OSE Derivatives

STR20 prices tend to fall less than SIR20 prices during wintering months

Helixtap Physical Rubber margins and intra regional spreads analysis:

Highlights

- The Fed rate hike is likely to provide more pricing flexibility for physical rubber manufacturers

- Seasonality analysis suggests Helixtap STR20 prices tend to fall less than Helixtap SIR20 prices during wintering months from February to May each year

- Helixtap STR20 price spread over Helixtap AFR10 was observed to have a strong seasonal trend of widening from May to August each year

- Helixtap SIR20 price spread over Helixtap AFR10 also tends to increase from the second half of June till August each year

This article will offer readers analysis on Technically Specified Rubber (TSR) and raw material spreads and price spreads between various regional rubber prices. The price spread between TSR and their respective raw material will be a good proxy for manufacturer margins.

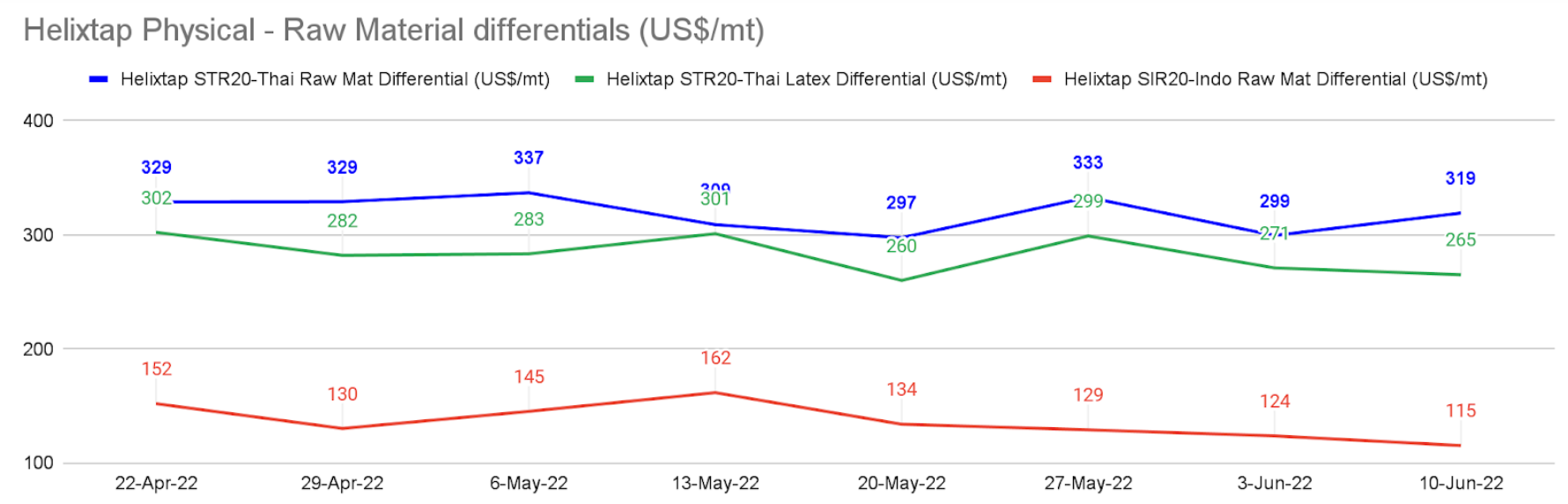

The TSR and raw material spreads covered are the Helixtap STR20 – Thai Raw Material, Helixtap STR20 – Thai Latex, Helixtap SIR20 – Indo Raw Material. The intra regional physical rubber price spreads covered are the Helixtap STR20 – Helixtap SIR20, Helixtap SIR20 – Helixtap AFR10 and Helixtap SIR20 – Helixtap AFR10. All price data used in this analysis are proprietary price assessment data from Helixtap.

A key part of this analysis is to identify any possible seasonal trend in the spreads covered. A strong seasonal trend suggests that the price spread will most often than not, trend upwards or downwards within specific months of the year. Such insights will allow market participants to predict the likelihood of spreads moving up or down in the upcoming months based on historical data analysis.

Since Helixtap AFR10 CIF prices include freight prices as a pricing component, a flat US$50/mt discount as a freight cost assumption is applied across all price data points for the purpose of this analysis. This would allow us to compare all Helixtap physical rubber prices on a FOB basis. It would also provide more appropriate analysis on potential arbitrage opportunities or even induce a change in procurement strategy due to changing price dynamics.

The Fed rate hike is likely to provide more pricing flexibility for physical rubber manufacturers

In the past four weeks, there has been a stable spread observed in the Helixtap STR20 – Thai Raw Material spread, trading between a high of US$333/mt to the low of US$297/mt in a US$35/mt range. This is the lowest range seen in any month since the launch of the Helixtap Raw Material price assessments in September 2021. A low range suggests a low relative level of volatility, with the Thai Raw Material price expected to track the physical Helixtap STR20 price closely. Hence, this spread is likely to trade around the month-long mean of US$312/mt with an estimated weekly swing from US$10/mt to US$20/mt based on volatility in the past month.

During the same time period, the Helixtap STR20 – Thai Latex spread traded from a US$299/mt high to a US$260/mt low within a US$39/mt range. This range is US$9/mt off from the lowest monthly range of US$30/mt seen in March 2022. Such a spread has been observed to show a slight downtrend, and is likely to trade around the month-long mean of US$274/mt with an estimated weekly swing of US$15/mt to US$20/mt based on volatility in the past month. In mid-September last year, the Thai Raw Material price was also at a US$269/mt premium over the Thai Latex price. Since February 2022, Thai Raw Materials have traded at a discount to Thai Latex prices.

The Helixtap SIR20 – Indo Raw Material price spread was observed to trade from US$134/mt to US$115/mt with a US$19/mt range. This spread is the narrowest compared to similar spreads for Thailand and is approximately half when compared to the other two spreads. Such a spread is also observed to have the lowest volatility. This suggests there was relative stability in how the historical margin for Indonesian rubber manufacturers behaved. But there has been a downtrend in the Helixtap SIR20 – Indo Raw Material price spread, with an overall change of -24.3% in the last two months. We expect this spread to trade around the month-long mean of US$125/mt with an estimated weekly swing of US$8/mt based on volatility in the past month.

The Helixtap STR20 – Thai Raw Material price spread is on average 2.4 times the spread in the Helixtap SIR20 – Indo Raw Material in the past 8 weeks. This multiplier has been trending upwards, with the latest multiple hitting 2.77 in the second week of June 2022. The historical weekly average of this ratio stands at 1.98. Assuming production costs stay constant, this suggests there is more pricing flexibility for Thai STR20 producers to potentially adjust prices downwards with a proportionally smaller impact on margins. It must be noted that such a margin analysis does not take into consideration various operational and production costs incurred by the rubber manufacturer.

While the margin could be higher for Thai producers, volatility as observed for the past month was also double for the Thai spreads compared to the Indon spread. Historically, the Helixtap STR20 – Thai Raw Material spread is the most volatile, followed by the Helixtap STR20 – Thai Latex and the Helixtap SIR20 – Indo Raw Material spreads. Higher volatility for these Thai spreads suggest more uncertainty on margin expectations for Thai producers.

The US dollar has also been on a steady appreciation against the Thai Baht since the start of April 2022, with an increase of 3.9% as of mid June 2022. In comparison, the US dollar has only appreciated against the Indonesian Rupiah by around 1.4% during the same period. This represents an almost threefold depreciation in the Thai Baht against the US Dollar compared to the Indonesian Rupiah against the greenback in the past two and a half months. This further boosts the pricing flexibility of Thai manufacturers in the market.

With a strong commitment to curb inflationary pressure, the US Federal Reserves announced a 0.75% interest rate hike in its latest FOMC statement. In the absence of any market intervention by the domestic central banks, such a move is likely to result in the US dollar appreciating even further against most other currencies.

Seasonality analysis suggests Helixtap STR20 prices tend to fall less than Helixtap SIR20 prices during wintering months from February to May each year

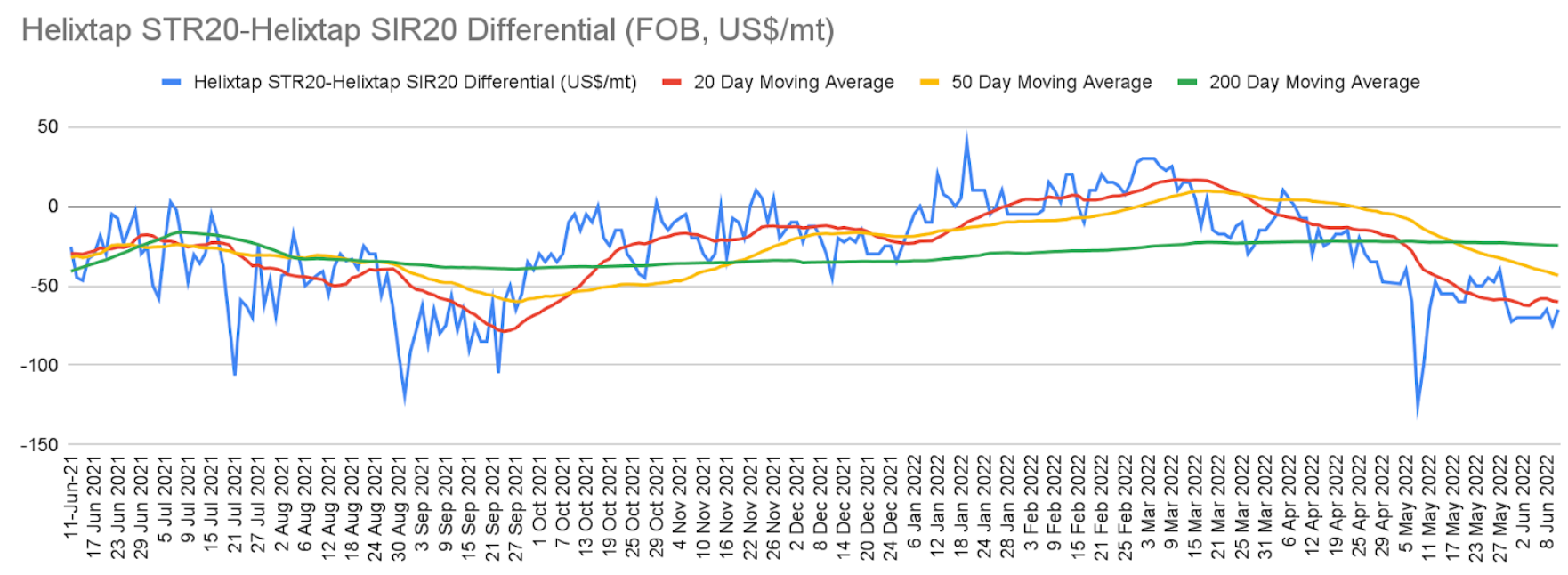

On average, the Helixtap STR20 price historically trades at a discount to Helixtap SIR20. The daily price spread has traded at a discount 72.4% of the time out of a total of 1,923 data points from January 2015 to June 2022. Based on seasonal trends, this spread tends to increase from February to May, during the dry wintering period for Hevea trees. This spread also tended to decrease in months closer to traditional winter from September to January in the following year.

From March to mid June this year, pricing dynamics for the STR 20 and SIR 20 price spread deviated from the historical seasonal trends. The average daily STR20 and SIR20 price spread in each month has trended downwards consistently, when the historical trends suggest otherwise. As of late June 2022, STR20 was at a discount of US$65/mt to SIR20.

Moving forward, it is seasonally expected to see the spread stay stable for July and August before decreasing from September to January in the next year. Understanding the pricing dynamics for this spread will allow physical rubber buyers who have the flexibility to procure from either region to plan their purchasing schedule accordingly and take advantage of any favourable movement in prices. As shown in other commodity markets, buyers who have a larger exposure to the spot market, compared to those locked into long term contracts, are in a more flexible position to take advantage of the ever changing price dynamics.

Helixtap STR20 price spread over Helixtap AFR10 was observed to have a strong seasonal trend of widening from May to August each year

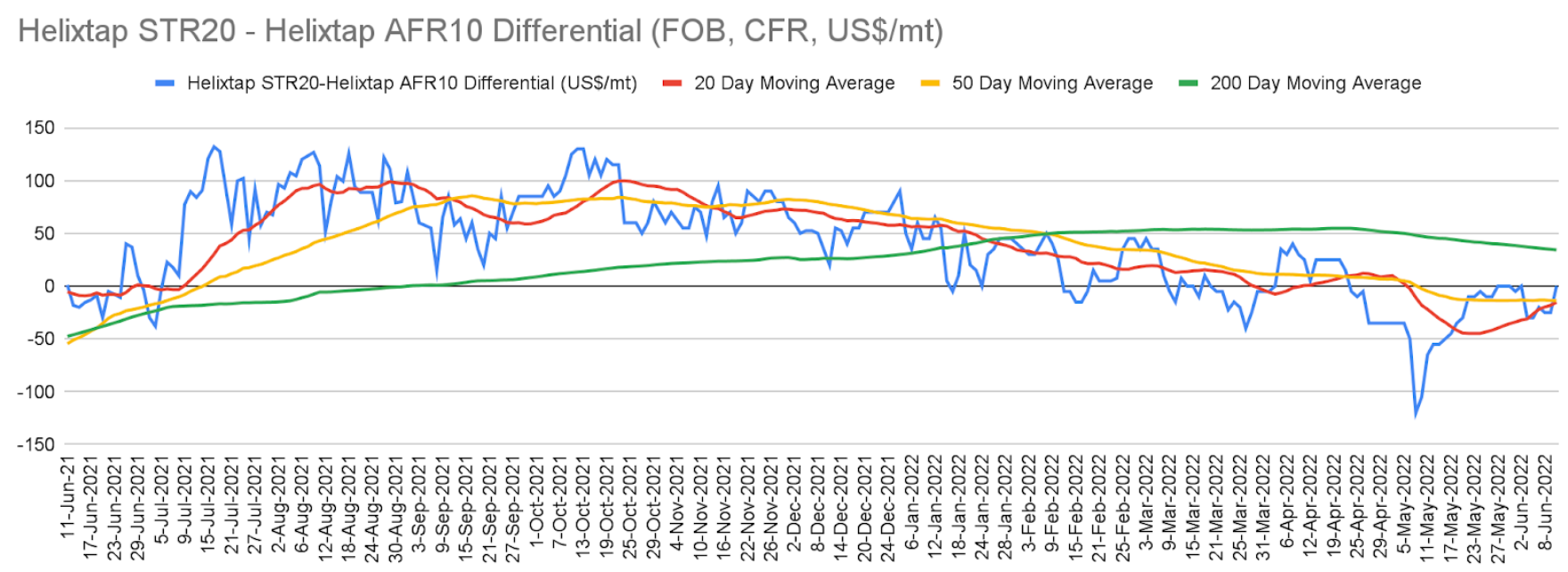

Helixtap STR20 was traded historically at a discount to Helixtap AFR10 76% of the time out of 1401 data points stretching back to January 2017. Given the Helixtap AFR10 is a CIF landed price at Rotterdam or Hamburg, it is expected that the AFR10 price should be at a premium over the STR 20 price. Accounting for this difference, a US$50/mt freight assumption is deducted from the AFR10 price data, to recalibrate the AFR10 price series to a FOB basis. On an estimated FOB basis, the STR20 price was observed to be at a premium to the AFR10 price for 89.9% of the time out of 357 data points since January 2021. By specification, AFR10 is supposed to be of higher grade compared to STR20.

Seasonally, this spread tends to decrease from September to January each year and has notably shown a decrease in all five previous Septembers from their previous months. Such a spread is also likely to see a seasonal increase in the months leading up to May to August each year. Analysis of season trends attempts to identify systematic and fixed priced trends due to regular buying and selling patterns as captured by the underlying historical price movements.

Historical seasonal trends suggest that the spread will likely remain stable for June before increasing in July and August.

Helixtap SIR20 price spread over Helixtap AFR10 also tends to increase from the second half of June till August each year

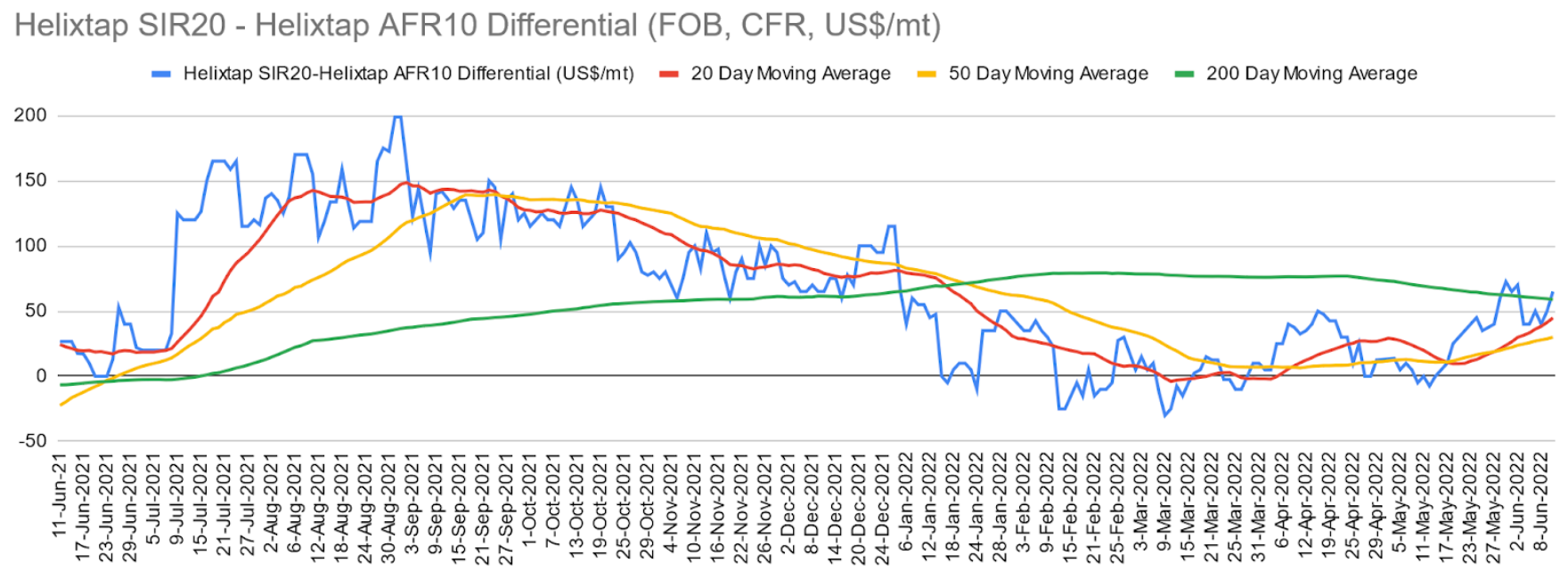

Helixtap SIR20 was traded at a historically high daily average price spread over the Helixtap AFR10 price in the past year compared to any previous year for a June to June time period. On an estimated FOB basis, SIR20 has traded at a premium over AFR10 for 77.1% of the time since January 2017.

Seasonally, this spread has shown a tendency to decrease in the first half of the year from January to May and subsequently increase in the next half from June to December. An exception to the seasonal norm was observed from September 2021, with average monthly spreads decreasing consistently up till March 2022. But the spread was observed to increase from June to August for each year for all five years of available historical record from 2017 to 2021. Interestingly, the SIR20 and AFR10 price spread has decreased in all six previous years for the month of March.

Seasonal trends differ across all three intra regional price spreads

The pricing dynamics for the various intra regional price spreads can be classified based on the wintering phenomenon in rubber trees in February to May. The STR20 – SIR20 and the STR20 – AFR10 price spreads were observed to have the tendency to widen during these months. Subsequently, the spread will trend downwards from September onwards. In contrast, the SIR20 – AFR10 spread exhibited different seasonal behaviour. It tends to increase for the first half of each year before trending downwards for the second half of the year.