OSE Derivatives

Navigating the rubber market: Today & Tomorrow

Summary of the key points discussed at Helixtap Technologies Flash webinar on 30 August 2022.

Points discussed: Negative margins in Indonesia, LTC reduction and prices breaking support levels. Is this the start of structural change?

Today: A Recap of the Current State of Play

- LTC pullback shook the market confidence

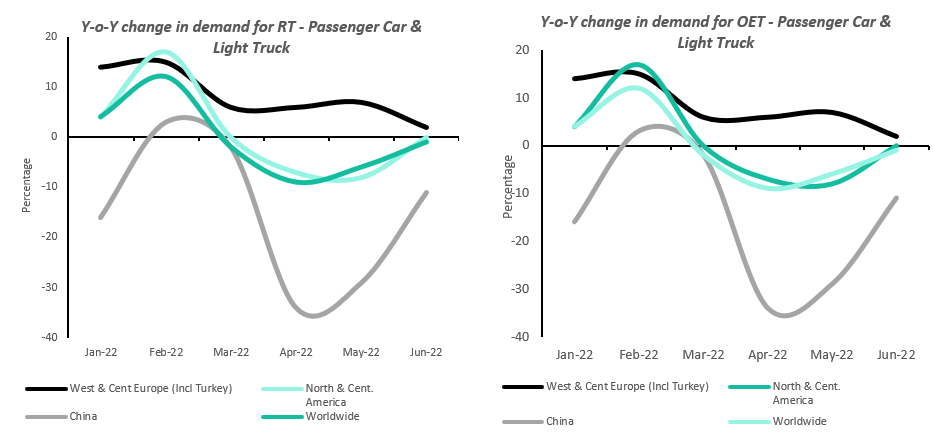

- Tire maker claims excess inventory

- Tire production shutdowns

The price pressure has proved to be anything but transient as the spot rubber prices slide back to the 2020 level. What we are witnessing right now is a culmination of a series of black swan events and unprecedented setbacks.

However, the one that really shook the rubber market confidence was a major tire maker’s pull back from their long-term contracts (LTC), taking the spot prices to a 22-month low.

The widening spread between the long-term contract price level and the physical market price underlines the apparent disconnect.

Tomorrow: Proceeding with Uncertainty

Last week prices were (almost) in free fall in the rubber markets. Indonesian grades were at the lowest premiums to futures and processors continued to face negative margins.

In Indonesia, sellers had to continue to swallow the bitter pill of selling at a negative margin. Sources Helixtap spoke to confirmed that a big factory in Palembang has stopped buying raw material to stem further losses and for some reprieve in raw material prices. This is the first time this has happened.

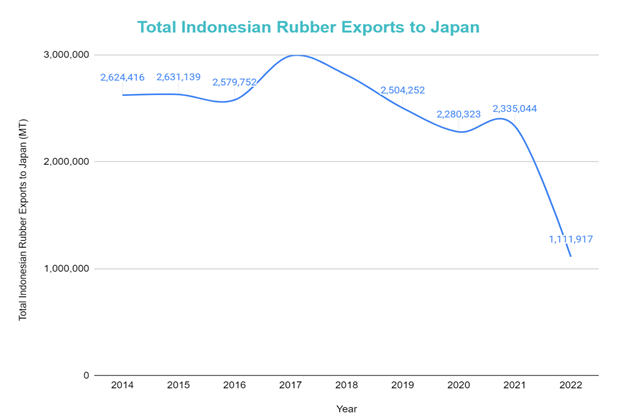

Japanese buyers are one of Indonesian rubber’s major supporters. If quality comes into question, Indonesian suppliers would have to compete to sell to more price sensitive markets, like China and India.

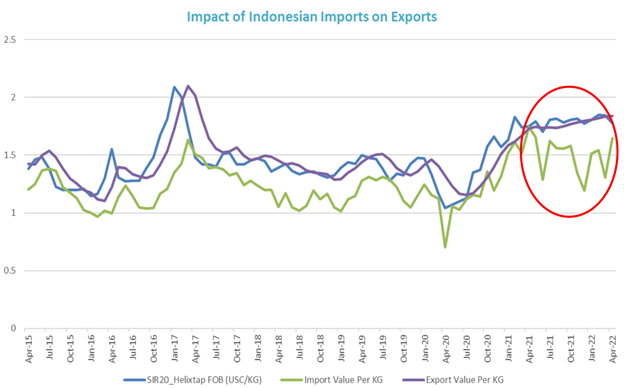

The chart below plots Helixtap’s assessed SIR20 physical prices (Helixtap’s data goes back to 2015) against the import and export value. Historically, the differential was stable but looking at the last year, you see the gap closing between the physical prices and import value. This could mean that simply importing cheaper raw material may actually have a negative impact on prices.

Conclusions:

This year has been a volatile one with multiple black swans. Arming oneself with timely data is critical to navigate the uncertain markets. Helixtap provides critical information for clients to make better decisions in both good and bad times. To delve deeper, register at Helixtap for free here.

To get access to the full webinar recording, please fill up the form here.