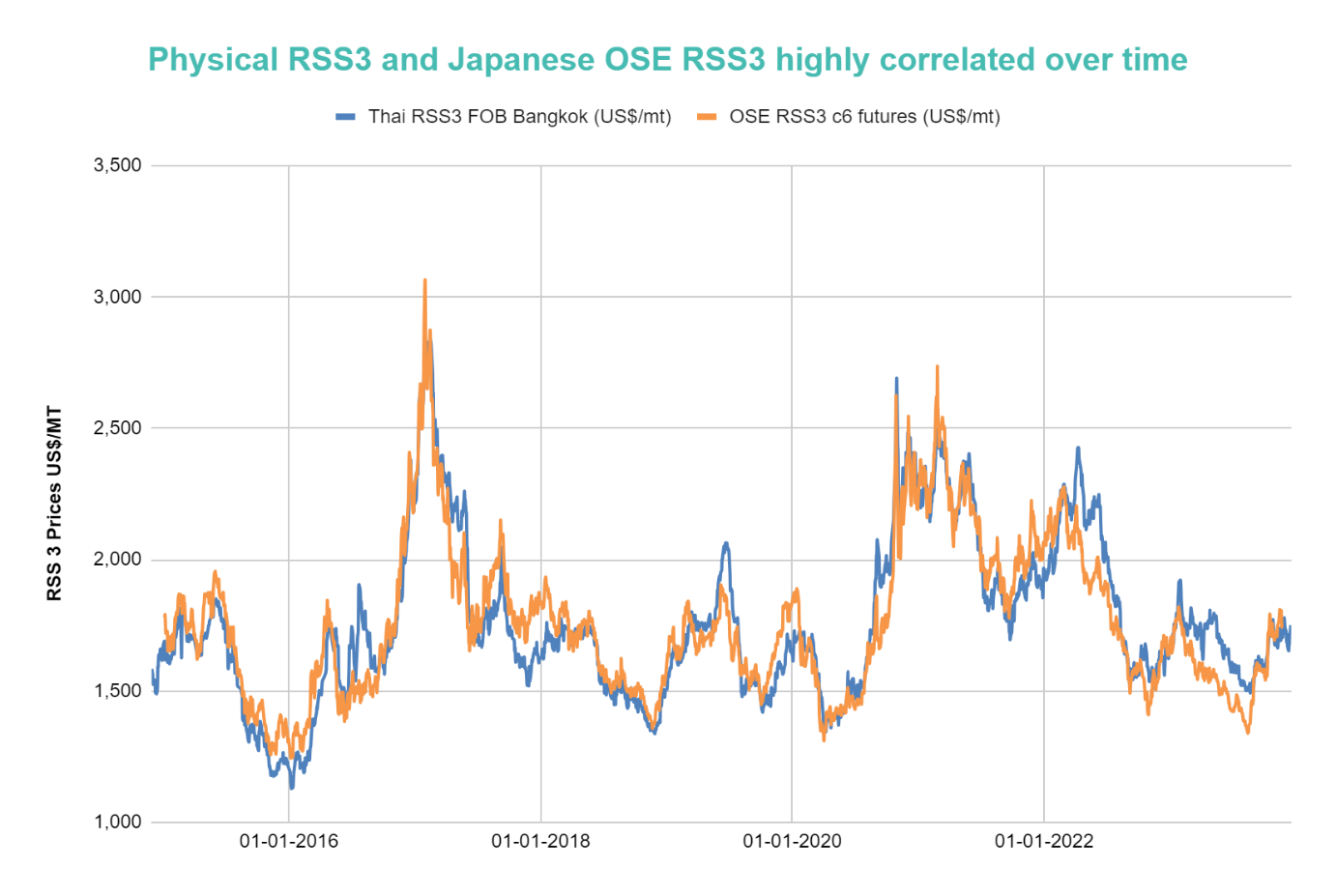

Pricing increments in physical RSS3 could have a spillover effect on Japan’s RSS3 futures

The net effect of these trends likely results in increased costs and eventually pricing for both sustainable and non-sustainable grades in the physical rubber market. Hence, physical RSS3 prices could see an overall pricing increase. Since 2015, the physical Thai RSS3 prices and OSE RSS3 futures have had a strong linear correlation of 0.93 on a daily basis. Any premium increase in physical rubber would most likely have a spillover effect on the rubber futures.

Otherwise, there would be arbitrage strategies that mitigate any significant pricing difference between the two rubber products. Some participants in the physical rubber market have highlighted the need to change delivery specifications into EUDR-compiled RSS3 on OSE. Although they do not represent the entire rubber supply chain, this change will surely impact futures market (and those with open positions) if designated suppliers and producers decide on their end to apply the EUDR for their entire rubber production.

Conclusion

Regulation or otherwise, it is not all bad news. The focus and spotlight of producing sustainable rubber is an important discussion and initiative. Furthermore, for traders of futures and physical, there are arbitrage opportunities and premiums during this uncertainty.

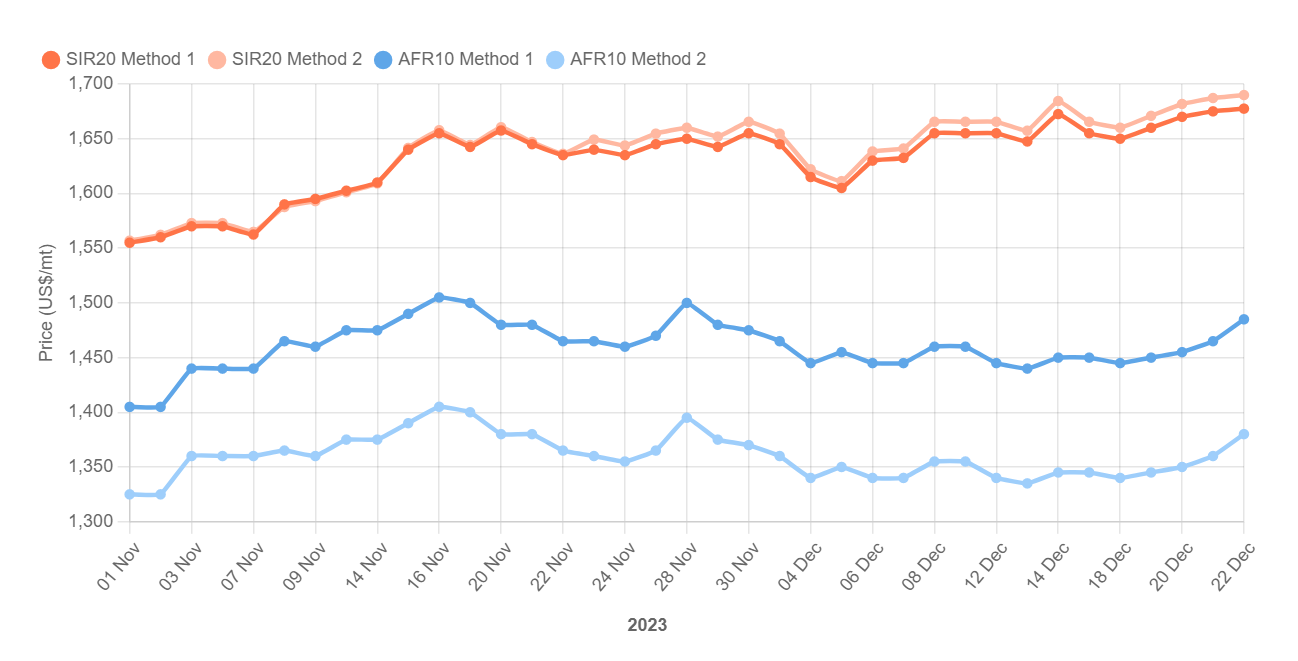

For example, there will be different premiums for various origins and grades of rubber. Using Helixtap’s ESG Price Guide, for African origin AFR10 FOB basis Abidjan, fair value premium is at about +100USD/MT during the period of November and December 2023. Whilst for Indonesian origin SIR20 FOB basis Belawan Surabaya, fair value premium is at +120 USD/MT during the period of November and December 2023.

For RSS3 grades, similar premiums need to be applied to reward producers and smallholders who are helping the industry with the important effort of decarbonisation, reducing deforestation and steps to address climate change. These premiums could spike as the implementation date draws closer but ultimately, in an oversupplied market, the consumers will have more influence.