OSE Derivatives

An Introduction to Platinum Investment

Executive summary

Platinum benefits from being both an industrial and precious metal, thirty times rarer than gold, and an effective portfolio diversifier.

Over recent years, the platinum market has been characterised by constrained supply and highly variable demand; looking ahead, however, supply is expected to remain constrained while demand is expected to grow strongly, supported by higher platinum loadings in autocatalysts, including substitution for more costly palladium as well as to meet tighter emissions standards, with platinum use in fuel cell electric vehicles (FCEVs) and in the production of green hydrogen becoming increasingly significant drivers of demand growth over the next decade.

Despite this compelling fundamental outlook, platinum continues to trade at a significant discount to gold and to palladium.

Precious metal with diverse industrial uses

Platinum is both a precious metal and an industrial metal – over 73 per cent of platinum demand arose from automotive and industrial uses in 2021.

Returns based on the price performance of platinum have historically been well correlated to returns based on gold’s price performance. This results in platinum providing diversification benefits similar to gold when included in a portfolio, as well as being a hedge against currency fluctuations and a store of value.

Also like gold, platinum is a hard asset that investors can turn to at times of increased risk. In fact, during the pandemic, purchases of platinum bars and coins significantly exceeded historic levels as investors turned to hard assets, specifically between March 2020 and August 2020.

With its unique combination of physical and chemical properties, platinum has a diversity of applications and consequently, demand drivers. Its high melting point, density, ultra-stability and extreme non-corrosiveness make it crucial to many industrial and manufacturing processes, yet it is also used to fabricate the finest jewellery in the world. Platinum investment demand is met by a range of investment products: physical bars and coins, on-line bullion accounts, physically-backed exchanged traded funds and futures contracts.

One of platinum’s most important uses is as a catalyst – the presence of even a small molecule can speed up chemical reactions, reducing process energy needs and improving yields. Platinum enabled the first-ever autocatalysts in the 1970s and to this day it remains a key component in vehicle emissions control, predominately in diesel autocatalysts in both light and heavy-duty vehicles and increasingly in gasoline engine vehicles where it has substituted for palladium.

Biocompatible and well tolerated by the body, platinum is used in numerous established medical treatments and is at the forefront of many new ones. Compounds made from platinum are used in the treatment of cancers.

Glass, petrochemicals, silicones and sensors are all produced using platinum. It is present in the hard disk drives that enable the growth of cloud storage in the global computing industry. Fuel cell technology that made the moon landing possible uses a platinum catalyst to produce electricity from hydrogen. Today, platinum is regarded as a critical mineral that is essential for the energy transition due to its use in proton exchange (PEM) technologies which are used not only to power fuel cell electric vehicles, but also to produce green hydrogen via electrolysis.

Platinum is a Platinum Group Metal (PGM), the other PGMs being palladium, rhodium, ruthenium, iridium, and osmium. The palladium and platinum markets are interlinked with regard to supply and demand. PGMs are co-products or by-products in the majority of their mining locations, and they are substitutes for each other in several industrial applications, most importantly in gasoline autocatalysts on a one for one basis.

Figure 1: Platinum supply and demand chart

Platinum supply

Thirty times rarer than gold, platinum is found at very low concentrations in the Earth’s crust. When compared to gold and silver mine production the rarity of platinum is highlighted further. In 2021, the mined production of silver, gold and platinum was 823 Moz, 115 Moz and 6 Moz, respectively.

Figure 2: Platinum supply map, platinum is 30x less abundant than gold

Platinum extraction from mining is concentrated in only three geographical locations in the world, with over 70 per cent of global mine supply coming from a relatively small geographic region in South Africa – the Bushveld Igneous Complex. Here, annual supply has declined from a peak of 5.3 Moz in 2006 to a projected 4.3 Moz in 2022, due to volatile margins hindering capital investment decisions.

The balance of mined supply comes from Zimbabwe, Russia, and North America. Platinum is very rarely found in isolation, and Southern Africa is the only primary source of platinum, with platinum in Russia and North America mined as a by-product of other metals (mainly nickel and palladium, respectively). Platinum is extracted, processed and purified through a complex series of physical and chemical processes; mining, concentrating, smelting, and refining.

Platinum is highly recyclable – mainly from spent autocatalysts and, to a lesser extent, jewellery. Secondary supply from recycling in 2006 was 1.4 Moz and this is projected to be 1.7 Moz in 2022.

Overall, projected total supply is on a declining trend, and in 2022 it is expected to be 6 per cent below the peak level it reached in 2006.

Diverse demand drivers

Figure 3: Drivers of platinum demand

Platinum demand arises from four segments: automotive (mainly autocatalysts in diesel vehicles); jewellery; industrial; and investment.

The largest segment of platinum demand is in automotive applications. Platinum is an excellent catalyst and is instrumental in reducing the three main harmful emissions from internal combustion engines (ICE): unburned hydrocarbons; carbon monoxide; and oxides of nitrogen. Emissions continue to be subject to increasingly strict regulations in most countries around the world and, historically, tightening emissions legislation has driven platinum automotive demand growth to a greater extent than changes in volumes of auto sales.

At around 40 per cent of demand, the outlook for platinum automotive demand is key to the supply/demand fundamentals of platinum. The size of this demand segment results in its developments impacting investor sentiment towards platinum.

Figure 4: Combined automotive drivetrain production outlook for light vehicles, light commercial vehicles and heavy-duty vehicles

While the electrification of the transport industry is undeniably essential to meet global emissions reductions targets in support of limiting global temperature rise, not all vehicle applications or geographies are compatible with electrification under current technologies. Consequently, ICE vehicles will remain a material part of the drivetrain mix for the foreseeable future, albeit a gradually declining one with increasing mild hybridisation.

In combination with the latest emission standards which increase platinum loadings per vehicle, and in particular increased platinum for palladium substitution in gasoline vehicles, this results in ICE-related automotive demand for platinum peaking in 2028. To put this into perspective, automotive demand for platinum is expected to peak at 3,819 koz in 2028, versus the 3,055 koz expected in 2022.

Platinum’s rarity and precious metal status has led to it becoming the premier metal used for the finest jewellery, especially in western markets and Japan, and more recently in China. That said, the platinum jewellery market has been facing headwinds, even before the impact of pandemic-related lockdowns was felt.

China is the single largest market for platinum jewellery, with a market share of 36 per cent, or 703 koz, in 2021, although this has been on a declining trend. Meanwhile, growth in demand for platinum jewellery has come from the US and India, although this has not been enough to compensate for the loss of market share in China.

Research has shown platinum to be the precious metal most associated with love and the expansion of platinum into global jewellery markets is rooted in buyer behaviour in the bridal sector, although self-purchasing has been an increasing trend.

Industrial demand for platinum has grown at twice the pace of global GDP since 2013, and since 2020 it has been the second largest demand segment after automotive.

Industrial uses of platinum are myriad. For example, its catalytic properties are used to make nitric acid for fertiliser and in the petrochemical industry to achieve a higher yield of higher-octane fuels during the reforming process. Platinum’s high melting point, stability and non-corrosiveness are vital to the glass making industry, as it can withstand the high temperatures necessary without distortion or causing contamination. Light emitting diode screens and glass fibre are produced using platinum.

The investment case for platinum

Since 1900, platinum has traded at a premium to gold for over 86 per cent of the time (on an annual average basis) as its supply/demand fundamentals added to its ‘precious’ value. However, in recent years, negative sentiment, rooted in concerns over the decline in demand for platinum in autocatalysts and, to a lesser extent, jewellery, has seen this premium eroded.

Today, the investment case for platinum has strengthened considerably. The outlook for the all-important automotive demand segment is demonstrating considerable upside as the transition away from ICE is likely to be slower, while increasingly stringent emissions standards are driving higher loadings as is platinum for palladium substitution. Supply, meanwhile, remains constrained.

The platinum market is projected to enter sustained and growing deficits from 2023, with ongoing robust demand for automotive and industrial end uses supplemented with small, but growing, demand from the hydrogen economy. As the decade progresses, platinum automotive demand from FCEVs will grow at an increasing pace, ultimately matching current automotive demand for platinum in the mid-2030s.

Overall, automotive demand for platinum – autocatalyst and FCEV combined – is expected to exceed 4,028 koz in 2026, 34 per cent higher than forecast automotive platinum demand in 2022 due to a combination of higher platinum loadings in autocatalysts, substitution for palladium and growing demand from FCEVs.

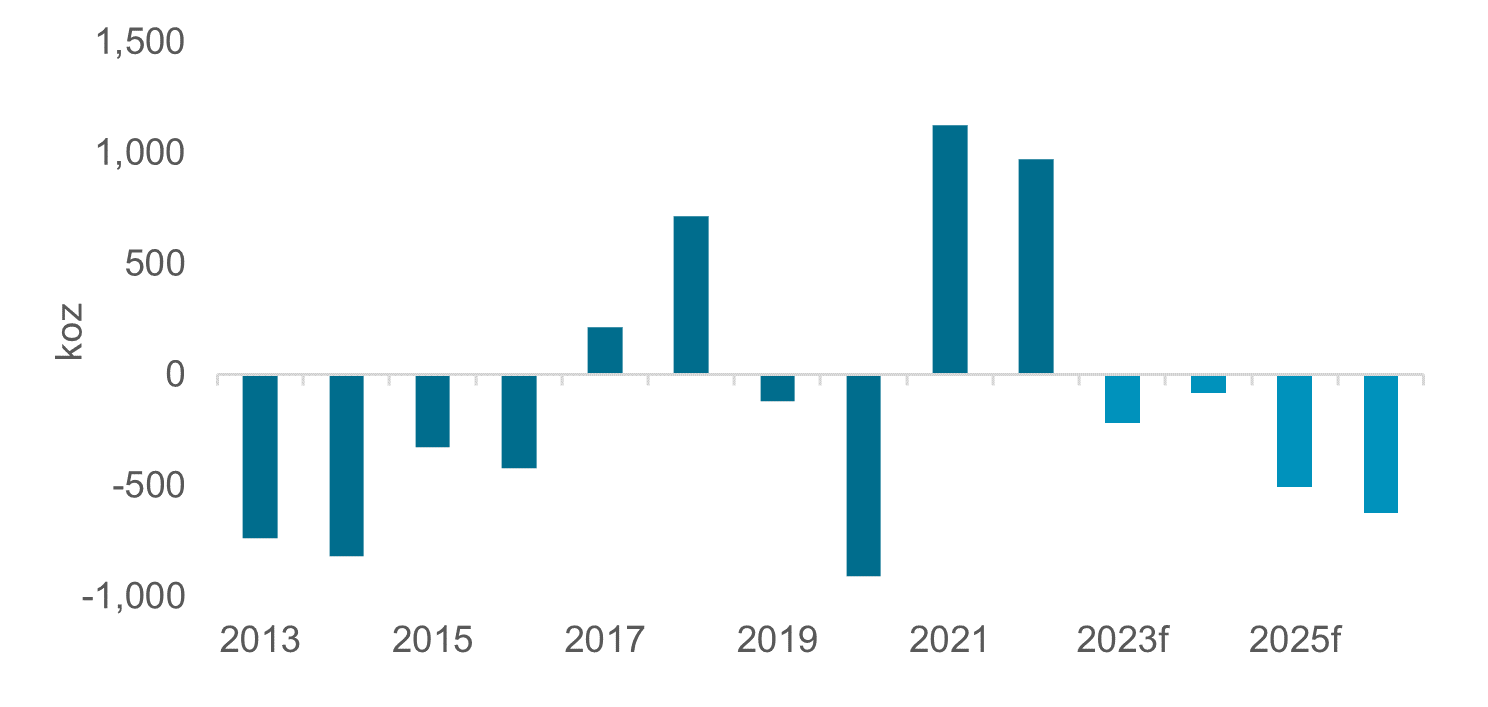

Figure 5: Sustained and deepening deficits in the platinum market from 2023 to 2026

This publication is general and solely for educational purposes. The publisher, The World Platinum Investment Council, has been formed by the world’s leading platinum producers to develop the market for platinum investment demand. Its mission is to stimulate investor demand for physical platinum through both actionable insights and targeted development, providing investors with the information to support informed decisions regarding platinum and working with financial institutions and market participants to develop products and channels that investors need.

The research for the period since 2019 attributed to Metals Focus in the publication is © Metals Focus Copyright reserved. All copyright and other intellectual property rights in the data and commentary contained in this report and attributed to Metals Focus, remain the property of Metals Focus, one of our third-party content providers, and no person other than Metals Focus shall be entitled to register any intellectual property rights in that information, or data herein. The analysis, data and other information attributed to Metals Focus reflect Metals Focus’ judgment as of the date of the document and are subject to change without notice. No part of the Metals Focus data or commentary shall be used for the specific purpose of accessing capital markets (fundraising) without the written permission of Metals Focus.

The research for the period prior to 2019 attributed to SFA in the publication is © SFA Copyright reserved.

This publication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. With this publication, neither the publisher nor its content providers intend to transmit any order for, arrange for, advise on, act as agent in relation to, or otherwise facilitate any transaction involving securities or commodities regardless of whether such are otherwise referenced in it. This publication is not intended to provide tax, legal, or investment advice and nothing in it should be construed as a recommendation to buy, sell, or hold any investment or security or to engage in any investment strategy or transaction. Neither the publisher nor its content providers are, or purports to be, a broker-dealer, a registered investment advisor, or otherwise registered under the laws of the United States or the United Kingdom, including under the Financial Services and Markets Act 2000 or Senior Managers and Certifications Regime or by the Financial Conduct Authority.

This publication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor. You are solely responsible for determining whether any investment, investment strategy, security or related transaction is appropriate for you based on your investment objectives, financial circumstances, and risk tolerance. You should consult your business, legal, tax or accounting advisors regarding your specific business, legal or tax situation or circumstances.

The information on which this publication is based is believed to be reliable. Nevertheless, neither the publisher nor its content providers can guarantee the accuracy or completeness of the information. This publication contains forward-looking statements, including statements regarding expected continual growth of the industry. The publisher and Metals Focus note that statements contained in the publication that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect actual results and neither the publisher nor its content providers accept any liability whatsoever for any loss or damage suffered by any person in reliance on the information in the publication.

The logos, services marks and trademarks of the World Platinum Investment Council are owned exclusively by it. All other trademarks used in this publication are the property of their respective trademark holders. The publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the publisher to any rights in any third-party trademarks.

© 2022 World Platinum Investment Council Limited. All rights reserved. The World Platinum Investment Council name and logo and WPIC are registered trademarks of World Platinum Investment Council Limited. No part of this report may be reproduced or distributed in any manner without attribution to the publisher, The World Platinum Investment Council, and the authors.

Related links

World Platinum Investment Council - WPIC®

World Platinum Investment Council - WPIC®