OSE Derivatives

Declining rubber export trends into Japan and market fundamentals unlikely to change

Highlights

- Key market fundamentals weaker in 1Q 2023 compared to last year

- Indonesian Natural Rubber (TSNR) exports to Japan outweigh Thai with lower unit cost estimates

- Japan the second biggest importer of TSNR from Indonesia since 2014, largest in June 2023

- Declining export trends into Japan and market fundamentals unlikely to change

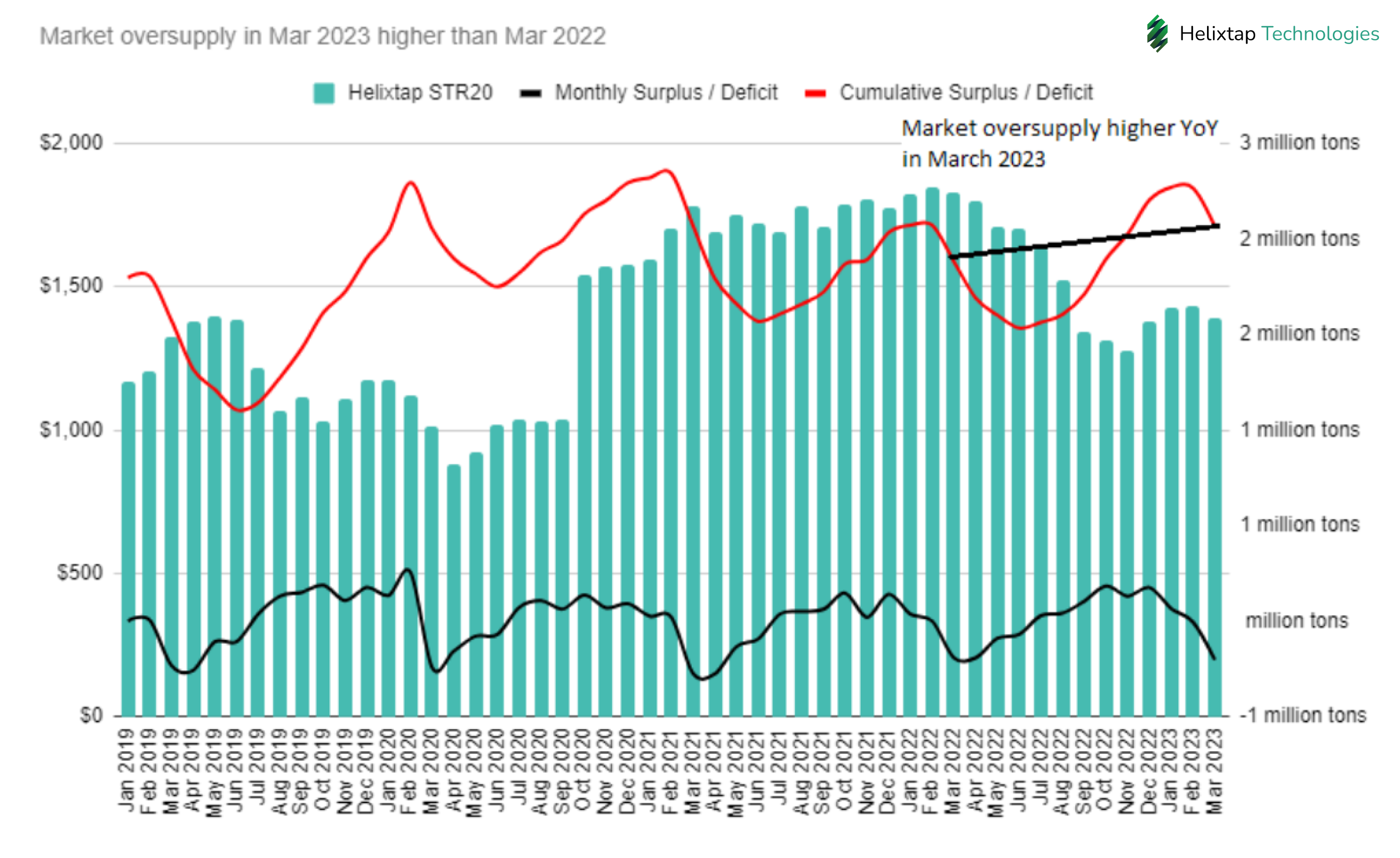

Since January 2007, the monthly surplus or deficit in natural rubber (NR) production has been derived by deducting monthly consumption from production, shown by the line in black. Over the years, monthly surplus or deficit tends to exhibit a seasonal trend because of the cyclical nature of NR production. Rubber trees experience wintering yearly from February to May with leaf shedding and hence production falls over these months. Over time, the monthly surplus started to build up and the market has been oversupplied since 2012. This monthly cumulative surplus is represented by the line in red. It is also an estimate for both publicly and privately-held inventories amongst rubber market participants globally.

Key market fundamentals weaker in 1Q 2023 compared to last year

Comparing the same quarter for 2023 and 2022, both production and consumption in 1Q 2023 was weaker than in 1Q 2022. Since 2007, it was also the first time that consumption in 1Q decreased aside from 2009 and 2020 being years that had global economic crises. Production also recorded the first reduction since the pandemic in 2020. Comparing the cumulative surplus shows the rubber market in March 2023 has a larger surplus of NR than in March last year.

On a monthly basis from January 2019 till March 2023, consumption has a positive correlation with Helixtap STR20 at 0.55, while production has a lower positive correlation at 0.12. Helixtap STR20, along with other grades are a series of price assessments for physical rubber originating from different regions around the world. Such prices are assessed after surveying multiple people across the supply chain and indicates the market volume-weighted price as assessed.

This suggests consumption is a key driver for prices, shown by STR20 mostly trading below US$1,500/mt for close to a year from August 2022. Likewise, other international grade price assessments such as SIR20, AFR10 (CIF Rotterdam/Hamburg), SMR20, SVR10 and TSR Mixture (CIF China) mostly traded below US$1,500/mt over the past year. Although the correlation between physical grade prices and consumption or production is not high, the downward prices in the past year coincides with a decrease in these market fundamentals.

Any continuation of weak consumption would likely result in a low price environment. In turn, lower prices would also result in a larger amount of supply dropping off the supply chain. In the currently oversupplied market, such removal of excess supply would eventually lead to supply-side support for prices.

Indonesian Natural Rubber (TSNR) exports to Japan outweigh Thai with lower unit cost estimates

Annually, Japan consumed smaller amounts of NR over time from about 890,000 tons in 2007 to 681,000 tons in 2022. As of 2022, this represents about 5% of the global market share in consumption. Relative to physical NR, market intelligence indicates that most Japanese consumers tend to buy SIR20 over other grades in the international market.

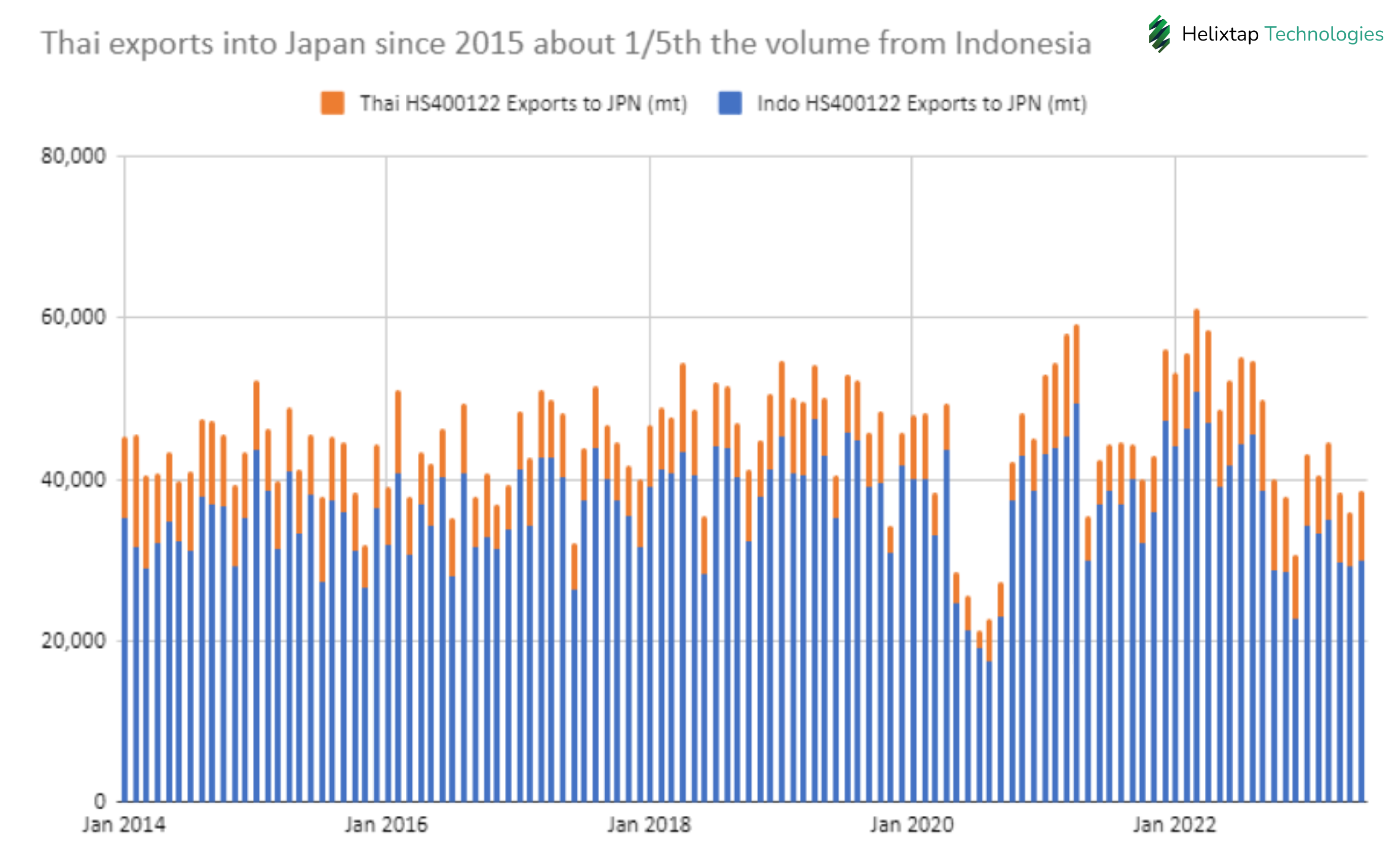

From the two largest producers of NR globally, an average 44,572 mt of TSNR (Technically-Specified Natural Rubber by HS Code 400122) has been exported to Japan monthly since 2014. Thai exports account for about 1/5th the amount exported by Indonesia over the entire period. Additionally, the unit cost of TSNR imports from Indonesia was also lower over 96 out of 114 months, or 84% of the time. This unit cost is derived by dividing the total value of TSNR exports by the quantity for the respective countries. Over an average month since 2014, Indo TSNR cost US$1,518/mt in exports compared to US$1,622/mt for Thai exports. Aside from quality concerns over TSR grades, importing TSNR at a lower cost could also be a factor for Japanese consumers importing a larger share from Indonesia.

In the period from January 2015 to March 2023, monthly world consumption was positively correlated with Helixtap SIR20 prices at 0.36. Similarly, Japanese consumption had a positive correlation with SIR20 prices at 0.16. The price decrease for SIR20 since last year coincides with lower TSNR exports to Japan as well. A lower correlation for Japanese consumption could be due to SIR20 being exported to various countries aside from Japan. Hence, prices should not be used as the only gauge for future consumption patterns. These consumption patterns are also subject to macroeconomic factors and supply chain disruptions as observed over the Covid-19 pandemic.

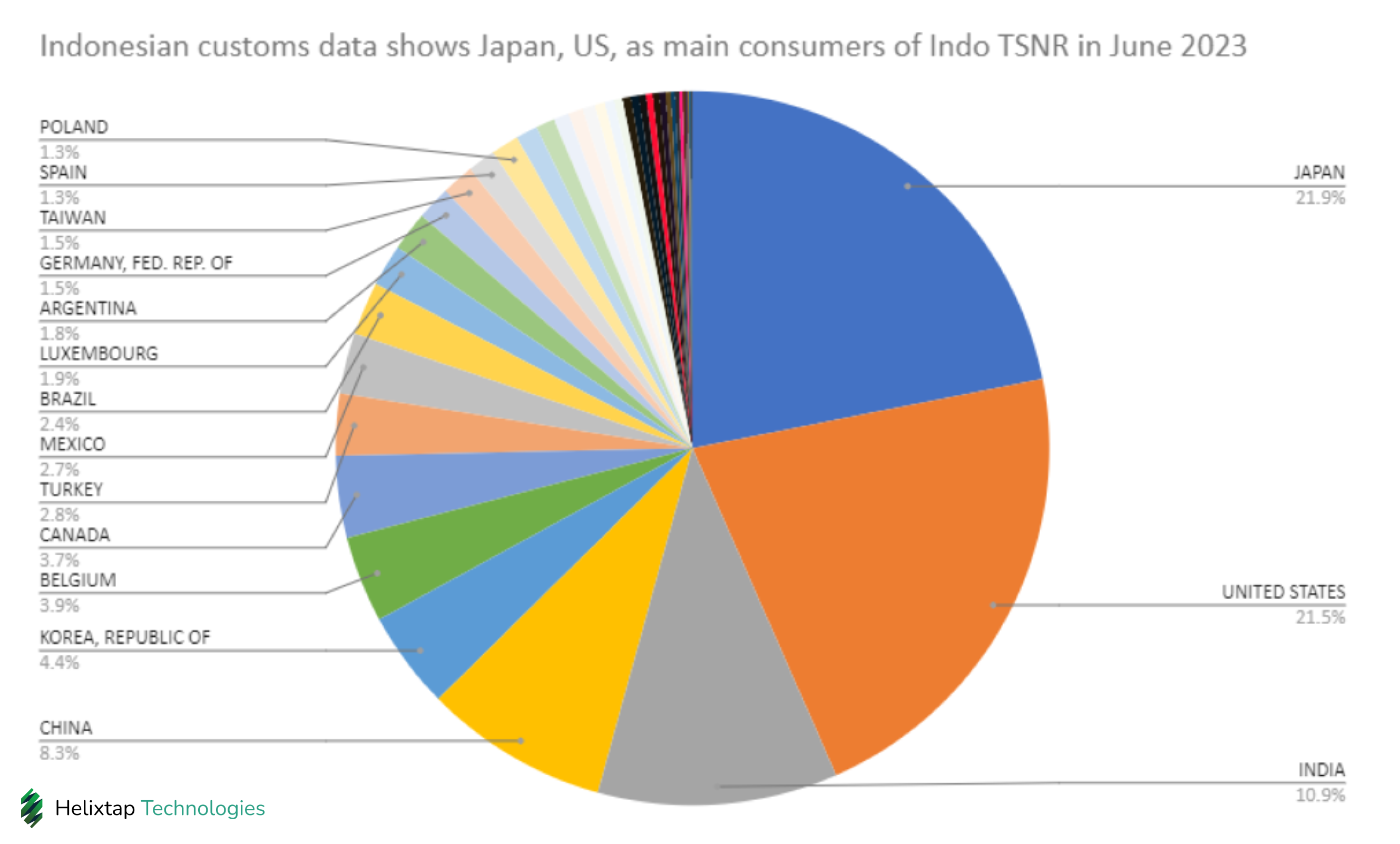

Japan the second biggest importer of TSNR from Indonesia since 2014, largest in June 2023

Trade flow data from Indonesia shows since January 2014, about 18% of all TSNR (by HS 400122) was exported to Japan. More recently over June 2023, Japan was the largest importer of Indonesian TSNR with about 22% of the export share. This supports market-gathered intelligence, suggesting consistent buying from large tyre manufacturers in the physical rubber market earlier this year.

However, these export trends have noted a decrease from the same period last year. Comparing 1H 2022 to 1H 2023 indicates that TSNR exports into Japan trended down from 329,637 mt to 240,849 mt this year for a 27% reduction. These exports also recorded a YoY decrease since November 2022 for a total of 8 consecutive months. Even in a weak export market, Japan retains the highest market share for Indonesian TSNR exports. This dynamic for market share is unlikely to change as factors such as freight and proximity from Indonesia affect buying decisions. China, with a larger proportion of NR consumption, also imports the majority of its rubber from Thailand.

Lower prices, lower exports and the market being more oversupplied than last year are reflective of poorer market conditions in 2023 thus far. Similar to last year, factory closures and farmers switching out of planting rubber were said to have impacted Indonesian production. Helixtap analysis estimated that the total capacity of the factory group was around 237,000 tons, or about 8.6% of Indonesian NR production in 2022. As described above, this removal of supply from the market could accelerate the timeline for supply-side price support.

Declining export trends into Japan and market fundamentals unlikely to change

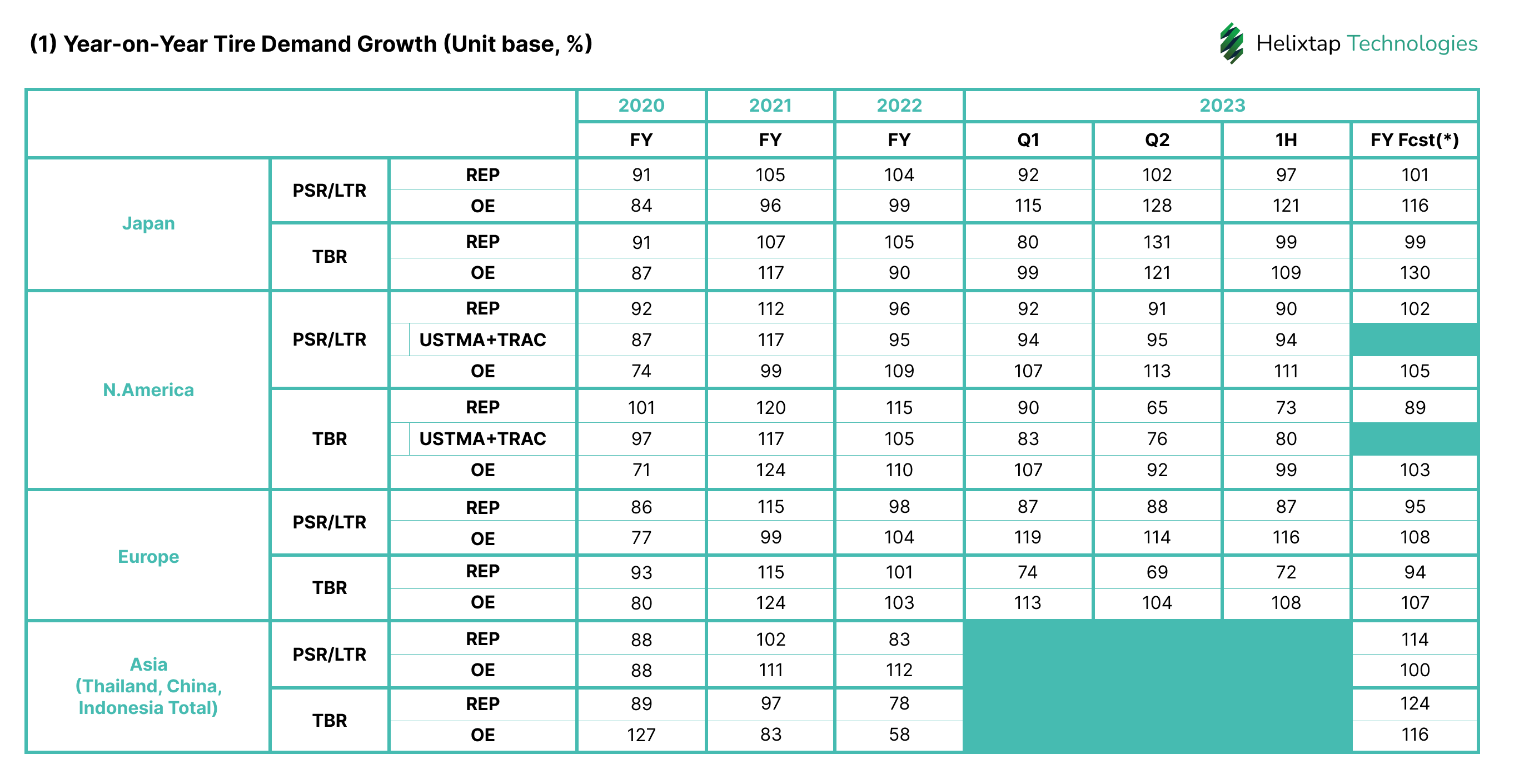

Index forecasts for FY 2023 from Bridgestone indicate most tyre segments are expected to see demand growing from 2022, with most indexes above 100. In the first half of 2023, original equipment segments recorded growth while replacement segments shrank. It is important to note that this forecast was disclosed on 16 February 2023, and does not factor in recent macroeconomic developments.

For the forecasted growth in demand to happen, global consumption would likely need to display YoY growth for the remainder of the year. From November 2022 till June 2023, TSNR exports into Japan from key producers showed a YoY decline across all months. Even as of 1H 2023, current trends in key exports into Japan have not yet shown an increase from last year. Given the trend, there would either need to be a drawdown in inventory or additional buying in the physical market to meet this demand. In this context, Bridgestone would need to draw on existing inventories to meet tyre demand growth or purchase from the international market to meet demand. Assuming similar outlook from other major tire makers, this may extend to them too, stocking up rubber ahead of the EU Deforestation-free Regulation (EUDR).

The mismatch between NR exports into Japan falling and an increase in tyre demand this year could be due to the 2 million mt of excess supply in the market. Hence, tyre manufacturers could rely on existing inventories to fulfil orders and only purchase from the international market when required. Market insights from industry contributors imply major tyre manufacturers have recently slowed buying activity while European sources were said to have secured inventory up till the end of the year.

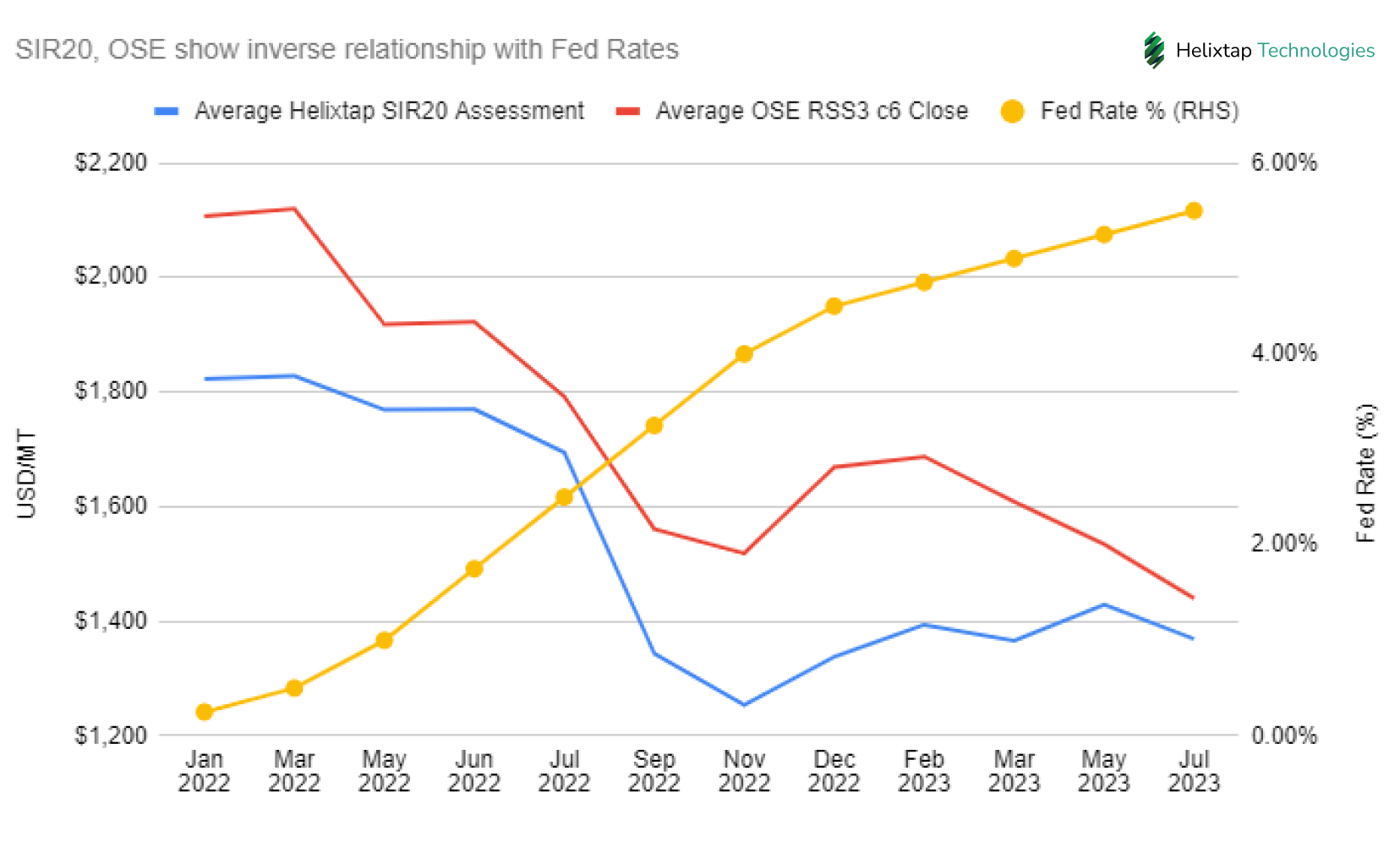

Federal Reserve rates are expected to remain stable between 525-550 basis points for the upcoming Fed meeting in September with an 80.5% probability, according to the CME FedWatch Tool on 25 August 2023. The next 2 meetings in November and December suggest the respective probabilities that rates will be stable at 50.3% and 49.6%. In the event a rate hike is implemented, the OSE RSS3 futures would observe a likely decrease, followed by physical rubber market participants pricing in this change by lowering NR prices similarly. However, a rate hike is not the only factor that determines the price trend. Currently, a weak Chinese economy, the uncertain state of the global economy and oversupply in the form of accumulating warehouse stocks have also resulted in weak price sentiment in the OSE rubber futures. Certain currency movements and technical support could allow for some reprieve for sellers, but in the absence of China’s recovery in demand, would likely be short lived.

In the short term, weaker market fundamentals ranging from oversupply to low prices and slowing demand are likely to persist if there are no significant changes in existing macroeconomic factors such as the above Fed rates. But, there is cause for an increase in Fed rates, considering US CPI was reported at 3.2% for the last 12-month period as of July 2023. The labour market remains firm with a 3.5% unemployment reading in July 2023 in a similar range to around 3.5% observed pre-pandemic over 2019. The 3% CPI figure earlier released for June was followed by a rate hike from 525 to 550 bps in July 2023. In this high interest rate environment, further increases are likely required to bring inflation down to 2% as the Fed’s long term target.

Previous analysis indicated oversupply could end by 2023, with assumptions for consumption and production based on historical growth rates. After considering the trend in falling yields and plantation area for the top 5 producers globally, the market would see the oversupply end by 2027. Both scenarios in the short term without any changes in key macroeconomics or further rate hikes allow for subdued prices in the longer term. In the longer term, these price dynamics also provide for faster removal of excess supply in the market. These factors could result in supply-side price support even earlier than 2027 as estimated.