OSE Derivatives

Currency fluctuation and its implications for and its implications for tyre and automakers

Highlights

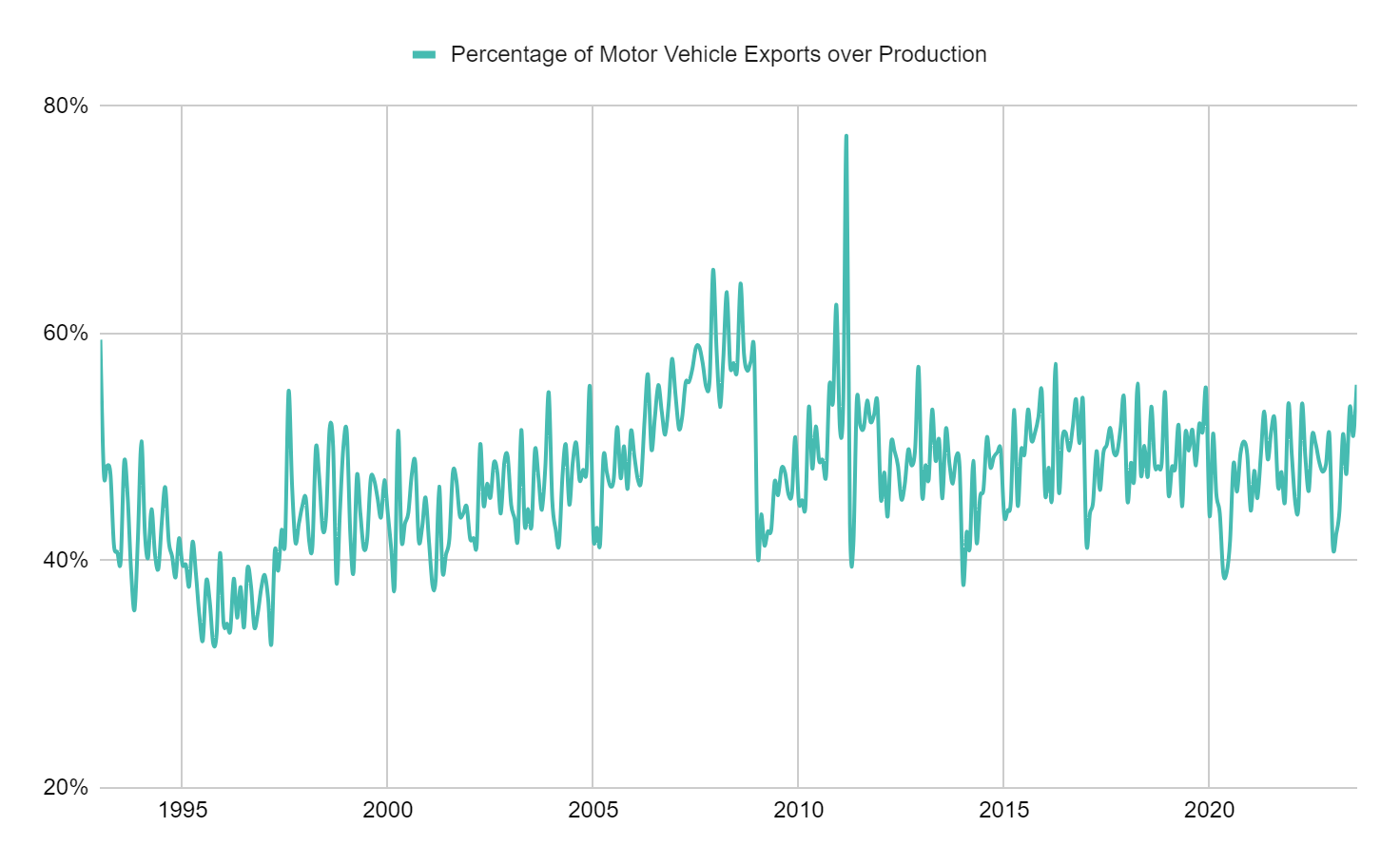

- Japanese auto production vulnerable to currency fluctuations with a 47 percent export dependence

- Discrepancy between central bank policies likely led to a weaker Yen and increased exports

- Export share and quantity of motor vehicles into the US increasing in 2023

- Domestic demand waning over 2023 but positive signs observed in October

- Automaker and tyre maker shares indicate a strong correlation with USD/JPY in 2023

In this article, currency fluctuations and impact to vehicle exports and production were analysed. In recent years, the Japanese Yen has been volatile, and vehicle exports and relevant manufacturers have been exposed to this volatility.

Japanese auto production vulnerable to currency fluctuations due to a 47 percent export dependence

Between January 1993 and August 2023, monthly exports of motor vehicles (including cars, trucks and buses) averaged about 47% of total motor vehicles produced domestically. If the Yen depreciates against other currencies, Japanese exports should see a corresponding increase in quantity as they have become relatively cheaper to export overseas.

As almost half of Japanese motor vehicle production is exported overseas, currency fluctuations have a strong impact on margins especially when shipments are transacted in US Dollars.

From a strategic perspective, Japanese auto manufacturers and tyre manufacturers can reduce their forex exposure by transacting in Yen for the domestic market or aim to grow domestic market share. Alternatively, they can hedge currency positions with OTC swaps to ensure consistent cash flows.

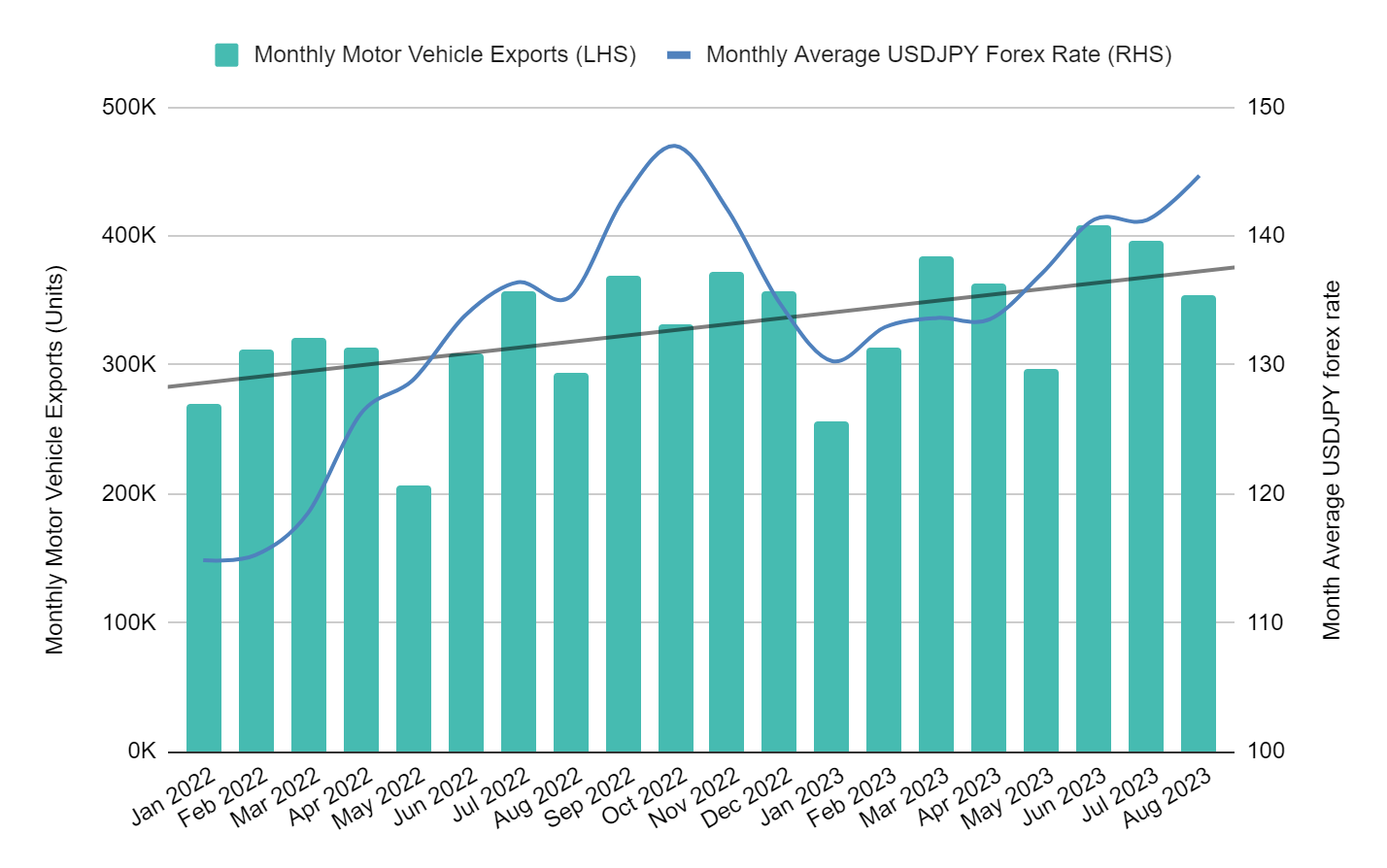

Discrepancy between central bank policies likely led to a weaker Yen and increased exports

The Bank of Japan’s (BOJ) interest rate policy has been held stable at -0.1% since 2016, with inflation remaining below a 2% target over many months. However, inflation this year has consistently registered above 3%, although it remains to be seen if BOJ’s policy will change. Differences between the policy rate level set by the Japanese central bank and the rest of the world raising interest rates since last year likely led to weakness in the Japanese Yen against the US Dollar.

At the same time, monthly motor vehicle exports overseas have increased along with a weakening Yen as shown with the trend line. As suggested above, a weaker Yen could be one of the reasons for increasing motor vehicle exports out of Japan. If Japan continues to hold interest rates steady or change them just a little bit while the US Fed keeps rates steady, the rising export trend is likely to continue.

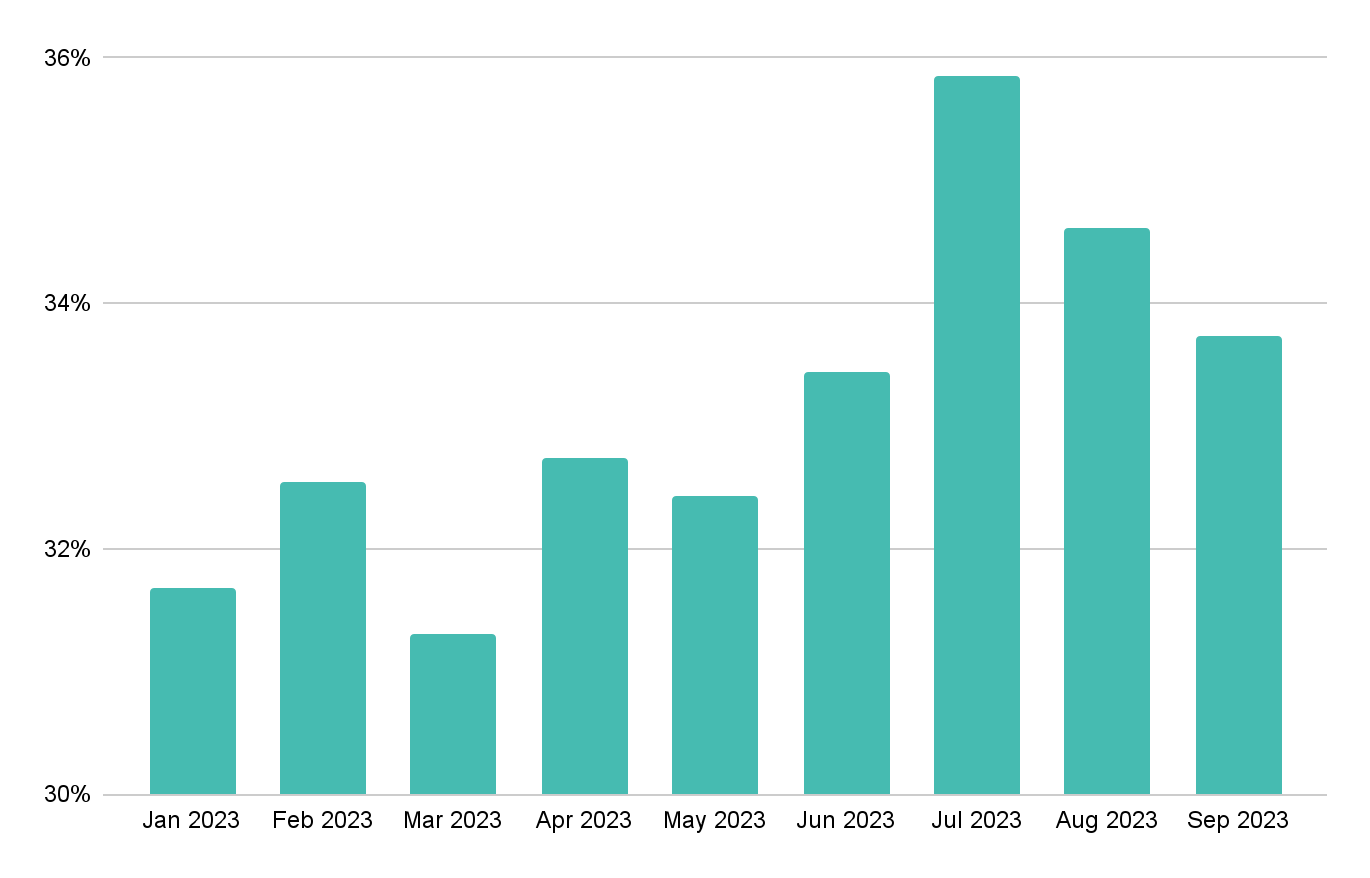

Export share and quantity of motor vehicles into the US increasing in 2023

From January 1975 till September 2023, a majority of about 37% of motor vehicle exports were headed to the United States, followed by Australia and Germany with 6% and 4.5% respectively. This year, the export share for Japanese Motor Vehicles into the US has also increased from 32% in January to almost 36% in July before trending down toward the winter season.

Supporting this data, earlier charts on monthly motor vehicle exports also trended upwards over this period of time. With the exception of January and February 2023, the US imported a larger quantity of motor vehicles in 2023 compared to 2022 from March till September. Such trends are likely due to the dynamics between a stronger Dollar and a weaker Yen.

Such analysis is purely from an alternate perspective and focuses the analysis on the USD/JPY factor. However, macroeconomic factors such as demand and supply are also important and this could also be due to some stock replenishment in the US.

If the USD continues to appreciate against the JPY, auto manufacturers could expect to see a greater share of motor vehicles exported to the US. From January 2021 till September 2023, the highest percentage exported into the US was about 38%, suggesting there could be further room for the export share to increase.

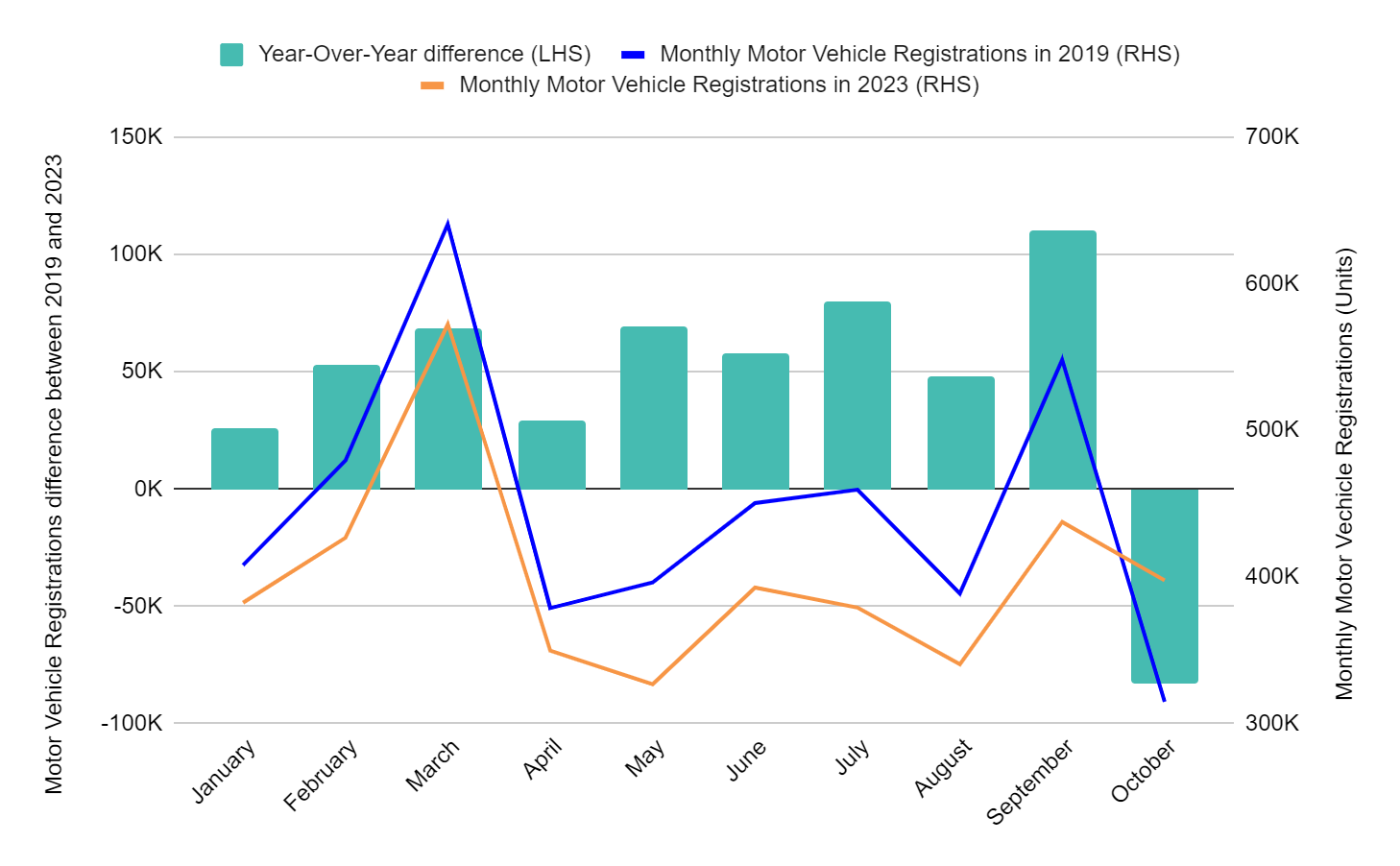

Domestic demand waning over 2023 but positive signs observed in October

The above chart analyses domestic demand in 2023. Across all months till September 2023, there were lower motor vehicle registrations than pre-covid in 2019. Recent data for October 2023 indicates stronger demand, with 83,000 more motor vehicle registrations than 2019. Throughout most of the year, domestic demand was observed to lag behind pre-covid levels. This suggests domestic demand has yet to increase beyond the levels seen prior to the pandemic.

Additionally, the difference in vehicle registrations between the same months in 2019 and 2023 has been increasing across the months. This implies consumers have been buying less motor vehicles than before. With each subsequent month, domestic demand gets poorer relative to 2019. Higher demand in October 2023 may be an early sign of a change in domestic demand trends. However, such trends likely require consecutive months of elevated demand to confirm.

Comparing the same duration shows that exports in 2023 have also been below pre-Covid levels till July 2023. However, the export difference has been decreasing across the months. With each subsequent month, exports get closer to the levels seen in 2019 and have exceeded those levels in August and September. Exports recorded for October were slightly weaker than the same month in 2019. Likewise, export trends likely need to be observed over a longer period of time to identify if demand has grown past pre-pandemic levels.

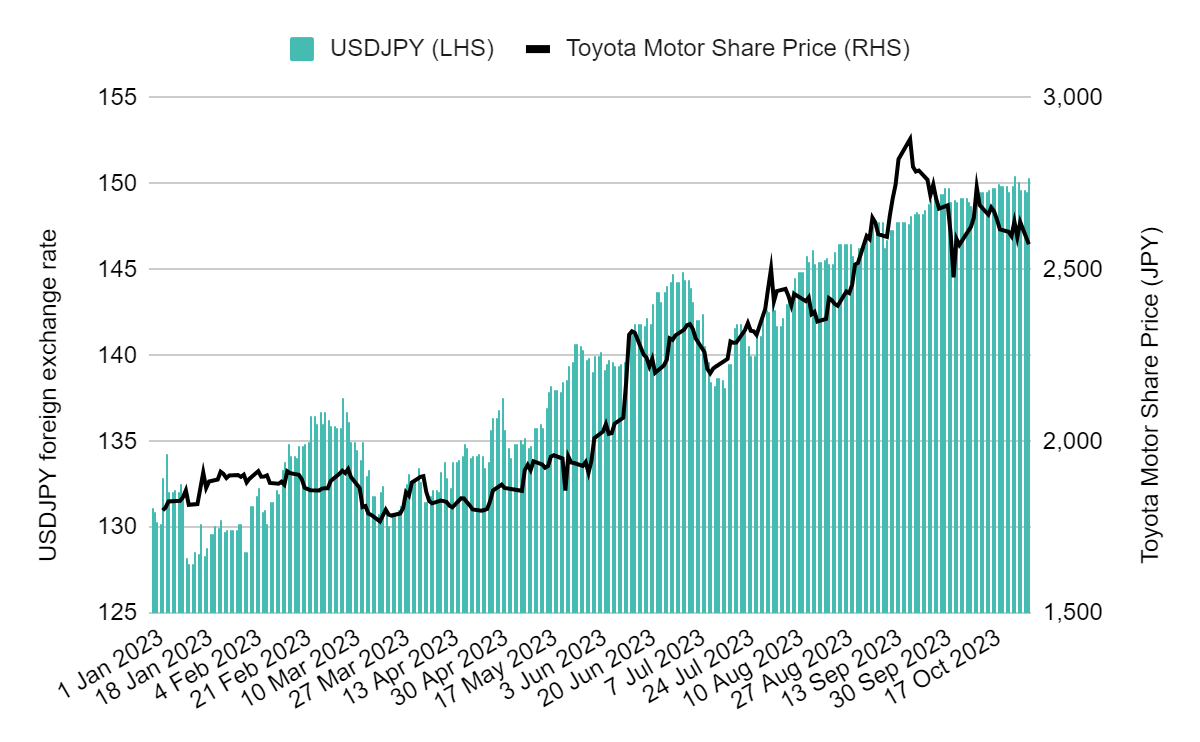

Automaker and tyre maker shares indicate a strong correlation with USD/JPY in 2023

The daily forex rate for the USD/JPY currency pair is plotted against Toyota’s daily share prices as a proxy for Japanese automakers up till October in 2023. It is obvious that there is a strong positive relationship between the two variables as a result of a significant dependence on exports. Even for tyre manufacturers such as Bridgestone, a similar relationship is observed with share prices increasing over the year while the Yen weakened. Market participants in export-reliant sectors could also face similar dynamics as observed in the automotive sector.

The above exports analysis implies there are signs that exports have been on a rising trend in 2023. Domestic demand has also exceeded pre-pandemic (2019) levels in October for the first time this year. Such a trend carrying over into 2024 could be favourable for these stakeholders, and could have a spillover effect upstream with higher natural rubber demand.

Barring any restrictions, market participants should emphasise on exports and conduct deals in the US Dollar due to its strength over the Yen. However, this assumes that central bank monetary policies remain similar, and that the USD keeps the appreciation over the Yen. Regardless, there is an opportunity to exploit currency differences to increase margins.

Related links

Helixtap Technologies