OSE Derivatives

50% drop in premiums for LTC, changing dynamics increase anticipation

Highlights

- AFR 10 initial offer at a premium of US$40, buyers bid flat

- SIR 20 likely to settle at a premium at US$80: market expectations

- Some Indo LTC volume might move to Africa

The annual long-term contract (LTC) premium for rubber is expected to see a 50% drop amid the bearish global market cues. Meanwhile, due to the volatility of spot markets, buyers are showing some preference for non-traditional sources. However, whether there will be a reduction or increase in contract volume is yet to be seen, especially with prices at a 2-years low.

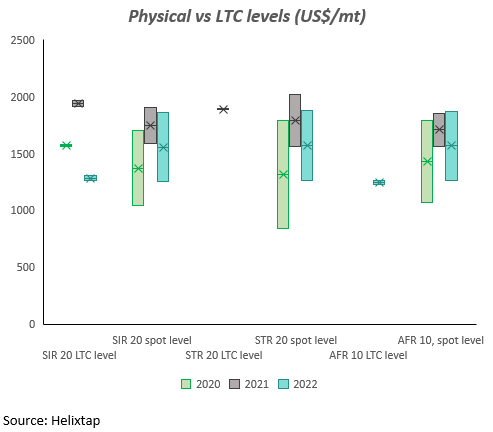

The current physical rubber prices are lower than the 7-year average, primarily driven by the bear market. According to Helixtap data, the prices have dropped 27%-31% across the board since January 2022. This downward bias in prices, coupled with the weakness in market fundamentals, has resulted in a drop in the premium for the LTC negotiations.

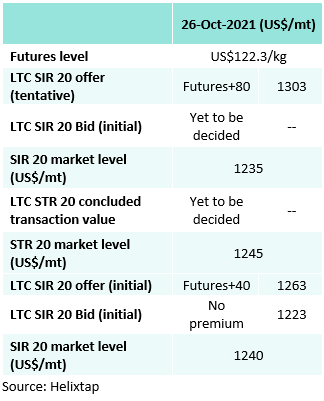

The market is expecting the settlement value for SIR 20 LTC would be at a premium of US$80/mt on SGX SICOM TSR20 Futures (US$ 122.3 /kg, on October 26, 2022) which translates to US$1303/mt, while the physical price is at US$1235/mt on FOB basis.

African negotiations send jitters amid producers

With the LTC negotiation at its nascent stage for African rubber and yet to start for Indonesia and Thailand, producers are worried about the outcome of the negotiations for 2022. An Africa-based source noted that they are still in discussions, but the pricing indication would be difficult for them to accept. “It is challenging for the moment. We are a bit stuck as our suppliers are unwilling to sell at current levels,” he added.

“Indo premiums have reduced from US$150 to US$80,” another producer source added that the buyers are citing the sluggish demand as the rationale. However, it would be difficult for some producers to match the buying expectation.

While the African producers are looking at the Indonesian market for direction, the initial offer from the African producers is at a premium of US$40/mt on SGX SICOM TSR20 Futures (US$ 122.3 /kg, on October 26, 2022) which translates to US$1263/mt, while the physical price is at US$1240/mt on FOB basis. However, the buyers are looking at a “no premium” price.

A “no premium” price might be unworkable for some African processors despite the drop in the raw material prices to 31600 FCFA/kg (US$ 47.9) in October 2022 from 35100 FCFA/kg (US$ 53.23) in September. The processors as they usually work on a 10% gross margin and break even at US$1300/mt. “Low price, the low premium would deflate most producers’ ability to be profitable,” the second producer source added.

Raw material prices non-supportive for Indonesia and Thailand

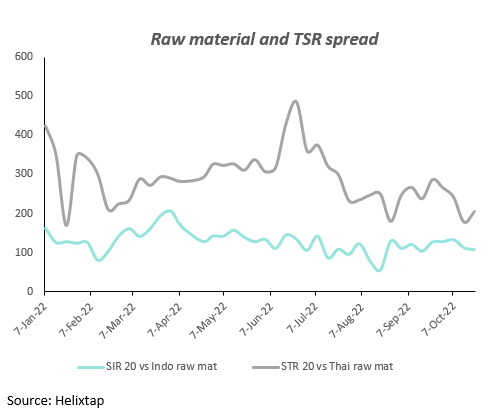

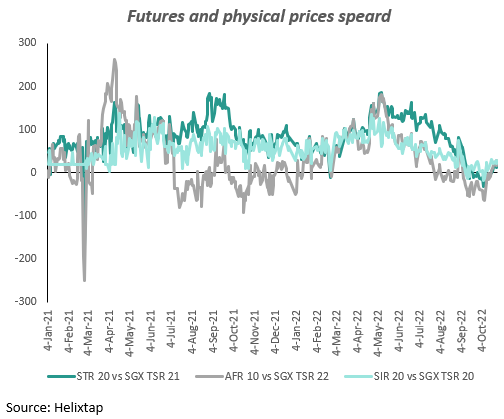

One of the major setbacks for the Indonesian and Thai rubber producers in the 2022 negotiations was the wide gap between the contract price and physical prices. The fact that the LTC prices are pegged on futures prices which is largely driven by speculative buying or selling aimed at profit booking rather than real-time volume trade inflating or deflating the prices artificially. Thus this leads to some distortion in the transacted level for LTC. In addition, the producers have to account for the volatility in the raw material prices, which was northbound during Q4 2021.

In Q2 2021, Helixtap Indonesian raw material prices were up 5%, while SIR 20 prices were up 3%.

Meanwhile, Thailand struggled with more-than-expected rainfall-impacted production, amplified by the labour shortage due to Covid restrictions.

2022 is witnessing a similar situation, wherein the correction in the raw material prices does not match the deep dive in the processed rubber prices.

The Indo raw material was corrected by 2% over the month, while SIR 20 prices dropped 5.6%. For Thai rubber, the drop in the raw material was marginal compared to a 6% drop in the STR prices.

The straight impact is on the producer margins. Indonesia has been struggling with negative margins all year long, and as per Helixtap calculations, Thai producers’ margins are now below 1% compared to around 4.7% in January.

The buyers are struggling as well

Meanwhile, the buyers have been struggling with their own set of challenges. Supply chain issues leading to a lack of inventory due to the semiconductor shortage have impacted auto production, trickling into the tire demand. In addition, lengthy lead times and high operating costs are likely to weigh on the market until the end of 2022 and 2023, making the market highly challenging for tire producers.

The withering demand amplified by the monetary tightening propped a major tire maker to pull back from their long-term contracts earlier in 2022. The tire maker notified the producers of excess inventory and the dip in demand.

In addition, the wide gap between the physical prices and LTC transacted level has been a major bottleneck for the tire makers. In 2021, the negotiation started with Standard Indonesian Rubber (SIR) 20 offered for LTC at a premium of US$120/mt on SGX SICOM TSR20 Futures (US$181.2/kg as of November 25, 2021) which translated to US$1932/mt while buying interest is at a premium of US$100/mt translating to US$1912/mt. The physical price SIR 20 was at US$1835/mt on FOB basis.

Traditionally, Indonesian producers book around 40%-50% of their monthly production volume for long-term contracts, which will be reduced to around 20% in 2021, owing to a wide gap between contract and physical prices.

The major tire manufacturers have settled prices for Thai rubber supply contracts for 2022 at a premium of US$70-US$80/mt on SGX SICOM TSR20 Futures (US$181.2/kg) which translates to US$1892/mt. With the physical price for Standard Thai Rubber (STR) 20 at US$1840/mt on FOB basis as on November 24, 2021, the gap is around US$50/mt.

The way forward

The future of these negotiations is still hazy amid clashing sentiments. With varying breakeven for the producers, a “no premium price” would impact their margins making the negotiation conclusion difficult. Furthermore, with hardly any optimism in the market, some producers might opt to go offline, unable to sustain the continued negative margins.

With the prices at a 2-year low compounded by weak market fundamentals, the market has decidedly moved in favour of the buyers. Moreover, the continued monetary policy tightening, the zero covid policy in China, and the possible threat of recession would keep the tire makers skeptical. The narrative pushed by the buyers is that the bearish market scenario is likely to continue. As a result, they intend to narrow the gap between the physical and contract prices.

The volume booking might see some changes as well. Some buyers could opt to move to more spot buying to insulate overbooking and map the purchase as per demand. However, with some uptick in the spot prices for Q1 2023 cargoes, while the slide continues in the prompter months, some buyers might look to lock larger volume before the prices start to rise again. In addition, there may be a shift to non-traditional sources. According to some Indonesian producers, some western market buyers are looking into African rubber.

The rubber industry is likely to close the year with a production forecast of 14.36 million tons for a demand projection of 14.55 million tons, according to the Association of Natural Rubber Producing Countries (ANRPC), which still indicates at a supply deficit. However, the reality is much gloomier. Thus the rubber buyers and sellers are likely to enter into a complex negotiation for the LTCs for 2023.